TIDMMBH

RNS Number : 0460F

Michelmersh Brick Holdings PLC

25 July 2016

25 July 2016

Michelmersh Brick Holdings Plc

("MBH", the "Company", or the "Group")

Half Year Results for the six months ended 30 June 2016

Michelmersh Brick Holdings Plc (AIM:MBH), the specialist brick

manufacturer, is pleased to report its half year results for the

six months ended 30 June 2016.

HIGHLIGHTS

Financial Highlights:

-- PBT increased to GBP2.6 million (H1 2015: GBP2.5 million)

-- Operating profit of GBP2.6 million (H1 2015: GBP2.7

million)

-- 4% Increase in EPS 2.57 pence (H1 2015: 2.47 pence)

-- Turnover steady at GBP15.3 million (H1 2015: GBP15.3

million)

-- Net cash balance GBP2.7 million against a net debt of GBP0.8

million at June 2015

Operational Highlights:

-- Good performance in a flat market

-- Average selling prices increase 2% over H1 2015

-- Landfill License completes consultation period which will

lead to economic realisation of Dunton site

-- Commenced kiln replacement project at Michelmersh - expected

completion in autumn 2016

-- The Group ended the period well ahead of intake target with a

forward order commitment over 47 million bricks

-- Well positioned for a stronger H2 2016 operational and

financial performance

Commenting on the results, Eric Gadsden, Chairman of Michelmersh

Brick Holdings Plc, said:

"The Company performed well in the first half despite the

expected weaker market, and is on track to deliver its targets for

the full year. We continue to invest in our plants to increase

efficiency, which over the medium term will enable us to outperform

the market with on-going creative development of products,

investment in process and encouragement of the efforts of its

employees. The business is profitable, cash generative and

supported by a strong and long-term asset base"

EU Referendum Outcome

Whilst it is too early to know the full long-term impacts of the

UK's exit from the EU, the Board feels that the Company is well

positioned to manage any effects within the brick manufacturing and

housing industry. The Board do not believe the outcome of the

referendum in itself results in any material change in the outlook

for the Group's near term financial results or future growth

prospects.

Enquiries:

Michelmersh Brick Holdings

Plc

Frank Hanna, Joint CEO

Stephen Morgan, Finance 01825

Director 430 413

Cenkos Securities plc

Bobbie Hilliam (NOMAD)

Harry Pardoe 020 7397

Alex Aylen (Sales) 8900

Yellow Jersey PR

07747

Charles Goodwin 788 221

07768

Dominic Barretto 357 739

About Michelmersh Brick Holdings PLC:

Michelmersh Brick Holdings PLC is a business with five market

leading brands: Blockleys, Charnwood, Freshfield Lane, Michelmersh

and Hathern Terra Cotta. These divisions operate within a fully

integrated business combining the manufacture of clay bricks, tiles

and pavers. The Group also includes a landfill operator, New Acres

Limited, and seeks to develop future landfill and development

opportunities on ancillary land assets.

Established in 1997 the Company has grown through acquisition

and organic growth into a profitable and asset rich business,

producing approximately 72 million clay bricks, tiles and pavers

per annum. MBH currently owns most of the UK's premium

manufacturing brands and is a leading specification brick and clay

paving manufacturer.

Michelmersh strives to be a well invested, long term,

sustainable, environmentally responsible business. Opportunity,

training and security for all employees, whilst meeting the needs

of stakeholders are at the forefront of everything we do. We aim to

lead the way in producing some of Britain's premium clay products

and enhancing our built environment by adding value to the

architectural landscape for generations to come.

We are Michelmersh Brick Holdings PLC: we are "Britain's Brick

Specialist".

Please visit the Group's websites at: www.mbhplc.co.uk and

www.bimbricks.com

Chairman's Statement

I am pleased to present the Group's results for the six months

ended 30 June 2016 in which the Group has maintained its position

within its marketplace. The Group generated a profit before tax of

GBP2.6 million (2015: GBP2.5 million). Turnover for the first six

months of 2016 was level with the equivalent period in 2015 despite

a small volume decrease offset by a 2% increase in average selling

price. Gross margin fell back slightly from 38.6% to 37.3% as a

result of some short-term production problems at one of our sites.

