Report of Foreign Issuer (6-k)

August 26 2015 - 8:56AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2015

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Public Offering of Debentures

Rio de Janeiro, August 26, 2015 - Petróleo Brasileiro S.A. - Petrobras, pursuant to the provisions of Brazilian Securities and Exchange Commission Instruction 358, of January 3, 2002, as amended, hereby announces that it has submitted, on this date, to the Brazilian Financial and Capital Markets Association (ANBIMA), a request for the preliminary analysis of registration for the public offer of simple debentures, not convertible into shares, unsecured, in up to three (3) series, to be held in accordance with the procedures of CVM Instruction 400, of December 29, 2003 and CVM Instruction 471, of August 8, 2008.

The offer will initially be for three hundred thousand (300,000) debentures with a face value of ten thousand reais (R$10,000.00), on the issue date, for a total initial amount of three billion reais (R$3,000,000,000.00). This amount may be increased through the exercise of the possible distribution of additional debentures and supplementary debentures.

The proceeds of the offer will be used (i) for the planned investments in the Business and Management Plan and/or extending the Company's debt profile; and/or (ii) to fund the expenses already incurred or to be incurred related to the prioritized investment project, in accordance with Law 12,431/11, as will be described in the offer documents.

In due course, a notice to the market will be issued, in accordance with Article 53 of CVM Instruction 400/03, containing information on: (i) the other characteristics of the issue; (ii) where to obtain the preliminary prospectus; (iii) the estimated dates and venues for the disclosure of the offering; and (iv) the conditions, the procedure and the bookbuilding date.

The offer will begin only after (i) the granting of the offer registration by the CVM; (ii) registration for the distribution and trading of the debentures on the CETIP and/or the BM&FBOVESPA, as applicable; (iii) the disclosure of the launch announcement; and (iv) the availability of the final prospectus to investors, including the reference form, prepared by the Company in accordance with CVM Instruction 480, of December 7, 2009, as amended.

This Material Fact does not constitute an offer, invitation or solicitation of an offer to purchase the debentures. Nor does this Material Fact, nor any of the information contained herein, form the basis of any contract or commitment.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results o f operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

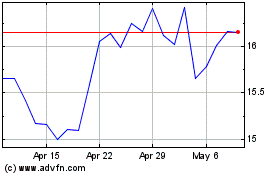

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

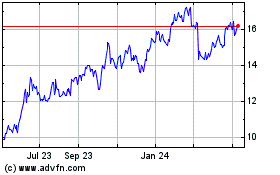

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024