TIDMLLOY

RNS Number : 5543F

Lloyds Banking Group PLC

28 July 2016

Lloyds Banking Group plc

2016 Half-Year

Pillar 3 disclosures

28 July 2016

BASIS OF PRESENTATION

This report presents the condensed half-year Pillar 3

disclosures of Lloyds Banking Group plc ('the Group') as at 30 June

2016, prepared in accordance with European Banking Authority (EBA)

guidelines on Pillar 3 disclosure frequency. The report should be

read in conjunction with the 2016 Lloyds Banking Group Half-Year

Results News Release.

The EBA guidelines on Pillar 3 disclosure frequency set out key

information that institutions in the EU banking sector should

consider disclosing on a more frequent than annual basis under

Pillar 3. The Group's assessment of these guidelines has resulted

in the disclosure of specific capital and leverage information at

the interim quarter ends, with further detailed analysis provided

at half-year as covered by this report. These half-year disclosures

remain in addition to the full annual disclosure of the Group's

Pillar 3 report. Risk-weighted assets by type of risk are included

in the individual half-year Management Reports for the Group's

significant subsidiaries; 'Lloyds Bank Group' and 'Bank of Scotland

Group'.

A number of significant differences exist between accounting

disclosures published in accordance with International Financial

Reporting Standards (IFRS) and Pillar 3 disclosures published in

accordance with prudential requirements which prevent direct

comparison in a number of areas. Of particular note are the

differences surrounding scope of consolidation, the definition of

credit risk exposure and the recognition, classification and

valuation of capital securities.

Unless otherwise specified, credit risk exposures are defined as

the exposure at default (EAD), prior to the application of credit

risk mitigation (CRM). EAD is defined as the aggregate of drawn (on

balance sheet) exposures, undrawn (off balance sheet) commitments

and contingent liabilities, after application of credit conversion

factors (CCF), and other relevant regulatory adjustments. Notable

exceptions to this definition include securitisation positions and

counterparty credit risk exposures. A summary, noting the

definitions applied, is provided below.

Exposure type Exposure type

Credit risk exposures (excluding

securitisation positions) EAD pre CRM(1)

Counterparty credit risk

exposures EAD post CRM

Securitisation positions The aggregate of the Group's

retained or purchased positions,

excluding those positions

rated below BB- or that

are unrated and therefore

deducted from capital.

(1) For credit risk exposures risk-weighted under the

Standardised Approach the EAD pre CRM value is

stated net of specific credit risk adjustments

(SCRAs). SCRAs relating to credit risk exposures

risk-weighted under a relevant Internal Ratings

Based (IRB) Approach methodology are netted against

expected losses.

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with

respect to the business, strategy and plans of Lloyds Banking Group

and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about Lloyds Banking Group's

or its directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results (including but not limited to the payment of

dividends) to differ materially from the plans, objectives,

expectations, estimates and intentions expressed in such forward

looking statements made by the Group or on its behalf include, but

are not limited to: general economic and business conditions in the

UK and internationally; market related trends and developments;

fluctuations in interest rates (including low or negative rates),

exchange rates, stock markets and currencies; the ability to access

sufficient sources of capital, liquidity and funding when required;

changes to the Group's credit ratings; the ability to derive cost

savings; changing customer behaviour including consumer spending,

saving and borrowing habits; changes to borrower or counterparty

credit quality; instability in the global financial markets,

including Eurozone instability, the exit by the UK from the

European Union (EU) and the potential for one or more other

countries to exit the EU or the Eurozone and the impact of any

sovereign credit rating downgrade or other sovereign financial

issues; technological changes and risks to cyber security; natural,

pandemic and other disasters, adverse weather and similar

contingencies outside the Group's control; inadequate or failed

internal or external processes or systems; acts of war, other acts

of hostility, terrorist acts and responses to those acts,

geopolitical, pandemic or other such events; changes in laws,

regulations, accounting standards or taxation, including as a

result of an exit by the UK from the EU, a further possible

referendum on Scottish independence; changes to regulatory capital

or liquidity requirements and similar contingencies outside the

Group's control; the policies, decisions and actions of

governmental or regulatory authorities or courts in the UK, the EU,

the US or elsewhere including the implementation and interpretation

of key legislation and regulation; the ability to attract and

retain senior management and other employees; requirements or

limitations on the Group as a result of HM Treasury's investment in

the Group; actions or omissions by the Group's directors,

management or employees including industrial action; changes to the

Group's post-retirement defined benefit scheme obligations; the

provision of banking operations services to TSB Banking Group plc;

