Marchex, Inc. (NASDAQ:MCHX), a mobile advertising

technology company, today announced its financial results for the

fourth quarter and full year ended December 31, 2014.

“Over the last several years, we have focused on bringing

visibility to the mobile advertising world through our call

analytics platform. Early on we saw the makings of a giant

advertising measurement opportunity as mobile experiences would

become a major driver of sales both online and offline, including

consumer calls to businesses,” said Pete Christothoulou, Chief

Executive Officer of Marchex. “In 2015 and beyond, we will continue

to support enterprise clients through call analytics product

innovations combined with delivering incredible customer

experiences.”

Q4 2014 Financial

Highlights1

- GAAP revenue was $33.3

million for the fourth quarter of 2014, compared to $39.7

million for the fourth quarter of 2013.

- GAAP net income from continuing

operations was $571,000 for the fourth quarter of 2014, compared to

GAAP net income from continuing operations of $597,000 for the

fourth quarter of 2013.

- GAAP net income from continuing

operations attributable to common stockholders per diluted share

was $0.01 for the fourth quarter of 2014. This compares to GAAP net

income from continuing operations attributable to common

stockholders per diluted share of $0.02 for the fourth quarter of

2013.

Q4 2014 Q4 2013 GAAP

Revenue $33.3 million $39.7 million

Call-Driven and related revenue5 $30.3 million

$34.5 million

Non-GAAP Results: Call-Driven

Adjusted OIBA4 $2.5 million $1.7 million

Call-Driven Adjusted EBITDA4 $3.4 million

$2.6 million

Adjusted OIBA4 $3.5

million $4.3 million

Adjusted EBITDA4

$4.4 million $5.2 million

Archeo Revenue including domain gains and sales2,4

$3.0 million $5.2 million

Domain gains and

sales2 $1.7 million $1.6 million

- Adjusted non-GAAP EPS3 from continuing

operations for the fourth quarter of 2014 was $0.05, compared to

$0.07 for the fourth quarter of 2013.

Full Year 2014 Financial

Highlights1

- GAAP revenue was $182.6

million for 2014, compared to $152.6 million for 2013.

- GAAP net loss from continuing

operations was $19.4 million for 2014, which includes the effect of

a non-cash charge to income tax expense of $22.3 million for a

valuation allowance on our deferred tax assets recorded in the

third quarter, compared to GAAP net income from continuing

operations of $957,000 for 2013.

- GAAP net loss from continuing

operations attributable to common stockholders per diluted share

was $0.49 for 2014. This compares to GAAP net income from

continuing operations attributable to common stockholders per

diluted share of $0.03 for 2013.

FY 2014 FY 2013 GAAP

Revenue $182.6 million $152.6 million

Call-Driven and related revenue5 $168.1

million $135.1 million

Non-GAAP Results:

Call-Driven Adjusted OIBA4 $11.1 million

$6.3 million

Call-Driven Adjusted EBITDA4

$14.7 million $9.9 million

Adjusted OIBA3,

4 $17.2 million $15.8 million

Adjusted

EBITDA3, 4 $20.9 million $19.5 million

Archeo Revenue including

domain gains and sales2,4 $14.5 million

$21.2 million

Domain gains and sales2 $7.4

million $6.2 million

1 In July 2013, certain pay-per-click assets were sold. As a

result, the financial results of these pay-per-click assets are

presented as discontinued operations, net of tax in our condensed

consolidated statements of operations in accordance with GAAP, and

are excluded from all other results unless otherwise noted.

2Includes domain sales recognized in gains on sales and

disposals of intangible assets in 2013 and domain sales recognized

in GAAP revenue. In September 2013 upon the launch of its domain

marketplace, the Company commenced recognizing domain sales as

revenue.

3 Adjusted OIBA, Adjusted EBITDA and Non-GAAP EPS include the

impact of domain gains and sales. Historically, these non-GAAP

measures excluded the impact of domain gains and sales.

4 Reconciliations of non-GAAP measures are included in the

financial tables attached to this press release and we encourage

investors to examine the reconciling adjustments between the GAAP

and non-GAAP measures.

5Allstate contributed revenue of $48.8 million and $18.0 million

in 2014 and 2013, respectively. Substantially all of the 2014

revenue related to the nine months ended September 30, 2014.

Marchex Q4 2014 and Recent Call-Driven

Business Highlights:

- Revenue. Call-Driven and related

revenue was $30.3 million for the fourth quarter of 2014 compared

to $34.5 million for the fourth quarter of 2013.

- Products. The Company recently

launched Marchex Call Analytics for Search, the newest addition to

its Call Analytics platform. For the first time, enterprise-level

marketers can track and measure which keywords drive sales from

millions of mobile consumers who call businesses directly from

click-to-call ads on their smartphones. Marketers can then improve

campaigns in real time based on this data.

