P.A.M. Transportation Services, Inc. (Nasdaq:PTSI) today reported

net income of $880,907, or diluted and basic earnings per share of

$0.10 for the quarter ended September 30, 2012, and net income of

$2,489,890, or diluted and basic earnings per share of $0.29 for

the nine month period then ended. These results compare to net loss

of $1,704,894, or diluted and basic loss per share of $0.19, and

net loss of $2,990,408, or diluted and basic loss per share of

$0.33, respectively, for the three and nine months ended September

30, 2011.

Operating revenues, including revenue from fuel surcharges, were

$94,548,874 for the third quarter of 2012, a 6.3% increase compared

to $88,937,884 for the third quarter of 2011. Operating revenues,

including fuel surcharges, were $284,860,094 for the nine months

ended September 30, 2012, a 5.6% increase compared to $269,854,603

for the nine months ended September 30, 2011.

Daniel H. Cushman, President of the Company, commented, "PAM

extended the trend of year over year earnings growth during the

third quarter 2012, despite significant hurdles faced during the

quarter. This quarter completes four consecutive quarters of

positive earnings, with each month of 2012 contributing both

operating and net income. Another milestone reached during the

quarter was the achievement of operating and net income during the

month of July, which we have not done in a decade – even in years

like 2006 when we had an operating income of approximately $30

million for the year. These results further bolster our confidence

in the continued refinement of our freight network and strategic

expense control efforts.

"As we looked forward to the third quarter, we were apprehensive

about July, due to the history of losses during the month, and

September, due to it only having nineteen work days. July has

historically been a very challenging month due to scheduled

shutdown periods with automotive customers, however,

diversification of our customer base helped to mitigate the impact

of this cycle in 2012. In hindsight, August was the most

challenging month of the quarter with an approximate $0.33 increase

in the national average price of diesel fuel during the month,

coupled with a softening in freight demand during the month.

September 2012 was the first nineteen revenue day month,

considering only major holidays, since November 2008. Despite these

significant hurdles, we improved third quarter operating income by

$3.6 million compared to the same period last year.

"We continue to find new growth opportunities with customers

that we did little or no business with prior to my arrival in July

2010, and to refine our freight network to attain a favorable mix

of rate optimization and cost minimization. We are pleased with the

customer diversification we have achieved over the last two and

half years and plan to increase focus on growth within this

customer base by emphasizing our core business offerings and

proving the value of our service. We continue to grow and develop

our service offerings of Expedited, Mexico, Dedicated, and Supply

Chain Solutions.

"Our fleet replenishment cycle is on schedule and we remain very

pleased with customer and driver satisfaction, reduced costs, and

the contribution towards improving CSA scores achieved by this

investment. As of September 30, 2012, our average tractor age was

1.9 years old, down from a high of 3.5 years in April 2011. The

specifications of our new equipment coupled with various

operational fuel saving strategies greatly reduces the effect of

severe upside volatility in fuel prices similar to those

experienced in August of this year.

"We continue to intensify our focus on our driving professionals

and look for ways to improve their satisfaction with the company,

as well as, programs to attract drivers from an ever decreasing

pool of qualified candidates. We have added approximately 10% more

drivers as of September 30, 2012, compared to September 30,

2011.

"While we are still apprehensive as we approach months that

present significant profitability hurdles such as those faced in

each month of the third quarter 2012, we grow more confident in our

model with each passing profitable month achieved. We would like to

commend our dedicated employees, and thank our customers, suppliers

and shareholders for their continued commitment and support."

P.A.M. Transportation Services, Inc. is a leading truckload dry

van carrier transporting general commodities throughout the

continental United States, as well as in the Canadian provinces of

Ontario and Quebec. The Company also provides transportation

services in Mexico through its gateways in Laredo and El Paso,

Texas under agreements with Mexican carriers.

The PAM Transportation Services, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5148

Certain information included in this document contains or may

contain "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements may relate to expected future financial

and operating results or events, and are thus prospective. Such

forward-looking statements are subject to risks, uncertainties and

other factors which could cause actual results to differ materially

from future results expressed or implied by such forward-looking

statements. Potential risks and uncertainties include, but are not

limited to, excess capacity in the trucking industry; surplus

inventories; recessionary economic cycles and downturns in

customers' business cycles; increases or rapid fluctuations in fuel

prices, interest rates, fuel taxes, tolls, license and registration

fees; the resale value of the Company's used equipment and the

price of new equipment; increases in compensation for and

difficulty in attracting and retaining qualified drivers and

owner-operators; increases in insurance premiums and deductible

amounts relating to accident, cargo, workers' compensation, health,

and other claims; unanticipated increases in the number or amount

of claims for which the Company is self insured; inability of the

Company to continue to secure acceptable financing arrangements;

seasonal factors such as harsh weather conditions that increase

operating costs; competition from trucking, rail, and intermodal

competitors including reductions in rates resulting from

competitive bidding; the ability to identify acceptable acquisition

candidates, consummate acquisitions, and integrate acquired

operations; a significant reduction in or termination of the

Company's trucking service by a key customer; terrorist attacks;

war; natural disasters; risk of doing business internationally; and

other factors, including risk factors, included from time to time

in filings made by the Company with the Securities and Exchange

Commission. The Company undertakes no obligation to publicly update

or revise forward-looking statements, whether as a result of new

information, future events or otherwise. In light of these risks

and uncertainties, the forward-looking events and circumstances

discussed above and in company filings might not transpire.