the extent of any future impairment charges or write-downs caused

by, but not limited to, depressed asset valuations, market

disruptions and illiquid markets; the value and effectiveness of

any credit protection purchased by the Group; the inability to

hedge certain risks economically; the adequacy of loss reserves;

the actions of competitors, including non-bank financial services

and lending companies; and exposure to regulatory or competition

scrutiny, legal, regulatory or competition proceedings,

investigations or complaints. Please refer to the latest Annual

Report on Form 20-F filed with the US Securities and Exchange

Commission for a discussion of certain factors together with

examples of forward looking statements. Except as required by any

applicable law or regulation, the forward looking statements

contained in this document are made as of today's date, and Lloyds

Banking Group expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward looking

statements. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

Contents

Table Risk-weighted assets movement by key driver

1:

Table Capital requirements

2:

Table Credit risk exposures

3:

Table Corporate master scale

4:

Table Retail master scale

5:

Table Corporate Main exposure by PD grade

6:

Table Corporate SME exposure by PD grade

7:

Table Central governments and central bank exposures

8: by PD grade

Table Institution exposures by PD grade

9:

Table Residential mortgages (SME) exposures by

10: PD grade

Table Residential mortgages (non-SME) exposures

11: by PD grade

Table Qualifying revolving retail exposures by

12: PD grade

Table Other SME exposures by PD grade

13:

Table Other non-SME exposures by PD grade

14:

Table Corporate Specialised Lending exposures

15: subject to supervisory slotting

Table Lloyds Banking Group own funds template

16:

Table Lloyds Banking Group leverage ratio common

17: disclosure

Table Lloyds Banking Group summary reconciliation

18: of accounting assets and leverage ratio

exposures

2016 Half-Year Pillar 3 Update

The following disclosures include information on Lloyds Banking

Group's own-funds, leverage, risk-weighted assets and capital

requirements by type of risk and by exposure class. Additional

detail has been included in relation to the Group's exposures

subject to the Internal Ratings Based (IRB) approach.

At 30 At 31

June Dec

2016 2015

Key ratios and risk-weighted assets

Fully loaded common equity tier 1 (CET1)

capital ratio(2) 13.0% 13.0%

Fully loaded tier 1 capital ratio 15.4% 15.2%

Fully loaded total capital ratio 18.7% 18.0%

Fully loaded total risk-weighted assets GBP222,297m GBP222,747m

Transitional CET1 capital ratio 13.1% 12.8%

Transitional tier 1 capital ratio 16.4% 16.4%

Transitional total capital ratio 21.8% 21.5%

Transitional total risk-weighted assets GBP222,778m GBP222,845m

Leverage ratio(1,2) 4.7% 4.8%

Average leverage ratio(3) 4.8%

(1) Reported on a fully loaded basis.

(2) The common equity tier 1 and leverage ratios at

31 December 2015 were reported on a pro forma basis,

including the dividend paid by the Insurance business

in February 2016 relating to 2015.

(3) The average leverage ratio is based on the average

of the month end tier 1 capital and exposure measures

over the quarter (1 April 2016 to 30 June 2016).

The average of 4.8 per cent compares to 4.7 per

cent at the start and end of the quarter.

