|

|

RBC Capital Markets

®

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-208507

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pricing Supplement

Dated September 27, 2016

To the Product Prospectus Supplement ERN-ES-1 Dated January

14, 2016, Prospectus Supplement Dated January 8, 2016, and

Prospectus Dated January 8, 2016

|

|

$948,000

Direct Investment Notes

Linked to 25 Common Equity Securities due

October 2, 2017

Royal Bank of Canada

|

|

|

|

|

|

Royal Bank of Canada is offering the Notes linked to 25 Common Equity Securities (the “Notes”). The Notes are linked to an equally weighted Basket consisting of 25 common equity securities set forth below. These basket components were selected according to the process set forth in the section, “Information Regarding the Issuers of the Reference Stocks.” The CUSIP number for the Notes is 78012KSV0.

The Notes may pay interest on December 30, 2016, March 30, 2017, June 30, 2017, and the maturity date. The amount of any interest to be paid on the Notes will not be fixed, and will depend upon the total dividends paid on the Reference Stocks during the preceding quarter, as described in more detail below.

On the maturity date, the amount that we will pay to you (the “Redemption Amount”) will depend upon the performance of the Basket over the term of the Notes. As described in more detail below, the Redemption Amount will be less than the price to the public set forth below if the Percentage Amount of the Basket is not at least approximately 102.30%.

We describe in more detail below how the payments on the Notes will be determined.

Issue Date: September 30, 2016

Maturity Date: October 2, 2017

The Notes will not be listed on any securities exchange.

Investing in the Notes involves a number of risks. See “Risk Factors” beginning on page S-1 of the prospectus supplement dated January 8, 2016, “Risk Factors” beginning on page PS-4 of the product prospectus supplement dated January 14, 2016, and “Selected Risk Considerations” beginning on page P-8 of this pricing supplement.

The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other Canadian or U.S. government agency or instrumentality.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

Per Note

|

|

Total

|

|

Price to public

|

100.00%

|

|

$948,000.00

|

|

Underwriting discounts and commissions

|

1.50%

|

|

$14,220.00

|

|

Proceeds to Royal Bank of Canada

|

98.50%

|

|

$933,780.00

|

The initial estimated value of the Notes as of the date of this pricing supplement is $973.386 per $1,000 in principal amount, which is less than the price to public. The actual value of the Notes at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. We describe our determination of the initial estimated value in more detail below.

RBC Capital Markets, LLC, which we refer to as RBCCM, acting as agent for Royal Bank of Canada, received a commission of $15.00 per $1,000 in principal amount of the Notes and used a portion of that commission to allow selling concessions to other dealers of up to $15.00 per $1,000 in principal amount of the Notes. The other dealers may forgo, in their sole discretion, some or all of their selling concessions. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page P-31 below.

We may use this pricing supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing supplement in a market-making transaction in the Notes after their initial sale.

Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

SUMMARY

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, the product prospectus supplement, the prospectus supplement, and the prospectus.

|

|

Issuer:

|

Royal Bank of Canada (“Royal Bank”)

|

|

|

Issue:

|

Senior Global Medium-Term Notes, Series G

|

|

|

Underwriter:

|

RBC Capital Markets, LLC (“RBCCM”)

|

|

|

Reference Asset:

|

The Notes are linked to the value of a basket (the “Basket”) consisting of the common equity securities of 25 publicly traded companies indicated on page P-3 (each, a “Reference Stock,” and collectively, the “Reference Stocks”). The Reference Stocks represent 25 common stocks identified by RBCCM using the process described in the section below, “The Selection of the Basket.” As set forth in more detail in that section, the Reference Stocks were selected based upon (a) improvements in their earnings outlook among securities analysts over a period of approximately eight months (from December 15, 2016 to August 19, 2016), relative to (b) changes in their market price over that period.

|

|

|

Currency:

|

U.S. Dollars

|

|

|

Minimum Investment:

|

$1,000 and minimum denominations of $1,000 in excess thereof

|

|

|

Pricing Date:

|

September 27, 2016

|

|

|

Issue Date:

|

September 30, 2016

|

|

|

Valuation Date:

|

September 27, 2017

|

|

|

Payment at Maturity

(if held to maturity):

|

The amount that you will receive at maturity for each $1,000 in principal amount of the Notes will depend upon the performance of the Basket and the dividends paid on the Reference Stocks. The Redemption Amount will equal the product of (a) $977.50 and (b) the Percentage Amount.

As discussed in more detail below, the Percentage Amount must exceed approximately 102.30% in order for you to receive a Redemption Amount per $1,000 in principal amount of the Notes that exceeds the principal amount. In addition, the Redemption Amount could be substantially less than the principal amount of the Notes.

|

|

|

Percentage Amount:

|

The Percentage Amount will equal an amount, expressed as a percentage and rounded to two decimal places, equal to:

|

|

|

Initial Price:

|

The closing price per share of a Reference Stock on the Pricing Date, as determined by the Calculation Agent, as set forth in the table on the next page.

|

|

|

Final Price:

|

The closing price per share of a Reference Stock on the Valuation Date.

|

|

Basket:

|

Reference Stock Issuer

|

Ticker

|

Initial Price

|

Number of

Shares

Initially in the

Basket

|

|

|

|

Alliance Data Systems Corporation

|

ADS

|

$213.47

|

$0.1874

|

|

|

|

Autodesk, Inc.

|

ADSK

|

$71.90

|

$0.5563

|

|

|

|

Amazon.com, Inc.

|

AMZN

|

$816.11

|

$0.0490

|

|

|

|

Activision Blizzard, Inc.

|

ATVI

|

$44.21

|

$0.9048

|

|

|

|

Broadcom Limited

|

AVGO

|

$170.86

|

$0.2341

|

|

|

|

Ball Corporation

|

BLL

|

$79.56

|

$0.5028

|

|

|

|

Bristol-Myers Squibb Company

|

BMY

|

$55.74

|

$0.7176

|

|

|

|

Chubb Limited

|

CB

|

$125.28

|

$0.3193

|

|

|

|

Centene Corporation

|

CNC

|

$69.08

|

$0.5790

|

|

|

|

salesforce.com, inc.

|

CRM

|

$70.05

|

$0.5710

|

|

|

|

Delphi Automatic PLC

|

DLPH

|

$68.40

|

$0.5848

|

|

|

|

Facebook, Inc.

|

FB

|

$128.69

|

$0.3108

|

|

|

|

Frontier Communications Corporation

|

FTR

|

$4.34

|

$9.2166

|

|

|

|

Huntington Bancshares Incorporated

|

HBAN

|

$9.74

|

$4.1068

|

|

|

|

KeyCorp

|

KEY

|

$12.15

|

$3.2922

|

|

|

|

KLA-Tencor Corporation

|

KLAC

|

$70.00

|

$0.5714

|

|

|

|

The Kroger Co.

|

KR

|

$29.90

|

$1.3378

|

|

|

|

Mylan N.V.

