Norway's Statoil Net Loss Deepens, To Reduce Spending, Maintain Dividend -- 2nd Update

February 04 2016 - 7:46AM

Dow Jones News

By Kjetil Malkenes Hovland

Norway's Statoil ASA (STO) said Thursday it would offer a scrip

dividend, allowing shareholders to accept newly issued shares

rather than cash dividends to fund spending after the oil and gas

producer reported its first full-year net loss since the company

was listed in 2001.

"These earnings are weak, but this is an industrywide problem,"

Statoil chief executive Eldar Sætre told The Wall Street

Journal.

In the wake of a roughly 70% drop in oil prices in 18 months,

global oil companies are presenting very weak fourth-quarter

earnings. Scrambling to restore profitability and maintain dividend

payouts, Statoil and its peers are slashing spending and shedding

thousands of workers as well as taking on more debt.

Statoil said it had reduced costs much more than expected, and

raised last year's cost-cutting target by 50% to $2.5 billion by

end-2016 compared with the 2013 level. Capital expenditure dropped

27% on the year in 2015 and is set to drop another 12% to $13

billion this year, it said.

However, the company continued to take on more debt to fund its

operations and dividend, and its debt ratio--debt as a share of

capital--rose to 26.8% by the end of 2015, from 20% a year earlier.

Statoil aims to keep that ratio below 30%, but suggested it may

rise toward 40% next year if oil prices stay below $40 per

barrel.

To free up cash, the company offered its shareholders the

opportunity to take shares instead of a cash dividend, at a 5%

discount for the fourth quarter. This tool, called a scrip

dividend, is already used by companies like Royal Dutch Shell,

Total SA and BP.

"This is an additional tool that a large share of the industry

has used for a while, and we've found it natural to add this to our

toolbox, to strengthen our financial capacity and fund our

investment program," Mr. Sætre said.

Norway's right-wing minority government said it supported the

move, but added that parliament would have to approve. The

government plans to maintain its 67% ownership, by echoing any move

by other investors to accept shares rather than cash dividends.

"This dividend model provides shareholders with options, and

enhances the company's flexibility," said Tord Lien, Norway's

Minister of Petroleum and Energy.

Squeezing drilling costs and engineering hours, the company has

managed to make ongoing projects profitable at only $30 a barrel,

from $39 a barrel three years ago, and projects in planning are now

set to be profitable at an average of $41 a barrel, down from $70 a

barrel three years ago, Mr. Sætre said.

Statoil shares traded 8% higher Thursday, as cost cuts and

continued dividend payouts encouraged investors although the

company reported a full-year net loss of 37.5 billion Norwegian

kroner ($4.42 billion), its first ever, from a net profit of 21.9

billion kroner a year earlier, on lower revenue, provisions and

write-downs.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

February 04, 2016 07:31 ET (12:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

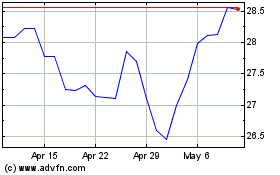

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Sep 2023 to Sep 2024