TIDMMBH

RNS Number : 6226S

Michelmersh Brick Holdings PLC

21 March 2016

21 March 2016

Michelmersh Brick Holdings Plc

("MBH" or the "Group")

FINAL RESULTS

Debt Eradicated. Dividend Doubled. Well Positioned for the

Future

Michelmersh Brick Holdings (AIM:MBH), the specialist brick

manufacturer and landfill company, is pleased to report its audited

final results for the year ended 31 December 2015, representing a

strong performance and continued progress.

Financial Highlights

-- Operating profit of GBP4.7 million (2014: 2.8 million), an improvement of 68%;

-- EPS 4.44 pence (2014: 2.72 pence);

-- Turnover up 2% to GBP29.1 million (2014: GBP28.5 million);

-- Cash generated by operations of GBP6.6 million (2014: GBP2.6 million);

-- Net debt eradicated with a year-end cash balance of GBP2.9

million against a net debt of GBP2.1 million at the start of the

year; and

-- Dividend doubled to 1.0 pence per share payable for the period.

Operational Highlights

-- Completion of the expansion project at Freshfield Lane and

implementation of packaging robots at Telford;

-- Brick production up 3% to 69.5 million (2014: 67.5 million)

helping to rebuild stocks to workable levels;

-- Average selling prices increased 9% on prior year prices; and

-- Strong showing at the BDA awards including the prestigious Chairman's award;

Eric Gadsden, Chairman at Michelmersh Brick Holdings, commented:

"The Group has had a very good year both in terms of reported

results but also with the continued development of management and

systems, all of which means the Group is well placed to continue

its success in the future. The product offering remains targeted at

premium sectors and our service levels are wedded to our key

customers.

"MBH occupies a defined sector within the brick industry and the

Board is committed to invest in process and people to maximise the

returns of the business. Finally, I would like to thank all our

shareholders and look forward to a busy period ahead."

CHAIRMAN'S STATEMENT

The Final Results for the year ended 31 December 2015 included

in this Annual Report represent a continuation of the excellent

performance of the Group. All of the key indicators are positive

and represent an improved performance against the previous year.

The Group returned a profit before taxation of GBP4.6 million

(2014: GBP2.6 million). I am particularly pleased that the strong

performance of the business allows us to report that the Board is

recommending a dividend for the year of 1 pence per share, a 100%

increase over the previous payment.

The period under review saw the completion of our expansion

project at Freshfield Lane and installation of packaging robots at

Blockleys. These developments were achieved for relatively modest

outlays but lay capacity and efficiency foundations for future

periods, a position from which the Group will continue its stable

and proven progress.

The Group continues to closely manage its trading assets. As

working capital has fallen, positive cash balances have been

achieved, eradicating net debt.

Whilst trading conditions have been favourable, we have made the

most of the opportunities that the market has presented. A strong

cash balance will enable us to continue exploiting such

developments, being able to respond to contingencies as they

arise.

Financial Highlights:

2015 2014

Turnover GBP29.1 GBP28.5

m m

Operating profit GBP4.7 GBP2.8

m m

Basic EPS 4.44 2.72

p p

Dividend per share 1.0 p 0.5 p

Net assets GBP49.2 GBP46.7

m m

Net assets per share 60.6p 57.5

p

Net cash / (debt) GBP2.9 (GBP2.1)

m m

Net cash generated

by operating activities GBP6.6 GBP2.6

m m

Turnover was 2% higher than in 2014 on reduced despatch volumes

as price increases yielded improved margins and a recovery of brick

stocks. Operating profit consequently grew by 68% to GBP4.7 million

(2014: GBP2.8 million) as a result of much improved margins. Gross

margin rose from 30.6% to 38.2% with sales price increases and our

controlled management of production costs. We are pleased that

considered and successful management policies have resulted in

discernible improvements in efficiency, as evidenced in EPS

increasing to 4.44 pence, 63.2% higher than in 2014.

Production volumes increased in the year as a result of

increased capacity at Freshfield Lane, our largest brick plant,

with the completion of the GBP2.2 million investment at the site in

the second quarter of 2015.

Cash and Borrowings

During the year, strong cash flow allowed the Group to repay the

GBP5 million term loan ahead of schedule, and to cancel the

borrowing facilities with ABN AMRO. We ended the year with a net

cash balance of GBP2.9 million after starting the year with net

debt of GBP2.1 million. The final payment of GBP1.5 million under

the 2013 land sale was received from Bovis whilst non-operating

cash outflows included GBP1.7 million of capital expenditure and

GBP406,000 in dividends.

