| |

|

|

|

|

|

|

RBC Capital Markets®

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-203433

|

| |

|

|

|

|

| |

|

| |

|

|

|

|

Pricing Supplement

Dated May 18, 2015

to the Product Prospectus Supplement FIN-1, Prospectus

Supplement and Prospectus, each dated April 30, 2015

|

|

$3,000,000

Redeemable Step Up Notes,

Due May 21, 2028

Royal Bank of Canada

|

| |

|

|

|

|

Royal Bank of Canada is offering the Redeemable Step Up Notes (the “Notes”) described below.

The CUSIP number for the Notes is 78012KDB0.

The Notes will accrue interest at the following rates during the indicated year of their term:

|

·

|

Years 1-5:

|

2.30% per annum

|

|

·

|

Years 6-10:

|

3.00% per annum

|

|

·

|

Years 11-12:

|

5.00% per annum

|

|

·

|

Year 13:

|

7.00% per annum

|

We will pay interest on the Notes on May 21 and November 21 of each year (each an “Interest Payment Date”), commencing on November 21, 2015.

We may call the Notes in whole, but not in part, on May 21, 2020, May 21, 2025 and May 21, 2027, upon 10 business days’ prior written notice. Any payments on the Notes are subject to our credit risk.

The Notes will not be listed on any U.S. securities exchange.

Investing in the Notes involves a number of risks. See “Risk Factors” beginning on page S-1 of the prospectus supplement dated April 30, 2015, “Additional Risk Factors Specific to the Notes” beginning on page PS-5 of the product prospectus supplement FIN-1 dated April 30, 2015 and “Additional Risk Factors” on page P-5 of this pricing supplement.

The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation (the “FDIC”) or any other Canadian or U.S. government agency or instrumentality.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

RBC Capital Markets, LLC has offered the Notes at a public offering price equal to the principal amount, and will purchase the Notes from us on the Issue Date at a purchase price that will be 97.75% of the principal amount. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page P-5 below.

To the extent that the total aggregate principal amount of the Notes being offered by this pricing supplement is not purchased by investors in the offering, one or more of our affiliates may purchase the unsold portion. However, our affiliates will not purchase more than 15% of the principal amount of the Notes.

We will deliver the Notes in book-entry only form through the facilities of The Depository Trust Company on May 21, 2015, against payment in immediately available funds.

| |

|

|

| |

|

|

| |

|

Redeemable Step Up Notes,

Due May 21, 2028

|

| |

|

|

SUMMARY

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, the product prospectus supplement FIN-1, the prospectus supplement, and the prospectus.

|

Issuer:

|

Royal Bank of Canada (“Royal Bank”)

|

| |

|

|

Issue:

|

Senior Global Medium-Term Notes, Series G

|

| |

|

|

Underwriter:

|

RBC Capital Markets, LLC

|

| |

|

|

Currency:

|

U.S. Dollars

|

| |

|

|

Minimum Investment:

|

$1,000 and minimum denominations of $1,000 in excess of $1,000

|

| |

|

|

Pricing Date:

|

May 18, 2015

|

| |

|

|

Issue Date:

|

May 21, 2015

|

| |

|

|

Maturity Date:

|

May 21, 2028

|

| |

|

|

CUSIP:

|

78012KDB0

|

| |

|

|

Type of Note:

|

Step Up Note

|

| |

|

|

Interest Rate:

|

Years 1-5: 2.30% per annum

Years 6-10: 3.00% per annum

Years 11-12: 5.00% per annum

Year 13: 7.00% per annum

|

| |

|

|

Interest Payment Dates:

|

Semi-annually, on May 21 and November 21 of each year, commencing on November 21, 2015. If an Interest Payment Date is not a New York business day, interest shall be paid on the next New York business day, without adjustment for period end dates and no interest shall be paid in respect of the delay.

|

| |

|

|

Redemption:

|

Redeemable at our option.

|

| |

|

|

Call Dates:

|

The Notes are callable, in whole, but not in part, on May 21, 2020, May 21, 2025 and May 21, 2027, upon 10 business days’ prior written notice.

|

| |

|

|

Survivor’s Option:

|

Applicable. See “General Terms of the Notes—Survivor’s Option” beginning on page PS-17 of the product prospectus supplement FIN-1 dated April 30, 2015.

|

| |

|

|

U.S. Tax Treatment:

|

Please see the discussion (including the opinion of our counsel Morrison & Foerster LLP) in the product prospectus supplement FIN-1 dated April 30, 2015 under “Supplemental Discussion of U.S. Federal Income Tax Consequences” and specifically the discussion under “Supplemental Discussion of U.S. Federal Income Tax Consequences—Supplemental U.S. Tax Considerations—Where the term of your notes will exceed one year—Fixed Rate Notes, Floating Rate Notes, Inverse Floating Rate Notes, Step Up Notes, Leveraged Notes, Range Accrual Notes, Dual Range Accrual Notes and Non-Inversion Range Accrual Notes,” and “Supplemental Discussion of U.S. Federal Income Tax Consequences—Supplemental U.S. Tax Considerations—Where the term of your notes will exceed one year—Sale, Redemption or Maturity of Notes that Are Not Treated as Contingent Payment Debt Instruments,” which apply to your Notes.

|

| |

|

|

| |

|

|

| |

|

Redeemable Step Up Notes,

Due May 21, 2028

|

| |

|

|

|

Calculation Agent:

|

RBC Capital Markets, LLC

|

| |

|

|

Listing:

|

The Notes will not be listed on any securities exchange.

