TIDMOOA

Octopus AIM VCT plc

Final Results

27 May 2016

Octopus AIM VCT plc, managed by Octopus Investments Limited, today

announces the final results for the year ended 29 February 2016.

These results were approved by the Board of Directors on 27 May 2016.

You may, in due course, view the Annual Report in full at

www.octopusinvestments.com by navigating to Investors, and selecting

Octopus AIM VCT plc from the drop down menu. All other statutory

information will also be found there.

Financial Summary

As at As at

29 February 2016 28 February 2015

Net assets (GBP'000) 77,224 72,612

Net profit/(loss) after tax (GBP'000) 742 (5,226)

Net asset value (NAV) per share 101.6p 110.2p

Ordinary Dividends per share paid in 5.3p 5.5p

year

Special Dividend per share paid in year 4.0p -

Proposed Final Dividend per share* 2.5p 2.8p

* Subject to shareholder approval at the Annual General Meeting, the

proposed final dividend will be paid on 22 July 2016 to shareholders on

the register on 24 June 2016.

Chairman's Statement

Introduction

The year to 29 February 2016 was characterised by an unsettled stock

market which had the effect of dampening the enthusiasm for share prices

even when companies demonstrated good business progress. The year opened

with worries about an impending General Election which turned briefly to

euphoria on the news of a single party majority in May before

international political and economic concerns once again created the

conditions for market volatility. This uncertainty has continued into

2016, with attention now on the European Referendum in June. Against

this background performance was rather muted with the 9.3p of dividends

paid out in the year only just exceeding the fall in the Net Asset Value

(NAV) to give a small positive total return. Some of the mature holdings

in the portfolio have seen their share prices advance on good news but

it has been significantly harder for the earlier stage companies which

have yet to make a profit. Their shares have tended to fare much worse

in a risk averse market even when they have met expectations.

Royal Assent was also given to the second Finance Act of the year in

November, bringing new VCT regulations which reconcile with EU State Aid

rules. Your Managers are not expecting to have to change their approach

in any substantial way as a result of these new regulations.

During the year your company raised GBP12.4 million by the issue of new

shares and a further GBP8.7million has been raised since the year end.

Your Company continued to buy back from selling shareholders.

Performance

Adding back the 5.3p of ordinary and 4p special dividends paid out in

the year, the Net Asset value rose marginally, by 0.6%. This compares

with a fall in the AIM index of 1.7%, a fall in the FTSE All Share Index

of 7.3% and a rise in the Smallcap Index ex Investment Trusts of 1.6%,

all on a total return basis.

As these figures suggest it has been smaller companies' shares which

have performed relatively well, reflecting the fact that larger

companies are perceived to be more exposed to international concerns

about Chinese growth and the weak oil price as well as political worries

around the Eurozone and the effects of the immigration crisis. However,

within the portfolio, performance has tended to polarise with the better

established and profitable companies seeing their share prices advance

on good news, and those yet to make a profit struggling to get investor

attention and seeing their share prices under pressure, particularly

those thought to be in need of further funding.

There have been signs that the appetite for takeovers has started to

revive. In the year under review, the cash offer for Advanced Computer

software completed and Chime Communications, Synabor and Enables IT were

all subject to takeover bids. Several other portfolio companies have

accelerated their growth through acquisitions during the year.

2016 did not match the previous year for the amount raised by new issues

on AIM although secondary fundraisings were even more in evidence. In

the year under review AIM has raised GBP5.4 billion in new capital,

fulfilling its purpose of providing additional growth capital for its

members. After a strong December and January for fundraisings, February

was quieter although the pipeline of new companies looking to float on

AIM seems to be steady.

In the interim accounts I reported that we had invested GBP4 million in

qualifying holdings. In the second half of the year we invested a

further GBP1.9 million in qualifying investments which included three

new holdings in Scientific Digital Imaging, Tyratech and Haydale

Graphene together with two further follow-on investments into Microsaic

and Nektan. The last was in the format of a convertible loan note. In

addition we invested GBP5.2 million in non-qualifying holdings in the

year, in order to put the funds raised to work in the market. We made

disposals totalling GBP5.9 million at a net profit of GBP4.3 million.

Further details of performance are contained in the Investment Managers'

Review.

New VCT Regulations

VCTs have always been subject to UK regulations, not least as they

confer tax benefits on investors. In recent years these regulations

have become subject themselves to European State Aid rules. The

Chancellor proposed new rules in his Summer Budget in July 2015 and,

following discussions with European authorities in Brussels, these

became law following the granting of Royal Assent in November 2015.

These are in addition to existing rules which already limited investment

to companies with gross assets of no more than GBP15 million, 250

employees and where no more than GBP5 million of State Aided funds had

been raised within the past 12 months.

The new rules now in force relate to the age of companies receiving a

first investment, a lifetime limit on State Aided funds and rules

designed to target any funds raised on a company's growth. They also

recognise that there is a class of company which is 'knowledge

intensive' and therefore hungrier for capital, and some of the limits

are more generous for these types of companies.

