SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2015

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

GOL LINHAS AÉREAS INTELIGENTES S.A.

CNPJ/MF nº 06.164.253/0001-87

NIRE 35.300.314.441

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON MARCH 26, 2015

I. Date, Time and Place: March, 26th 2015, at 04:00 p.m., on Praça Comte. Linneu Gomes, S/N, Portaria 3 – Prédio 15 – Board of Directors’ Meeting Room, Jardim Aeroporto, São Paulo (“Company”). II. Attendance: All the members of the Board of Directors of the Company. III. Presiding board: As a chairman off the meeting, Mr. Henrique Constantino, who invited me, Claudia Karpat, to act as secretary of the meeting. IV. Calling: Waived, due to the attendance of all the members of the Board of Directors. V. Agenda: To pass resolutions on the following matters: (i) the Financial Statements of the Company, the Management Report, the Management comments about the economic situation of the Company, and the Opinion issued by the Independent Auditors (Ernst & Young Auditores Independentes S.S) about the fiscal year 2014 (“Financial Statements”), as other documents, in accordance with applicable regulations, in particular, CVM (“Brazilian Securities Exchange Comission”) Instruction N.º 481/09 ("INCVM 481/09"), which shall be submitted to the next Annual Shareholders’ Meeting of Company; (ii) the management proposal for allocation of the result for fiscal year 2014 and the Budget for the fiscal year of 2015; (iii) the Proposal for Director’s and Board of Officers of Compensation for the fiscal year of 2015; (iv) the creation of the Audit Committee of the Company (”CAE”), pursuant to INCVM 308/99, in replacement of the Audit Committee, and right afterwards, the approval of its Bylaws, which are an integral part of these Minutes as Annex I; (v) amendment of the 2nd Article of the Bylaws of the Accounting and Tax Policies and Financial Statements of the Subcommittee, regarding the composition of the Subcommittee, of which the Bylaws reflecting the amendments is an integral part of these Minutes as Annex II; (vi) election of the members of the Committees and Subcommittee of the Company, with the ratification of its acts carried out. VI. Resolutions: After the necessary explanations were provided, after detailed review of the Financial Statements and other documents referring to the matters hereof, the following matters were approved by unanimous vote: (i) the Financial Statements of the Company, including the Management Report, the Management comments about the economic situation of the Company, and the Opinion issued by the Independent Auditors, all of them about the fiscal year 2014 (“Financial Statements”), which will be submitted to the Annual Shareholders Meeting, with the recommendation for the shareholders to approve the same. Accordingly, a copy of the Financial Statements duly approved and initialed by the Presiding Board, will be filed with the head-office and will be disclosed by the Company within the legal term. Were also approved the Audit Committee Statement and the Statement of the Officers of the Company about the Financial Statements and other documents, according with INCVM