Following the repayment of the Barclays term loan, the Group has

entered into a GBP4 million Revolving Credit Facility ("RCF") with

Barclays to provide operating cash headroom, although no drawdowns

have been made against this facility to date.

The interest burden in 2015 comprised charges related to the

term loan before repayment in June 2015 and charges associated with

the early settlement of the ABN AMRO facility and accelerated

amortisation of prepaid arrangement fees. Finance charges going

forward will be limited to the RCF non-utilisation fee and any

facility utilisation.

Assets and Working Capital

Tangible fixed assets, including a substantial land element,

form a significant part of the Group's balance sheet at 83% of net

assets. Working capital has reduced by 5% over 2015, despite the

strategic increase in brick stocks, as debtors and creditors have

been carefully managed with a positive impact on cash balances. The

Group's net assets per share increased by more than 5%.

Dividend

The Board are intent upon maintaining a sustainable dividend

policy that reflects a balance between trading cash flows and

long-term reinvestment in capital assets. Accordingly, the Board

proposes a dividend of 1.0 pence (2014: 0.5 pence) per share in

respect of 2015.

The Board will seek to continue to make dividend payments out of

trading cash flow annually to maintain a prudent level of dividend

cover.

Land assets

As reported in the 2014 Annual Report, the Group has ceased

landfill activities in order to maximise the long-term economic

contribution of the Telford site. Contribution from landfill was

negligible in the period and will remain discontinued for some

years pending development on the site which releases the maximum

clay reserves. At this point landfill will recommence.

However, a draft license will shortly be issued for final

consultation at our Dunton site. We are making good progress with

bringing this forward as an income generator, and other land assets

in the Group are continually being assessed to maximise their

long-term value in conjunction with, but secondary to, the primary

objective to optimize brick manufacturing facilities.

Board realigned

From 1 January 2016, there has been a change in structure and

operational function of your Board. Frank Hanna and Peter Sharp

have been appointed as Joint Chief Executives and the Group can

look forward to the renewed energy and ingenuity that they will

bring. Martin Warner has relinquished his previous role as Chief

Executive and now serves as executive Deputy Chairman, absorbing

some of the responsibilities vacated by Alan Hardy. Alan resigned

as Non-executive director in October 2015 to pursue his other

interests and we all wish him well.

The new structure retains the experience and expertise required

to take the Group forward in the face of new challenges.

Our team

The continued success of the Group depends considerably upon the

commitment and diligence of our employees and, on behalf of the

Board, I would like to extend to them all my sincere thanks.

Outlook

The Group has had a very good year both in terms of reported

results, but also with the continued development of management and

systems, all of which means the Group is well placed to continue

its success in the future. The product offering remains targeted at

premium sectors and our service levels are wedded to our key

customers. The Board is committed to continued investment in

processes and our staff.

During 2015, Michelmersh was joined in the public markets by one

of its historic competitors and may be set to be joined by another.

We look forward to the challenge and the greater visibility this

brings to our sector.

We believe that demand will remain around current levels going

forwards so long as the residential development market remains

constrained by the current planning system and unhelpful changes to

taxation.

This will impact the industry, which has responded to the

product shortages seen in 2013 and 2014. The market will settle

down and the level of imports is reducing. Bricks will continue to

be supplied from across Europe, particularly in light of the

continuing weakness in the marketplace. However, product

suitability and currency fluctuations are a notable risk for this

sector of the market.

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:00 ET (07:00 GMT)

With our well invested and competitive works, key products

supplying the RMI sector and strong financial position the business

is set to prosper as these factors play out over the medium

term.

Eric Gadsden

Chairman

21 March 2016

CHIEF EXECUTIVES' REVIEW

Clay Products

Demand for our products at the start of 2015 followed the trend

from the end of 2014 and our first half showed continued sustained

increases in activity. Towards the end of the year, activity in the

construction sector settled, with demand levelling off as reported

in our October market statement. Over the year we despatched 66.4

million bricks, some 4 million less than in 2014. The average

selling price over the year of GBP429 per thousand (2014: GBP395)

maintains our 40% premium over industry averages.

