NASDAQ Tops U.S. Exchanges for IPOs in Second Quarter of 2014

June 30 2014 - 10:40AM

79 new listings in second quarter, including 55

IPOs

Strongest first half of the year for new listings

at NASDAQ since 2000 with 99 IPOs in 2014

Leads U.S. exchanges in technology and venture

capital-backed IPOs completed in the quarter

The NASDAQ OMX Group, Inc. (Nasdaq:NDAQ) announced that it welcomed

79 new listings in the second quarter of 2014, including 55 initial

public offerings (IPOs), on The NASDAQ Stock Market (NASDAQ), to

bring its total IPO count to 99 for the first half of 2014. This

represents more IPOs than any other U.S. exchange and a 57 percent

increase in listings compared to the same quarter last year –

marking the strongest first half of the year for NASDAQ listings

since 2000. The combined proceeds raised by NASDAQ's IPOs in the

second quarter totaled approximately $8.8 billion to bring its

year-to-date proceeds raised to approximately $13.5 billion.

"NASDAQ is maintaining its leadership position by continuing to

attract new and quality companies, which further reinforces the

strength of our capital markets," said Nelson Griggs, Senior Vice

President of listings at NASDAQ OMX. "We are extremely proud to be

the exchange of choice for innovative companies seeking to go

public from a broad range of sectors and we expect to see positive

momentum in the IPO market for the remainder of the year."

SECOND QUARTER 2014 HIGHLIGHTS+

- Over 60 percent of all IPOs in the U.S. during the second

quarter occurred on NASDAQ.

- 90 percent of NASDAQ's IPOs in the second quarter filed under

the JOBS Act.

Technology

- NASDAQ continues to attract leading technology companies to its

market.

- 13 technology companies listed in the second quarter, more than

any other U.S. exchange, including:

- JD.com (Nasdaq:JD)

- GoPro (Nasdaq:GPRO)

- Sabre Technologies (Nasdaq:SABR)

- Weibo (Nasdaq:WB)

- Top five technology IPOs by proceeds raised in the second

quarter listed on NASDAQ.

- NASDAQ's technology IPOs in 2014 are up an average of 29

percent from their offer price to date.

Venture Capital and Private Equity-backed IPOs

- 74 percent of venture capital-backed IPOs listed with NASDAQ

during the first half of 2014.

- 12 private-equity backed listings, including The Michaels

Companies (Nasdaq:MIK) and Markit Ltd. (Nasdaq:MRKT)

- Venture capital and private equity-sponsored IPOs raised more

than $7.6 billion in combined proceeds.

(+Data source: EDGAR Online, Renaissance Capital as of June 27,

2014)

| |

| SECOND

QUARTER 2014 |

| TOTAL NEW LISTINGS (April 1,

2014 – June 30, 2014)* |

79 |

| Initial Public

Offerings** |

55 |

| Upgrades from

Over-the-Counter |

15 |

| ETF, Structured Products,

Reverse Mergers & Other Listings |

8 |

| Transfers to NASDAQ from

Competing Exchanges |

1 |

*Data source: NASDAQ, FactSet, EDGAR Online

**Includes the following capital raising events in the U.S. as

priced between April 1, 2014 and June 27, 2014: IPO, REIT, SPAC,

BDC, Foreign Exchange Dual Listing, Best Effort and Spin-offs

NASDAQ OMX NORDIC SECOND QUARTER 2014

HIGHLIGHTS

(Denmark, Finland, Iceland, Sweden)

"The first half of 2014 has been the strongest in our Nordic

markets since 2007, both in terms of new listings and capital

raised and across a wide range of sectors," said Adam Kostyál,

Senior Vice President and head of European listings at NASDAQ OMX.

"Year over year we have seen a 100 percent increase in listings and

based on the current pipeline, the second half of 2014 will be

equally strong. In addition, we continue to see interest among

European companies, particularly within tech and life science,

looking to raise capital at NASDAQ in the U.S. which has a

favorable investor ecosystem for these specialty sectors."

- NASDAQ OMX Nordic Listings year-to-date:

- Total 43 Listings* (18 Main Market, 25 First North)

- 30** IPOs (11 Main Market, 19 First North)

- Proceeds raised year-to-date***:

- Approximately $4.5 billion

- Top three NASDAQ OMX Nordic IPOs in 2014:

- ISS (ISS) – $1.5 billion (Copenhagen)

- Com Hem (COMH) – $854 million (Stockholm)

- OW Bunker (OW) - $575 million (Copenhagen)

*Including switches and secondary listings **Including spinoffs

***Nordic main markets and First North

About NASDAQ OMX Group

NASDAQ OMX (Nasdaq:NDAQ) is a leading provider of trading,

exchange technology, information and public company services across

six continents. Through its diverse portfolio of solutions, NASDAQ

OMX enables customers to plan, optimize and execute their business

vision with confidence, using proven technologies that provide

transparency and insight for navigating today's global capital

markets. As the creator of the world's first electronic stock

market, its technology powers more than 70 marketplaces in 50

countries, and 1 in 10 of the world's securities transactions.

NASDAQ OMX is home to more than 3,400 listed companies with a

market value of over $8.5 trillion and more than 10,000 corporate

clients. To learn more, visit www.nasdaqomx.com.

Cautionary Note Regarding Forward-Looking Statements

The matters described herein contain forward-looking statements

that are made under the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements about NASDAQ OMX's listings

business and other businesses, products and offerings. We caution

that these statements are not guarantees of future performance.

Actual results may differ materially from those expressed or

implied in the forward-looking statements. Forward-looking

statements involve a number of risks, uncertainties or other

factors beyond NASDAQ OMX's control. These factors include, but are

not limited to factors detailed in NASDAQ OMX's annual report on

Form 10-K, and periodic reports filed with the U.S. Securities and

Exchange Commission. We undertake no obligation to release any

revisions to any forward-looking statements.

NDAQG

CONTACT: NASDAQ OMX Media Relations Contacts:

Will Briganti

+1.646.441.5012

William.Briganti@NASDAQOMX.com

Linda Recupero

+1.212.231.5534

Linda.Recupero@NASDAQOMX.com

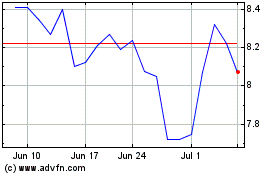

Weibo (NASDAQ:WB)

Historical Stock Chart

From Mar 2024 to Apr 2024

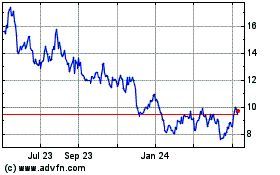

Weibo (NASDAQ:WB)

Historical Stock Chart

From Apr 2023 to Apr 2024