481/09, which shall be disclosed within the legal terms and shall likewise be submitted to the Annual Shareholders’ Meeting of the Company; (ii) regarding the management proposal for allocation of the result, the Company having recorded a loss for fiscal year 2014, the Directors report that no distribution of dividends related to the fiscal year 2014 shall be made to the shareholders; (iii) the Proposal for Global Compensation for Director’s and Executive Officers for the fiscal year of 2015 and of the Budget for the fiscal year of 2015; (iv) the creation of the Company’s CAE, pursuant to the INCVM 308/99, in replacement of the Audit Committee, which ceases to exist on this date. Right afterwards, the CAE’s Bylaws is approved as well, and it is attached to these Minutes as Annex I; (v) the amendment of the 2nd Article of the Bylaws of the Accounting and Tax Policies and Financial Statements of the Subcommittee of the Company, which shall have the following wording: “2nd Article – The Accounting and Tax Policies and Financial Statements Subcommittee shall comprise for 3 (three) members, elected by the Board of Directors, namely: The Financial Vice-President of the Company or one Executive Officer with equivalent duties and 2 (two) independent experts, as special technical members, for terms of office of one (1) year, reelecting being permitted.” . The Bylaws, with the amendments reflected in the document which integrates these Minutes as Annex II, are approved; (vi) the election of the following members, for a term of 1 (one) year counted from this date, for the following Committees and Subcommittee of the Company: (a) CAE: Messrs. (i) Richard Freeman Lark Jr., Brazilian, single, business manager, holder of Identity Card R.G. no. 50.440.294-8, issued by SSP/SP, and enrolled with the C.P.F. under nº 214.996.428-7; (ii) Antonio Kandir, Brazilian, divorced, engineer, holder of Identity Card R.G. no. 4.866.700-6 SSP/SP and enrolled with the C.P.F. under nº 146.229.631-91; and (iii) Luiz Kaufmann, Brazilian, engineer, married, holder of Identity Card R.G. no. 7.162.266-SSP/SP and enrolled with the C.P.F. under nº 362.006.990-72, being Mr. Luiz Kaufmann the member who complies with the legal requirements as provided for in Article 31-C, paragraphs 5º and 6º of INCVM 481/09; (b) People Management and Corporate Governance Committee: Messrs. (i) Constantino de Oliveira Junior, Brazilian, married, businessman, holder of Identity Card R.G. no. 929.100, issued by SSP/DF, and enrolled with the C.P.F. under nº 417.942.901-25; (ii) Henrique Constantino, Brazilian, married, businessman, holder of Identity Card R.G. no. 1.022.856, issued by SSP/DF, and enrolled with the C.P.F. under nº 443.609.911-34; (iii) Paulo Sergio Kakinoff, Brazilian, married, business manager, holder of Identity Card R.G. no. 25.465.939-1, issued by SSP/SP and enrolled with the C.P.F. under nº 194.344.518-41; (iv) Antonio Kandir, already identified above; (v) Betânia Tânure de Barros, Brazilian, married, psychologist, holder of Identity Card R.G. no. M-1.072.104 and enrolled with C.P.F. under nº 385.001.086-49; and (vi) Paulo Cézar Aragão, Brazilian, divorced, lawyer, holder of Identity Card OAB/RJ no. 21.560 and enrolled with C.P.F. under nº 174.204.407-78; (c) Financial Policies Committee: Messrs. (i) Constantino de Oliveira Junior, already identified above; (ii) Richard Freeman Lark Jr., already identified above; (iii) Luiz Kaufmann, already identified above; (iv) Paulo Sergio Kakinoff, already identified above; and (v) Edmar Prado Lopes Neto, Brazilian, married, engineer, holder of Identity Card RG no. 04.066.178-7, issued by IFP/RJ and enrolled with the C.P.F. under nº 931.827.087-91;

(d) Risk Committee: Messrs. (i) Constantino de Oliveira Junior, already identified above; (ii) Richard Freeman Lark Jr., already identified above; (iii) Luiz Kaufmann, whose details were mentioned above; and (iv) Paulo Sergio Kakinoff, already identified above; (e) Alliances Committee: Messrs. (i) Constantino de Oliveira Junior, already identified above; (ii) Henrique Constantino, already identified above; (iii) Edward H. Bastian, citizen of the United States of America, married, business manager, holder of Passport of the United States of America No. 214067455; and (iv) Pieter Elbers, Dutch, married, business manager, with Dutch Passport No. BN139PP18; and (f) Accounting and Tax Policies and Financial Statements Sub-Committee: the gentlemen (i) Edmar Prado Lopes Neto, already identified above; (ii) Marcos da Cunha Carneiro, Brazilian, married, economist, holder of Identity Card No. 04.831.135-1, issued by IFP, and enrolled with the C.P.F. under nº 663.964.337-53; and (iii) Natan Szuster, Brazilian, married, accountant, holder of Identity Card R.G. no. 2.964.224, issued by the Traffic Department-RJ, and enrolled with the C.P.F. under nº 388.585.417-15; all of them domiciled at the Company’s address, as indicated in these minutes, being ratified all acts practiced during the month of March of the current year. VII. Adjournment of the Meeting and Drawing-up of these Minutes: The floor was offered to whoever might wish to use it, and since nobody did so, the meeting was adjourned for the necessary time for the drawing-up of these minutes. After the meeting was reopened, these minutes were read, checked and signed by attendees. I hereby certify that this is a faithful copy of the minutes drawn-up in the proper book.