|

MYL

|

$41.31

|

$0.9683

|

|

|

|

Netflix, Inc.

|

NFLX

|

$97.07

|

$0.4121

|

|

|

|

Newell Brands Inc.

|

NWL

|

$52.40

|

$0.7634

|

|

|

|

Royal Caribbean Cruises Ltd.

|

RCL

|

$74.35

|

$0.5380

|

|

|

|

Signet Jewelers Limited

|

SIG

|

$74.69

|

$0.5355

|

|

|

|

Molson Coors Brewing Company

|

TAP

|

$107.53

|

$0.3720

|

|

|

|

DENTSPLY SIRONA Inc.

|

XRAY

|

$59.55

|

$0.6717

|

|

|

|

Xerox Corporation

|

XRX

|

$10.03

|

$3.9880

|

|

|

|

Component

Weights:

|

1/25 for each Reference Stock (subject to adjustment as provided below).

|

|

|

Initial Basket Level:

|

The initial level of the Basket shall be deemed to be $1,000.

|

|

|

Initial Composition of

the Basket:

|

The

Basket shall

initially be deemed to consist of a number of shares of each Reference Stock calculated as follows:

·

Each Reference Stock shall initially constitute 1/25 of the Basket, with an aggregate value of $40 ($1,000 divided by 25).

·

Accordingly, initially, the number of shares of each Reference Share in the Basket was calculated by dividing $40 by the Initial Price, rounded to four decimal places.

·

The number of shares of each Reference Share initially included in the Basket was determined on the Pricing Date, and is set forth in the table above.

For example, if the Initial Price of a hypothetical Reference Share is $20, the Basket will initially be deemed to include 2 shares of that Reference Share ($40 divided by $20).

|

|

|

Final Basket Level:

|

The value of the shares (and any other assets) in the Basket as of the close of trading on the Valuation Date, as determined by the Calculation Agent, using the Final Price of each Reference Stock.

|

|

|

Adjustments to the

Composition of the

Basket:

|

The Calculation Agent will adjust the number of shares of each Reference Stock in the Basket, as may be needed to reflect stock splits, reverse stock splits, stock dividends, and similar transactions, as discussed in the section of the product

supplement

,

“

General

Terms of the Notes—Anti-Dilution Adjustments Relating to Equity Securities.” See “Other Terms of Your Notes” on page P-11 of this document.

|

|

|

Interest Payment

Dates:

|

December 30, 2016, March 30, 2017, June 30, 2017 and October 2, 2017 (the maturity date).

|

|

|

Interest Calculation

Dates:

|

December 27, 2016, March 27, 2017, June 27, 2017 and September 27, 2017 (the Valuation Date).

|

|

|

Calculation of Interest

Payments:

|

The amount of each interest payment, if any, will depend upon the amount of dividends paid on each Reference Stock during the Interest Calculation Period preceding each interest payment date, and will equal, for each $1,000 in principal amount, 97.75% of the sum of the Dividend Amounts for each of the Reference Stocks.

|

|

|

Interest Calculation

Period:

|

The first Interest Calculation Period will commence on the trading day after the Pricing Date and end on the first Interest Calculation Date.

Each subsequent Interest Calculation Period will begin on the trading day following an Interest Calculation Date and end on the next Interest Calculation Date. The final Interest Calculation Date will occur on the Valuation Date.

|

|

|

Dividend Amount:

|

For each Reference Stock, an amount in U.S. dollars equal to (a) $1,000 divided by the Initial Price of the applicable Reference Stock multiplied by (b) the applicable Component Weight multiplied by (c) 100% of the gross cash distributions (including ordinary and extraordinary dividends) per share of Reference Stock declared by the applicable Reference Stock Issuer where the date that the applicable Reference Stock has commenced trading ex-dividend on its primary U.S. securities exchange as to each relevant distribution occurs during the relevant Interest Calculation Period, as described in more detail below.

|

|

|

Maturity Date:

|

October 2, 2017, subject to extension for market and other disruptions, as described

in the product prospectus supplement dated January 14, 2016.

|

|

|

Term:

|

Approximately 53 weeks.

|

|

|

Principal at Risk:

|

The Notes

are

NOT

principal protected. You may lose all or a substantial portion of your principal amount at maturity if the value of the Basket decreases, or does not increase by at least 2.30%, from the Pricing Date to the Valuation Date.

|

|

|

Calculation Agent:

|

RBCCM

|

|

|

U.S. Tax Treatment:

|

By purchasing a Note, each holder agrees (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat the Note as a pre-paid cash-settled contingent income-bearing derivative contract linked to the Basket for U.S. federal income tax purposes. However, the U.S. federal income tax consequences of your investment in the Notes are uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different from that described in the preceding sentence. Please see the section below, “Supplemental Discussion of U.S. Federal Income Tax Consequences,” and the discussion (including the opinion of our counsel Morrison & Foerster LLP) in the product prospectus supplement dated January 14, 2016 under “Tax Consequences,” which apply to the Notes.

|

|

|

Secondary Market:

|

RBCCM (or one of its affiliates), though not obligated to do so, plans to maintain a secondary market in the Notes after the Issue Date.

The amount that you may receive upon sale of your Notes prior to maturity may be less than the principal amount of your Notes.

|

|

|

Listing:

|

The Notes will not be listed on any securities exchange.

|

|

|

Clearance and

Settlement:

|

DTC global (including through its indirect participants Euroclear and Clearstream, Luxembourg as described under “Description of Debt Securities—Ownership and Book-Entry Issuance” in the prospectus dated January 8, 2016).

|

|

|

Events of Default:

|

In case an event of default with respect to the Notes will have occurred and be continuing, the amount declared due and payable on the Notes upon any acceleration will be determined by the Calculation Agent and will be an amount of cash equal to the amount payable as described above under the caption “—Payment at Maturity,” calculated as if the date of acceleration were the Valuation Date. The Dividend Amount for each Reference Stock will only include dividends declared and paid through that date.

|

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together with the prospectus dated January 8, 2016, as supplemented by the prospectus supplement dated January 8, 2016 and the product prospectus supplement dated January 14, 2016, relating to our Senior Global Medium-Term Notes, Series G, of which these Notes are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to them in the product prospectus supplement. In the event of any conflict, this pricing supplement will control.

The Notes vary from the terms described in the product prospectus supplement in several important ways. You should read this pricing

supplement carefully.

This pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the prospectus supplement dated January 8, 2016 and “Risk Factors” in the product prospectus supplement dated January 14, 2016, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. You may access these documents on the Securities and Exchange Commission (the “SEC”) website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website):

Prospectus dated January 8, 2016:

Prospectus Supplement dated January 8, 2016:

Product Prospectus Supplement ERN-ES-1 dated January 14, 2016:

Our Central Index Key, or CIK, on the SEC website is 1000275. As used in this pricing supplement, “we,” “us,” or “our” refers to Royal Bank of Canada.