Non-Operating Q4 2014

Highlights:

Marchex purchased 669,000 shares or 2% of its outstanding Class

B common stock for a total price of $2.5 million under its new

share repurchase program established in November 2014.

Business Outlook

The following forward-looking statements reflect Marchex's

expectations as of February 25, 2015, and exclude any contribution

from Archeo operations, including domain sales, and discontinued

operations. Archeo operating results would be additive to our

Call-Driven revenue, profitability, and other measures

below:

Call-Driven

financial guidance for the First Quarter ending March 31,

2015

Call-Driven Revenue $32 million or more Call-Driven

Adjusted OIBA 1 $1.5 million or more Call Driven Adjusted

EBITDA 1 $2.5 million or more

1 These non-GAAP Call-Driven measures assign all Marchex

corporate overhead costs to the Call-Driven results.

Reconciliations of non-GAAP measures are included in the financial

tables attached to this press release and we encourage investors to

examine the reconciling adjustments between the GAAP and non-GAAP

measures.

Conference Call and Webcast

Information

Management will hold a conference call, starting at 5:00 p.m. ET

on Wednesday, February 25, 2015 to discuss its fourth quarter and

year ended December 31, 2014 financial results, and other company

updates. Access to the live webcast of the conference call will be

available online from the Investors section of Marchex’s website at

www.marchex.com. An archived version

of the webcast will also be available at the same location,

beginning two hours after completion of the call.

About Marchex

Marchex is a mobile advertising technology company. The company

provides a suite of products and services for businesses that

depend on consumer phone calls to drive sales. Marchex’s mobile

advertising platform delivers new customer phone calls to

businesses, while its technology analyzes the data in these calls

to help maximize ad campaign results. Marchex disrupts traditional

advertising models by giving businesses full transparency into

their ad campaign performance and charging them based on new

customer acquisition.

Please visit www.marchex.com,

blog.marchex.com or @marchex on Twitter (Twitter.com/Marchex),

where Marchex discloses material information from time to time

about the company, its financial information, and its business.

Forward-Looking

Statements:

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, included in this press release

regarding our strategy, future operations, future financial

position, future revenues, other financial guidance, acquisitions,

projected costs, prospects, plans and objectives of management are

forward-looking statements. We may not actually achieve the plans,

intentions, or expectations disclosed in our forward-looking

statements and you should not place undue reliance on our

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

the forward-looking statements we make. There are a number of

important factors that could cause Marchex's actual results to

differ materially from those indicated by such forward-looking

statements which are described in the "Risk Factors" section of our

most recent periodic report and registration statement filed with

the SEC. All of the information provided in this release is as of

February 25, 2015 and Marchex undertakes no duty to update the

information provided herein.

Non-GAAP Financial

Information:

To supplement Marchex's consolidated financial statements

presented in accordance with GAAP and to provide clarity internally

and externally, Marchex uses certain non-GAAP measures of financial

performance and liquidity, including OIBA , Adjusted OIBA, Adjusted

EBITDA, Revenue including domain gains and/or sales, Adjusted OIBA

and EBITDA including and excluding domain gains and sales and

Adjusted non-GAAP EPS including and excluding domain gains and

sales. Marchex also provides Call-Driven Adjusted OIBA and

EBITDA.

OIBA represents income (loss) from

operations plus (1) stock-based compensation expense and (2)

amortization of intangible assets from acquisitions. This measure,

among other things, is one of the primary metrics by which Marchex

evaluates the performance of its business. Additionally, Marchex's

management uses Adjusted OIBA, which

excludes acquisition and separation related costs, as this item is

not indicative of Marchex’s recurring core operating results.

Adjusted OIBA is the basis on which Marchex's internal budgets are

based and by which Marchex's management is currently evaluated.

Marchex believes these measures are useful to investors because

they represent Marchex's consolidated operating results, taking

into account depreciation and other intangible amortization, which

Marchex believes is an ongoing cost of doing business, but

excluding the effects of certain other expenses such as stock-based

compensation, amortization of intangible assets from acquisitions

and acquisition and separation related costs. Adjusted EBITDA represents income before interest,

income taxes, depreciation, amortization, stock compensation

expense, and acquisition and separation related cost. Marchex

believes that Adjusted EBITDA is another alternative measure of

liquidity to GAAP net cash provided by operating activities that

provides meaningful supplemental information regarding liquidity

and is used by Marchex's management to measure its ability to fund

operations and its financing obligations. Historically, these

Non-GAAP measures excluded gain/loss on sales and disposals of

intangible assets for each asset and any domain sales

contribution.

