By Julie Jargon

For McDonald's Corp., the suggestion that it should spin off its

vast property holdings poses an existential question: What are the

Golden Arches without real estate?

As McDonald's approaches the third anniversary of declining

sales, some analysts have been asking whether shareholders could

get better returns if the company placed its U.S. properties in a

publicly traded real-estate investment trust.

McDonald's has always maintained the importance of owning its

own property. But executives responding to recent queries haven't

ruled out the possibility of spinning off its real estate, with

Chief Financial Officer Kevin Ozan saying last month that it will

consider all financial options to boost shareholder value, and

update investors in November.

Hedge fund chief Larry Robbins, of Glenview Capital Management,

said in a March letter to investors that McDonald's could unlock at

least $20 billion in value if it were to spin off its U.S. real

estate.

Many investors like REITs because they tend to trade at higher

multiples than retail companies and pay little or no tax on their

earnings as long as they distribute most of their profits through

dividends. Macy's Inc. is under similar pressure from activist

investor Starboard Value LP. Darden Restaurants Inc. in June became

the first major restaurant chain to announce plans to transfer

properties into a REIT. Doing so enables companies to collect an

upfront sum that can be used to buy back shares or pay down

debt.

That could make such a move attractive to McDonald's top

management, especially since the fast-food chain's shares--at

$92.87 as of Monday's close--are down more than 10% from their

all-time closing high in April 2013.

McDonald's shares rose 1.6% the day Mr. Robbins issued his

letter.

A number of analysts have since questioned McDonald's about its

intent to do something with its real estate.

"We continue to evaluate opportunities to further enhance value

for all shareholders and addressing our operational issues is our

first and most critical priority," a McDonald's spokeswoman

said.

Publicly traded Arcos Dorados Holdings Inc., McDonald's largest

franchisee, which owns more than 2,100 McDonald's throughout Latin

America and the Caribbean, last month said it is planning to

outright sell or sell and then lease back some of its non-core

real-estate assets, such as office buildings and distribution

centers as part of a broad cost-cutting plan.

But some analysts say the arguments against a McDonald's REIT

far outweigh those for it. For starters, the burger giant derives

huge revenue from its real estate. Rental income from franchisees

accounted for more than a fifth of McDonald's $27.4 billion in

total revenue last year--when overall revenue fell 2.4% and profit

dropped 15%--and represents a growing part of its business. Rent

payments from franchisees have risen 26% over the past five years

to $6.1 billion last year.

Sara Senatore, an analyst at Sanford Bernstein who has studied

McDonald's real estate, estimates its world-wide property,

including the U.S., is worth more than $42 billion. In the U.S.

alone, home to more than 14,000 McDonald's restaurants, she

estimates that the company's real estate is worth between $25

billion and $35 billion. McDonald's current market value is around

$87.5 billion after the recent broad market downturn.

But she and others note that selling off the property would

introduce new costs for McDonald's, which could have to start

paying rent on the roughly 1,500 U.S. restaurants it operates on

its own. "Adding lease costs at a time when there's been a

deterioration in McDonald's fundamentals doesn't make a lot of

sense," Ms. Senatore said.

Creating a REIT also could distract from the agenda of new Chief

Executive Steve Easterbrook, who since taking over on March 1 has

emphasized his desire to rejuvenate operations.

"McDonald's is facing a lot of headwinds, like minimum wage

increases and more competitors," said Bob Schulz, managing director

at Standard & Poor's Ratings Services. "This would be an

additional complication for management's time."Standard &

Poor's in May lowered its credit rating on McDonald's to "A-" from

"A" after McDonald's accelerated a share repurchase plan.

Real estate has been a backbone of McDonald's business almost

since its founding. McDonald's first chief executive, Harry

Sonneborn, reportedly once told investors, "The only reason we sell

15 cent hamburgers is because they are the greatest provider of

revenue from which our tenants can pay us rent."

All that property has attracted outside interest before. Nearly

a decade ago, activist investor Bill Ackman pushed McDonald's to

spin off some its real estate, but other shareholders didn't get

behind his plan and he ultimately dropped it.

Splitting off the real estate would involve other complications.

In some cases McDonald's owns the land and building for its

restaurants outright. In others, it rents the building from another

landlord and subleases it to franchisees. In the latter case,

McDonald's pays its landlords a market rent of about 5% of the

restaurants' sales and then charges its franchisees 10%, according

to Ms. Senatore.

McDonald's franchise-disclosure documents, given to prospective

operators, spell out that structure, saying that the company

applies a finance fee on top of the monthly base rent "to produce

an appropriate return for McDonald's."

"What's reported as rent is really rent plus McDonald's

premium," Ms. Senatore said. A REIT wouldn't be able to charge that

premium, meaning the property would effectively be worth less in a

REIT.

Franchisees, whose relations with McDonald's already are

strained, also likely would balk, said John Gordon, founder of

restaurant consulting firm Pacific Management Consulting Group.

They fear a REIT might have more incentive to jack up rent over

time than McDonald's, which wants to maximize rent but also wants

franchisees to be financially healthy so its business can thrive.

McDonald's sometimes gives rent breaks to franchisees who remodel

or add new equipment, something a REIT wouldn't do, Mr. Gordon

said.

"My prediction is they'll slow roll this forever," he said of

McDonald's management.

Write to Julie Jargon at julie.jargon@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 05:44 ET (09:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

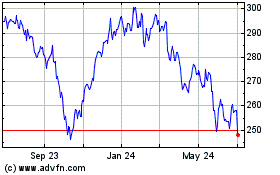

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

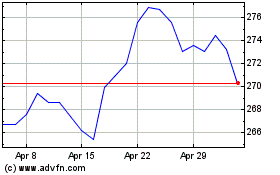

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024