To summarise the changes, in order to qualify companies must:

-- have fewer than 250 full time equivalent employees; and

-- have less than GBP15 million of gross assets at the time of investment

and no more than GBP16 million immediately post investment; and

-- be less than seven years old (or 10 years if a knowledge intensive fund)

if raising State Aided funds for the first time; and

-- have raised no more than GBP5 million of State Aided funds in the

previous 12 months and less than the lifetime limit of GBP12 million (or

GBP20 million if a knowledge intensive fund); and

-- produce a business plan to show that its funds are being raised for

growth.

Follow-on investments are allowed to provide further capital for an

existing investment up to the lifetime limit, and in certain

circumstances a company may obtain clearance to raise money to develop a

new business or market. Money raised from VCTs is not allowed to be used

for acquisitions, or to buy out debt or existing equity. In addition,

non-qualifying purchases of AIM shares are no longer allowed.

Draft clarification notes to go with the VCT legislation have just been

published and so it is still too early to come to any conclusions about

what effect these new rules will have on VCT qualifying deal flow for

AIM companies. Your VCT has made two investments since the rules became

law and has seen a steady flow of qualifying opportunities. At 88%, the

VCT is well above the minimum 70% qualifying requirement and therefore

under no immediate pressure to invest its cash.

Dividends

An interim dividend of 2.5p was paid to shareholders in January 2016. It

is your Board's intention to continue to pay a minimum of 2.5p each half

year and to adjust annually, based on the year-end share price, the

final dividend so that shareholders receive either 5p per annum or a 5%

yield, whichever is the greater at the time. This will enable dividends

to progress with a rising NAV, whilst maintaining the minimum historic

level. With respect to the year to February 2016 your Board has so far

declared and paid an interim dividend of 2.5p and now has pleasure in

recommending a final dividend of 2.5p, which brings the total dividend

for the year to 5p which is higher than an annualised yield of 5%, based

on the share price of 95.875p on 29 February 2016.

Special dividends are by definition special and do not form part of the

minimum payment. A 4p special dividend was paid in respect of the year

to 28 February 2015 following the exceptional profit realised on the

takeover of Advanced Computer Software. No special dividend is proposed

for the year ended 29 February 2016.

Dividend Reinvestment scheme

In common with many other VCTs in the industry, your Company has started

a Dividend Reinvestment Scheme (DRIS). Some shareholders have already

taken advantage of this opportunity. For investors who do not need

income, but value the additional tax relief on their reinvested

dividends, this is an attractive scheme and I hope more shareholders

will find it useful. In the course of the year 468,005 new shares have

been issued under this scheme. The dividend referred to above will be

eligible for the DRIS.

Share Buy Backs

In the year ended 29 February 2016 we bought back 1,494,656 shares for

cancellation. The average month end discount to Net Asset Value at

which your shares have traded through the year has been 5.1% compared to

the closing monthly bid price in line with the Board's policy of 5%.

Share Issues

In the year to 29 February 2016 we have raised a total of GBP12.4

million of new capital. This figure is made up, first, of GBP8.5

million raised under the combined offer with Octopus AIM VCT 2 plc ("AIM

VCT 2") which launched on 29 August 2014. This offer closed, fully

subscribed, on 1 July 2015. A further combined fundraise with AIM VCT 2

was launched on 21 December 2015 to raise up to GBP20 million, with an

overallotment facility of GBP10 million. By the year end GBP3.9 million

had been raised under this offer. At the date of this report a further

GBP8.7 million had been raised in the period since 29 February 2016. The

offer remains open and the Company can raise up to a further GBP5.4

million before reaching the maximum of GBP18 million.

VCT Status

PricewaterhouseCoopers LLP provides your Board and Investment Manager

with advice concerning continuing compliance with HMRC regulations for

VCTs. Your Board has been advised that Octopus AIM VCT is in compliance

with the conditions laid down by HMRC for maintaining approval as a VCT.

A key requirement is to maintain at least a 70% qualifying investment

level. As at 29 February 2016 some 88% of the portfolio as measured by

HMRC rules was invested in qualifying investments.

Risks and uncertainties

In accordance with the Listing Rules under which your Company operates

your Board has to comment on the potential risks and uncertainties which

could have a material impact on the Company's performance. A risk arises

from the requirement to maintain compliance with HMRC regulations

requiring 70% of your Company's assets to be invested in qualifying

holdings. Other risks include economic conditions which impact

particularly on smaller companies in which your Company invests and this

could have an adverse impact on share prices.

Annual General Meeting

The Annual General Meeting will be held on Thursday, 7 July 2016. I very

much hope that you will be able to come. After the formal business our

Investment Managers will make a presentation. At the Annual General

Meeting, a resolution will be proposed to extend the life of the Company

until 2022 in order to preserve the VCT status of the Company for the

benefit of both existing shareholders and new investors participating in

the present share offer. I have been Chairman since the formation of the

Company and will be retiring at the Annual General Meeting. I am

delighted to announce that Roger Smith will be succeeding me. We will

seek to appoint a new non-executive director during the course of the

year.

Outlook

Markets have been generally more volatile in the last few months in the

face of more pronounced fears about global economic growth. While many

of the widely reported international concerns are of less relevance to

smaller UK companies such as those in the portfolio, the EU Referendum

is now casting a shadow over the market which will continue until the

result is known at the end of June.