São Paulo, March 26th, 2015.

|

_____________________________

Henrique Constantino

Chairman |

_____________________________

Claudia Karpat

Secretary |

|

|

|

ANNEX I

BYLAWS OF THE AUDIT COMMITTEE

CHAPTER I

DEFINITIONS

1st Article - For all purposes and effects of these Bylaws, the following defined expressions and terms when capitalized shall have the below indicated meanings, without prejudice of other capitalized defined expressions and terms, whose meanings are given to them in the Articles of these Bylaws:

|

Term |

Definition |

|

BM&FBOVESPA |

BM&FBOVESPA S.A. - Stock Exchange and Commodities and Futures Exchange |

|

CVM |

Brazilian Securities Commission |

|

Codes |

Jointly, the Ethics Code and the Conduct Handbook of the Company |

|

Conduct Documents |

Jointly, the Codes and the Policies |

|

Instruction 308 |

Instruction No. 308, of May 14th, 1999, of the CVM |

|

Corporations Law |

Law no. 6404, of December 15th, 1976, as amended |

|

NYSE |

New York Stock Exchange |

|

Policies |

Jointly, the Information and Disclosure Policy and the Manual for Disclosure and Use of Information and Policy for Negotiation of Securities Issued by the Company |

|

Regulation |

Regulation of the Level 2 Listing of the Corporate Governance of BM & F Bovespa |

|

SEC |

U.S. Securities and Exchange Commission |

CHAPTER II

GENERAL RULES

2nd Article - The CAE, as set forth in Article 26 of the Company´s Bylaws and in Article 31-B of Instruction CVM no. 308, is an advisory body linked directly to the Board of Directors and shall function permanently, and it shall comply with the applicable provisions of Instruction no. 308 of

the CVM, of US Laws, particularly the Sarbanes-Oxley Act, as well as with the rules of NYSE, the Regulation, the Company’s Bylaws and these Bylaws of this Committee.

3rd Article - The CAE shall have (i) operational autonomy and budget allocation, yearly or per project, within the limits approved by the Company’s Board of Directors, for the performance of consultations, assessment and investigations within the scope of its activities, including to hire and to use independent external specialists; and (ii) means to receive complaints, including confidential complaints, whether internal or external to the Company, in matters related to the scope of its activities, as provided for in the 9th Article of these Bylaws.

CHAPTER III

COMPOSITION OF THE COMMITTEE

4th Article - The CAE shall be composed by, at least, 03 (three) members, all of them elected by the Board of Directors, with a mandate term of 1 (one) year, and, in the event of definitive impediment or vacancy of the office of a member of the CAE, it shall be competence of the Board of Directors to elect an alternate member, who shall complete the mandate of the replaced member.

1st Paragraph – The members of the CAE shall cause the Board of Directors to take the measures required to inform CVM of such replacement within up to 10 (ten) days of the respective resolution of the Board of Directors in this sense.

2nd Paragraph – All members of the CAE shall be Independent Board Members, as such term is defined in the Regulation and as defined in the applicable norms of SEC and of NYSE. Additionally to the independence requirements established in the Regulation and in the applicable norms of SEC and of NYSE, the members of the CAE, as established by Instruction 308, cannot be, or have been, during the last 5 (five) years:

a) Officer or employee of the Company, its direct or indirect controlling company, controlled or affiliated company, or companies under common control; or

b) Technical responsible of the team involved in the Company’s audit works; and

c) Spouse, straight line or collateral relative, up to the third degree, and relative by marriage up to the second degree, of the persons indicated under letters “a” and “b” above.

3rd Paragraph – Without prejudice of the provisions of the 2nd Paragraph above, in compliance with Article 31-C, 5th and 6th §§, of Instruction CVM no. 308, at least 1 (one) of the members of the CAE shall have recognized experience in matters of corporate accounting, which experience shall be evidenced by means of the availability of documents proving the compliance with the requirements determined by Instruction 308, which shall be kept at the head office of the Company for a term of 5 (five) years counted from the last day of mandate of such member.