HYPOTHETICAL RETURNS AT MATURITY

The following hypothetical examples are provided for illustration purposes only and are hypothetical; they do not purport to be representative of every possible scenario concerning increases or decreases in the value of the Basket and the related effect on the Redemption Amount. The following hypothetical examples illustrate the payment you would receive on the maturity date if you purchased $1,000 in principal amount of the Notes. Numbers appearing in the examples below have been rounded for ease of analysis. This table does not reflect any interest that may be paid on the Notes.

|

Percentage Amount

|

Redemption Amount per $1,000 in

Principal Amount

|

Percentage Gain (or Loss) per

$1,000 in Principal Amount

|

|

140.00%

|

$1,368.50

|

36.85%

|

|

130.00%

|

$1,270.75

|

27.08%

|

|

120.00%

|

$1,173.00

|

17.30%

|

|

110.00%

|

$1,075.25

|

7.53%

|

|

102.30%

(1)

|

$1,000.00

|

0.00%

|

|

100.00%

(2)

|

$977.50

|

-2.25%

|

|

90.00%

|

$879.75

|

-12.03%

|

|

80.00%

|

$782.00

|

-21.80%

|

|

70.00%

|

$684.25

|

-31.58%

|

|

60.00%

|

$586.50

|

-41.35%

|

|

50.00%

|

$488.75

|

-51.13%

|

|

40.00%

|

$391.00

|

-60.90%

|

|

30.00%

|

$293.25

|

-70.68%

|

|

20.00%

|

$195.50

|

-80.45%

|

|

10.00%

|

$97.75

|

-90.23%

|

|

0.00%

|

$0.00

|

-100.00%

|

(1)

Due to the payment formula set forth above, for you to receive a Redemption Amount greater than the principal amount the Notes, the Percentage Amount must be greater than approximately 102.30%.

(2)

If the Percentage Amount is not at least approximately 102.30%, you will lose some or all of the principal amount of the Notes.

Please see the sections below, “Selected Risk Considerations—Principal at Risk” and “—The Notes Will Not Reflect the Full Performance of the Reference Stocks, Which Will Negatively Impact Your Return on the Notes.”

SELECTED RISK CONSIDERATIONS

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in the Reference Stocks. These risks are explained in more detail in the section “Risk Factors” beginning on page PS-4 of the product prospectus supplement. In addition to the risks described in the prospectus supplement and the product prospectus supplement, you should consider the following:

|

|

·

|

Principal at Risk

– Investors in the Notes could lose all or a substantial portion of their principal amount if there is a decline in the value of the Basket. Investors will also lose a portion of their principal amount if the Percentage Amount is not at least approximately 102.30%.

|

|

|

·

|

The Notes May Not Pay Interest and Your Return May Be Lower than the Return on a Conventional Debt Security of Comparable Maturity –

There may be no periodic interest payments on the Notes, and any such payments may be less than there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. The amount of each interest payment, if any, will depend upon the amount of dividends paid on each Reference Stock during the Interest Calculation Period preceding each interest payment date. The yield that you will receive on your Notes, which could be negative, may be less than the yield you could earn if you purchased a standard senior debt security of ours with the same maturity date. Your investment may not reflect the full opportunity cost to you when you take into account factors that affect the time value of money.

|

|

|

·

|

The Notes Will Not Reflect the Full Performance of the Reference Stocks, Which Will Negatively Impact Your Return on the Notes –

Because the calculation of the Redemption Amount for each $1,000 in principal amount reflects the product of the Percentage Amount and $977.50, the return, if any, on the Notes will not reflect the full performance of the Reference Stocks. Therefore, the yield to maturity based on the methodology for calculating the Redemption Amount will be less than the yield that would be produced if the Reference Stocks were purchased and held for a similar period. Similarly, the interest payments you receive on the Notes will be less than the applicable Dividend Amounts.

|

|

|

·

|

Payments on the Notes Are Subject to Our Credit Risk, and Changes in Our Credit Ratings Are Expected to Affect the Market Value of the Notes –

The Notes are Royal Bank’s senior unsecured debt securities. As a result, your receipt of all required payments on the Notes will be dependent upon Royal Bank’s ability to repay its obligations as of the applicable payment date. This will be the case even if the value of the Basket increases after the Pricing Date, or if substantial payments are made on the Reference Stocks. No assurance can be given as to what our financial condition will be at any time during the term of the Notes.

|

|

|

·

|

There May Not Be an Active Trading Market for the Notes—Sales in the Secondary Market May Result in Significant Losses –

There may be little or no secondary market for the Notes. The Notes will not be listed on any securities exchange. RBCCM and other affiliates of Royal Bank may make a market for the Notes; however, they are not required to do so. RBCCM or any other affiliate of Royal Bank may stop any market-making activities at any time. Even if a secondary market for the Notes develops, it may not provide significant liquidity or trade at prices advantageous to you. We expect that transaction costs in any secondary market would be high. As a result, the difference between bid and asked prices for your Notes in any secondary market could be substantial.

|

|

|

·

|

You Will Not Have Any Rights to the Reference Stocks

– As a holder of the Notes, you will not have voting rights or other rights that holders of the Reference Stocks would have. You will have no right to receive shares of the Reference Stocks.

|

|

|

·

|

The Historical Performance of the Reference Stocks Should Not Be Taken as an Indication of Their Future Performance –

The Final Prices of the Reference Stocks will determine the Redemption Amount. The historical performance of the Reference Stocks does not necessarily give an indication of their future performance. As a result, it is impossible to predict whether the prices of the Reference Stocks will rise or fall during the term of the Notes. The prices of the Reference Stocks will be influenced by complex and interrelated political, economic, financial and other factors.

|

|

|

·

|

Holders of the Reference Stocks Are Only Entitled to Receive Those Dividends as Each Issuer’s Board of Directors May Declare out of Funds Legally Available –

Although dividends and distributions on one or more of the

|

Reference Stocks may have historically been declared by the applicable board of directors, they are not required to do so and may reduce or eliminate those dividends in the future. The Dividend Amount of one or more of the Reference Stocks during the term of the Notes may be zero. If the dividends paid on the Reference Stocks are not significant, any interest payments that you receive on the Notes may not be sufficient to provide you with your desired return on the Notes.

|

|

·

|

The Initial Estimated Value of the Notes Is Less than the Price to the Public

– The initial estimated value set forth on the cover page of this pricing supplement does not represent a minimum price at which we, RBCCM or any of our affiliates would be willing to purchase the Notes in any secondary market (if any exists) at any time. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the value of the Basket, the borrowing rate we pay to issue securities of this kind, and the inclusion in the price to the public of the underwriting discount and the estimated costs relating to our hedging of the Notes. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. Assuming no change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your Notes prior to maturity may be less than your original purchase price, as any such sale price would not be expected to include the underwriting discount and the hedging costs relating to the Notes. In addition to bid-ask spreads, the value of the Notes determined for any secondary market price is expected to be based on the secondary rate rather than the internal funding rate used to price the Notes and determine the initial estimated value. As a result, the secondary price will be less than if the internal funding rate was used. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity.