Despite this background there is no reason to be disheartened as far as

smaller companies are concerned, and the performance of your portfolio

depends as ever, more on the progress made by individual companies

rather than any macro-economic or political factors. There are several

holdings in the healthcare and technology sector expected to move into

profit over the next two or more years and among the more mature

holdings a number have produced good results in the recent March results

season.

Michael Reeve

Chairman

27 May 2016

Investment Manager's Review

Introduction

Smaller company share prices proved resilient during the year to 29

February 2016 in contrast to the FTSE 100 which saw some steep declines

in some of its members exposed to a weak oil price and international

markets. At the interim stage we reported that the wider stock market

had once again become a more difficult place after an initial burst of

enthusiasm following the General Election result in May had passed. This

more cautious tone persisted for the remainder of the year, with the

result that the NAV total return was slightly down in the second half

although it remained just in positive territory for the year as a whole.

It was the share prices of earlier stage companies needing cash to

fulfil growth plans that were most affected and we talk about some

examples in the portfolio later on in this report. More established and

profitable companies saw their share prices advance despite market

conditions and these contributed positively to performance in the year.

Overall it seems quite likely, at this stage, that similar conditions

will prevail through 2016, with companies only seeing their share prices

advance as a result of positive results rather than on any general

market trends.

While AIM itself has had some criticism in 2015, it has continued to

support existing companies even though the number of new flotations was

lower than in the previous twelve months. The benefit of increased

market nervousness is that valuations have tended to be more realistic,

which bodes well for investing the cash being raised under the current

offer.

The Alternative Investment Market

The year to 29 February 2016 started well with the AIM Index

participating in a general rise in the stock market. However, its higher

exposure to resource stocks meant that it could not sustain this rise as

worries about a Chinese slowdown intensified and it ended 1.7% down by

the end of the period, behind smaller companies generally although still

well ahead of the FTSE 100.

Despite this volatility, and a lower level of new listings on AIM than

in 2014, the market raised a very substantial sum, GBP5.4 billion, for

existing AIM listed companies for the year as a whole. That is the

highest level of secondary fundraising on AIM since 2010 and is proof

that the market will support companies with good reasons for asking for

additional growth capital. The ability of AIM to attract a range of new

issues and to raise further funds for small growing companies is its

most important characteristic as far as the VCT is concerned.

2015 finished with a large number of companies testing the temperature

of the water, as they examined the possibility of floating in the first

quarter of 2016. These are beginning to come through in the form of

prospectus's landing on our desks although this has been slower than we

expected at the end of 2015, probably as a result of more turbulent

market conditions. However, assuming that owners and managers set a

higher priority on growth than some arbitrary valuation, we would expect

to see a healthy flow of new companies coming to AIM in 2016. We also

expect to see many existing AIM companies continue to use their listing

to raise finance for further growth.

Performance

Dividend payments in the year were higher than usual as a result of a

special dividend paid out of the profit from the Advanced Computer

Software holding which was taken over in March 2015. Adding these back

to show the total return, the Net Asset Value decreased in the year by

slightly less than the 9.8p of dividends paid out, giving a total return

of 0.6%. This compares with a total return for the FTSE Smallcap Index

of 1.6% and for AIM of -1.7%. The FTSE All Share Index was affected by a

sell-off in larger companies perceived to be exposed to global growth

and a weak oil price and it underperformed returning -7.3% in the twelve

month period. The portfolio benefited from its exposure to small

growing companies many of which are operating in a domestic economy that

has been enjoying better growth than many of its international

counterparties.

Within the portfolio it was the older, more established and already

profitable companies that tended to perform best in these market

conditions, with a number of the not yet profitable earlier stage

companies seeing their share prices decline. Among the latter Mycelx,

highlighted in the accounts a year ago, continued to suffer from a weak

share price as a result of fears about the prolonged effect of a low oil

price. The management has cut costs and is preserving its cash. Several

other earlier stage companies had a negative impact on the performance

of the NAV in the year including Oxford Pharmascience and Proxama.

Oxford Pharmascience has a technology that reduces the harmful effects

of drugs on the stomach through slow release of the active ingredients.

Although the share price has performed poorly, the company raised GBP20

million in 2015 and so has cash to fund further trials if it should

prove necessary. Proxama, a company with near field communications

technology to allow people to transact by tapping their mobile phone,

has seen its share price decline on fears that it will need more money

in order to execute its strategy. It has recently announced a series of

contracts that indicate that it may now be managing to get some sales

traction.

EKF Diagnostics was the other holding that performed particularly badly

in the year. Difficulties with its US molecular diagnostics laboratory

were compounded by some lumpy order patterns in its point of care

diagnostics business, and the company ended up announcing a strategic

review which resulted in a potential bid. When any formal bid failed to

materialise, the company announced that it would be cutting costs and

concentrating its efforts on restoring shareholder value through

focusing on the point of care business.