4th Paragraph – The members of the CAE shall be literate in finances and, at least 1 (one) member shall be sufficiently experienced in finances and accounting to qualify as an Audit Committee Financial Expert, as defined by the norms of U.S. Securities Act, of 1933, of the United States of America.

5th Paragraph – Participation in the CAE of Officers of the Company, and of its direct or indirect controlling company, controlled or affiliated company, or companies under common control is forbidden.

6th Paragraph - In the event that any member of the CAE is part of, at any time, more than 3 (three) audit committees in publicly-held companies, the Board of Directors shall verify if such fact does not make the effective performance of said member in the CAE impossible, and shall inform such decision to the market.

7th Paragraph – If the mandate of the members of the CAE is terminated for any reason, such members only shall be able to integrate the CAE again after, at least, 3 (three) years have passed after mandate termination.

8th Paragraph – The function as member of the CAE cannot be delegated.

Article 5 - CAE members shall meet the requirements provided in Article 147 of Brazilian Corporation Law (Rule 6.404/76) and keep an impartial and ethical behavior while performing their activities, and especially with respect to financial statement estimates and Company's management.

Sole Paragraph - While performing their duties, CAE members shall serve with loyalty and use the due diligence required from persons holding such position, being prohibited from interfering in any conflict situations that may affect Company's and Company shareholders' interests.

Article 6 - When taking office, CAE members shall execute (i) the instrument of appointment; (ii) an statement acknowledging the compliance with the terms of these Bylaws and the Conduct

Documents; and (iii) a certificate stating they are not prevented from holding office, pursuant to these Bylaws and Article 147 of the Corporation Act.

Article 7 - At the first meeting after being elected, CAE members shall appoint one of their peers to hold office as CAE coordinator, whose duties and tasks are defined in article 13 of these Bylaws (“Coordinator”).

Article 8 - CAE members shall immediately notify the Company, CVM, and SEC upon any change in their shareholding position in the Company.

CHAPTER IV

AUTHORITY

Article 9 - In addition to the functions, duties, and authority granted to CAE pursuant to Article 26, Paragraph 6, of Company's Bylaws, and article 31-D, of Instruction 308, CAE shall be responsible for:

A. Quality and Completeness of Financial Reports

1. Supervising quarterly, interim, and annual financial statements with Company's Management and independent public accountants, including management report statements;

2. Supervising the press releases on results, as well as financial information and result indicators provided to analysts and rating agencies;

3. Revising with the independent auditors:

a) Company's critical accounting policies and practices applicable to Company's financial reporting;

b) Any alternative treatment of financial information in accordance with the accounting practices accepted in Brazil and in the US, which has been discussed with Management, the ramification of uses of such alternative treatments and statements, and independent auditors' preferred treatment;

c) Any hindrances found during the audit, scope of work or information access limitations, and points of disagreement with Management regarding the financial reporting; and

d) Other material communication between public independent auditors and Management, including the correspondence on accounting issues and internal controls, management letter, and spreadsheet of non-adjusted audit differences;

4. Supervising with Management the effectiveness of information procedures and controls to be disclosed in the financial reporting;

5. Revising with Management material trends and progresses in Company's financial statement reporting and disclosing requirements and practices; and

6. Revising material transactions with related parties.

B. Compliance with Rules and Regulations

1. Revising with Management, the appropriateness and effectiveness of the procedures for ensuring the compliance with the applicable rules and regulations;

2. Revising with Management any legal issues including the progress of pending litigation that might materially affect the Company and any reports or queries from regulatory or government agencies; and

3. Monitoring the compliance of Company's employees with Company's Conduct Documents and conflict of interest situations.