Archeo revenue including domain gains and sales represents GAAP

revenue and includes sales proceeds from the sale of domains

recognized in gain/loss on sales and disposals of intangible assets

and domain sales sold through Marchex’s Domain Marketplace which

are recognized in GAAP revenue. Adjusted OIBA

and EBITDA including or excluding domain gains and sales

includes the above descriptions of Adjusted OIBA and EBITDA and

includes/excludes domain sales contribution and gain/loss on sales

and disposals of intangible assets. Call-Driven Adjusted OIBA and EBITDA includes the

above descriptions of Adjusted OIBA and EBITDA for the Call-Driven

segment. The Call-Driven Adjusted OIBA and EBITDA assigns all

Marchex general corporate overhead costs to the Call-Driven

results. Financial analysts and investors may use the non-GAAP

historical Revenue including/excluding domain gains and sales and

Adjusted OIBA and EBITDA including/excluding domain gains and sales

to help with comparative financial evaluation to make informed

investment decisions. Adjusted non-GAAP

EPS represents Adjusted non-GAAP net income applicable to

common stockholders divided by GAAP diluted shares outstanding.

Adjusted non-GAAP net income applicable to common stockholders

generally captures those items on the statement of operations that

have been, or ultimately will be, settled in cash exclusive of

certain items that are not indicative of Marchex’s recurring core

operating results and represents net income applicable to common

stockholders plus the net of tax effects of: (1) stock-based

compensation expense, (2) amortization of intangible assets from

acquisitions, (3) acquisition and separation related costs, (4)

interest and other income (expense), (5) discontinued operations,

net of tax and (6) dividends paid to participating securities, and

also (7) excludes the effect of any tax valuation allowance.

Financial analysts and investors may use Adjusted non-GAAP EPS to

analyze Marchex's financial performance since these groups have

historically used EPS related measures, along with other measures,

to estimate the value of a company, to make informed investment

decisions, and to evaluate a company's operating performance

compared to that of other companies in its industry. Adjusted Non-GAAP EPS excluding domain gains and

sales includes the above description of Adjusted non-GAAP

EPS and excludes domain sales contribution and gain/loss on sales

and disposals of intangible assets.

Marchex's management believes that investors should have access

to, and Marchex is obligated to provide, the same set of tools that

management uses in analyzing the company's results. These non-GAAP

measures should be considered in addition to results prepared in

accordance with GAAP, and should not be considered in isolation, as

a substitute for, or superior to, GAAP results. Marchex’s non-GAAP

financial measures may be defined differently from time to time and

may be defined differently than similar titled terms used by other

companies, and accordingly, care should be exercised in

understanding how Marchex defines its non-GAAP financial measures

in this release. Marchex endeavors to compensate for the

limitations of the non-GAAP measures presented by providing the

comparable GAAP measure with equal or greater prominence, GAAP

financial statements, and detailed descriptions of the reconciling

items and adjustments, including quantifying such items, to derive

the non-GAAP measure.

MARCHEX, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Operations (in thousands, except

per share data) (unaudited) Three

Months Ended December 31, 2013

2014 Revenue $ 39,680 $ 33,291

Expenses: Service costs (1) 23,833 17,853 Sales and marketing (1)

2,832 3,090 Product development (1) 6,760 6,962 General and

administrative (1) 4,382 4,796 Amortization of intangible assets

from acquisitions 426 - Acquisition and separation related costs

(62 ) - Total operating expenses 38,171

32,701 Gain on sales and disposals of intangible assets, net

35 - Income from operations

1,544 590 Interest expense and other, net 11

(19 ) Income from continuing operations before provision for

income taxes 1,555 571 Income tax expense 958

- Net income from continuing operations 597

571 Discontinued operations: Income from discontinued operations,

net of tax 7 - Gain on sale from discontinued operations, net of

tax 1 - Discontinued operations,

net of tax 8 - Net income 605 571 Dividends paid to participating

securities - (28 ) Net income

applicable to common stockholders $ 605 $ 543

Basic and diluted net income per Class A and Class B share

applicable to common stockholders: Continuing operations $ 0.02 $

0.01 Discontinued operations, net of tax 0.00

- Basic and diluted net income per Class A and

Class B share applicable to common stockholders: $ 0.02 $ 0.01

Dividends paid per share $ - $ 0.02 Shares used to calculate basic

net income per share applicable to common stockholders Class A

7,770 5,233 Class B 28,371 35,969 Shares used to calculate diluted

net income per share applicable to common stockholders Class A

7,770 5,233 Class B 38,713 41,567 (1 ) Includes stock-based

compensation allocated as follows: Service costs $ 362 $ 365 Sales

and marketing 171 231 Product development 508 579 General and

administrative 1,321 1,704 Total

$ 2,362 $ 2,879

MARCHEX, INC.

