TIDMEMG

RNS Number : 0014A

Man Group plc

17 December 2014

Man Group plc Announces Acquisition of Silvermine Capital

Management LLC

NEW YORK and LONDON, 17 December 2014 -- Man Group plc ("Man

Group") announced today that it has entered into a conditional

agreement to acquire Silvermine Capital Management LLC

("Silvermine" or the "Company"), a Connecticut-based leveraged loan

manager with $3.8 billion of funds under management across nine

active collateralised loan obligation ("CLO") structures as of 30

November 2014 (the "Acquisition"). The Acquisition is expected to

complete in the first quarter of 2015, subject to certain approvals

being obtained.

Silvermine is wholly-owned by the firm's founders and senior

staff members and is based in Stamford, Connecticut. The team of 17

focuses exclusively on managing US levered credit portfolios and,

since inception in 2005, has executed 16 separate transactions

totalling $6.7 billion.

Upon completion of the Acquisition, Silvermine will be

integrated into Man GLG and will operate under the Man GLG

Silvermine name which will complement Man GLG's existing credit

business. Silvermine's team will remain in place under the

leadership of two of the firm's founders, G. Steven Kalin and

Richard F. Kurth, who will continue to work alongside the other

co-founders Aaron Meyer and Jonathan Marks.

The Acquisition follows Man Group's recent acquisitions in the

US of Pine Grove Asset Management LLC, Numeric Holdings LLC and the

Merrill Lynch Alternative Investments LLC fund of hedge fund

portfolio. The strategic rationale for the Acquisition

includes:

-- Integration of Silvermine's specialised and high calibre team

into Man Group, with long-term experience and expertise in US

levered credit;

-- Significant enhancement of Man Group's existing US credit

business and global CLO footprint, providing the necessary scale to

become a significant player in the US CLO market;

-- Further expansion of Man Group's footprint in the US,

utilising Silvermine's distinct distribution channel through

investment banks, and adding to the firm's investment capabilities;

and

-- Opportunity for the new Man GLG Silvermine business to

leverage Man Group's infrastructure, banking relationships,

distribution capabilities, and balance sheet.

The consideration paid by Man Group is structured to align its

interests with Silvermine and comprises:

-- An upfront payment of $23.5 million, paid in cash from

existing resources upon completion of the transaction;

-- Two earn out payments, payable following the first and fifth

anniversary of closing, on a sliding scale dependent on levels of

run rate management fees at the time:

o After one year, up to $16.5 million; and

o After five years, up to $30 million.

-- The earn out payments are expected to be paid in cash, also

funded from Man Group's resources at the time; however Man Group

has retained the right to, at its discretion, issue ordinary shares

at the then prevailing market price in order to satisfy some or all

of the consideration payable.

The regulatory capital requirement associated with the

Acquisition is expected to be approximately $45 million. As of 30

November 2014, Silvermine's run rate management fee revenues and

PBT were $17 million and $8 million respectively, based on $3.8

billion in funds under management.

Mark Jones, co-CEO of Man GLG, stated, "The acquisition of

Silvermine will transform our existing credit business and position

us to benefit from strong demand for US CLOs and other credit

strategies. Silvermine is a highly respected, specialised business

with an excellent track record of outperformance. As part of Man

Group, Silvermine will benefit from our world class infrastructure,

distribution and access to capital and we are confident that this

acquisition will bring meaningful advantages to our investors by

further diversifying our offering."

Steven Kalin and Richard Kurth, Managing Directors of

Silvermine, commented, "We're excited about the opportunities that

joining Man Group will bring to us and to our investors. We have

always been focused on identifying opportunities in the credit

space that, given their risk/return proposition, deliver attractive

performance for our clients. We are pleased to be joining forces

with an organisation that not only embraces our firm's

entrepreneurial spirit, but plans to help foster that spirit and

collaborate with us to further grow the business".