C. Qualification, Independence, and Adequacy of the services provided by Independent Public Auditors

1. Coordinating with the Board of Directors the hiring, dismissal, supervision, and compensation of independent public accountants;

2. Establishing, for ratification by the Board of Directors, policies and procedures for the provisional approval of the services to be performed by independent public accountants, and provisionally approve such services in accordance with the policies and procedures established;

3. Supervising independent public accountant's activities (including the resolution of inconsistencies between the Management and independent public accountants regarding the financial reporting) and establish a communication protocol with the independent public accountants;

4. Obtaining from independent public accountants, and revise with the senior representatives of the accounting firm, at least on annual basis, a report describing:

a) The internal quality control procedures;

b) The policy on the rotation of the partner responsible for the independent audit;

c) Any relevant issues raised at the firm's latest quality control revision, or revision by peers, as well as any inquiry or investigations by government authorities or

professionals from other regulatory bodies, in the preceding 5-year period, in connection with one or more independent audit carried by the firm, and the actions taken for remediating these issues; and

d) Any professional and commercial relationships between the independent audit firm and Company (in order to review the matter of independent public accountant's independence);

5. Establishing policies for hiring employees and former employees of independent audit firms;

6. Reviewing on annual basis the qualification, independence, and performance of independent public accountants.

D. Internal Audit

1. CAE shall revise the organization, staffing, responsibilities, work plans, and deliverables of Company's internal audit position.

E. Risk Assessment and Management

1. Discussing and monitoring with Management the policies and procedures on the assessment and management of risks, possibly requiring detailed information on Management compensation, use of assets, and expenses Management incurs on Company's behalf.

F. Internal Controls

1. Reviewing with management, the internal and external accountants, the quality and effectiveness of Company's internal controls and any substantial or material deficiencies of the internal controls.

G. Complaints and Whistleblowing

1. Establishing procedures for receiving, retaining, and handling complaints regarding accounting, internal controls, or auditing matters, including procedures for confidential or anonymous submission by employees, on concerns related to questionable matters regarding accounting and auditing.

a) Complaints may be submitted by the internet by www.eticanagol.com.br and/or by telephone through Hotline: 0800 886 0011.

b) CAE shall ensure, upon request, whistleblower's confidentiality.

c) CAE shall determine the applicable actions required for investigating the facts and information on the complaint subject.

d) CAE Coordinator shall report any findings and recommendations resulting from complaints received to the Board of Directors CAE so the appropriate actions are taken whenever claims involve a member of Company's Board.

H. Other Activities

1. Meeting separately and regularly with Management, internal auditors, and independent accountants for identifying any relevant issues that might warrant CAE's attention;

2. Providing the performance evaluation of the Audit Committee, when installed, pursuant to article 29 of the Bylaws;

3. Performing the additional activities required for fulfilling its functions as set out in the applicable rules of CVM, SEC, BM&FBOVESPA, and NYSE.

Article 10 - While carrying out its activities, CAE may hire and use external and independent specialists, observing the budget available, as provided in Article 3 of these Bylaws.

CHAPTER V

OPERATION

Article 11 - cae Coordinator shall be chosen by the actual members at the first meeting of this Committee following its election.

Article 12 - In case of Coordinator's absence, disability, or dismissal, the Coordinator's functions shall be performed by one of the then remaining CAE members, chosen upon mutual agreement.

Article 13 - CAE Coordinator's responsibilities include:

a) Ensuring the good operation and performance of the body, complying, and causing to be complied with, these Bylaws;

b) Naming the CAE member that shall serve as secretary of the body (“Secretary”);

c) Convene, install, decide the agenda, and act as chairman of CAE meetings;

d) Act as CAE representative in CAE's relationship with the Board of Directors, with Board of Officers, and any internal or external audits, internal bodies and committees thereof, signing, when necessary, their correspondence, invitations, and reports addressed to them;

e) Convening, on CAE's behalf, occasional attendees of the meetings, as applicable;

f) Meeting, at least on quarterly basis, with the Board of Directors, and attending Company's Annual Meeting, whether or not accompanied by other CAE members; and

g) Causing Company's independent public accountants to meet CAE's demands in all matters under CAE authority.

Article 14 - The duties of the Secretary include:

a) Serving as CAE secretary and at the meetings of this body;

b) Prepare the minutes of meetings; and

c) Filing with Company any documents submitted at the meetings, and those referred to in Article 4, Paragraph 3 of these Bylaws.

