London Stock Exchange Group PLC Final Results -19-

March 05 2015 - 2:02AM

UK Regulatory

Annual Improvements 2010-2012 and Annual Improvements 2011-2013;

and

IFRIC 21, 'Levies'.

The adoption of these standards did not have a material impact

on these non-statutory consolidated financial statements.

The following standards and interpretations were issued by the

IASB and IFRIC since the last Annual Report, but have not been

adopted either because they were not endorsed by the European Union

(EU) at 31 December 2014 or they are not yet mandatory and the

Group has not chosen to early adopt. The impact on the Group's

financial statements of the future standards, amendments and

interpretations is still under review, but the Group does not

expect any of these changes to have a material impact on the

results or the net assets of the Group:

International accounting standards and interpretations Effective date

Amendments to IFRS 11, 'Joint arrangements' 1 January 2016

on accounting for acquisitions of interest in

a joint operations

Amendment to IAS 16,'Property,plant and equipment' 1 January 2016

and IAS 38,'Intangible assets',

on Clarification of Acceptable Methods of Depreciation

and Amortisation

Amendments to IAS 27, 'Separate financial statements' 1 January 2016

on equity method in separate financial statements

Amendments to IFRS 10, 'Consolidated financial 1 January 2016

statements' and IAS 28, 'Associates and joint

ventures' on sale and contribution of assets

between an investor and its associate or joint

venture

Annual Improvements 2012-2014 1 January 2016

Amendments to IFRS 10, 'Consolidated financial 1 January 2016

statements', IFRS 12, 'Disclosure of interests

in other entities' and IAS 28, 'Associates and

joint ventures' on applying the consolidated

exception for investment entities

Proposed amendments to IAS 1,'Presentation of 1 January 2016

financial statements' disclosure initiative

IFRS 14,'Regulatory deferral accounts' 1 January 2016

IFRS 15 'Revenue from contracts with customers' 1 January 2017

IFRS 9 'Financial instruments' on classification 1 January 2018

and measurement and amendments regarding general

hedge accounting

The preparation of the non-statutory financial statements

requires management to make estimates and assumptions that affect

the reported income and expense, assets and liabilities and

disclosure of contingencies at the date of the non-statutory

financial statements. Although these estimates and assumptions are

based on management's best judgment at the date of the

non-statutory financial statements, actual results may differ from

these estimates.

For these non-statutory financial statements the Group is not

adopting the columnar format for its consolidated income

statement.

Prior period restatements

The restatement to the 12 months ended 31 December 2013 relates

to insufficient deferred tax liability being recognised against

historical intangible assets acquired and the 2014 Rights

Issue.

The deferred tax liability is recognised in respect of the

amortisation of the acquired intangibles which have no or partial

tax base for the Group. The deferred tax is then released to the

income statement over the same period as the amortisation of the

acquired intangible assets.

The correction of these entries result in an increase in

deferred tax liability, goodwill and a resulting credit to the

income statement as the deferred tax liability is unwound over the

useful economic lives of the associated purchased intangibles. In

addition in circumstances where the underlying assets have been

recognised in a currency other than sterling there is an adjustment

in relation to the retranslation of these balances.

On 22 August 2014, the Group announced a Rights Issue in

relation to its proposed acquisition of the Frank Russell Company.

The

Rights Issue constituted 74,347,813 new ordinary shares of par

value 6 79/86 at 1,295p. This generated share premium of GBP957.7m.

Consequently the 2013 basic and adjusted earnings per share numbers

have been restated using the weighted average share count as if the

rights issue had taken place at the start of the period.

2. Segmental Information

Unaudited segmental disclosures for the 12 months to 31 December 2014

are as follows:

Post

Trade Post

Services Trade

- CC&G Services

Capital and Monte - LCH. Information Technology Investment

Markets Titoli Clearnet Services Services Management Other Eliminations Group

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------- ----------

Revenue from

external

customers 333.2 96.5 329.4 373.0 66.0 79.7 5.4 - 1,283.2

Inter-segmental

revenue - 1.1 - - 10.1 - - (11.2) -

----------- ----------

Revenue 333.2 97.6 329.4 373.0 76.1 79.7 5.4 (11.2) 1,283.2

Net treasury

income through

CCP business - 32.6 60.0 - - - - - 92.6

Other income - - (0.5) - - - 5.3 - 4.8

----------- ----------

Total income 333.2 130.2 388.9 373.0 76.1 79.7 10.7 (11.2) 1,380.6

Operating

profit before

amortisation

of purchased

intangible

assets and

non-recurring

items 162.8 62.9 113.9 190.1 12.0 9.7 4.4 1.7 557.5

Amortisation

of purchased

intangible

assets (122.0)

Impairment

of purchased

intangibles

and goodwill (22.0)

Non-recurring

items (67.5)

Operating

profit 346.0

Net finance

expense (68.1)

Profit before

taxation 277.9

Other income

statement

items

Depreciation

and

non-acquisition

software

amortisation (14.9) (5.5) (26.1) (12.2) (4.2) (0.6) (0.3) 3.7 (60.1)

----------- ----------

Unaudited segmental disclosures for the 12 months to 31 December 2013

are as follows:

Post

Trade Post

Services Trade

- CC&G Services

Capital and Monte - LCH. Information Technology

Markets Titoli Clearnet Services Services Other Eliminations Group

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------- ----------

Revenue

from external

customers 296.8 98.7 172.3 339.5 62.2 4.5 - 974.0

Inter-segmental

revenue - 0.5 - - 16.5 - (17.0) -

Revenue 296.8 99.2 172.3 339.5 78.7 4.5 (17.0) 974.0

Net treasury

income through

CCP business - 59.2 48.1 - - - - 107.3

Other income - - (2.9) - - 15.1 - 12.2

Total income 296.8 158.4 217.5 339.5 78.7 19.6 (17.0) 1,093.5

Operating

profit before

amortisation

of purchased

intangible

assets and

non-recurring

items 133.0 99.5 49.2 161.4 21.4 6.5 6.0 477.0

Amortisation

of purchased

intangible

assets (108.9)

Non-recurring

items (38.7)

Operating

profit 329.4

Net finance

expense (67.2)

Profit before

taxation 262.2

Other income

statement

items

Depreciation

and non-acquisition

software

amortisation (27.8) (5.5) (14.2) (15.7) (4.2) (0.1) 13.8 (53.7)

3. Expenses by nature

Expenses comprise the following:

12 months 12 months

to to

31 December 31 December

2014 2013

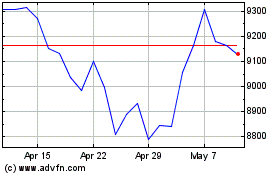

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Aug 2024 to Sep 2024

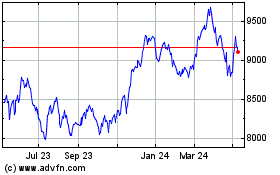

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Sep 2023 to Sep 2024