AND SUBSIDIARIES Condensed Consolidated Statements of

Operations (in thousands, except per share data)

(unaudited) Twelve Months Ended

December 31, 2013

2014 Revenue $ 152,550 $ 182,644 Expenses:

Service costs (1) 91,858 114,581 Sales and marketing (1) 11,182

12,251 Product development (1) 27,346 29,561 General and

administrative (1) 19,385 20,923 Amortization of intangible assets

from acquisitions 2,926 434 Acquisition and separation related

costs 878 (68 ) Total operating

expenses 153,575 177,682 Gain on sales and disposals of intangible

assets, net 3,774 -

Income from operations 2,749 4,962 Interest expense and other, net

(37 ) (62 ) Income from continuing operations

before provision for income taxes 2,712 4,900 Income tax expense

1,755 24,277 Net income

(loss) from continuing operations 957 (19,377 ) Discontinued

operations: Income (loss) from discontinued operations, net of tax

(70 ) 9 Gain on sale from discontinued operations, net of tax

930 278 Discontinued operations,

net of tax 860 287 Net income

(loss) 1,817 (19,090 ) Dividends paid to participating securities

- (127 ) Net income (loss) applicable

to common stockholders $ 1,817 $ (19,217 )

Basic and diluted net income (loss) per Class A and Class B

share applicable to common stockholders: Continuing operations $

0.03 $ (0.49 ) Discontinued operations, net of tax $ 0.02

$ 0.01 Basic and diluted net income (loss) per Class

A and Class B share applicable to common stockholders: $ 0.05 $

(0.48 ) Dividends paid per share $ - $ 0.08 Shares used to

calculate basic net income (loss) per share applicable to common

stockholders Class A 8,816 5,853 Class B 26,798 34,157 Shares used

to calculate diluted net income (loss) per share applicable to

common stockholders Class A 8,816 5,853 Class B 36,999 40,010

(1 ) Includes stock-based compensation allocated as follows:

Service costs $ 1,180 $ 1,382 Sales and marketing 645 894 Product

development 1,635 2,595 General and administrative 5,777

7,032 Total $ 9,237 $

11,903

MARCHEX, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (in thousands)

(unaudited) December 31,

December 31, Assets 2013

2014 Current assets: Cash and cash equivalents

$ 30,912 $ 80,032 Accounts receivable, net 30,005 25,941 Prepaid

expenses and other current assets 2,943 3,143 Refundable taxes 97

131 Deferred tax assets 1,016 -

Total current assets 64,973 109,247 Property and equipment,

net 5,440 5,430 Deferred tax assets 25,138 - Intangibles and other

assets, net 484 313 Goodwill 65,679 65,679 Intangible assets from

acquisitions, net 434 - Total

Assets $ 162,148 $ 180,669

Liabilities and Stockholders' Equity Current

liabilities: Accounts payable $ 15,922 $ 13,766 Accrued expenses

and other current liabilities 7,988 7,515 Deferred revenue

1,388 2,117 Total current liabilities

25,298 23,398 Other non-current liabilities 2,095

1,118 Total Liabilities 27,393 24,516

Class A common stock 80 55 Class B common stock 309

373 Treasury stock (2 ) (2,503 ) Additional paid-in capital 305,517

348,467 Accumulated deficit (171,149 )

(190,239 ) Total Stockholders' Equity 134,755

156,153 Total Liabilities and Stockholders' Equity $

162,148 $ 180,669

MARCHEX,

INC. AND SUBSIDIARIES Reconciliation of GAAP Income from

Operations to Operating Income Before Amortization (OIBA)

and Adjusted Operating Income Before Amortization (Adjusted

OIBA) (in thousands) (unaudited)

Three Months Ended December 31,

2013 2014 Income from

operations $ 1,544 $ 590 Stock-based compensation 2,362 2,879

Amortization of intangible assets from acquisitions 426

- Operating income before

amortization (OIBA) 4,332 3,469 Acquisition and separation related

costs (62 ) -

Adjusted

operating income before amortization (Adjusted OIBA) $

4,270 $ 3,469 Domain sales contribution (1,549

) (1,679 ) Gain on sales and disposals of intangible assets, net

(35 ) - Adjusted OIBA excluding

domain gains and sales $ 2,686 $ 1,790

Twelve Months Ended December 31,

2013 2014

Income from operations $ 2,749 $ 4,962 Stock-based compensation

9,237 11,903 Amortization of intangible assets from acquisitions

2,926 434 Operating

income before amortization (OIBA) 14,912 17,299 Acquisition and

separation related costs 878 (68 )

Adjusted operating income before amortization (Adjusted

OIBA) $ 15,790 $ 17,231 Domain

sales contribution (2,388 ) (7,341 ) Gain on sales and disposals of

intangible assets, net (3,774 ) -

Adjusted OIBA excluding domain gains and sales $ 9,628

$ 9,890 Certain

reclassifications have been made to prior periods to conform to

current presentation.