CHAPTER VI

MEETINGS OF THIS COMMITTEE

Article 15 - The CAE shall meet, ordinarily, at least bimonthly, so that Company's accounting information are always reviewed by this body before being disclosed, and, extraordinarily, at any time, convened by CAE Coordinator, by its own initiative or upon written request of any acting member, in fulfillment of any matter under its authority as defined in Chapter IV hereunder.

Article 16 - The quorum for holding any meeting and passing any resolution shall be at least the simple majority of CAE members.

Article 17 - The call notice shall be delivered no later than three (3) days before the meeting and be received personally upon filing certificate or by e-mail against receipt certificate informing: the place, date, time, and agenda of the meeting (which shall not include general items such as “matters of general interest of the Company” or “other matters”).

Article 18 - Meetings shall be held at Company's registered office, and may be extraordinarily held elsewhere.

Article 19 - Minutes and opinions shall be prepared on the meetings and filed with other CAE documents.

GENERAL MEETINGS AND MEETINGS OF THE BOARD OF DIRECTORS AND BOARD OF OFFICERS

Article 20 - CAE members may attend the meetings of the Board of Directors and of the Board of Officers the purpose of which is to discuss matters they are interested in.

Article 21 - CAE members shall report their activities to the Board of Directors, at least annually, or when requested by any of their members.

Article 22 - CAE members or Coordinator shall attend Company's Annual Meeting.

CHAPTER VIII

FINAL PROVISIONS

Article 23 - Company shall keep at Company's registered office and at CVM's disposal, for a 5-year term, a drawn up annual report prepared by CAE, describing:

a) Company's activities, the results and findings achieved, and any recommendation made; and

b) Any situation where there is a substantial discrepancy between Company's Management, the independent public accountants, and CAE regarding Company's financial statements.

Article 24 - This Charter shall remain accessible on Company's Website, and such fact shall be informed in Company's periodical reports.

Article 25 - Any questions raised on the enforcement of these Bylaws shall be clarified upon analysis, with the participation of the specialized legal advisers, of the provisions of Brazilian Corporate legislation and the Sarbanes-Oxley Act, and SEC and NYSE rules.

Article 26 - These Bylaws may be revised as a consequence of the previous article provision.

**********

[Bylaws approved at the Meeting of the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. held on March 26, 2015]

ANNEX II

BYLAWS

OF THE ACCOUNTING AND TAX POLICIES AND FINANCIAL STATEMENTS SUB-COMMITTEE

Article 1 – The Accounting and Tax Policies and Financial Statements Sub-Committee is a division that is subordinated to the Audit Committee and to the Board of Directors, and has the following duties and responsibilities:

(a) from time to time revise the accounting and tax policies and financial statements of the Company and to make recommendations to the Board of Directors;

(b) follow-up and assess the compliance with the accounting and tax policies and financial statements adopted by the Company;

(c) prepare and provide to the Audit Committee a summary of review and approval of the matters discussed by the Sub-Committee;

(d) submit quarterly presentations to the Audit Committee about matters within its incumbency; and

(e) advise the Audit Committee of issues which it understands that should be the subject matter of assessment, review and/or any other action by the referred Audit Committee.

Article 2 – The Accounting and Tax Policies and Financial Statements Subcommittee shall comprise for 3 (three) members, elected by the Board of Directors, namely: The Financial Vice-President of the Company or one Executive Officer with equivalent duties and 2 (two) independent expertss, as special technical members, for terms of office of one (1) year, reelecting being permitted.

Article 3 – The Accounting and Tax Policies and Financial Statements Sub-Committee shall have one Secretary, selected among its members, by mutual agreement, at the time of the first meeting of the Sub-Committee, who shall exercise his duties for a term of one (1) year.

Paragraph One — In the absence of the Secretary, he will be replaced by any of the other members of the Sub-Committee. A chairman of the meetings shall be appointed at each meeting, among the members of the Sub-Committee.

Paragraph Two — In case of vacancy in the office of Secretary, a new Secretary shall be elected, whose duties shall be exercised until the expiration of the term of office of the member being replaced.