On a positive note some of the more established holdings in the

portfolio enjoyed strong share price gains in the year and more than

compensated for the poor share price performance of anything considered

by the market to be small and early stage. Breedon, Staffline, Brooks

Macdonald, Idox, Vertu Motors and GB Group all saw their share prices

respond well to good figures showing strong progress in their respective

businesses with the promise of further growth to come. In particular,

Breedon has made a takeover bid for Hope Group, a rival UK aggregates

and cement business which will double its size, making it the largest

independent UK based aggregates business and give it a much coveted

entry into the London cement market. It is awaiting the approval of the

Competition and Markets Authority. They are all now well established,

and by VCT standards, sizeable businesses.

Encouragingly, several other portfolio companies saw their businesses

develop significantly in the year and were rewarded with share price

gains. Tasty, a restaurant operator, has now built its estate to more

than 50 outlets and has the funding to grow it by 15 units a year out of

existing resources. This fund first invested in 2007 and it took three

years before the company reached profitability, since then it has

accelerated its growth plans. Adept Telecom made a significant

acquisition, increasing its ability to win business with larger

customers and Animalcare demonstrated that it could successfully launch

several new animal medicines into the market in a twelve month period.

DP Poland, which owns the Dominos Pizza franchise in Poland, is still a

long way from profitability but it has now demonstrated a financial

model that works, and the shares have strengthened as a result.

Learning Technologies also reaped the benefit of several acquisitions

made since it reversed the business of Epic into Indeed On-line and is

now bidding for and winning substantial government contracts.

Among the non-qualifying holdings Skyepharma was the best performer, and

is now subject to a takeover bid from Vectura, another mid-sized

pharmaceutical company specialising in the respiratory sector. The

combined Group will be cash generative as well as having a portfolio of

products in development providing potential for future growth. RWS,

Restore and Gooch and Housego all performed well in the year.

Portfolio Activity

In addition to the GBP4 million invested in six qualifying investments

in the first half of the year, we invested a further GBP1.9 million in

five further qualifying investments in the second half. Two of these

were follow on investment into Nektan and Microsaic, both of which have

yet to generate any significant sales and are still proving their

business models. All of the new investments were in existing AIM

companies. Among them, only Scientific Digital Imaging is already

profitable although Tyratech is already selling its head lice treatment

based on natural plant extracts to WalMart in the US and Boots in the UK

and will be using the funds raised to accelerate its sales towards

profitability. Haydale also has existing sales. It has a technology to

functionalise graphene to enable its properties of strength and

conductivity to be used in conjunction with other substances.

We have also invested a proportion of our newly raised cash in

non-qualifying holdings with a view to improving returns by putting

liquid assets to work. We invested in a number of larger AIM companies,

which we know well and which, as relatively developed profitable and

dividend paying companies, represent a balance to the risk, which the

younger qualifying companies necessarily inject into the portfolio. In

total we invested GBP5.2 million into new non-qualifying holdings in the

year. In aggregate therefore we have invested over GBP11.1 million in

the year to February 2016, which compares with the GBP12.4 million

raised by the company.

During the year we made disposals of GBP5.9 million realising an overall

profit over book cost of GBP4.3 million. The major sale in the year was

the disposal of Advanced Computer Software Group, which we covered in

the interim statement. In the second half of the year Chime

Communications and Synabor were taken over for cash. Enables IT was

also taken over, and as a result the fund now has a holding in 1 Spatial,

a software Group which specialises in managing vast quantities of

geospatial data. The holding in Staffline was trimmed, but the only

other holding which was sold entirely in the second half was Goals

Soccer Centres, which had always been a non-qualifying holding and

produced a small profit.

Outlook

Markets have had a very unsettled start to 2016, with worries about a

further slowdown in China, continuing weakness in the oil price and

worries about the possibility of rising interest rates exacerbated by a

new uncertainty posed by the EU referendum in June. Despite the US

raising rates in December, the prospect of a rate rise in the UK still

seems to be some way off, and forecasts remain for slow economic growth.

As far as the domestic economy is concerned this is a similar outlook to

this time last year and goes some way to explain why many smaller UK

focused companies have continued to publish encouraging trading

statements which have often been followed by upgrades to analysts'

forecasts. On a more cautious note, it has become apparent in the

recent reporting season that the market is very nervous about companies

disappointing with some share prices falling substantially on bad news.

Inevitably it is the still unprofitable companies perceived to need

further funding that are most vulnerable in this situation, with the

specific risk increased where VCTs are no longer able to follow their

money at a lower price under new regulations and therefore at risk of

returns being diluted. We believe that share price performance will

continue to be driven by the progress of individual companies and take

comfort from the fact that 85% by value of the equity portfolio is

represented by profitable companies and 70% by dividend paying

companies.

A relatively positive UK economic outlook is also a reason to believe

that capital raising and flotations will remain a significant feature of

AIM this year. In those circumstances we would expect to invest the

present cash balance profitably for shareholders in new qualifying

holdings.