MARCHEX, INC. AND

SUBSIDIARIES Reconciliation from Net Cash provided by

Operating Activities to Adjusted EBITDA (in thousands)

(unaudited) Three Months

Ended December 31, 2013

2014 Net cash provided by operating

activities $ 6,109 $ 4,302 Changes in assets and liabilities (1,636

) 58 Income tax expense 958 - Interest expense and other, net (14 )

20 Gain on sales and disposals of intangible assets, net 35 - Loss

on discontinued operations, net of tax (7 ) - Excess tax benefits

related to stock compensation (209 ) -

Adjusted EBITDA $ 5,236 $

4,380 Domain sales contribution (1,549 ) (1,679 ) Gain on

sales and disposals of intangible assets, net (35 )

- Adjusted EBITDA excluding domain gains and

sales $ 3,652 $ 2,701 Net cash used in

investing activities $ (549 ) $ (1,000 ) Net cash

provided by (used in) financing activities $ 202 $

(3,922 )

Twelve Months Ended

December 31, 2013

2014 Net cash provided by operating activities

$ 13,596 $ 22,419 Changes in asset and liabilities (1,154 ) (25,990

) Income tax expense 1,755 24,277 Acquisition and separation

related costs 940 - Interest expense and other, net 30 62 Gain on

sales and disposals of intangible assets, net 3,774 - Income (loss)

on discontinued operations, net of tax 42 (9 ) Tax effect on gain

on sale of discontinued operations 563

143

Adjusted EBITDA $ 19,546

$ 20,902 Domain sales contribution (2,388 ) (7,341 )

Gain on sales and disposals of intangible assets, net (3,774

) - Adjusted EBITDA excluding domain

gains and sales $ 13,384 $ 13,561 Net

cash provided by (used in) investing activities $ 1,647

$ (3,178 ) Net cash provided by (used in) financing

activities $ (261 ) $ 29,879 Certain

reclassifications have been made to prior periods to conform to

current presentation.

MARCHEX, INC. AND

SUBSIDIARIES Reconciliation of GAAP EPS to Adjusted Non-GAAP

EPS (in thousands, except per share data)

(unaudited) Three

Months Ended December 31, 2013

2014 Adjusted Non-GAAP EPS from

continuing operations $ 0.07 $ 0.05 Net

income applicable to common stockholders - diluted (GAAP EPS) $

0.02 $ 0.01 Shares used to calculate diluted net income per share

applicable to common stockholders 38,713 41,567 Net income

applicable to common stockholders $ 605 $ 543 Stock-based

compensation 2,362 2,879 Acquisition and separation related costs

(62 ) - Amortization of intangible assets from acquisitions 426 -

Interest expense and other, net (11 ) 19 Dividends paid to

participating securities - 28 Tax valuation allowance - (659 )

Discontinued operations, net of tax (8 ) - Estimated impact of

income taxes (676 ) (598 )

Adjusted

Non-GAAP net income from continuing operations $

2,636 $ 2,212 Domain sales contribution (1,549

) (1,552 ) Gain on sales and disposals of intangible assets, net

(35 ) - Estimated impact of income taxes on domain gains and sales

607 635 Adjusted Non-GAAP

net income excluding domain gains and sales $ 1,659 $

1,295

Adjusted Non-GAAP EPS from continuing

operations $ 0.07 $

0.05 Adjusted Non-GAAP EPS excluding domain

gains and sales $ 0.04 $ 0.03

Diluted shares used to calculate Adjusted Non-GAAP

EPS (1) 38,713 41,567

(1)

For the purpose of computing the number of diluted shares for

Adjusted Non-GAAP EPS, Marchex uses the accounting guidance that

would be applicable for computing the number of diluted shares for

GAAP EPS. Certain reclassifications have been made to prior

periods to conform to current presentation.

MARCHEX, INC. AND SUBSIDIARIES Reconciliation of GAAP EPS

to Adjusted Non-GAAP EPS (in thousands, except per share

data) (unaudited)

Twelve Months Ended December 31, 2013

2014 Adjusted Non-GAAP EPS from

continuing operations $ 0.27 $ 0.26 Net

income (loss) from continuing operations applicable to common

stockholders - diluted (GAAP EPS) $ 0.03 $ (0.49 ) Shares used to

calculate diluted net income (loss) per share applicable to common

stockholders 36,999 40,010 Net income (loss) applicable to

common stockholders $ 1,817 $ (19,217 ) Stock-based compensation

9,237 11,903 Acquisition and separation related costs 878 (68 )

Amortization of intangible assets from acquisitions 2,926 434

Interest expense and other, net 37 62 Dividends paid to

participating securities - 127 Tax valuation allowance 651 21,686

Discontinued operations, net of tax (860 ) (287 ) Estimated impact

of income taxes (4,574 ) (3,495 )