In the second half of the year, we concentrated on rebuilding

our stocks and increasing margins. These decisions were enacted

against the background of a brick manufacturing industry in a state

of rapid growth, where plants were de-mothballed to meet a demand

that was being filled by European imports. This was aided by a

currency exchange advantage and fuelled by poor local demand.

Industry stocks have subsequently recovered, and a period of

relative stability has been achieved, although the Group starts

2016 with a strong and balanced order book.

The Group's production performance has been enhanced during 2015

with the completion of the project to increase capacity at

Freshfield Lane. Output rose by 3% to 69.5 million from 67.5

million bricks, with 2016 set to exceed this again. A GBP500,000

investment in a robotic packaging plant at Blockleys will increase

efficiency and allow further expansion of output in due course.

Cost of production per unit increased by a modest 3% in 2015 over

2014 as a result of wage increases and accelerated depreciation

ahead of further plant upgrades in 2016. Energy costs continue to

fall and have helped to limit cost inflation in 2015. Forward

hedging mechanisms suggest that energy will continue to have a

dampening effect on cost inflation over coming years.

The Group continued the important strategy of a 'well balanced'

market approach to distribution. Working hard in conjunction with

our retail partners we delivered an optimum product mix, thus

enabling a margin-focused result. Our key delivery sectors were new

housing, urban regeneration, commercial specification and the all

the important Repair, Maintenance and Improvement ("RMI") market.

We continued our strong support of merchants and distributors with

our robust distribution and partnership policy. We also experienced

a notable increase in projects utilising our bespoke Select Order

Process as a way of improving site planning and project

delivery.

Michelmersh had tremendous success at the 2015 brick awards,

winning categories such as the Best Public and Education Building,

the Best Housing Design Award and the Best Refurbishment Project.

Eight Artillery Row, London, won the prestigious BDA Chairman's

Award. The awards were testament to the Group's high quality

products, customer service and attention to detail. Other notable

projects during 2015 included the RIBA London Award winning

Brentford Lock West Development by Duggan Morris and the Watkin

Jones Student Accommodation, Glasgow as well as Octagon's Long Walk

Villas in Windsor.

We continue to be at the forefront of delivering much needed

high quality housing and community regeneration with companies such

as Crest, Croudace, Countryside properties, Cala Homes, Keepmoat

and the Berkeley Group.

Hathern Terra Cotta had a strong 2015, increasing turnover by

40% and quadrupling contribution. We supplied bespoke terra cotta

to a number of prestigious projects such as Brighton College, the

V&A Museum, Plaistow Hospital and the stunning Victoria Quarter

in Leeds.

A program of haulage fleet improvement and review saw our fleet

continue to grow, offering greater flexibility for the northern

region.

The Group successfully concluded the BIMBrick project in

readiness for the 2016 launch deadline. Acting rapidly on the

Government's Construction Strategy published in May 2011, MBH PLC

responded with its first range of clay products files. As the first

brick manufacturer to introduce Building Information Modelling

("BIM") files in the UK, we are now delighted to see a surge in

Industry support, acceptance and participation. The Group is

committed to upgrading files alongside the latest BIM software

developments and has therefore released 'V2' files earlier this

year. The files include bricks, pavers and roof tile products.

Management Systems

The Board is committed to improving energy efficiency and

performance through the planning and design of our operations. We

monitor and evaluate our energy consumption using a variety of

techniques including automatic half hourly data systems that link

to production output. The energy efficiency reports that are

generated enable us to develop strategies and best practice

techniques to continually improve. We are very pleased to report

that our commitment to energy management has delivered the

successful completion and independent verification of our ISO 50001

energy management system. The Group and its plants now operate to

this international standard that will drive our energy efficiency

performance for future periods as well as delivering full

compliance to the government Energy Savings Opportunity Scheme

known as ESOS.

During the period we also enhanced our sustainability

performance by achieving verification to BES 6001 the standard for

responsible sourcing of construction products. All of our brick,

paver, tile and terra cotta products now meet this standard with a

good performance rating.

Staff Development

Following the change in Board responsibilities, the management

structure below the Joint Chief Executives has been reorganised to

allow us to oversee the management of the operations whilst

adopting our new responsibilities. A sub-board of Associate

Directors made up of key production and sales managers has been

established to co-ordinate operational matters and provide an

environment for succession planning. These associate directors have

all been in the Group for some time and we expect them to develop

individually and as a team for the benefit of the Group.