|

|

|

·

|

The Initial Estimated Value of the Notes on the Cover Page Is an Estimate Only, Calculated as of the Time the Terms of the Notes Were Set –

The initial estimated value of the Notes is based on the value of our obligation to make the payments on the Notes, together with the mid-market value of the derivative embedded in the terms of the Notes. See “Structuring the Notes” below. Our estimate is based on a variety of assumptions, including our credit spreads, expectations as to dividends, interest rates and volatility, and the expected term of the Notes. These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Notes or similar securities at a price that is significantly different than we do.

|

The value of the Notes at any time after the Pricing Date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a result, the actual value you would receive if you sold the Notes in any secondary market, if any, should be expected to differ materially from the initial estimated value of the Notes.

|

|

·

|

Our Business Activities May Create Conflicts of Interest

– We and our affiliates expect to engage in trading activities related to the Reference Stocks that are not for the account of holders of the Notes or on their behalf. These trading activities may present a conflict between the holders’ interests in the Notes and the interests we and our affiliates will have in their proprietary accounts, in facilitating transactions, including options and other derivatives transactions, for their customers and in accounts under their management. These trading activities, if they influence the prices of the Reference Stocks, could be adverse to the interests of the holders of the Notes. We and one or more of our affiliates may, at present or in the future, engage in business with the issuers of the Reference Stocks, including making loans to or providing advisory services. These services could include investment banking and merger and acquisition advisory services. These activities may present a conflict between our or one or more of our affiliates’ obligations and your interests as a holder of the Notes. Any of these activities by us or one or more of our affiliates may affect the value of the Reference Stocks, and, therefore, the market value of the Notes.

|

|

|

·

|

You Must Rely on Your Own Evaluation of the Merits of an Investment Linked to the Reference Stocks –

In the ordinary course of their business, RBCCM and our other affiliates have expressed views on the value of the Reference Stocks and/or expected movements in their prices, and may do so in the future. These views or reports may be communicated to clients of our affiliates. However, these views are subject to change from time to time. Moreover, other professionals who transact business in markets relating to any Reference Stock may at any time have significantly different views from those of our affiliates. For these reasons, you are encouraged to derive information concerning the Reference Stocks from multiple sources, and you should not rely solely on views expressed by us or our affiliates.

|

|

|

·

|

The Inclusion of the Reference Stocks in the Basket Does Not Guarantee a Positive Return on the Notes –

There can be no assurance that any Reference Stock, or the Basket in its entirety, will increase in value. The performance of

|

the Reference Stocks may be less than the performance of the equities markets generally, and less than the performance of specific sectors of the equity markets, or other securities in which you may choose to invest. The Reference Stocks were selected according to the criteria described below. As of the date of this document, the Equity Research Department of RBCCM believes that the prices of the Reference Stocks have the potential to increase during the term of the Notes. However, there can be no assurance that this strategy for selecting the Reference Stocks will be successful, or that the prices of the Reference Stocks will increase. Although RBCCM has expressed a positive view as to the Basket prior to the date of this pricing supplement, its views may change significantly during the term of the Notes, whether as to the Basket as a whole, or as to one or more of the Reference Stocks. In addition, any positive views of RBCCM’s research divisions are separate and apart from the offering of the Notes, and do not constitute investment advice. Our offering of the Notes does not constitute our recommendation or the recommendation of RBCCM or our other affiliates to invest in the Notes or in the Reference Stocks.

The methodology for selecting the Reference Stocks relates to (a) changes in analyst consensus earnings estimates and (b) changes in the stock price of the Reference Stocks. Neither of these factors will necessarily result in a positive return on the Basket. Views of the securities analysists (including those of RBCCM) that contributed to the earnings estimates are subjective, and reflect the models and other tools utilized by those analysts; these views may not reflect the future performance of the relevant companies. In addition, to the extent that the selection of the Reference Stocks was based upon changes in their historical prices, these changes may not be indicative of any future performance. Accordingly, a different methodology for selecting the Reference Stocks may produce a set of securities that have a greater return than the Reference Stocks during the term of the Notes.

|

|

·

|

An Investment in the Notes Is Subject to Risks Relating to Foreign Securities Markets

– Six of the Reference Stocks are organized outside of the U.S. An investment linked to companies of this type involves particular risks. For example, the relevant foreign markets may be more volatile than the U.S. markets, and market developments may affect these markets differently from the U.S. or other securities markets. Direct or indirect government intervention to stabilize the securities markets outside the U.S., as well as cross-shareholdings in certain companies, may affect trading prices and trading volumes in those markets.

|

|

|

·

|

As Calculation Agent, RBCCM Will Have the Authority to Make Determinations that Could Affect the Value of Your Notes and Your Payment at Maturity –

As calculation agent for your Notes, RBCCM will have discretion in making various determinations that affect your Notes, including determining the Final Prices, the Percentage Amount, the Redemption Amount, the amounts of any interest payments on the Notes, and whether any market disruption events have occurred. The Calculation Agent also has discretion in making certain adjustments relating to mergers and certain other corporate transactions that an issuer of a Reference Stock may undertake. The exercise of this discretion by RBCCM could adversely affect the value of your Notes and may present RBCCM, which is our wholly owned subsidiary, with a conflict of interest.

|

|

|

·

|

Market Disruption Events and Adjustments –

The payments on the Notes are subject to adjustment as described in this pricing supplement and the product prospectus supplement. For a description of what constitutes a market disruption event as well as the consequences of that market disruption event, see “General Terms of the Notes—Market Disruption Events” in the product prospectus supplement.

|

OTHER TERMS OF YOUR NOTES

Certain Reorganization Events

If an issuer of a Reference Stock undergoes a Reorganization Event, as described on PS-16 of the product prospectus supplement dated January 14, 2016 (for example, if it merges with another entity and is not the surviving company), that Reference Stock may be removed from the Basket by the Calculation Agent following the effective date of the Reorganization Event, with the Component Weights of the remaining Reference Stocks increasing proportionately to reflect the relevant weightings of those remaining Reference Stocks at the time of the Reorganization Event.

In order to accomplish the foregoing, the Calculation Agent will determine the value of the shares of the Reference Stock in the Basket that is subject to the Reorganization Event, and will add to the Basket a number of shares of each other Reference Stock that is proportionate to the relative weightings of the Reference Stocks at the time of the Reorganization Event.

In the event of a Reorganization Event, The Calculation Agent will have sole discretion in determining the distribution of shares. In order to determine the value of the Reference Stock that is subject to the Reorganization Event, the Calculation Agent may use its closing price on the last trading day on which it trades prior to the effective date of the relevant transaction, the terms of the transaction that is the subject of the Reorganization Event, or such other commercially reasonable method as it may determine to be appropriate at that time. The weightings of the remaining Reference Stocks at that time, and the number of shares of each to be added to the Basket, will be determined by the Calculation Agent based upon the percentage of the Basket value that they constitute, from their respective closing prices.