Administration costs have fallen slightly despite increased

expenditure on IT systems. The interest burden of recent years has

been replaced by modest interest income as we maintained a cash

positive position throughout the 6 months.

Dividend

The final dividend of 1.0 (2014: 0.5) pence per share for 2015

was paid on 30 June 2016. It is not the Board's current policy to

pay an interim dividend but it does intend to propose a full year

dividend out of 2016 earnings payable in June 2017. The Board

recognises the need to provide a meaningful yield to shareholders

and has therefore adopted a progressive dividend policy for future

years.

Assets

Final consultation on the landfill license at the Dunton site

has been completed and we await issue of the final license by the

Environment Agency. We expect conclusion of this process within

weeks and are actively considering options to activate the site in

2016.

Operational Review

Volumes of bricks sold fell slightly in the first half to 35.1

million (H1 2015: 35.7 million) in what is a very competitive

market. The Group did however achieve low single digit average

selling price increases of 2% that allowed us to maintain turnover

at lower volume. With a full period of the expanded capacity at

Freshfield Lane, production in the period increased from 34.8 to

35.2 million allowing stock levels to return to circa 10 weeks

sales, a level at which we can provide a timely and reliable

service to our customers.

Increased production at our two biggest plants, Freshfield Lane

and Blockleys, was offset by shortfall in output from the

Michelmersh site in Romsey as yields were affected by clay

geological issues in the existing quarry as delays in working

through ecological and archaeological issues restricted expansion

into the new available reserves. These issues have now been

resolved and the effect on the remainder of the year is expected to

be minimal and our GBP1m investment in a new kiln will be

operational in the second half.

Cost of production has been affected by the Michelmersh

performance and the Group's gross profit has fallen by 1.3% to

37.3%.

As also reported in the equivalent 2015 period, the energy costs

have fallen in the period despite the increase in output. The Group

has continued to hedge forward into winter 2017 to lock into the

benign energy market and secure ongoing production costs. Recent

rises in energy cost indicators will have limited effect on future

costs for the Group.

The first six months of 2016 have seen a robust level of order

intake across the Group, particularly at our southern plants. The

Group ended the period well ahead of intake target with a forward

order commitment over 47 million bricks. Again, the emphasis is to

ensure a good well balanced mix of forward orders. This strategy

was reflected in our product and delivery mix across the various

market sectors. The Group aims to continue this theme during

2016.

Strong deliveries in the key repair, maintenance and improvement

market ("RMI") via key national and regional builders merchants

have been complemented with deliveries to quality housing and

regeneration projects. Commercial specification work made up the

balance, enhanced by BIM and a number of high end bespoke blends

from both our i-Line and Synthesis ranges.

A number of recently supplied notable projects have been the

RIBA London Award winning Banham Group, Thornsett Road, Wandsworth,

the Riverside building for Waveney District Council and Millgate's

spectacular Englemere, Ascot development. Ongoing future

developments include Crest Nicholson's Longcross, Chertsey and the

inspiring, sustainable Citu Little Kelham project in Sheffield.

The Group has seen a significant level of traffic and data

downloads through it's BIMBricks.com branded website. It has been

very positive to see the impact of BIM on project management and

order intake.

Hathern Terracotta continues to improve its contribution to the

Group and has exceeded the exceptional performance in H1 2015.

Current orders and prospects suggest that operational performance

will proceed ahead of historic levels.

Outlook

We appraise a wide range of economic, construction survey and

brick industry statistics against which we measure and plan our

business. This information is filtered through our experience and

real-time feedback from our markets. Over the past few months there

are number of conflicting trends that have been further confused by

pre and post Brexit market movements.

Industry statistics suggest that brick manufacturing is largely

steady and delivery volumes slightly, but not significantly, up and

this is reflected in flat pricing. Imports seem to be falling from

recent increased levels with currency and local economy factors

indicating that this reduction will continue. Most commentators

recognise the release of pressure from imports and the long term

increasing demand for housing and this leads to a steady and

growing demand for bricks. Whilst this may not be apparent in

markets yet, the direction of travel is established.