Table 1: Risk-weighted assets movement by key driver

Credit Credit Counterparty

risk risk Credit credit Market Operational

IRB STA risk risk(3) risk risk Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Fully loaded risk-weighted

assets as at 31

December 2015 222,747

Less total threshold

risk-weighted

assets(1, 2) (10,690)

Risk-weighted

assets as at

31 December 2015 151,563 20,443 172,006 10,153 3,775 26,123 212,057

Asset size (1,940) (831) (2,771) (1,220) (137) - (4,128)

Acquisitions and

disposals (1,686) - (1,686) 38 - - (1,648)

Model updates 3,229 (28) 3,201 99 (418) - 2,882

Methodology and

policy (327) 121 (206) - - - (206)

Asset quality (1,931) 143 (1,788) 1,203 (64) - (649)

Movement in risk

levels - - - - (215) - (215)

Foreign exchange

movements 2,506 420 2,926 453 (19) - 3,360

Risk-weighted

assets as at

30 June 2016 151,414 20,268 171,682 10,726 2,922 26,123 211,453

------- ------ ------- ------------ ------ ----------- --------

Threshold risk-weighted

assets(1) 11,325

--------

Transitional risk-weighted

assets as at 30June

2016 222,778

--------

Movement to fully

loaded

risk-weighted

assets(2) (481)

--------

Fully loaded risk-weighted

assets as at 30

June 2016 222,297

--------

(1) Threshold risk-weighted assets reflect the element

of significant investments and deferred tax assets

that are permitted to be

risk-weighted instead of deducted from CET1 capital.

Significant investments primarily arise from the

investment in the Group's Insurance business.

(2) Differences may arise between transitional and

fully loaded threshold risk-weighted assets where

deferred tax assets reliant on future profitability

and arising from temporary timing differences and

significant investments exceed the fully loaded

threshold limit, resulting in an increase in amounts

deducted from CET1 capital rather than being risk-weighted.

(3) Counterparty credit risk includes movements in

contributions to the default fund of central counterparties

and movements in credit valuation adjustment risk.

The risk-weighted assets movement table provides analysis of the

reduction in risk-weighted assets in the period by risk type and an

insight into the key drivers of the movements. The key driver

analysis is compiled on a monthly basis through the identification

and categorisation of risk-weighted asset movements and is subject

to management judgment.

Movements in credit risk-weighted assets in the six months to 30

June 2016 were driven by the following:

-- Asset size movements include risk-weighted asset movements

arising from new lending and asset run-off. During the six months

to 30 June, credit risk-weighted assets assessed on both

Standardised and Internal Ratings Based approaches decreased by

GBP2.8 billion primarily due to repayments and exits, partly offset

by growth in targeted customer segments.

-- Disposal of the Group's interest in Visa Europe and further

disposals within the run-off business reduced credit risk- weighted

assets by GBP1.7 billion.

-- Model update increases of GBP3.2 billion were mainly driven

by a change in approach for the Retail Buy-to-let mortgage

portfolio and other small model refinements.

-- Methodology and policy movements include changes due to

refinements in the application of regulatory policy.

-- Asset quality movements capture movements in the assessed

quality of assets due to changes in borrower risk, including

changes in the economic environment. Net reductions in credit

risk-weighted assets of GBP1.8 billion primarily relate to model

calibrations and a net change in credit quality, partially offset

by increases in valuation of centrally held strategic equity

investments.

-- Foreign exchange movements reflect the depreciation of

Sterling which has contributed to a GBP2.9 billion increase in

credit risk-weighted assets of which GBP2.3 billion arose in the

final week of June following the outcome of the EU referendum.

Counterparty credit risk and CVA risk increases of GBP0.6

billion are principally driven by yield curve and foreign exchange

movements of which GBP0.9 billion arose in the final week of June

following the outcome of the EU referendum, partially offset by

increased capital relief from CVA related hedges.

Market risk-weighted assets reduced by GBP0.9 billion due to a

reduction in the Value-at-Risk multiplier and active portfolio

management.

The risk-weighted assets and Pillar 1 capital requirements, by

key regulatory risk type, of the Group as at 30 June 2016 are

presented in the table below.