Additional Anti-Dilution Adjustments

The Calculation Agent will adjust the number of shares of each Reference Stock in the Basket, as it determines may be needed to reflect stock splits, reverse stock splits, stock dividends, and other corporate transactions, which are discussed in the section of the product supplement, “General Terms of the Notes—Anti-Dilution Adjustments Relating to Equity Securities.” For example, if a Reference Stock is subject to a 2-for-1 stock split, the Calculation Agent may determine that, upon the applicable effective date, each one share of that Reference Stock in the Basket shall be deemed to thereafter to represent two shares.

INFORMATION REGARDING THE ISSUERS OF THE REFERENCE STOCKS

The issuer of each Reference Stock is registered under the Securities Exchange Act of 1934, as amended (“Exchange Act”). Companies with securities registered under the Exchange Act are required to periodically file financial and other information required by the Securities and Exchange Commission (“SEC”). This information is filed with the SEC and can be inspected and copied by you at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, information filed by the issuers of the Reference Stocks with the SEC electronically is available to the public over the Internet at the SEC’s website at http://www.sec.gov.

The Selection of the Basket

The Reference Stocks represent the common stocks of 25 issuers selected by RBCCM as of August 22, 2016. To select the Reference Stocks, RBCCM identified the highest ranking stocks included in the S&P 500

®

Index (the “SPX”), excluding stocks in the energy sector, using the following criteria:

|

|

·

|

Each relevant stock’s “Forward EPS Percentage Change” was added to its “Price Percentage Change” (each as defined below). The sum for each stock was deemed to be its “Difference”.

|

|

|

·

|

The 25 stocks with the highest Difference were included in the Basket.

|

For each stock, the “Forward EPS Percentage Change” represents the change in its analyst consensus earnings estimates per share for the next 12 months, comparing these amounts as of December 31, 2015 to these amounts as of August 19, 2016. These consensus earnings estimates were obtained based on information provided by FactSet Research Systems Inc., as of the relevant dates.

For each stock, its “Price Percentage Change” reflects the change in its closing price per share between these two dates.

For example, for any given security, if its analyst consensus earnings per share increased from $10 to $12 between those two dates, its Forward EPS Percentage Change would be 20%. If its closing price increased from $10 to $11 between those two dates, its “Price Percentage Change” would be 10%. As a result, its Difference would be: 30 (20% + 10%).

In contrast, if its analyst consensus earnings per share increased from $10 to $13 between those two dates, its Forward EPS Percentage Change would be 30%. If its closing price decreased $10 to $9 between those two dates, its “Price Percentage Change” would be -10%. As a result, its Difference would be: 20 (30% + -10%).

The Basket represents the 25 stocks from the applicable SPX with the highest Difference.

Neither we nor our affiliates makes any representation as to the future performance of any Reference Stock or the Basket.

Description of the Reference Stock Issuers

The following information regarding each issuer of the Reference Stocks is derived from publicly available information and we have not independently verified it.

|

|

·

|

Alliance Data Systems Corporation provides data-driven and transaction-based marketing and customer loyalty solutions. The company offers integrated outsourced marketing solutions, including customer loyalty programs, database marketing services, consulting, analytics and creative services, email marketing and private label and co-branded retail credit cards. Its common stock trades on the New York Stock Exchange (the “NYSE”) under the symbol “ADS.”

|

|

|

·

|

Autodesk, Inc. supplies PC software and multimedia tools. The company's products are used across industries and in the home for architectural design, mechanical design, geographic information systems and mapping, and visualization applications. The company’s software products are sold through a network of dealers and distributors. Its common stock trades on the NASDAQ Global Select Market (the “NASDAQ”) under the symbol “ADSK.”

|

|

|

·

|

Amazon.com, Inc. is an online retailer that offers a wide range of products. The company’s products include books, music, videotapes, computers, electronics, home and garden, and numerous other products. The company offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Its common stock trades on the NASDAQ under the symbol “AMZN.”

|

|

|

·

|

Activision Blizzard, Inc. publishes, develops, and distributes interactive entertainment software and peripheral products. The company's products covers diverse game categories, including action/adventure, action sports, racing, role playing, simulation, first-person action, music-based gaming, and strategy. Its common stock trades on the NASDAQ under the symbol “ATVI.”

|

|

|

·

|

Broadcom Limited designs, develops, and supplies semiconductors and integrated circuits. The company offers products such as broadband carrier access, cables, switches, network processors, and wireless connectors. Its common stock trades on the NASDAQ under the symbol “AVGO.”

|

|

|

·

|

Ball Corporation manufactures metal, food, and household products industries. The company supplies aerospace and other technologies and services to commercial and governmental customers. Its common stock trades on the NYSE under the symbol “BLL.”

|

|

|

·

|

Bristol-Myers Squibb Company is a biopharmaceutical company that discovers, develops and delivers medicines. Its common stock trades on the NYSE under the symbol “BMY.”

|

|

|

·

|

Chubb Limited is a property and casualty insurance company. The company provides commercial and personal property, casualty, personal accident and supplemental health insurance, reinsurance, and life insurance to clients

.

Its common stock trades on the NYSE under the symbol “CB.”

|

|

|

·

|

Centene Corporation is a multi-line managed care organization that provides medicaid and medicaid-related programs. The company also provides specialty services, including behavioral health, nurse triage, and treatment compliance. Its common stock trades on the NYSE under the symbol “CNC.”

|

|

|

·

|

salesforce.com, inc. provides software on demand. The company supplies a customer relationship management service to businesses providing a technology platform for customers and developers to build and run business applications. Its common stock trades on the NYSE under the symbol “CRM.”

|

|

|

·

|

Delphi Automotive PLC manufactures vehicle components. The company produces electrical and electronic, powertrain, safety, and thermal technology components for automobile and commercial vehicle manufacturers. Its common stock trades on the NYSE under the symbol “DLPH.”

|

|

|

·

|

Facebook Inc. operates a social networking website. The company website allows people to communicate with their family, friends, and coworkers. The company develops technologies that facilitate the sharing of information, photographs, website links, and videos. Its common stock trades on the NASDAQ under the symbol “FB.”

|

|

|

·

|

Frontier Communications Corporation provides communications services to residential and business customers in urban, suburban, and rural communities in the United States. Its common stock trades on the NASDAQ under the symbol “FTR.”

|

|

|

·

|

Huntington Bancshares Incorporated is a bank holding company. The company's subsidiaries provide full-service commercial and consumer banking services, mortgage banking services, automobile financing, equipment leasing, investment management, trust services, brokerage services, customized insurance service programs, and other financial products and services. Its common stock trades on the NASDAQ under the symbol “HBAN.”

|

|

|

·

|

KeyCorp is a financial services holding company. The company provides retail and commercial banking, commercial leasing, investment management, consumer finance, and investment banking products and services to individual, corporate, and institutional clients. Its common stock trades on the NYSE under the symbol “KEY.”