Berkshire Capital Securities LLC is acting as financial adviser

to Silvermine.

Enquiries:

Fiona Smart

Head of Investor Relations

+44 20 7144 2030

fiona.smart@man.com

Rosanna Konarzewski

Global Head of Communications

+44 20 7144 2078

media@man.com

Finsbury (UK enquiries)

James Bradley/Michael Turner

+44 207 251 3801

ManGroupUK@Finsbury.com

Prosek Partners (US enquiries)

Brian Schaffer/Caroline Harris-Gibson

+1 212 279 3115

bschaffer@prosek.com/cgibson@prosek.com

Notes to editors:

About Man Group

Man Group is a leading investment management business with a

diverse offering in hedge funds and long only products across

equity, credit, managed futures, convertibles, emerging markets,

global macro and multi-manager solutions. At 30 September 2014, Man

Group's funds under management were $72.3 billion. The original

business was founded in 1783. Today, Man Group is listed on the

London Stock Exchange and is a constituent of the FTSE 250 Index

with a market capitalisation of around GBP2.6 billion. Man Group

also supports many awards, charities and initiatives around the

world, including sponsorship of the Man Booker literary prizes.

Further information can be found at www.man.com.

About Man GLG

Man GLG, a wholly owned subsidiary of Man Group (since 14

October 2010), is a global asset management company offering its

clients a wide range of performance-oriented investment products

and managed account services. Founded in 1995, Man GLG is dedicated

to achieving consistent, attractive investment returns through

traditional, alternative and hybrid investment strategies. Man GLG

currently manages $32.2 billion.

The performance Man GLG generates for its clients is driven by

the proven expertise of its team of investment professionals

underpinned by a rigorous approach to investment analysis and a

strong focus on risk management. Man GLG has been investing in

credit and convertible strategies for over 15 years. Steve Roth

heads the Man GLG Global Credit team which is an established

business, with $7 billion of funds under management. The absolute

return strategy incorporates a diverse range of approaches and

asset classes including relative value, distressed debt, event

driven capital structure arbitrage and convertible bond arbitrage

strategies. The long-only credit strategies include investing in

corporate bonds, convertible bonds and asset-backed securities with

a range of approaches applied to each.

About Silvermine

Founded in 2005, Silvermine is a SEC registered investment

advisor with, as of 30 November 2014, approximately $3.8 billion in

assets under management focused on high yield credit. The founding

team has worked together for over 10 years using primarily senior

secured loans as the basis to express their views through a variety

of credit products. Since inception, the Company has executed 16

separate transactions totalling $6.7 billion. At 31 December 2013,

Silvermine had gross balance sheet assets of $24.5 million and

profit before tax attributable to these assets of $11.6

million.

Forward-looking statements and other important information

This document contains forward-looking statements with respect

to the financial condition, results and business of Man Group plc.

By their nature, forward looking statements involve risk and

uncertainty and there may be subsequent variations to estimates.

Man Group plc's actual future results may differ materially from

the results expressed or implied in these forward-looking

statements.

The content of the website referred to in this announcement is

not incorporated into and does not form part of this

announcement.

Nothing in this announcement should be construed as or is

intended to be a solicitation for or an offer to provide investment

advisory services.

Nothing in this announcement is intended to be a profit forecast

or a profit estimate for any period or a forecast of future profits

and statements relating to earnings accretion or enhancement should

not be interpreted to mean that earnings per Man ordinary share for

the current or future financial periods will necessarily match or

exceed its historical published earnings per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTRBFTMBABMLI

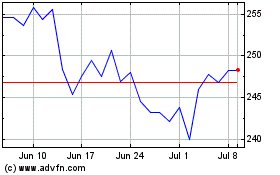

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

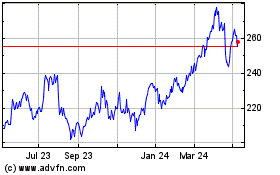

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024