The Company performed well in the first half, despite the

expected weaker market, and is on track to deliver its targets for

the full year. We continue to invest in our plants to increase

efficiency which over the medium term will enable us to outperform

the market with on-going creative development of products,

investment in process and encouragement of the efforts of its

employees. The business is profitable and cash generative and

supported by a strong and long-term asset base.

Eric Gadsden

Chairman

25 July 2016

Consolidated Income Statement

6 months 6 months 12 months

ended ended ended

30 30 31

June June December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Revenue 15,292 15,327 29,071

Cost of sales (9,581) (9,411) (17,961)

Gross profit 5,711 5,916 11,110

Administration expenses (3,126) (3,244) (6,468)

Other income 13 41 68

Operating profit 2,598 2,713 4,710

Finance income/(costs) 8 (209) (153)

------------ ------------ ----------

Profit before taxation 2,606 2,504 4,557

Taxation (521) (501) (951)

------------ ------------ ----------

Profit for the period 2,085 2,003 3,606

------------ ------------ ----------

Basic earnings per share 2.57 2.47 p 4.44

p p

Diluted earnings per share 2.55 2.46 p 4.42

p p

Consolidated Statement of Comprehensive Income

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Profit for the financial period 2,085 2,003 3,606

---------- ---------- -------------

Other comprehensive income

Items which will not subsequently be reclassified to profit or loss

Revaluation surplus of property, plant & equipment - - 1,163

Revaluation deficit of property, plant & equipment - - (2,771)

Deferred tax on revaluation - - 804

---------- ---------- -------------

Other comprehensive income for the period net of tax - - (804)

---------- ---------- -------------

Total comprehensive income for

the financial period 2,085 2,003 2,802

---------- ---------- -------------

Consolidated Balance Sheet

As at As at As at

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Assets

Non-current assets

Intangible assets 2,475 2,475 2,476

Property, plant and equipment 41,354 42,472 40,810

---------- ---------- -------------

43,829 44,947 43,286

Current assets

Inventories 7,278 6,239 7,195

Trade and other receivables 6,045 8,198 4,308

Investments 30 30 30

Cash and cash equivalents 2,747 132 2,935

---------- ---------- -------------

Total current assets 16,100 14,599 14,468

---------- ---------- -------------

Total assets 59,929 59,546 57,754

---------- ---------- -------------

Liabilities

Current liabilities

Trade and other payables 4,899 4,840 4,165

Provisions - 6 -

Interest bearing borrowings - 906 456

Corporation tax payable 521 871 -

---------- ---------- -------------

5,420 6,623 4,621

---------- ---------- -------------

Non-current liabilities

Deferred tax liabilities 3,914 4,593 3,914

---------- ---------- -------------

Total liabilities 9,334 11,216 8,535

---------- ---------- -------------

Net assets 50,595 48,330 49,219

========== ========== =============

Equity attributable to equity holders

Share capital 16,247 16,247 16,247

Share premium account 11,495 11,495 11,495

Reserves 16,953 17,564 16,850

Retained earnings 5,900 3,024 4,627

---------- ---------- -------------

Total equity 50,595 48,330 49,219

========== ========== =============

Consolidated Statement of Changes in Equity

Share Share Merger Share Revaluation Retained Total

Capital Option Reserve Premium Reserve Earnings Equity

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2015 16,247 48 979 11,495 16,503 1,422 46,694

Profit for

the period - - - - - 2,003 2,003

-------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income - - - - - 2,003 2,003

Share based

payment - 39 - - - - 39

Dividends

paid - - - - - (406) (406)

Transfer to

retained earnings - - - - (5) 5 -

As at 30 June

2015 16,247 87 979 11,495 16,498 3,024 48,330

Profit for

the period - - - - - 1,603 1,603

Revaluation

surplus - - - - 1,163 - 1,163

Revaluation

deficit - - - - (2,771) - (2,771)