The AIM Team

Octopus Investments Limited

27 May 2016

Investment Portfolio

% equity

Fair held by

Cost as Value at all

at 29 Cumulative 29 % equity funds

February change in February Movement held by managed

Quoted 2016 fair value 2016 in year AIM VCT by

Investments Sector (GBP'000) (GBP'000) (GBP'000) ('GBP000) plc Octopus

Staffline

Recruitment

plc Support Services 334 4,626 4,960 1,756 1.3% 11.0%

Breedon

Aggregates Construction &

Limited Building 859 3,971 4,830 1,413 0.6% 1.2%

GB Group plc Support Services 715 2,220 2,935 1,034 0.9% 9.0%

Brooks

MacDonald

Group plc Finance 746 1,979 2,725 583 1.1% 8.3%

Technology

Quixant plc Hardware 697 1,952 2,649 500 2.3% 6.4%

Tasty plc Leisure & Hotels 622 1,834 2,456 402 2.8% 5.2%

Idox plc Software 353 2,040 2,393 493 1.3% 3.6%

Mattioli Woods

plc Finance 529 1,740 2,269 261 1.6% 2.4%

Learning

Technologies

Group plc Support Services 1,320 782 2,102 876 1.5% 2.4%

Vertu Motors

plc General Retailers 1,265 449 1,714 153 0.7% 5.0%

TLA Worldwide

plc Media 807 888 1,695 (40) 2.8% 6.1%

Telecommunication

Netcall plc Services 438 1,236 1,674 (463) 2.6% 4.5%

Pharmaceuticals &

Ergomed plc Biotech 1,440 31 1,471 15 3.1% 10.7%

RWS Holdings

plc Support Services 367 885 1,252 127 0.3% 6.7%

Pharmaceuticals &

Skyepharma plc Biotech 672 448 1,120 241 0.3% 0.6%

Animalcare Food Producers &

Group plc Processors 306 806 1,112 66 2.6% 6.8%

Restore Group

plc Support Services 467 605 1,072 78 0.4% 9.6%

Gooch & Housego Electronic &

plc Electrical 489 549 1,038 216 0.5% 11.9%

Cello Group plc Media 895 122 1,017 (73) 1.4% 5.4%

Craneware plc Software 183 831 1,014 303 0.5% 1.9%

Nektan Limited Software 845 (340) 505 (714) 2.6% 16.2%

Pharmaceuticals &

Abcam Plc Biotech 895 109 1,004 109 0.1% 2.1%

Clinigen Group Pharmaceuticals &

plc Biotech 935 47 982 47 0.1% 3.3%

DP Poland plc Leisure & Hotels 546 401 947 64 2.8% 4.7%

Adept Telecom Telecommunication

plc Services 601 321 922 304 1.9% 3.8%

Escher Group

Holdings plc Software 1,003 (119) 884 (147) 3.2% 5.5%

Bond

International

plc Software 353 496 849 17 2.2% 3.3%

Brady plc Software 947 (99) 848 (432) 1.8% 3.0%

CityFibre

Infrastructure Telecommunication

Holdings Plc Services 1,025 (201) 824 (201) 0.6% 1.6%

Advanced

Medical Pharmaceuticals &

Solutions Biotech 757 48 805 48 0.2% 7.7%

Nasstar plc Software 481 312 793 (24) 2.5% 7.1%

Judges

Scientific Electronic &

plc Electrical 314 443 756 (101) 0.8% 1.4%

Next Fifteen

plc Media 688 45 733 45 0.5% 7.0%

SQS Software

plc Software 291 404 695 (57) 0.4% 13.1%

Oxford

Pharmascience Pharmaceuticals &

Group plc Biotech 1,350 (709) 641 (709) 1.1% 3.5%

Sinclair Pharma Pharmaceuticals &

plc Biotech 765 (151) 614 48 0.3% 0.6%

EKF Diagnostics

plc Health 931 (322) 609 (706) 1.3% 2.4%

Tyratech Chemicals 600 - 600 - 5.5% 19.9%

Cambridge

Cognition

Group plc Health 601 (43) 558 (17) 5.0% 17.8%

Ideagen plc Software 419 139 558 102 0.7% 5.4%

Omega

Diagnostics

plc Health 465 90 555 29 3.5% 6.2%

Gear4Music

Holdings plc Media 557 (44) 513 (44) 2.0% 5.1%

Gamma

Communications Telecommunication

Plc Services 488 24 512 24 0.1% 7.3%

Haydale

Graphene Plc Chemicals 598 (131) 467 (131) 2.5% 9.0%

Mears Group plc Support Services 139 320 459 (78) 0.1% 0.1%

Iomart Group

plc Software 268 122 390 86 0.1% 8.1%

Plastics Engineering &

Capital plc Machinery 400 (16) 384 (56) 1.1% 9.1%

Midatech Pharma Pharmaceuticals &

plc Biotech 600 (218) 382 (274) 0.7% 3.0%

Access

Intelligence

plc Software 375 (19) 356 169 2.7% 5.3%

Engineering &

Microsaic plc Machinery 625 (314) 311 (325) 2.3% 8.6%

Proxama plc Software 763 (458) 305 (244) 3.0% 12.1%

Vianet Group

plc Support Services 359 (77) 282 42 1.1% 4.6%

Scientific Healthcare

Digital equipment 179 89 268 89 3.5% 12.0%

Futura Medical Pharmaceuticals &

plc Biotech 613 (371) 242 (129) 1.1% 5.2%

Fusionex

International

plc Software 282 (44) 239 (451) 0.4% 1.3%

Sphere Medical Health 600 (375) 225 (375) 2.6% 4.4%

ReNeuron Group Pharmaceuticals &

Plc Biotech 324 (146) 178 (146) 0.2% 1.2%

Tangent

Communications

plc Support Services 578 (419) 159 (14) 2.1% 4.7%

WANdisco plc Software 241 (88) 153 (379) 0.4% 0.7%