We have strengthened our technical team at the beginning of the

year with the addition of a sustainability and improvement manager

to develop and maintain the performance of our management systems.

We also strengthened our engineering team and extended our

successful engineering apprenticeship programme to the Charnwood

factory. The group has a good demographic mix and sustainable

technical skills base in the important area of electrical and

mechanical engineering.

Landfill and Land Assets

As mentioned by the Chairman above, landfill activity was

minimal and restricted to the start of the year.

Recently our plans to develop the quarry at Charnwood have been

reviewed in light of the significantly improved operating

performance of this site over the past two years. We are now able

to economically extract additional mineral reserves in our quarry,

giving us 12 year's supply of manufacturing materials. This period

has potential to be extended significantly if mixed with other

minerals in the locality. It became clear that the brickmaking

operations should be optimised by the most cost effective clay

option, allowing development potential to be realised in the

future.

The Environment Agency will shortly issue a draft landfill

license for the former Dunton brickworks site at Chesham. Subject

to further local consultation, the site will soon be ready to be

brought forward as an income-generating asset in the coming months.

The landfill site will operate for six years and will then be

remediated as amenity land.

The extensive planning process at Michelmersh has been completed

and an option agreement secured for the extraction of mineral

adjacent to the brickworks. The site now has reserves to support

operations to secure the business and employment for over 20

years.

Outlook

Industry activity continues at a level higher than in recent

history fuelled by government incentives to housebuilders and

stronger economic conditions. With the frenzy removed from the

market, and with some difficult weather conditions over the winter

period, the indications are that the construction sector will

continue to grow at a healthy level for the medium term.

Whilst the high end housing and London apartment market are

suffering from slowing demand we have adapted our market sector

strategy and product mix for the RMI, commercial, self-build and

mid-range housing market where the Group continues to enjoy strong

demand and value added.

The Group occupies a defined sector within the brick industry

and the Board is committed to invest in process and people to

maximise the returns of the business.

Frank Hanna, Peter Sharp

Joint Chief Executives

21 March 2016

Consolidated Income Statement

For the year ended 31 December 2015

2015 2014

GBP'000 GBP'000

Revenue 29,071 28,476

Cost of sales (17,961) (19,750)

-------------------------------- ---------- ----------

Gross profit 11,110 8,726

Administrative expenses (6,468) (6,086)

Other income 68 161

-------------------------------- ---------- ----------

Operating profit 4,710 2,801

Finance costs (153) (199)

-------------------------------- ---------- ----------

Profit before taxation 4,557 2,602

Taxation (951) (401)

Profit for the financial year 3,606 2,201

-------------------------------- ---------- ----------

Basic earnings per share 4.44 p 2.72 p

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:00 ET (07:00 GMT)

Diluted earnings per share 4.42 p 2.72 p

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2015

2015 2014

GBP'000 GBP'000

Profit for the financial year 3,606 2,201

Other comprehensive income

Items which will not subsequently

be classified to profit and

loss

Revaluation surplus of property, 1,163 -

plant and equipment

Revaluation deficit of property,

plant and equipment (2,771) (1,000)

Deferred tax on movement 804 (128)

------------------------------------ -------- --------

(804) (1,128)

----------------------------------- -------- --------

Total comprehensive income

for the year 2,802 1,073

------------------------------------ -------- --------

Consolidated Balance Sheet

As at 31 December 2015

2015 2014

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 2,476 2,476

Property, plant and equipment 40,810 41,899

-------------------------------- --------- ---------

43,286 44,375

Current assets

Inventories 7,195 6,084

Trade and other receivables 4,308 7,346

Investments 30 30

Cash and cash equivalents 2,935 2,809

-------------------------------- --------- ---------

Total current assets 14,468 16,269

-------------------------------- --------- ---------

Total assets 57,754 60,644

Liabilities

Current liabilities

Trade and other payables 4,165 3,940

Provisions - 112

Corporation tax payable 456 370

Interest bearing liabilities - 19

-------------------------------- --------- ---------

Total current liabilities 4,621 4,441

-------------------------------- --------- ---------

Non-current liabilities

Deferred tax liabilities 3,914 4,593

Interest bearing liabilities - 4,916

-------------------------------- --------- ---------

3,914 9,509

------------------------------- --------- ---------

Total liabilities 8,535 13,950

Net assets 49,219 46,694

-------------------------------- --------- ---------

Equity attributable to equity

holders

Share capital 16,247 16,247

Share premium account 11,495 11,495

Reserves 16,850 17,530

Retained earnings 4,627 1,422

-------------------------------- --------- ---------

Total equity 49,219 46,694

-------------------------------- --------- ---------

Consolidated Statement of changes in equity

For the year ended 31 December 2015

Share Share Merger Share Revaluation Retained Total

Capital option reserve premium reserve earnings

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2014 16,162 246 979 11,495 19,705 (3,084) 45,503