Adjusted Non-GAAP net income from continuing operations

$ 10,112 $ 11,145 Domain sales

contribution (2,388 ) (7,341 ) Gain on sales and disposals of

intangible assets, net (3,774 ) - Estimated impact of income taxes

on domain gains and sales 2,306 2,635

Adjusted Non-GAAP net income from continuing

operations excluding domain gains and sales $ 6,256 $

6,439

Adjusted Non-GAAP EPS from continuing

operations $ 0.27 $

0.26 Adjusted Non-GAAP EPS from continuing

operations excluding domain gains and sales $ 0.17 $

0.15

Shares used to calculate diluted net

income (loss) per share applicable to common stockholders

(GAAP)

36,999 40,010 Weighted average stock options and common shares

subject to purchase or cancellation (if applicable) -

2,116 Diluted shares used to calculate

Adjusted Non-GAAP EPS (1) 36,999 42,125

(1)

For the purpose of computing the number of diluted shares for

Adjusted Non-GAAP EPS, Marchex uses the accounting guidance that

would be applicable for computing the number of diluted shares for

GAAP EPS. Certain reclassifications have been made to prior

periods to conform to current presentation.

MARCHEX, INC. AND SUBSIDIARIES (in thousands)

(unaudited)

Reconciliation of GAAP Income (Loss) from

Operations to Operating Income before Amortization (OIBA)

and Adjusted Operating Income Before Amortization (Adjusted

OIBA)

Three Months Ended

Twelve Months Ended 12/31/2013

3/31/2014 6/30/2014

9/30/2014

12/31/2014 12/31/2013

12/31/2014 Income from operations $

1,544 $ 1,436 $ 1,711 $ 1,225 $ 590 $ 2,749 $ 4,962 Stock-based

compensation 2,362 2,883 3,117 3,024 2,879 9,237 11,903

Amortization of intangible assets from acquisitions 426

403 31

- - 2,926

434 Operating income before amortization

(OIBA) 4,332 4,722 4,859 4,249 3,469 14,912 17,299 Acquisition and

separation related costs (62 ) -

(68 ) - -

878 (68 )

Adjusted operating income

before amortization (Adjusted OIBA) $ 4,270

$ 4,722 $ 4,791 $ 4,249

$ 3,469 $ 15,790 $ 17,231

Domain sales contribution (1,549 ) (1,893 ) (2,217 ) (1,552 )

(1,679 ) (2,388 ) (7,341 ) Gain on sales and disposals of

intangible assets, net (35 ) -

- - -

(3,774 ) - Adjusted OIBA

excluding domain gains and sales $ 2,686 $ 2,829

$ 2,574 $ 2,697 $ 1,790

9,628 9,890

Reconciliation from Net Cash provided by Operating Activities to

Adjusted EBITDA

Three Months Ended

Twelve Months Ended 12/31/2013

3/31/2014 6/30/2014

9/30/2014

12/31/2014 12/31/2013

12/31/2014 Net cash provided by

operating activities $ 6,109 $ 8,078 $ 3,289 $ 6,750 $ 4,302 $

13,596 $ 22,419 Changes in assets and liabilities (1,636 ) (2,984 )

1,672 (24,736 ) 58 (1,154 ) (25,990 ) Income tax expense 958 588

709 22,980 - 1,755 24,277 Acquisition and separation related costs

- - - - - 940 - Gain on sales and disposals of intangible assets,

net 35 - - - - 3,774 - Discontinued operations, net of tax (7 ) (9

) - - - 42 (9 ) Tax effect of gain on sale of discontinued

operations - - - 143 - 563 143 Interest expense and other, net (14

) 2 22 18 20 30 62 Excess tax benefits related to stock

compensation (209 ) - -

- - -

-

Adjusted EBITDA

$ 5,236 $ 5,675 $ 5,692

$ 5,155 $ 4,380 $ 19,546

$ 20,902 Domain sales contribution (1,549 ) (1,893 )

(2,217 ) (1,552 ) (1,679 ) (2,388 ) (7,341 ) Gain on sales and

disposals of intangible assets, net (35 ) -

- -

- (3,774 ) - Adjusted

EBITDA excluding domain gains and sales $ 3,652 $

3,782 $ 3,475 $ 3,603 $

2,701 $ 13,384 $ 13,561 Net cash

provided by (used in) investing activities $ (549 ) $ (807 )

$ (545 ) $ (826 ) $ (1,000 ) $ 1,647

$ (3,178 ) Net cash provided by (used in) financing

activities $ 202 $ 343 $ 33,680

$ (222 ) $ (3,922 ) $ (261 ) $ 29,879

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

MARCHEX, INC.