Table 2: Capital requirements

June-16 June-16 Dec-15 Dec-15

Pillar Pillar

Risk- 1 Risk- 1

weighted capital weighted capital

assets requirements assets requirements

CREDIT RISK GBPm GBPm GBPm GBPm

Exposures subject to the

IRB approach

Foundation IRB approach

Corporate - main 43,103 3,448 43,005 3,441

Corporate - SME 8,471 678 8,814 705

Corporate - specialised

lending 6 1 8 1

Central governments and

central banks 1,661 133 1,347 108

Institutions 1,216 97 1,430 114

Retail IRB approach

Retail mortgages 39,032 3,122 38,252 3,060

of which: residential mortgages

(SME) 2,891 231 3,214 257

of which: residential mortgages

(non-SME) 36,141 2,891 35,038 2,803

Qualifying revolving retail

exposures 12,066 965 12,501 1,000

Other SME 1,766 141 1,807 145

Other non-SME 11,523 922 11,352 908

Other IRB approaches(1)

Corporate - specialised

lending 14,296 1,144 14,386 1,151

Equities - exchange traded 2,484 199 2,837 227

Equities - private equity 5,649 452 5,664 453

Equities - other 1,321 106 1,392 111

Securitisation positions(2) 3,069 245 3,266 261

Non-credit obligation assets(3) 5,751 460 5,502 440

--------- ------------- --------- -------------

Total - IRB approach 151,414 12,113 151,563 12,125

--------- ------------- --------- -------------

Exposures subject to the

standardised approach

Central governments and - - - -

central banks

Regional governments or - - - -

local authorities

Public sector entities 3 - 2 -

Multilateral development - - - -

banks

Institutions 36 3 24 2

Corporates 11,829 946 11,921 954

Retail 3,088 247 2,880 230

Secured by mortgages on

immovable property 2,092 167 2,109 168

of which: residential property 2,063 165 2,078 166

of which: commercial property 29 2 31 2

Exposures in default 1,074 86 1,198 96

Other items(3) 2,146 172 2,309 185

--------- ------------- --------- -------------

Total - standardised approach 20,268 1,621 20,443 1,635

--------- ------------- --------- -------------

Total credit risk 171,682 13,734 172,006 13,760

--------- ------------- --------- -------------

Threshold - significant

investments 8,349 668 7,817 625

Threshold - deferred tax 2,976 238 2,971 238

--------- ------------- --------- -------------

Total credit risk (transitional) 183,007 14,640 182,794 14,623

--------- ------------- --------- -------------

Table 2: Capital requirements (continued)

June-16 June-16 Dec-15 Dec-15

Risk- Pillar Risk- Pillar

weighted 1 weighted 1

assets capital assets capital

requirements requirements

GBPm GBPm GBPm GBPm

COUNTERPARTY CREDIT RISK

IRB approach 8,485 679 7,328 586

Standardised approach 531 43 509 41

Central counterparties 143 11 144 12

Settlement risk - - - -

Contributions to the default

fund of a central counterparty 466 37 488 39

--------- ------------- --------- -------------

Total counterparty credit

risk 9,625 770 8,469 678

--------- ------------- --------- -------------

Credit valuation adjustment

(CVA)

Standardised method 1,101 88 1,684 135

--------- ------------- --------- -------------

Total credit valuation adjustment 1,101 88 1,684 135

--------- ------------- --------- -------------

MARKET RISK

Internal models approach 2,466 197 3,224 258

Standardised approach

Interest rate position risk

requirement 374 30 477 38

of which: specific interest

rate risk of securitisation

positions 32 3 78 6

Equity position risk requirement - - - -

Foreign exchange position

risk requirement 82 7 74 6

Commodity position risk

requirement - - - -

--------- ------------- --------- -------------

Total market risk 2,922 234 3,775 302

--------- ------------- --------- -------------

OPERATIONAL RISK

Standardised approach 26,123 2,090 26,123 2,090

--------- ------------- --------- -------------

Total operational risk 26,123 2,090 26,123 2,090

--------- ------------- --------- -------------

Total - transitional 222,778 17,822 222,845 17,827

--------- ------------- --------- -------------

(1) Credit risk exposures subject to other IRB approaches

include specialised lending exposures risk-weighted

in accordance with supervisory slotting criteria,

equity exposures risk-weighted in accordance with

the Simple Risk Weight Method and securitisation

positions risk-weighted in accordance with the

Internal Assessment Approach (IAA) and Ratings

Based Approach (RBA).