|

|

|

·

|

KLA-Tencor Corporation manufactures yield management and process monitoring systems for the semiconductor industry. The company's systems are used to analyze product and process quality at critical steps in the manufacture of circuits and provide feedback so that fabrication problems can be identified. Its common stock trades on the NASDAQ under the symbol “KLAC.”

|

|

|

·

|

The Kroger Co. operates supermarkets and convenience stores in the United States. Its common stock trades on the NYSE under the symbol “KR.”

|

|

|

·

|

Mylan NV is a generic and specialty pharmaceuticals company. The company operates an active pharmaceutical ingredient manufacturer and runs a specialty business focused on respiratory, allergy, and psychiatric therapies. Its common stock trades on the NASDAQ under the symbol “MYL.”

|

|

|

·

|

Netflix, Inc. is an Internet subscription service for watching television shows and movies. Subscribers can watch unlimited television shows and movies streamed over the Internet to their televisions, computers, and mobile devices and in the United States, subscribers can receive standard definition DVDs and Blu-ray Discs delivered to their homes. Its common stock trades on the NASDAQ under the symbol “NFLX.”

|

|

|

·

|

Newell Brands Inc. retails consumer products. The company offers housewares, home furnishings, office supplies, tools and hardware, and hair accessories. Its common stock trades on the NYSE under the symbol “NWL.”

|

|

|

·

|

Royal Caribbean Cruises Ltd. is a cruise company operating a fleet of vessels in the cruise vacation industry. Its common stock trades on the NYSE under the symbol “RCL.”

|

|

|

·

|

Signet Jewelers Ltd. operates as a retail company. The company, through its subsidiaries, retails jewelry, watches, gifts, and accessories. The company operates in the United States, the United Kingdom, Puerto Rico, and Canada. Its common stock trades on the NYSE under the symbol “SIG.”

|

|

|

·

|

Molson Coors Brewing Company brews beer through breweries in Canada, the United States and Europe. Its common stock trades on the NYSE under the symbol “TAP.”

|

|

|

·

|

DENTSPLY SIRONA Inc. manufactures and distributes dental supplies on a worldwide basis. The company's products include dental prosthetics, endodontic instruments, dental sealants, ultrasonic scalers, dental x-ray equipment, and intraoral cameras. Its common stock trades on the NASDAQ under the symbol “XRAY.”

|

|

|

·

|

Xerox Corporation offers business process and IT outsourcing support, document technology, and solutions. The company offers services from claims reimbursement and electronic toll transactions to the management of HR benefits and customer care centers to the operation of a company's technology infrastructure. Its common stock trades on the NYSE under the symbol “XRX.”

|

Hypothetical Historical Performance of the Basket

While actual historical information on the Basket did not exist before the Pricing Date, the following graph sets forth the hypothetical historical daily performance of the Basket from May 17, 2012 (the date on which the Reference Stock with the most limited trading history, Facebook, Inc., began trading) through September 27, 2016. The graph is based upon actual daily historical closing prices of the Reference Stocks and a hypothetical basket level of 100.00 as of May 17, 2012. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the Notes may be. Any hypothetical historical upward or downward trend in the level of the Basket shown below is not an indication that the level of the Basket is more or less likely to increase or decrease at any time over the term of the Notes.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

Delivery of the Notes will be made against payment for the Notes on September 30, 2016, which is the third (3rd) business day following the Pricing Date (this settlement cycle being referred to as “T+3”). See “Plan of Distribution” in the prospectus dated January 8, 2016. For additional information as to the relationship between us and RBCCM, please see the section “Plan of Distribution - Conflicts of Interest” in the prospectus dated January 8, 2016

.

The value of the Notes shown on your account statement may be based on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market in the Notes (which it is not obligated to do). That estimate will be based upon the price that RBCCM may pay for the Notes in light of then prevailing market conditions, our creditworthiness and transaction costs. For a period of approximately three months after the Issue Date of the Notes, the value of the Notes that may be shown on your account statement is expected to be higher than RBCCM’s estimated value of the Notes at that time. This is because the estimated value of the Notes will not include the underwriting discount and our hedging costs and profits; however, the value of the Notes shown on your account statement during that period is initially expected to be a higher amount, reflecting the addition of RBCCM’s underwriting discount and our estimated costs and profits from hedging the Notes. This excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Notes, it expects to do so at prices that reflect their estimated value.

STRUCTURING THE NOTES

The Notes are our debt securities, the return on which is linked to the performance of the Reference Stocks. As is the case for all of our debt securities, including our structured notes, the economic terms of the Notes reflect our actual or perceived creditworthiness at the time of pricing. In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under these Notes at a rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. Using this relatively lower implied borrowing rate rather than the secondary market rate, is a factor that reduced the initial estimated value of the Notes at the time their terms were set. Unlike the estimated value included in this pricing supplement, any value of the Notes determined for purposes of a secondary market transaction may be based on a different funding rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options, other derivatives or trading in shares of any Reference Stock) on the issue date with RBCCM

,

one of our other subsidiaries or any third-party hedge provider. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Reference Stocks, and the tenor of the Notes. The economic terms of the Notes and their initial estimated value depend in part on the terms of these hedging arrangements.

The lower implied borrowing rate is a factor that reduces the economic terms of the Notes to you. The initial offering price of the Notes also reflects the underwriting commission and our estimated hedging costs. These factors resulted in the initial estimated value for the Notes on the Pricing Date being less than their public offering price. See “Selected Risk Considerations—The Initial Estimated Value of the Notes Is Less than the Price to the Public” above.

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada LLP, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the Indenture and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the Notes is a matter governed by the laws of the Province of Ontario or Québec, or the laws of Canada applicable therein, and will be valid obligations of the Bank, subject to equitable remedies which may only be granted at the discretion of a court of competent authority, subject to applicable bankruptcy, to rights to indemnity and contribution under the Notes or the Indenture which may be limited by applicable law; to insolvency and other laws of general application affecting creditors’ rights, to limitations under applicable limitations statutes, and to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated January 8, 2016, which has been filed as Exhibit 5.1 to Royal Bank’s Form 6-K filed with the SEC dated January 8, 2016.

In the opinion of Morrison & Foerster LLP, when the Notes have been duly completed in accordance with the Indenture and issued and sold as contemplated by the prospectus supplement and the prospectus, the Notes will be valid, binding and enforceable obligations of Royal Bank, entitled to the benefits of the Indenture, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith). This opinion is given as of the date hereof and is limited to the laws of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the legal opinion dated January 8, 2016, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K dated January 8, 2016.

SUPPLEMENTAL DISCUSSION OF

U.S. FEDERAL INCOME TAX CONSEQUENCES

The following is a general description of the material U.S. tax considerations relating to the Notes. It does not purport to be a complete analysis of all tax considerations relating to the Notes. Prospective purchasers of the Notes should consult their tax advisors as to the consequences under the tax laws of the country of which they are resident for tax purposes and the tax laws of the U.S. of acquiring, holding and disposing of the Notes and receiving payments under the Notes. This summary is based upon the law as in effect on the date of this document and is subject to any change in law that may take effect after such date.