AND SUBSIDIARIES Quarterly Financial Summary Information

(in thousands)

NON-GAAP

MEASURES Amounts below exclude Discontinued Operations

CONSOLIDATED Q113

Q213 Q313

Q413 Q114

Q214 Q314

Q414 GAAP Revenue $

34,732 $ 37,578 $ 40,560

$ 39,680 $ 50,496 $

49,676 $ 49,181 $ 33,291

Adjusted OIBA $ 3,604 $ 3,550

$ 4,366 $ 4,270 $ 4,722

$ 4,791 $ 4,249 $ 3,469

Adjusted EBITDA $ 4,516

$ 4,480 $

5,314 $ 5,236

$ 5,675 $

5,692 $ 5,155

$ 4,380

CALL-DRIVEN AND RELATED Q113

Q213 Q313

Q413 Q114

Q214 Q314

Q414 GAAP Revenue $ 31,108

$ 33,893 $ 35,668 $

34,457 $ 45,492 $ 45,857

$ 46,379 $ 30,323 Adjusted OIBA

$ 1,371 $ 1,508 $ 1,693

$ 1,725 $ 2,411 $ 2,897

$ 3,279 $ 2,512 Adjusted EBITDA

$ 2,246 $

2,401 $ 2,598

$ 2,618 $

3,312 $ 3,764

$ 4,170 $

3,409

ARCHEO

Q113 Q213

Q313 Q413

Q114 Q214

Q314 Q414 GAAP Revenue

$ 3,624 $ 3,685 $ 4,892

$ 5,223 $ 5,004 $ 3,819

$ 2,802 $ 2,968 Adjusted OIBA

$ 2,233 $ 2,042 $ 2,673

$ 2,545 $ 2,311 $ 1,894

$ 970 $ 957 Adjusted EBITDA

$ 2,270 $

2,079 $ 2,716

$ 2,618 $

2,363 $ 1,928

$ 985 $

971 Due to rounding, the sum of quarterly amounts may

not equal amounts reported for year-to-date periods.

MARCHEX, INC. AND SUBSIDIARIES Financial Summary by

Segment (in thousands) (unaudited)

Three Months Ended

Twelve Months Ended 12/31/2013

3/31/2014 6/30/2014

9/30/2014 12/31/2014

12/31/2013 12/31/2014

Marchex - Consolidated5

Revenue - GAAP2 $ 39,680

$ 50,496 $ 49,676

$ 49,181 $ 33,291

$ 152,550 $ 182,644

Revenue including domain gains3 $ 39,715 $

50,496 $ 49,676 $ 49,181 $

33,291 $ 156,324 $ 182,644

Adjusted OIBA

including domain gains and sales4 $

4,270 $ 4,722 $

4,791 $ 4,249

$ 3,469 $ 15,790 $

17,231 Adjusted OIBA excluding domain gains and

sales4 $ 2,686 $ 2,829 $ 2,574 $

2,697 $ 1,790 $ 9,628 $ 9,890

Adjusted EBITDA including domain gains and sales4

$ 5,236 $ 5,675

$ 5,692 $ 5,155

$ 4,380 $ 19,546

$ 20,902 Adjusted EBITDA excluding domain

gains and sales4 $ 3,652 $ 3,782 $ 3,475 $

3,603 $ 2,701 $ 13,384 $ 13,561

Call-Driven1 and related Revenue - GAAP $

34,457 $ 45,492 $ 45,857 $ 46,379 $ 30,323 $ 135,126 $ 168,051

Adjusted OIBA4 $ 1,725 $ 2,411 $ 2,897 $ 3,279 $ 2,512 $ 6,297 $

11,099 Adjusted EBITDA4 $ 2,618 $ 3,312 $ 3,764 $ 4,170 $ 3,409 $

9,863 $ 14,655

Archeo1,5 Revenue - GAAP2 $

5,223 $ 5,004 $ 3,819 $ 2,802 $ 2,968 $ 17,424 $ 14,593 Revenue

including domain gains3 $ 5,258 $ 5,004 $ 3,819 $ 2,802 $ 2,968 $

21,198 $ 14,593 Adjusted OIBA including domain gains and sales4 $

2,545 $ 2,311 $ 1,894 $ 970 $ 957 $ 9,493 $ 6,132 Adjusted OIBA

excluding domain gains and sales4 $ 961 $ 418 $ (323 ) $ (582 ) $

(722 ) $ 3,331 $ (1,209 ) Adjusted EBITDA including domain gains

and sales4 $ 2,618 $ 2,363 $ 1,928 $ 985 $ 971 $ 9,683 $ 6,247

Adjusted EBITDA excluding domain gains and sales4 $ 1,034 $ 470 $

(289 ) $ (567 ) $ (708 ) $ 3,521 $ (1,094 ) 1 The

financial results for Call-Driven and Archeo have been derived from

the unaudited condensed consolidated financial statements. The

Call-Driven financial results include certain direct operating

expenses and general corporate overhead expenses. The Archeo

financial results include direct operating expenses. 2 In September

2013, Marchex launched its Domains Marketplace and through it,

commenced buying and selling of domains.