Altitude Group

plc Media 600 (450) 150 (117) 3.9% 4.5%

Engineering &

TP Group plc Machinery 648 (502) 146 (66) 1.3% 6.3%

Enteq Upstream

plc Oil Services 1,032 (908) 124 (26) 1.7% 3.7%

MyCelx

Technologies

plc Oil Equipment 1,470 (1,369) 101 (912) 5.3% 11.5%

Dods Group plc Media 203 (114) 89 34 0.2% 0.2%

1Spatial plc Software 300 (253) 47 (28) 0.1% 0.2%

Tanfield Group Engineering &

plc Machinery 226 (182) 44 (17) 0.6% 0.6%

Lombard Medical

Technologies

plc Health 408 (368) 40 (166) 0.3% 0.7%

Work Group plc Support Services 943 (911) 32 (15) 4.1% 6.2%

Clean Air Power

Limited Industrial 485 (485) - (161) 2.0% 8.8%

Total Quoted Investments 42,619 21,157 63,777 1,936

% equity

Fair held by

Cost as Value at all

at 29 Cumulative 29 % equity funds

February change in February Movement held by managed

Unquoted 2016 fair value 2015 in year AIM VCT by

Investments Sector (GBP'000) (GBP'000) (GBP'000) ('GBP000) plc Octopus

Hasgrove plc Media 88 62 150 70 2.2% 13.0%

Rated People

Limited Software 354 (322) 32 (322) 0.5% 1.5%

Total Unquoted Investments 442 (260) 182 (252)

% equity

Fair held by

Cost as Value at all

at 29 Cumulative 29 % equity funds

February change in February Movement held by managed

Loan Note 2016 fair value 2015 in year AIM VCT by

Investments Sector (GBP'000) (GBP'000) (GBP'000) ('GBP000) plc Octopus

Nektan Limited Software 500 - 500 - N/A 16.2%

Access

Intelligence

plc Software 120 - 120 - N/A 5.3%

Total Loan Note Investments 620 - 620 -

Total Investments 43,681 20,897 64,578 1,684

Money Market Funds 5,269

Total fixed asset investments and

money market funds 69,847

Cash at bank 9,751

Debtors less creditors (2,374)

Total net assets 77,224

Top ten holdings

Listed below are the ten largest investments, valued at bid price, as at

29 February 2016:

Staffline Recruitment Plc

Staffline is a provider of labour to employers.

Initial investment date: December 2004

Cost: GBP334,000

Valuation: GBP4,960,000

Equity held: 1.3%

Last audited accounts: 31 December 2015

Revenue: GBP702.2 million

Profit before tax: GBP5.5 million

Net assets: GBP73.2 million

Breedon Aggregates Limited

Breedon Aggregates supplies a diverse range of products to the

construction and building sectors from a number of quarries and other

sites in the Midlands and Scotland.

Initial investment date: August 2010

Cost: GBP859,000

Valuation: GBP4,830,000

Equity held: 0.6%

Last audited accounts: 31 December 2015

Revenue: GBP318 million

Profit before tax: GBP31.3 million

Net assets: GBP233 million

GB Group Plc

GB Group specialises in ID verification to help customers avoid ID theft

and fraud and to verify the age and circumstances of both customers and

employees for regulatory and commercial reasons.

Initial investment date: November 2011

Cost: GBP715,000

Valuation: GBP2,935,000

Equity held: 1.0%

Last audited accounts: 31 March 2015

Revenue: GBP57.3 million

Profit before tax: GBP5.9 million

Net assets: GBP46.1 million

Brooks MacDonald Group Plc

Brooks MacDonald is a provider of asset management and financial

consulting services with a particular emphasis on the pensions market.

Initial investment date: March 2005

Cost: GBP746,000

Valuation: GBP2,725,000

Equity held: 1.1%

Last audited accounts: 30 June 2015

Revenue: GBP77.7 million

Profit before tax: GBP11.4 million

Net assets: GBP74.2 million

Quixant Plc

Quixant designs and manufactures advanced PC based computer systems for

the gaming industry.

Initial investment date: September 2013

Cost: GBP697,000

Valuation: GBP2,649,000

Equity held: 2.3%

Last audited accounts: 31 December 2015

Revenue: $41.8 million

Profit before tax: $9.2 million

Net assets: $25.7 million

Tasty Plc

Tasty is the operator of Wildwood and Dim T restaurants in the 'casual

dining' sector.

Initial investment date: May 2007

Cost: GBP622,000

Valuation: GBP2,456,000

Equity held: 2.8%

Last audited accounts: 27 December 2015

Revenue: GBP35.8 million

Profit before tax: GBP3.1 million

Net assets: GBP19.2 million

Idox Plc

Idox is a leading software and information management solutions provider,

mainly to the public and engineering sectors.