(2) Securitisation positions exclude amounts allocated

to the 1,250 per cent risk weight category. These

amounts are deducted from capital after the application

of specific credit risk adjustments (SCRA), rather

than being risk-weighted.

(3) Other items (Standardised Approach) and non-credit

obligation assets (IRB Approach) predominantly

relate to other balance sheet assets that have

no associated credit risk. These comprise various

non-financial assets, including fixed assets, cash,

items in the course of collection, prepayments

and sundry debtors.

Table 3: Credit risk exposures

June-16 June-16 June-16 Dec-15 Dec-15 Dec-15

Credit Risk- Average Credit Risk- Average

risk weighted risk risk weighted risk

exposure assets weight exposure assets weight

Exposure class GBPm GBPm % GBPm GBPm %

Exposures subject

to the IRB approach

Foundation IRB approach

Corporate - main 80,887 43,103 53% 80,629 43,005 53%

Corporate - SME 12,833 8,471 66% 12,964 8,814 68%

Corporate - specialised

lending 5 6 128% 6 8 120%

Central governments

and central banks 20,844 1,661 8% 15,716 1,347 9%

Institutions 6,697 1,216 18% 7,364 1,430 19%

Retail IRB approach

Retail mortgages 338,264 39,032 12% 341,807 38,252 11%

of which: residential

mortgages (SME) 10,462 2,891 28% 10,517 3,214 31%

of which: residential

mortgages

(non-SME) 327,802 36,141 11% 331,290 35,038 11%

Qualifying revolving

retail exposures 37,424 12,066 32% 36,975 12,501 34%

Other SME 2,493 1,766 71% 2,661 1,807 68%

Other non-SME 15,351 11,523 75% 14,331 11,352 79%

Other IRB approaches(1)

Corporate - specialised

lending 19,836 14,296 72% 19,887 14,386 72%

Equities - exchange

traded 857 2,484 290% 978 2,837 290%

Equities - private

equity 2,973 5,649 190% 2,981 5,664 190%

Equities - other 357 1,321 370% 376 1,392 370%

Securitisation positions(2) 20,853 3,069 15% 22,125 3,266 15%

Non-credit obligation

assets(3) 9,387 5,751 61% 9,228 5,502 60%

--------- --------- ------- --------- --------- -------

Total - IRB approach 569,061 151,414 27% 568,028 151,563 27%

--------- --------- ------- --------- --------- -------

Exposures subject

to the standardised

approach

Central governments

and central banks 99,949 - - 88,415 - -

Regional governments

or local authorities 1 - 20% 1 - 20%

Public sector entities 3 3 100% 2 2 100%

Multilateral development

banks 1,436 - - 997 - -

Institutions 195 36 18% 170 24 14%

Corporates 14,185 11,829 83% 14,463 11,921 82%

Retail 4,735 3,088 65% 4,438 2,880 65%

Secured by mortgages

on immovable property 5,783 2,092 36% 5,840 2,109 36%

of which: residential

property 5,754 2,063 36% 5,809 2,078 36%

of which: commercial

property 29 29 100% 31 31 100%

Exposures in default 923 1,074 116% 1,005 1,198 119%

Other items(3) 3,324 2,146 65% 3,204 2,309 72%

--------- --------- ------- --------- --------- -------

Total - standardised

approach 130,534 20,268 16% 118,535 20,443 17%

--------- --------- ------- --------- --------- -------

Total credit risk 699,595 171,682 25% 686,563 172,006 25%

--------- --------- ------- --------- --------- -------

Threshold - significant

investments 3,340 8,349 250% 3,127 7,817 250%

Threshold - deferred

tax 1,191 2,976 250% 1,188 2,971 250%

--------- --------- ------- --------- --------- -------

Total credit risk

(transitional) 704,126 183,007 26% 690,878 182,794 26%

--------- --------- ------- --------- --------- -------

(1) Credit risk exposures subject to other IRB approaches

include corporate specialised lending exposures

risk-weighted in accordance with supervisory slotting

criteria, equity exposures risk-weighted in accordance

with the Simple Risk Weight Method and securitisation

positions risk-weighted in accordance with the

IAA and the RBA.

