Pacific Energy Development Announces the Acquisition of 14,000 Net Acres & 40 Wells in the Niobrara Shale Formation, the Secu...

March 10 2014 - 8:30AM

Marketwired

Pacific Energy Development Announces the Acquisition of 14,000 Net

Acres and 40 Wells in the Niobrara Shale Formation, the Securing of

a Drilling Capital Facility, the Raising of $7.3 Million Through

Equity Issuance, and Cancellation of Shares Resulting in

Effectively No Increase in Shares Outstanding

DANVILLE, CA--(Marketwired - Mar 10, 2014) - PEDEVCO Corp. d/b/a

Pacific Energy Development (NYSEMKT: PED) (the "Company"), an

energy company engaged in the acquisition and development of

strategic high-value energy projects in the U.S. and Asia, today

announced the following:

- The closing of the previously announced acquisition of

approximately 28,000 net acres in Wattenberg and Wattenberg

Extension in Colorado

- The entering of a joint venture with RJ Resources for a 50%

working interest on the project going forward, resulting in 14,000

net acres to the Company

- The closing of a $34,500,000 loan to facilitate the purchase of

the Colorado acreage

- Establishment of a $15,500,000 drilling facility for the

development of the new Colorado acreage

- The issuing of 3,438,500 shares of common stock through an

underwritten registered shelf offering for gross proceeds to the

Company of $7,392,775

- The cancellation of 3,333,333 shares of common stock resulting

in 26,309,011 shares issued and outstanding

The Company today announced

that it has successfully completed the previously announced

acquisition of an interest in 40 wells and approximately 28,000 net

acres in the DJ Basin, Colorado from an independent U.S. oil and

gas company. The acreage acquired in the Niobrara Shale

Formation is almost entirely located in Weld County, Colorado,

including some acreage in the prolific Wattenberg Area. Of the

40 wells in which interests were acquired, 11 are now operated by

the Company, 14 are non-operated, and the Company will have an

after-payout interest in the remaining 15 wells. The purchase had

an effective date of December 1, 2013. The Company paid

approximately $28 million in cash, reflecting oil and gas

production credited to the Company since the December 1, 2013

effective date, and certain other adjustments.

In order to finance the

acquisition and provide the Company with sufficient capital to

immediately commence a meaningful development program covering this

new acreage, the Company entered into a 3-year term debt facility

with RJ Resources, a subsidiary of a NY-based investment management

group with more than $1.3 billion in assets under management

specializing in resource investments. As part of the transaction,

RJ Resources, will be a 50% working interest partner with the

Company in the development of its assets going forward, allowing

the Company to undertake a more aggressive drilling program, in

2014. As a result, the Company has an interest in 14,000 net

acres after closing. The Company has drawn down $34.5 million

of a $50 million dollar debt facility, and can draw down the

remaining $15.5 million for drilling capital to develop this new

acreage. In addition to cash on hand, proceeds of the just

completed offering of common stock, and future anticipated oil and

gas revenues, this facility should give the Company sufficient

drilling capital to meet its 2014 drilling budget.

Casimir Capital LP served as

the Company's financial advisor in the acquisition and debt

financing transactions.

On March 7th, the Company

closed its recently announced underwritten offering of an aggregate

of 3,438,500 shares of common stock, which included the full

exercise of the overallotment by the underwriters. The Company

has received gross proceeds of $7,392,775 before deducting

underwriting discounts and estimated offering expenses as a result

of the offering.

The Company further announced

today that it has cancelled 3,333,333 shares of common stock that

had been held in escrow in connection with an August 2013

subscription, which has been cancelled by the Company, resulting in

a reduction in the number of the Company's shares of common stock

to 26,309,011 currently issued and outstanding, after taking into

account the new shares issued in connection with the March 7th

public offering.

Frank C. Ingriselli, President and CEO of the Company, stated,

"We believe that this acquisition transforms our Company into one

of the key players in the prolific Niobrara play. It offers us a

unique opportunity to significantly increase our daily production

in the DJ Basin and increase our acreage by over 500%, and also

provides us an entry into the exciting Wattenberg

Area. Through the experience and operational efficiencies we

have gained through our operations in the Niobrara play over recent

years, we are confident that we can successfully develop these

assets, thereby maximizing shareholder value. We are also pleased

to work with our new strategic partner, RJ Resources, who has

afforded us the financial backing to launch an aggressive

development program for this asset and the access to capital needed

to accomplish our strategic plan. In considering this joint venture

with RJ Resources, we determined that selling down an interest in

the future drilling would allow the Company to undertake a more

aggressive drilling program to better develop this acreage. I

am also pleased that, consistent with our focus on building

shareholder value, we were able to accomplish this acquisition and

access to significant drilling capital with essentially no net

additional equity issued by the Company."

About Pacific Energy Development (PEDEVCO Corp.)

PEDEVCO Corp, d/b/a Pacific Energy Development (NYSEMKT: PED),

is a publicly-traded energy company engaged in the acquisition and

development of strategic, high growth energy projects, including

shale oil and gas assets, in the United States and Asia. The

Company's principal assets include its Niobrara asset located in

the DJ Basin in Colorado, its Mississippian asset located in

Comanche, Harper, Barber and Kiowa Counties, Kansas, and its North

Sugar Valley asset located in Matagorda County, Texas. The Company

has also previously announced its entry into an agreement to

acquire a working interest in a 380,000 acre producing asset

located in the Pre-Caspian Basin, one of the largest producing

basins in Kazakhstan, which acquisition is pending Kazakhstan

government approval. Pacific Energy Development is

headquartered in Danville, California, with offices in Houston,

Texas and Beijing, China.

Forward-Looking Statements

All statements in this press release that are not based on

historical fact are "forward-looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995 and the

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. While management has based any forward-looking statements

contained herein on its current expectations, the information on

which such expectations were based may change. These

forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of risks,

uncertainties, and other factors, many of which are outside of the

Company's control, that could cause actual results to materially

differ from such statements. Such risks, uncertainties, and other

factors include, but are not necessarily limited to, those set

forth under Item 1A "Risk Factors" in the Company's Annual Report

on Form 10-K for the year ended December 31, 2012. The Company

operates in a highly competitive and rapidly changing environment,

thus new or unforeseen risks may arise. Accordingly, investors

should not place any reliance on forward-looking statements as a

prediction of actual results. The Company disclaims any intention

to, and undertakes no obligation to, update or revise any

forward-looking statements. Readers are also urged to carefully

review and consider the other various disclosures in the Company's

public filings with the SEC.

Contacts Pacific Energy Development Bonnie Tang 1-855-733-3826

ext 21 (Media) PR@pacificenergydevelopment.com Investor Relations:

Liviakis Financial Communications, Inc. John Liviakis

+1-415-389-4670 john@liviakis.com Stonegate, Inc. Casey Stegman

214-987-4121 casey@stonegateinc.com

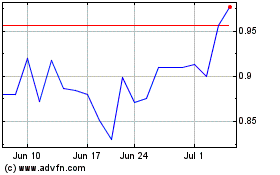

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024