The following section supplements the discussion of U.S. federal income taxation in the accompanying prospectus and prospectus supplement and it supersedes the discussion of U.S. federal income taxation in the accompany product prospectus supplement. It applies only to those holders who are not excluded from the discussion of U.S. federal income taxation in the accompanying prospectus. This discussion applies only to U.S. holders and non-U.S. holders that will purchase the Notes upon original issuance and will hold the Notes as capital assets for U.S. federal income tax purposes. In addition, the discussion below assumes that an investor in the Notes will be subject to a significant risk that it will lose a significant amount of its investment in the Notes.

You should consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the Notes in your particular circumstances, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.

NO STATUTORY, JUDICIAL OR ADMINISTRATIVE AUTHORITY DIRECTLY DISCUSSES HOW THE NOTES SHOULD BE TREATED FOR U.S. FEDERAL INCOME TAX PURPOSES. AS A RESULT, THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF AN INVESTMENT IN THE NOTES ARE UNCERTAIN. BECAUSE OF THE UNCERTAINTY, YOU SHOULD CONSULT YOUR TAX ADVISOR IN DETERMINING THE U.S. FEDERAL INCOME TAX AND OTHER TAX CONSEQUENCES OF YOUR INVESTMENT IN THE NOTES, INCLUDING THE APPLICATION OF STATE, LOCAL OR OTHER TAX LAWS AND THE POSSIBLE EFFECTS OF CHANGES IN FEDERAL OR OTHER TAX LAWS.

We will not attempt to ascertain whether any of the entities whose stock is included in the Basket would be treated as a “passive foreign investment company” within the meaning of Section 1297 of the Code, or a “U.S. real property holding corporation,” within the meaning of Section 897 of the Code. If any of the entities whose stock is included in the Basket were so treated, certain adverse U.S. federal income tax consequences could possibly apply to a holder. You should refer to any available information filed with the SEC and other authorities by the entities whose stock is included in the Basket and consult your tax advisor regarding the possible consequences to you in this regard, if any.

In the opinion of our counsel, Morrison & Foerster LLP, it would generally be reasonable to treat a note with terms described in this document as a pre-paid cash-settled contingent income-bearing derivative contract linked to the Basket for U.S. federal income tax purposes, and the terms of the Notes require a holder and us (in the absence of a change in law or an administrative or judicial ruling to the contrary) to treat the Notes for all tax purposes in accordance with such characterization. In addition, we intend to treat the contingent coupons as U.S. source income for U.S. federal income tax purposes. The following discussion assumes that the treatment described in this paragraph is proper and will be respected.

Although the U.S. federal income tax treatment of the contingent quarterly coupon is uncertain, we intend to take the position, and the following discussion assumes, that such contingent quarterly coupon (including any contingent quarterly coupon paid on or with respect to the maturity date) constitutes taxable ordinary income to a U.S. holder at the time received or accrued in accordance with the holder’s regular method of tax accounting. If the Notes are so treated, a U.S. holder should generally recognize capital gain or loss upon the sale or maturity of the Notes in an amount equal to the difference between the cash amount a holder receives at such time (other than amounts properly attributable to any contingent quarterly coupon, which would be taxed, as described above, as ordinary income) and the holder’s tax basis in the Notes. In general, a U.S. holder’s tax

basis in the Notes will be equal to the price the holder paid for the Notes. Capital gain recognized by an individual U.S. holder is generally taxed at preferential rates where the property is held for more than one year and is generally taxed at ordinary income rates where the property is held for one year or less. The ordinary income treatment of the contingent quarterly coupons, in conjunction with the capital loss treatment of any loss recognized upon the sale, exchange or maturity of the Notes, could result in adverse tax consequences to a holder because the deductibility of capital losses is subject to limitations.

While the matter is not entirely clear, to the extent a Reference Stocks is the type of financial asset described under Section 1260 of the Code (including, among others, any equity interest in pass-thru entities such as regulated investment companies (including certain exchange traded funds), real estate investment trusts, partnerships, trusts and passive foreign investment companies), an investment in the Notes will likely, in whole or in part, be treated as a “constructive ownership transaction” to which Section 1260 of the Code applies. If Section 1260 of the Code applies, all or a portion of any long-term capital gain recognized by a U.S. holder in respect of the Notes will be recharacterized as ordinary income (the “Excess Gain”). In addition, an interest charge will also apply to any deemed underpayment of tax in respect of any Excess Gain to the extent such gain would have resulted in gross income inclusion for the U.S. holder in taxable years prior to the taxable year of the sale, exchange or maturity (assuming such income accrued at a constant rate equal to the applicable federal rate as of the date of sale, exchange or maturity). If an investment in the Notes is treated as a constructive ownership transaction, it is not clear how the net underlying long-term capital gain would be computed and to what extent any long-term capital gain of a United States holder in respect of the Notes will be recharacterized as ordinary income. Unless otherwise established by clear and convincing evidence, the net underlying long-term capital gain is treated as zero. U.S. holders should consult their tax advisors regarding the potential application of Section 1260 of the Code to an investment in the Notes.

Alternative Treatments. Alternative tax treatments of the Notes are also possible and the Internal Revenue Service might assert that a treatment other than that described above is more appropriate. For example, it is possible to treat the Notes, and the Internal Revenue Service might assert that the Notes should be treated, as a single debt instrument. Because the Notes have a term that exceeds one year, such debt instrument would be subject to the special tax rules governing contingent payment debt instruments. If the Notes are so treated, a holder would generally be required to accrue interest income over the term of the securities based upon the yield at which we would issue a non-contingent fixed-rate debt instrument with other terms and conditions similar to the Notes. In addition, any gain a holder might recognize upon the sale or maturity of the Notes would be ordinary income and any loss recognized by a holder at such time would generally be ordinary loss to the extent of interest that same holder included in income in the current or previous taxable years in respect of the Notes, and thereafter, would be capital loss.

Because of the absence of authority regarding the appropriate tax characterization of the Notes, it is also possible that the Internal Revenue Service could seek to characterize the Notes in a manner that results in other tax consequences that are different from those described above. For example, the Internal Revenue Service could possibly assert that any gain or loss that a holder may recognize upon the sale or maturity of the Notes should be treated as ordinary gain or loss.

The Internal Revenue Service has released a notice that may affect the taxation of holders of the Notes. According to the notice, the Internal Revenue Service and the U.S. Treasury Department are actively considering whether the holder of an instrument such as the Notes should be required to accrue ordinary income on a current basis irrespective of any contingent quarterly coupons. It is not possible to determine what guidance they will ultimately issue, if any. It is possible, however, that under such guidance, holders of the Notes will ultimately be required to accrue income currently irrespective of any contingent quarterly coupons and this could be applied on a retroactive basis. The Internal Revenue Service and the U.S. Treasury Department are also considering other relevant issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital and whether the special “constructive ownership rules” of Section 1260 of the Code, which very generally can operate to recharacterize certain long-term capital gains as ordinary income and impose an interest charge, might be applied to such instruments. Holders are urged to consult their tax advisors concerning the significance, and the potential impact, of the above considerations. We intend to treat the Notes for U.S. federal income tax purposes in accordance with the

treatment described in this document unless and until such time as the U.S. Treasury Department and Internal Revenue Service determine that some other treatment is more appropriate.