Article 4 – The Accounting and Tax Policies and Financial Statements Sub-Committee shall hold regular meetings bimonthly, and special meetings, whenever called by the Secretary, on his own initiative or upon request of any of the other members of the Sub-Committee.

Article 5 – A minimum quorum of two (2) members is required for the Accounting and Tax Policies and Financial Statements Committee to validly adopt resolutions, which shall be made by majority vote. In case of tie vote, a new meeting shall be required to be held, with the attendance of all the members of the Sub-Committee, for the matter to be once again submitted to voting and decided.

Sole Paragraph – In the absence of a minimum quorum, as required in the head paragraph of this Article, the Secretary will call a new meeting, which shall be held as urgently as required for the matter to be decided.

Article 6 – The meetings of the Accounting and Tax Policies and Financial Statements Sub-Committee shall be called by any written means (fax, letter and/or e-mail).

Article 7 – The decisions of the Accounting and Tax Policies and Financial Statements Sub-Committee shall be made by majority vote, and the member whose vote was defeated will be entitled to have it recorded in the Minutes of the respective meeting.

Article 8 – Minutes shall be drawn-up for all the meetings of the Accounting and Tax Policies and Financial Statements Sub-Committees, which shall be signed by all the attendees.

Article 9 – At the first meeting of the Accounting and Tax Policies and Financial Statements Sub-Committee after its organization, the Sub-Committee shall approved an annual schedule of activities.

Article 10 – During the meetings, any acting member of the Accounting and Tax Policies and Financial Statements Sub-Committee will be entitled to request and to individually review corporate books and other documents, make notes and remarks thereof, which shall be discussed and resolutions shall be made with respect thereto at the respective meetings, provided that such books and documents refer to the matters within the incumbency of the Sub-Committee, under the terms of Article 1 above.

Sole Paragraph – Review of the documents shall not be permitted unless at the head-office of the Company and upon prior request.

Article 11 – Requests for information and/or explanations about the Company’s business from any permanent member of the Accounting and Tax Policies and Financial Statements Sub-Committee shall be filed with the management bodies of the Company, in a proper form signed by the Secretary of the Accounting and Tax Policies and Financial Statements Sub-Committee.

Article 12 – It is the duty of the Secretary to:

(a) call the members of the Sub-Committee to the meetings at least five (5) business days in advance; and

(b) request to the management of the Company such information and/or explanations deemed to be necessary under the terms described in article 10 above.

Sole Paragraph – It is permitted for the Secretary to request to the Board of Officers to make persons available for supporting the meetings of the Accounting and Tax Policies and Financial Statements Sub-Committee.

Article 13 – The presence of members of the Accounting and Tax Policies and Financial Statements Sub-Committee at General Shareholders’ Meetings and Board of Directors’ Meetings, in order to answer to requests of information possibly made by the shareholders or directors may be required by the Board of Directors, in writing, at least five (5) days in advance.

Article 14 – The Accounting and Tax Policies and Financial Statements Sub-Committee may prepare Policies about the matters within its scope of incumbency, under the terms of Article 1 above, which Policies may be changed from time to time by the Accounting and Tax Policies and Financial Statements Sub-Committee itself, provided that these changes are made by unanimous resolution of the Sub-Committee members, without prejudice to the provisions in Article 7 above.

Article 15 – Any cases not expressly provided for herein shall be decided by the Board of Directors.

***********

[Bylaws approved at the Meeting of the Board of Directors of Gol Linhas Aéreas Inteligentes S.A. held on March 26, 2015]

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 26, 2015

|

GOL LINHAS AÉREAS INTELIGENTES S.A. |

|

|

|

|

|

By: |

/S/ Edmar Prado Lopes Neto

|

| |

Name: Edmar Prado Lopes Neto

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

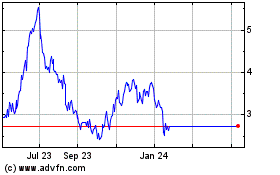

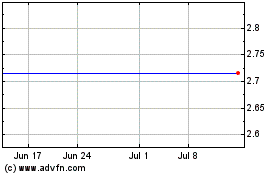

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024