MARKET SNAPSHOT: Nasdaq Touches Intraday Record, But Stocks Struggle For Direction After ECB Decision

December 08 2016 - 10:26AM

Dow Jones News

By Mark DeCambre and Victor Reklaitis, MarketWatch

Lululemon leaps 18% after earnings report

U.S. stocks on Thursday touched fresh record levels in intraday

trading after the European Central Bank held its key rates steady

but said it would taper its asset-purchase plan in April, while

leaving the door open for an extension of its economic stimulus

program "if necessary."

However, Wall Street struggled to hold on to higher levels,

offering signs that the market may be trying to reassess new

heights for stocks achieved in the wake of Donald Trump's election

win a month ago.

The Nasdaq Composite Index hit an all-time intraday trading high

of 5,407.02, joining the other trading benchmarks which notched

trading records Wednesday. The tech-laden index hit its first

record since Nov. 29 and was most recently trading at 5,399, up

0.1%.

The Dow Jones Industrial Average gave up 13 points, or less than

0.1%, at 19,540, but briefly set an all-time trading high of

19,592.95, led by sharp gains in banks including J.P. Morgan Chase

& Co. (JPM) and Goldman Sachs Group(GS).

The S&P 500 index also set an intraday record of 2,24.06,

but was retreating, with 8 of the S&P 500's 11 sectors trading

in negative territory. Utilities and real estate were the worst

performers, while tech and financials were among the best,

suggesting that investors were rotating out of defensive sectors

and into those perceived as riskier.

The early tone was set by the ECB meeting.

The central bank said it would in April taper its asset-purchase

program to buying EUR60 billion ($64 billion) in bonds each month

from EUR80 billion until the end of December 2017, "or beyond, if

necessary, and in any case until the Governing Council sees a

sustained adjustment in the path of inflation consistent with its

inflation aim." The ECB's targets inflation of near 2%.

"The statement [by the ECB] has taken some of the impact of the

decision to taper [asset purchases] and at this point in the cycle

tapering is viewed as a good thing because it is seen as a sign of

improvement," said Colin Cieszynski, chief market strategist at CMC

Markets told MarketWatch. He said that volatility is likely as the

news conference begins and as investors look for further clues

about the central bank's plans.

The euro was the vehicle for early volatility, dropping

precipitously against the dollar after an early steep pop higher in

the currency after the ECB decision faded. The euro rose 0.7% to

$1.0874, its highest level since Nov. 14. But it soon turned lower

(http://www.marketwatch.com/story/dollar-buying-takes-a-breather-as-investors-look-ahead-to-central-bank-meetings-2016-12-08),

falling more than 1% to a three-day low of $1.0663.

On Wednesday, the Dow and S&P 500 closed higher by 1.6% and

1.3%, respectively, as each gauge scored a record close

(http://www.marketwatch.com/story/dow-industrials-aim-for-fresh-all-time-high-2016-12-07).

The Nasdaq Composite climbed 1.1%, finishing 0.1% shy of its

all-time closing high, achieved in late November.

Individual movers: Shares in Lululemon Athletica Inc.(LULU)

soared 18%. The Canadian seller of athletic apparel late Wednesday

posted better-than-expected earnings

(http://www.marketwatch.com/story/lululemon-jumps-on-strong-earnings-new-buyback-plan-2016-12-07)

and announced a new buyback plan.

Costco Wholesale Corp.(COST) declined 2.7% after the warehouse

club chain reported stronger-than-anticipated earnings

(http://www.marketwatch.com/story/costco-same-store-sales-rise-following-declines-2016-12-07)

late Wednesday.

Home builder Hovnanian Enterprises Inc.(HOV) fell 4.1% after

disappointing quarterly results from the home builder

Economic news: A report on U.S. weekly on employment showed that

jobless claims dropped by 10,000 to 258,000, matching forecasts and

extending a streak of claims below 300,000. The report continues a

trend that points to a healthy labor market.

See:Italy put a cloud over Europe, but there is a silver lining

for the ECB

(http://www.marketwatch.com/story/how-italys-no-vote-might-be-the-ecbs-silver-lining-2016-12-05)

The Federal Reserve entered the so-called blackout period

Tuesday ahead of its meeting Dec. 13-14, so there are no Fed

speakers on the docket.

Check out:

Other markets:Oil futures

(http://www.marketwatch.com/story/oil-prices-stabilize-as-investors-watch-for-china-data-2016-12-08)

traded higher, erasing some of this week's decline. European stocks

(http://www.marketwatch.com/story/european-stocks-edge-higher-as-ecb-decision-looms-2016-12-08)

have been trading higher, while Asian markets closed mostly higher

(http://www.marketwatch.com/story/asian-markets-catch-a-ride-on-wall-streets-record-wave-2016-12-07).

Gold futures were dropping, and a key dollar index was ticking

higher.

(END) Dow Jones Newswires

December 08, 2016 10:11 ET (15:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

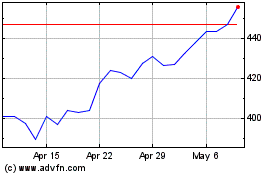

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Aug 2024 to Sep 2024

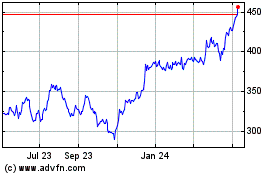

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Sep 2023 to Sep 2024