Domain sales occurring after this date are

included in GAAP revenue and related cost in service cost. Prior to

this date, domain sales were recognized in gain on sales and

disposals of intangible assets in the unaudited condensed

consolidated financial statements.

3 Domain sales recognized in gain on sales and disposals of

intangible assets, net. 4

These are non-GAAP measures of operating

results and liquidity. These non-GAAP measures are adjusted for net

gains from sales of intangible assets, net and direct contribution

of domain sales sold through its Domains Marketplace.

5

Amounts presented exclude results of

discontinued operations. Operating results of discontinued

operations relate to certain pay-per-click assets sold in July 2013

and are included in discontinued operations, net of tax in the

unaudited condensed consolidated financial statements.

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

MARCHEX, INC. AND SUBSIDIARIES Reconciliation to Reported

Financial and Non-GAAP Information (in thousands)

(unaudited)

Three Months Ended Twelve Months Ended

12/31/2013 3/31/2014

6/30/2014 9/30/2014

12/31/2014 12/31/2013

12/31/2014 Revenue6

Consolidated - GAAP1 $ 39,680 $

50,496 $ 49,676 $ 49,181

$ 33,291 $ 152,550 $

182,644 Add: Domain gains2 35 -

- - - 3,774

- Consolidated including domain gains and sales3 39,715 50,496

49,676 49,181 33,291 156,324 182,644 Less: Archeo4 including domain

gains and sales3 5,258 5,004

3,819 2,802 2,968 21,198

14,593 Call-Driven4 and related $ 34,457 $ 45,492

$ 45,857 $ 46,379 $ 30,323 $ 135,126 $

168,051 Adjusted OIBA5,6 Consolidated excluding domain gains

and sales $ 2,686 $ 2,829 $ 2,574 $ 2,697 $ 1,790 $ 9,628 $ 9,890

Add: Domain gains and sales 1,584 1,893

2,217 1,552 1,679 6,162

7,341

Consolidated including domain gains and

sales 4,270 4,722 4,791 4,249

3,469 15,790 17,231 Less: Archeo4 including

domain gains and sales 2,545 2,311

1,894 970 957 9,493

6,132 Call-Driven4 and related $ 1,725 $ 2,411

$ 2,897 $ 3,279 $ 2,512 $ 6,297 $

11,099 Adjusted EBITDA5,6 Consolidated excluding domain

gains and sales $ 3,652 $ 3,782 $ 3,475 $ 3,603 $ 2,701 $ 13,384 $

13,561 Add: Domain gains and sales 1,584 1,893

2,217 1,552 1,679

6,162 7,341

Consolidated including domain gains

and sales 5,236 5,675 5,692 5,155

4,380 19,546 20,902 Less: Archeo4 including

domain gains and sales 2,618 2,363

1,928 985 971 9,683

6,247 Call-Driven4 and related $ 2,618 $ 3,312

$ 3,764 $ 4,170 $ 3,409 $ 9,863 $

14,655 1 In September 2013, Marchex launched

its Domains Marketplace and through it, commenced buying and

selling of domains.

Domain sales occurring after this date are

included in GAAP revenue and related cost in service cost. Prior to

this date, domain sales were recognized in gain on sales and

disposals of intangible assets, net in the unaudited condensed

consolidated financial statements.

2 Domain sales recognized in gain on sales and disposals of

intangible assets, net in the unaudited condensed consolidated

financial statements. 3

Domain sales recognized in either gain on

sales and disposals of intangible assets or in revenue in the

unaudited condensed consolidated financial statements.

4 The financial results for Call-Driven and Archeo have been

derived from the unaudited condensed consolidated financial

statements. The Call-Driven financial results include certain

direct operating expenses and general corporate overhead expenses.

The Archeo financial results include direct operating expenses. 5

These are non-GAAP measures of operating

results and liquidity. These non-GAAP measures are adjusted for net

gains from sales of intangible assets, net and direct contribution

of domain sales sold through its Domains Marketplace.

6

Amounts presented exclude results of

discontinued operations. Financial results of discontinued

operations related to certain pay-per-click assets sold in July

2013 and are included in discontinued operations, net of tax in the

unaudited condensed consolidated financial statements.

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

Marchex Investor RelationsTrevor Caldwell, 206-331-3600Email:

ir(at)marchex.comorMEDIA INQUIRIESMarchex Corporate

CommunicationsSonia Krishnan, 206-331-3434Email:

skrishnan(at)marchex.com

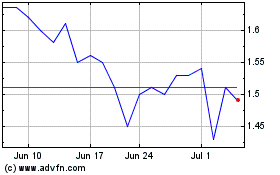

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

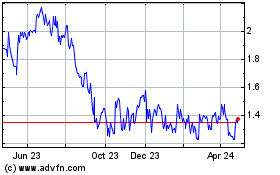

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Apr 2023 to Apr 2024