| P.A.M. Transportation Services,

Inc. and Subsidiaries Key Financial and Operating Statistics

(unaudited) |

| |

Quarter ended September

30, |

Nine Months Ended

September 30, |

| |

2012 |

2011 |

2012 |

2011 |

| |

|

|

|

|

| Revenue, before fuel surcharge |

$74,431,498 |

$70,616,157 |

$223,299,708 |

$213,219,669 |

| Fuel surcharge |

20,117,376 |

18,321,727 |

61,560,386 |

56,634,934 |

| |

94,548,874 |

88,937,884 |

284,860,094 |

269,854,603 |

| |

|

|

|

|

| Operating expenses and costs: |

|

|

|

|

| Salaries, wages and

benefits |

35,276,939 |

30,275,768 |

101,082,341 |

88,490,423 |

| Fuel expense |

26,426,777 |

30,965,185 |

84,662,101 |

96,366,058 |

| Operating supplies and

expenses |

10,302,930 |

10,363,520 |

29,746,415 |

28,848,040 |

| Rent and purchased

transportation |

5,456,601 |

5,868,836 |

18,780,677 |

16,679,761 |

| Depreciation |

9,638,665 |

8,071,219 |

28,192,850 |

24,745,428 |

| Operating taxes and

licenses |

1,246,297 |

1,188,797 |

3,725,698 |

3,712,334 |

| Insurance and claims |

3,487,272 |

3,113,108 |

10,082,119 |

9,825,635 |

| Communications and

utilities |

532,901 |

554,990 |

1,659,690 |

1,904,760 |

| Other |

1,087,826 |

1,228,189 |

3,720,573 |

4,160,647 |

| Loss (gain) on disposition of

equipment |

153,727 |

4,123 |

(89,685) |

31,079 |

| Total operating expenses and costs |

93,609,935 |

91,633,735 |

281,562,779 |

274,764,165 |

| |

|

|

|

|

| Operating income (loss) |

938,939 |

(2,695,851) |

3,297,315 |

(4,909,562) |

| |

|

|

|

|

| Interest expense |

(644,967) |

(375,179) |

(1,811,534) |

(1,356,708) |

| Non-operating income |

1,188,283 |

172,609 |

2,677,219 |

1,325,080 |

| |

|

|

|

|

| Income (loss) before income taxes |

1,482,255 |

(2,898,421) |

4,163,000 |

(4,941,190) |

| Income tax expense (benefit) |

601,348 |

(1,193,527) |

1,673,110 |

(1,950,782) |

| |

|

|

|

|

| Net income (loss) |

$880,907 |

$(1,704,894) |

$2,489,890 |

$(2,990,408) |

| |

|

|

|

|

| Diluted earnings (loss) per share |

$0.10 |

$(0.19) |

$0.29 |

$(0.33) |

| |

|

|

|

|

| Average shares outstanding – Diluted |

8,703,029 |

8,941,163 |

8,701,520 |

9,142,278 |

| |

|

|

| |

Quarter ended September

30, |

Nine Months Ended

September 30, |

| Truckload Operations |

2012 |

2011 |

2012 |

2011 |

| |

|

|

|

|

| Total miles |

49,757,225 |

48,178,945 |

150,523,395 |

147,188,224 |

| Operating ratio* |

98.87% |

104.20% |

98.65% |

102.60% |

| Empty miles factor |

8.60% |

9.12% |

8.79% |

7.95% |

| Revenue per total mile, before fuel

surcharge |

$1.38 |

$1.38 |

$1.36 |

$1.36 |

| Total loads |

63,140 |

68,704 |

195,199 |

209,384 |

| Revenue per truck per work day |

$610 |

$584 |

$613 |

$592 |

| Revenue per truck per week |

$3,050 |

$2,920 |

$3,065 |

$2,960 |

| Average company trucks |

1,612 |

1,728 |

1,627 |

1,726 |

| Average owner operator trucks |

170 |

47 |

129 |

40 |

| |

|

|

|

|

| Logistics Operations |

|

|

|

|

| Total revenue |

$5,913,898 |

$4,266,822 |

$18,634,493 |

$13,417,421 |

| Operating ratio |

97.23% |

97.92% |

97.14% |

97.92% |

| |

|

|

|

|

| * Operating ratio has been

calculated based upon total operating expenses, net of fuel

surcharge, as a percentage of revenue, before fuel surcharge. We

used revenue, before fuel surcharge, and operating expenses, net of

fuel surcharge, because we believe that eliminating this sometimes

volatile source of revenue affords a more consistent basis for

comparing our results of operations from period to period. |

|

|

|

|

CONTACT: P.A.M. TRANSPORTATION SERVICES, INC.

P.O. BOX 188

Tontitown, AR 72770

Lance K. Stewart

(479) 361-9111

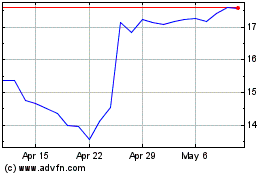

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

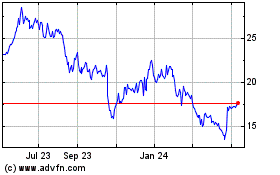

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Sep 2023 to Sep 2024