Initial investment date: May 2008

Cost: GBP353,000

Valuation: GBP2,393,000

Equity held: 1.3%

Last audited accounts: 31 October 2015

Revenue: GBP62.6 million

Profit before tax: GBP9.8 million

Net assets: GBP53.6 million

Mattioli Woods Plc

Mattioli Woods is a financial advisor and investment manager and

administrator, particularly of pension funds.

Initial investment date: November 2005

Cost: GBP529,000

Valuation: GBP2,269,000

Equity held: 1.6%

Last audited accounts: 31 May 2015

Revenue: GBP34.6 million

Profit before tax: GBP5.3 million

Net assets: GBP39.5 million

Learning Technologies Group plc

Learning Technologies is a learning technologies agency which provides a

comprehensive and integrated range of e-learning services and

technologies to corporate and government clients.

Initial investment date: June 2011

Cost: GBP1,320,000

Valuation: GBP2,102,000

Equity held: 1.5%

Last audited accounts: 31 December 2015

Revenue: GBP19.9 million

Profit before tax: GBP1.5 million

Net assets: GBP25.5 million

Vertu Motors plc

The Vertu Motors group operates a nationwide chain of 120 franchised

motor dealerships offering sale, servicing, parts and bodyshop

facilities for new and used car and commercial vehicles.

Initial investment date: December 2006

Cost: GBP1,265,000

Valuation: GBP1,714,000

Equity held: 0.8%

Last audited accounts: 29 February 2016

Revenue: GBP2.4 billion

Profit before tax: GBP26 million

Net assets: GBP197.9 million

Directors' Responsibilities Statement

The Directors are responsible for preparing the Strategic Report,

Directors' Report, Directors' Remuneration Report and the financial

statements in accordance with applicable law and regulations. They are

also responsible for ensuring that the annual report includes

information required by the Listing Rules of the Financial Conduct

Authority.

Company law requires the Directors to prepare financial statements for

each financial year. Under that law the Directors have elected to

prepare the financial statements in accordance with UK Generally

Accepted Accounting Practice ("GAAP"), including Financial Reporting

Standard 102 - 'The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland' ("FRS 102"), (United Kingdom

accounting standards and applicable law). Under company law the

Directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of affairs of

the Company and of the profit or loss of the Company for that period.

In preparing these financial statements the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgments and accounting estimates that are reasonable and prudent;

-- state whether applicable UK accounting standards have been followed,

subject to any material departures disclosed and explained in the

financial statements;

-- prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Company will continue in business; and

-- prepare a Strategic Report, Directors' Report and Directors' Remuneration

Report which comply with the requirements of the Companies Act 2006.

The Directors are responsible for keeping adequate accounting records

that are sufficient to show and explain the Company's transactions, to

disclose with reasonable accuracy at any time the financial position of

the Company and to enable them to ensure that the financial statements

comply with the Companies Act 2006. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

The directors confirm that:

-- so far as each Director is aware, there is no relevant audit information

of which the Company's auditor is unaware; and

-- the Directors have taken all the steps that they ought to have taken as

directors in order to make themselves aware of any relevant audit

information and to establish that the auditors are aware of that

information.

The Directors are responsible for preparing the annual report in

accordance with applicable law and regulations. The Directors consider

the annual report and the financial statements, taken as a whole,

provides the information necessary to assess the Company's performance,

business model and strategy and is fair, balanced and understandable.

The Directors are responsible for ensuring the annual report and the

financial statements are made available on the Company's website.

Financial statements are published on the website in accordance with

legislation in the United Kingdom governing the preparation and

dissemination of financial statements, which may vary from legislation

in other jurisdictions. The Directors' responsibility also extends to

the ongoing integrity of the financial statements contained therein.

The Directors confirm, to the best of their knowledge:

-- that the financial statements, prepared in accordance with UK GAAP,

including FRS 102, give a true and fair view of the assets, liabilities,

financial position and profit or loss of the Company taken as a whole;

and

-- the annual report, including the strategic report, includes a fair review

of the development and performance of the business and the financial

position of the Company taken as a whole, together with a description of

the principal risks and uncertainties that it faces.

On Behalf of the Board

Michael Reeve

Chairman

27 May 2016

Income Statement

Year to 29 February 2016 Year to 28 February 2015

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gain/(Loss) on

disposal of fixed

asset

investments - 59 59 - (298) (298)

Gain/(Loss) on

valuation of

fixed asset

investments - 1,684 1,684 - (4,005) (4,005)

Investment Income 816 - 816 703 - 703

Investment

management fees (340) (1,021) (1,361) (302) (906) (1,208)

Other expenses (456) - (456) (418) - (418)

Net return on

ordinary

activities before

taxation 20 722 742 (17) (5,209) (5,226)

Taxation - - - - - -

Net return on

ordinary

activities after

taxation 20 722 742 (17) (5,209) (5,226)

Earnings per share

- basic and

diluted 0.0p 1.0p 1.0p 0.0p (8.8p) (8.8p)

-- the 'Total' column of this statement represents the statutory Income

Statement of the Company; the supplementary revenue return and capital

return columns have been prepared in accordance with the AIC Statement of

Recommended Practice

-- all revenue and capital items in the above statement derive from

continuing operations

-- the Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds

The Company has no recognised gains or losses other than the results for

the period as set out above. Accordingly a Statement of Comprehensive

Income is not required.