Profit for the

year - - - - - 2,201 2,201

Revaluation deficit - - - - (1,000) - (1,000)

Deferred taxation

on revaluation - - - - (128) - (128)

---------------------- --------- --------- --------- --------- ------------ ---------- --------

Total comprehensive

income - - - - (1,128) 2,201 1,073

Share based payment - 33 - - - - 33

Shares issued

during the year 85 - - - - - 85

Transfer to retained

earnings - (231) - - (42) 273 -

Reclassification - - - - (2,032) 2,032 -

---------------------- --------- --------- --------- --------- ------------ ---------- --------

At 31 December

2014 16,247 48 979 11,495 16,503 1,422 46,694

Profit for the

year - - - - - 3,606 3,606

Revaluation surplus - - - - 1,163 - 1,163

Revaluation deficit - - - - (2,771) - (2,771)

Deferred taxation

on revaluation - - - - 804 - 804

---------------------- --------- --------- --------- --------- ------------ ---------- --------

Total comprehensive

income - - - - (804) 3,606 2,802

Share based payment - 129 - - - - 129

Transfer to retained

earnings - - - - (5) 5 -

Dividend paid - - - - - (406) (406)

---------------------- --------- --------- --------- --------- ------------ ---------- --------

At 31 December

2015 16,247 177 979 11,495 15,694 4,627 49,219

---------------------- --------- --------- --------- --------- ------------ ---------- --------

Consolidated Statement of cash flows

For the year ended 31 December 2015

2015 2014

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 4,557 2,602

Profit on sale of fixed assets (7) (2)

Profit on sale of investments - (15)

Finance costs 153 199

Depreciation 1,174 973

Amortisation 3 2

Market value adjustment on

intangible assets (3) (40)

Share based payment charge 129 33

--------------------------------------- -------- --------

Cash flow from operations before

changes in working capital 6,006 3,752

(Increase)/decrease in inventories (1,070) 250

Decrease/(increase) in receivables 1,489 (1,219)

Increase/(decrease) in payables 197 (177)

--------------------------------------- -------- --------

Net cash generated by operations 6,622 2,606

Taxation paid (740) -

Interest paid (104) (206)

--------------------------------------- -------- --------

Net cash generated by operating

activities 5,778 2,400

--------------------------------------- -------- --------

Cash flows from investing activities

Purchase of property, plant

and equipment (1,734) (2,069)

Proceeds of sale of investments - 31

Proceeds of sale of land 1,500 1,500

Proceeds of disposal of property,

plant and equipment 7 4

--------------------------------------- -------- --------

Net cash used in investing

activities (227) (534)

--------------------------------------- -------- --------

Cash flows from financing activities

Repayment of interest bearing

borrowings (5,000) (155)

Proceeds of share issue - 85

Dividend paid (406) -

Repayment of hire purchase

and finance obligations (5) (5)

--------------------------------------- -------- --------

Net cash used in financing

activities (5,411) (75)

--------------------------------------- -------- --------

Net increase in cash and cash

equivalents 140 1,791

Cash and cash equivalents at

the beginning of the year 2,795 1,004

--------------------------------------- -------- --------

Cash and cash equivalents at

the end of the year 2,935 2,795

--------------------------------------- -------- --------

Cash and cash equivalents comprise:

Cash at bank and in hand 2,935 2,809

Bank overdraft - (14)

--------------------------------------- -------- --------

2,935 2,795

-------------------------------------- -------- --------

NOTES TO THE FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:00 ET (07:00 GMT)

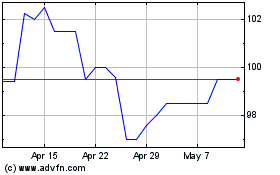

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

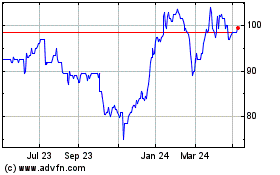

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Apr 2023 to Apr 2024