|

| |

|

|

Clearance and

Settlement:

|

DTC global (including through its indirect participants Euroclear and Clearstream, Luxembourg as described under “Description of Debt Securities—Ownership and Book-Entry Issuance” in the prospectus dated April 30, 2015).

|

|

Terms Incorporated in

the Master Note:

|

All of the terms appearing above the item captioned “Listing” on page P-2 of this pricing supplement and the terms appearing under the caption “General Terms of the Notes” in the product prospectus supplement FIN-1 dated April 30, 2015, as modified by this pricing supplement.

|

| |

|

|

| |

|

|

| |

|

Redeemable Step Up Notes,

Due May 21, 2028

|

| |

|

|

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together with the prospectus dated April 30, 2015, as supplemented by the prospectus supplement dated April 30, 2015 and the product prospectus supplement FIN-1 dated April 30, 2015, relating to our Senior Global Medium-Term Notes, Series G, of which these Notes are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to them in the product prospectus supplement FIN-1. In the event of any conflict, this pricing supplement will control. The Notes vary from the terms described in the product prospectus supplement FIN-1 in several important ways. You should read this pricing supplement carefully.

This pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the prospectus supplement dated April 30, 2015, “Additional Risk Factors Specific to the Notes” in the product prospectus supplement FIN-1 dated April 30, 2015 and “Additional Risk Factors” in this pricing supplement, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. You may access these documents on the SEC website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website):

Prospectus dated April 30, 2015:

Prospectus Supplement dated April 30, 2015:

Product Prospectus Supplement FIN-1 dated April 30, 2015:

Our Central Index Key, or CIK, on the SEC website is 1000275. As used in this pricing supplement, the “Company,” “we,” “us”, or “our” refers to Royal Bank of Canada.

| |

|

|

| |

|

|

| |

|

Redeemable Step Up Notes,

Due May 21, 2028

|

| |

|

|

ADDITIONAL RISK FACTORS

The Notes involve risks not associated with an investment in ordinary fixed rate notes. This section describes the most significant risks relating to the terms of the Notes. For additional information as to these risks, please see the product prospectus supplement FIN-1 dated April 30, 2015 and the prospectus supplement dated April 30, 2015. You should carefully consider whether the Notes are suited to your particular circumstances before you decide to purchase them. Accordingly, prospective investors should consult their financial and legal advisors as to the risks entailed by an investment in the Notes and the suitability of the Notes in light of their particular circumstances.

Early Redemption Risk. We have the option to redeem the Notes on the Call Dates set forth above. It is more likely that we will redeem the Notes prior to their stated maturity date to the extent that the interest payable on the Notes is greater than the interest that would be payable on our other instruments of a comparable maturity, terms and credit rating trading in the market. If the Notes are redeemed prior to their stated maturity date, you may have to re-invest the proceeds in a lower rate environment.

Investors Are Subject to Our Credit Risk, and Our Credit Ratings and Credit Spreads May Adversely Affect the Market Value of the Notes. Investors are dependent on Royal Bank’s ability to pay all amounts due on the Notes on the interest payment dates and at maturity, and, therefore, investors are subject to the credit risk of Royal Bank and to changes in the market’s view of Royal Bank’s creditworthiness. Any decrease in Royal Bank’s credit ratings or increase in the credit spreads charged by the market for taking Royal Bank’s credit risk is likely to adversely affect the market value of the Notes.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

Delivery of the Notes will be made against payment for the Notes on May 21, 2015, which is the third (3rd) business day following the Pricing Date (this settlement cycle being referred to as “T+3”). See “Plan of Distribution” in the prospectus supplement dated April 30, 2015. For additional information as to the relationship between us and RBC Capital Markets, LLC, please see the section “Plan of Distribution—Conflicts of Interest” in the prospectus dated April 30, 2015.

After the initial offering of the Notes, the price to the public may change. To the extent that the total aggregate principal amount of the Notes being offered by this pricing supplement is not purchased by investors in the offering, one or more of our affiliates may purchase the unsold portion. However, our affiliates will not purchase more than 15% of the principal amount of the Notes. Sales of these Notes by our affiliates could reduce the market price and the liquidity of the Notes that you purchase.

We may use this pricing supplement in the initial sale of the Notes. In addition, RBC Capital Markets, LLC or another of our affiliates may use this pricing supplement in a market-making transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

| |

|

|

| |

|

|

| |

|

Redeemable Step Up Notes,

Due May 21, 2028

|

| |

|

|

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada LLP, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the Indenture and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the Notes is a matter governed by the laws of the Province of Ontario or Québec, or the laws of Canada applicable therein, and will be valid obligations of the Bank, subject to equitable remedies which may only be granted at the discretion of a court of competent authority, subject to applicable bankruptcy, insolvency and other laws of general application affecting creditors’ rights, and subject to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Quebec and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated April 30, 2015, which has been filed as Exhibit 5.1 to Royal Bank’s Form 6-K filed with the SEC on April 30, 2015.

In the opinion of Morrison & Foerster LLP, when the Notes have been duly completed in accordance with the Indenture and issued and sold as contemplated by the prospectus supplement and the prospectus, the Notes will be valid, binding and enforceable obligations of Royal Bank, entitled to the benefits of the Indenture, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith). This opinion is given as of the date hereof and is limited to the laws of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the legal opinion dated April 30, 2015, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K dated April 30, 2015.

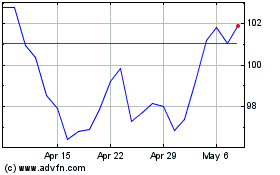

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024