Deferred tax

on revaluation - - - - 804 - 804

-------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income - - - - (804) 1,603 799

Share based

payment - 90 - - - - 90

As at 31 December

2015 16,247 177 979 11,495 15,694 4,627 49,219

Profit for

the period - - - - - 2,085 2,085

Total comprehensive

income - - - - - 2,085 2,085

Share based

payment - 103 - - - - 103

Dividends

paid - - - - - (812) (812)

As at 30 June

2016 16,247 280 979 11,495 15,694 5,900 50,595

======== ======== ======== ======== ============ ========= ========

Consolidated Statement of Cash Flows

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Net cash generated by

operating activities 1,628 2,799 5,778

---------- ---------- --------------

Cash flows from investing

activities

Purchase of property,

plant and equipment (1,004) (958) (1,734)

Proceeds from sale of - - -

investment

Proceeds from sale of

land - - 1,500

Proceeds on disposal

of property, plant and

equipment - - 7

---------- ---------- --------------

Net cash used in investing

activities (1,004) (958) (227)

---------- ---------- --------------

Cash flows from financing

activities

Repayment of interest

bearing borrowings - (5,000) (5,000)

Dividends paid (812) (406) (406)

Repayment of finance

lease obligations - (2) (5)

---------- ---------- --------------

Net cash used in financing

activities

(812) (5,408) (5,411)

---------- ---------- --------------

Net (decrease)/increase

in cash and cash equivalents (188) (3,567) 140

Cash and cash equivalents

at beginning of period 2,935 2,795 2,795

---------- ---------- --------------

Cash and cash equivalents

at end of period 2,747 (772) 2,935

========== ========== ==============

Cash and cash equivalents

comprise:

Cash at bank and in

hand 2,747 132 2,935

Bank overdraft - (904) -

---------- ---------- ----------------

2,747 (772) 2,935

========== ========== ================

NOTES TO THE GROUP INTERIM REPORT

1. GENERAL INFORMATION

Michelmersh Brick Holdings Plc ("the Company") is a public

limited company incorporated in the United Kingdom under the

Companies Act 2006 (registration number 3462378). The Company is

domiciled in the United Kingdom and its registered address is

Freshfield Lane, Danehill, Haywards Heath, West Sussex, RH17 7HH.

The Company's Ordinary Shares are traded on the AIM Market of the

London Stock Exchange plc. Copies of the Interim Report and Annual

Report and Accounts may be obtained from the address above, or at

www.mbhplc.co.uk.

2. ACCOUNTING POLICIES

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the European Union. IFRS is subject to amendment and

interpretation by the International

Accounting Standards Board (IASB) and the IFRS Interpretations

Committee and there is an ongoing process of review and endorsement

by the European Commission. The financial information has been

prepared on the basis of IFRS that the Directors expect to be

adopted by the European Union and applicable as at 31 December

2016.

Statutory accounts

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 31 December 2015 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498(2) or

(3) of the Act.

The financial information for the six months ended 30 June 2016

and 30 June 2015 is unaudited.

3. EARNINGS PER SHARE

The calculation of earnings per share is based on a profit of

GBP2,085,000 (six months ended 30 June 2015 -GBP2,003,000; 12

months ended 31 December 2015-GBP3,606,000) and 81,234,656 being

the weighted average number of ordinary shares in issue.

Diluted

At 30 June 2016 there were 483,147 dilutive shares under option

leading to 81,717,803 weighted average number of ordinary shares

for the purposes of diluted earnings per share. A calculation is

performed to determine the number of share options that are

potentially dilutive based on the number of shares that could have

been acquired at fair value, considering the monetary value of the

subscription rights attached to outstanding share options.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEWFIEFMSEIW

(END) Dow Jones Newswires

July 25, 2016 02:00 ET (06:00 GMT)

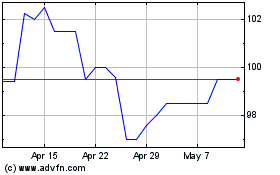

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Apr 2023 to Apr 2024