Backup Withholding and Information Reporting. Payments made with respect to the Notes and proceeds from the sale or exchange of the Notes may be subject to a backup withholding tax unless, in general, the holder complies with certain procedures or is an exempt recipient. Any amounts so withheld generally will be refunded by the Internal Revenue Service or allowed as a credit against the holder's U.S. federal income tax liability, provided the holder makes a timely filing of an appropriate tax return or refund claim to the Internal Revenue Service.

Reports will be made to the Internal Revenue Service and to holders that are not excepted from the reporting requirements.

Non-U.S. holders. The following discussion applies to non-U.S. holders of the Notes. A non-U.S. holder is a beneficial owner of a Note that, for U.S. federal income tax purposes, is a non-resident alien individual, a foreign corporation, or a foreign estate or trust.

While the U.S. federal income tax treatment of the Notes (including proper characterization of the contingent quarterly coupons for U.S. federal income tax purposes) is uncertain, U.S. federal income tax at a 30% rate (or at a lower rate under an applicable income tax treaty) will be withheld in respect of the contingent quarterly coupons paid to a non-U.S. holder unless such payments are effectively connected with the conduct by the non-U.S. holder of a trade or business in the U.S. (in which case, to avoid withholding, the non-U.S. holder will be required to provide a Form W-8ECI). We will not pay any additional amounts in respect of such withholding. To claim benefits under an income tax treaty, a non-U.S. holder must obtain a taxpayer identification number and certify as to its eligibility under the appropriate treaty’s limitations on benefits article, if applicable (which certification may generally be made on a Form W-8BEN or W-8BEN-E, or a substitute or successor form). In addition, special rules may apply to claims for treaty benefits made by corporate non-U.S. holders. A non-U.S. holder that is eligible for a reduced rate of U.S. federal withholding tax pursuant to an income tax treaty may obtain a refund of any excess amounts withheld by filing an appropriate claim for refund with the Internal Revenue Service. The availability of a lower rate of withholding or an exemption from withholding under an applicable income tax treaty will depend on the proper characterization of the contingent monthly coupons under U.S. federal income tax laws and whether such treaty rate or exemption applies to such contingent monthly coupon payments. No assurance can be provided on the proper characterization of the contingent quarterly coupons for U.S. federal income tax purposes and, accordingly, no assurance can be provided on the availability of benefits under any income tax treaty. Non-U.S. holders should consult their tax advisors in this regard.

Except as discussed below, a non-U.S. holder will generally not be subject to U.S. federal income or withholding tax on any gain (not including, for the avoidance of doubt, any amounts properly attributable to any contingent quarterly coupon which would be subject to the rules discussed in the previous paragraph) upon the sale or maturity of the Notes, provided that (i) the holder complies with any applicable certification requirements (which certification may generally be made on a Form W-8BEN or W-8BEN-E, or a substitute or successor form), (ii) the payment is not effectively connected with the conduct by the holder of a U.S. trade or business, and (iii) if the holder is a non-resident alien individual, such holder is not present in the U.S. for 183 days or more during the taxable year of the sale or maturity of the Notes. In the case of (ii) above, the holder generally would be subject to U.S. federal income tax with respect to any income or gain in the same manner as if the holder were a U.S. holder and, in the case of a holder that is a corporation, the holder may also be subject to a branch profits tax equal to 30% (or such lower rate provided by an applicable U.S. income tax treaty) of a portion of its earnings and profits for the taxable year that are effectively connected with its conduct of a trade or business in the U.S., subject to certain adjustments. Payments made to a non-U.S. holder may be subject to information reporting and to backup withholding unless the holder complies with applicable certification and identification requirements as to its foreign status.

A “dividend equivalent” payment is treated as a dividend from sources within the U.S. and such payments generally would be subject to a 30% U.S. withholding tax if paid to a non-U.S. holder. Under U.S. Treasury Department regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents if such specified ELIs reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give rise to

a U.S. source dividend. However, withholding on “dividend equivalent” payments, if any, will not apply to securities issued before January 1, 2017. If any payments are treated as dividend equivalents subject to withholding, we (or the applicable paying agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

As discussed above, alternative characterizations of the Notes for U.S. federal income tax purposes are possible. Should an alternative characterization, by reason of change or clarification of the law, by regulation or otherwise, cause payments as to the Notes to become subject to withholding tax in addition to the withholding tax described above, we will withhold tax at the applicable statutory rate. The Internal Revenue Service has also indicated that it is considering whether income in respect of instruments such as the Notes should be subject to withholding tax. We will not be required to pay any additional amounts in respect of such withholding. Prospective investors should consult their own tax advisors in this regard.

Foreign Account Tax Compliance Act. The Foreign Account Tax Compliance Act (“FATCA”), imposes a 30% U.S. withholding tax on certain U.S. source payments of interest (and OID), dividends, or other fixed or determinable annual or periodical gain, profits, and income, and on the gross proceeds from a disposition of property (including payments at maturity, or upon a redemption or sale) of a type which can produce U.S. source interest or dividends (“withholdable payments”), if paid to a foreign financial institution (including amounts paid to a foreign financial institution on your behalf) unless such institution enters into an agreement with the U.S. Treasury Department to collect and provide to the U.S. Treasury Department certain information regarding U.S. account holders, including certain account holders that are foreign entities with U.S. owners, with such institution or otherwise complies with FATCA. In addition, the Notes may constitute a “financial account” for these purposes and thus, be subject to information reporting requirements pursuant to FATCA. The legislation also generally imposes a withholding tax of 30% on withholdable payments made to a non-financial foreign entity, unless that entity provides the withholding agent with a certification that it does not have any substantial U.S. owners or a certification identifying the direct and indirect substantial U.S. owners of the entity.

The U.S. Treasury Department and the IRS have announced that withholding on payments of gross proceeds from a sale or redemption of the Notes will only apply to payments made after December 31, 2018. We will not pay additional amounts with respect to any FATCA withholding. Therefore, if such withholding applies, any payments on the Notes will be significantly less than what you would have otherwise received. Depending on your circumstances, these amounts withheld may be creditable or refundable to you. Foreign financial institutions and non-financial foreign entities located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules. You are urged to consult with your own tax advisor regarding the possible implications of FATCA on your investment in the Notes.

|

|

P-

21

|

RBC Capital Markets, LLC

|

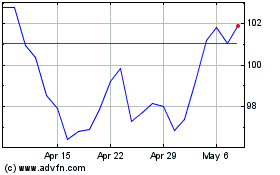

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024