Statement of Financial Position

As at 29 February 2016 As at 28 February 2015

GBP'000 GBP'000 GBP'000 GBP'000

Fixed asset investments* 64,578 57,711

Current assets:

Investments* 5,269 454

Debtors 48 203

Cash at bank 9,751 14,992

15,068 15,649

Creditors: amounts falling

due within one year (2,422) (748)

Net current assets 12,646 14,901

Net assets 77,224 72,612

Called up equity share

capital 760 656

Shares to be issued - 319

Share premium 21,643 13,951

Capital redemption reserve 24 9

Special distributable

reserve 60,062 63,684

Capital reserve realised (26,518) (29,810)

Capital reserve unrealised 20,898 23,468

Revenue reserve 355 335

Total equity shareholders'

funds 77,224 72,612

Net asset value per share 101.6p 110.2p

- basic and diluted

* held at fair value through profit & loss (FVTPL)

The statements were approved by the Directors and authorised for issue

on 27 May 2016 and are signed on their behalf by:

Michael Reeve

Chairman

Company number: 03477519

Statement of Changes in Equity

Shares Capital Special Capital Capital

Share Share to be redemption distributable reserve reserve Revenue

Capital Premium issued reserve reserves realised unrealised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 March

2014 547 873 1,327 2 64,455 (27,338) 29,512 352 69,730

Management fee

allocated as

capital

expenditure - - - - - (906) - - (906)

Current year

(loss) on

disposal (298) - - (298)

Current period

loss on fair

value of

investments - - - - - - (4,005) - (4,005)

Prior years'

holding

gains/losses

now realised - - - - - 2,039 (2,039) - -

Loss on

ordinary

activities

after tax - - - - - - - (17) (17)

Total other

comprehensive

income for the

year - - - - - - - - -

Contributions

by and

distributions

to owners:

Repurchase and

cancellation

of own

shares (7) - - 7 (771) - - - (771)

Issue of

shares 116 13,717 (1,327) - - - - - 12,506

Share issue

costs - (639) - - - - - - (639)

Cash received

for shares to

be issued - - 319 - - - - - 319

Dividends paid - - - - - (3,307) - - (3,307)

Balance as at

28 February

2015 656 13,951 319 9 63,684 (29,810) 23,468 335 72,612

As at 1 March

2015 656 13,951 319 9 63,684 (29,810) 23,468 335 72,612

Management fee

allocated as

capital

expenditure - - - - - (1,021) - - (1,021)

Current year

gains on

disposal - - - - - 59 - - 59

Current period

gain on fair

value of

investments - - - - - - 1,684 - 1,684

Prior years'

holding

gains/losses

now realised - - - - - 4,254 (4,254) - -

Gain on

ordinary

activities

after tax - - - - - - - 20 20

Total other

comprehensive

income for the

year - - - - - - - - -

Cancellation of

Share Premium - (4,658) - - 4,658 - - - -

Contributions

by and

distributions

to owners:

Repurchase and

cancellation

of own shares (15) - - 15 (1,499) - - - (1,499)

Issue of shares 119 12,989 (319) - - - - - 12,789

Share issue

costs - (639) - - - - - - (639)

Dividends paid - - - - (6,781) - - - (6,781)

Balance as at

29 February

2016 760 21,643 - 24 60,062 (26,518) 20,898 355 77,224

Statement of Cash Flows

For the year to 29 For the year to 28

February 2016 February 2015

GBP'000 GBP'000

Cash flows from operating

activities

Return on ordinary

activities before tax 742 (5,226)

Adjustments for:

Decrease in debtors 155 51

Increase in creditors 1,674 574

(Gain)/loss on disposal

of fixed assets (59) 298

(Gain)/loss on valuation

of fixed asset

investments (1,684) 4,005

Cash from operations 828 (298)

Income taxes paid - -

Net cash generated from

operating activities 828 (298)

Cash flows from investing

activities

Purchase of fixed asset

investments (11,043) (5,291)

Sale of fixed asset

investments 5,919 3,845

Net cash flows from

investing activities (5,124) (1,446)

Cash flows from financing

activities

Purchase of own shares (1,499) (771)

Share issues* 12,469 13,194

Decrease in shares to be

issued (319) (1,008)

Dividends Paid* (6,781) (3,307)

Net cash flows from

financing activities 3,870 8,108

(Decrease)/Increase in

cash and cash

equivalents (426) 6,364

Opening cash and cash

equivalents 15,446 9,082

Closing cash and cash

equivalents 15,020 15,446

Cash and cash equivalents

comprise

Cash at Bank 9,751 14,992

Money Market Funds 5,269 454

15,020 15,446

*Includes GBP491,000 of dividends where shares were issued under the

DRIS.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Octopus AIM VCT PLC via Globenewswire

HUG#2016108

http://www.octopusinvestments.com

(END) Dow Jones Newswires

May 27, 2016 11:45 ET (15:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

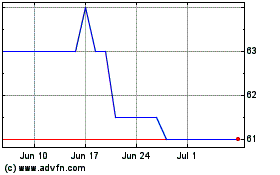

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Sep 2023 to Sep 2024