(2) Securitisation positions exclude amounts allocated

to the 1,250 per cent risk weight category. These

amounts are deducted from capital, after the application

of SCRAs, rather than being risk-weighted at 1,250

per cent.

(3) Other items (Standardised Approach) and non-credit

obligation assets (IRB approach) predominantly

relate to other balance sheet assets that have

no associated credit risk. These comprise various

non-financial assets, including fixed assets, cash,

items in the course of collection, prepayments

and sundry debtors.

Exposures subject to the IRB approach - key movements

FIRB Corporate Main

-- Overall Corporate Main exposures have remained relatively

flat, with underlying reductions driven by active portfolio

management, offset by the impact of Sterling depreciation,

particularly in the last week of June.

FIRB Corporate SME

-- The average risk-weight on FIRB Corporate SME lending has

reduced to 66 per cent, driven by targeted new lending which has

resulted in an overall improvement in credit quality. This has also

led to a reduction in the average PD.

FIRB Central governments and central banks

-- FIRB Central governments and central banks exposures

increased by GBP5.1 billion driven by an increase in deposits with

the Federal Reserve.

Retail IRB Residential mortgages

-- Retail IRB residential mortgage exposures decreased by GBP3.5

billion reflecting the Group's focus on balancing margin and risk

considerations with volume growth in the current competitive low

growth market. The small increase in average risk weight was driven

by model updates.

Retail Qualifying revolving

-- Retail IRB Qualifying revolving retail exposures increased by

GBP0.4 billion largely due to targeted growth in credit cards. The

average risk weight reduced from 34 per cent to 32 per cent largely

due to improved asset quality.

Retail Other non-SME

-- Retail other (non-SME) exposures have increased by GBP1.0

billion and average risk weights have reduced from 79 per cent to

75 per cent primarily as a result of continued growth in UK Motor

Finance

Equities

-- There was a minimal reduction in equities compared to

December 2015 as the impact of disposals of certain strategic

investments (including Visa Europe) was largely offset by increases

in the valuation of centrally held investments.

Securitisation positions

-- Securitisation exposures decreased by GBP1.3 billion mainly due to net sales in the period.

Exposures subject to the Standardised Approach - key

movements

Standardised Central governments and central banks

-- Standardised central governments and central banks' exposures

increased by GBP11.5 billion primarily due to management of the

liquid asset portfolio, specifically placement of funds with

European sovereigns, primarily Netherlands.

Internal Rating Scales

Within the Group, PD internal rating scales are used in

assessing the credit quality of the Foundation IRB and Retail IRB

portfolios. Two separate scales exist within the business - a

Corporate Master Scale which covers all relevant corporate, central

government and central bank and institution portfolios and a Retail

Master Scale which covers all relevant retail portfolios.

PD master scales

Table 4: Corporate master scale

In commercial portfolios the PD models segment counterparties

into a number of rating grades, with each grade representing a

defined range of default probabilities and there are a number of

different model rating scales. Counterparties/exposures migrate

between rating grades if the assessment of the PD changes. The

modelled PD 'map' through local scales to a single Corporate

(non-retail) master scale comprising of 19 non-default ratings.

Together with four default ratings the Corporate master scale forms

the basis on which internal reporting is completed. These ratings

scales can also be mapped to External Ratings as shown below.

Range External S&P Rating

PD Grades Lower Mid Upper (Approximate Equivalent)

1-4 0.000% 0.018% 0.035% AAA to AA-

5 0.036% 0.043% 0.050% A+

6 0.051% 0.060% 0.080% A

7 0.081% 0.110% 0.140% A-

8 0.141% 0.180% 0.220% BBB+

9 0.221% 0.280% 0.340% BBB

10 0.341% 0.420% 0.500% BBB-

11 0.501% 0.630% 0.760% BB+

12 0.761% 1.000% 1.240% BB

13 1.241% 1.620% 2.000% BB-

14 2.001% 2.600% 3.200% B+

15 3.201% 4.200% 5.200% B+

16 5.201% 6.200% 7.200% B

17 7.201% 8.700% 10.200% B-

18 10.201% 12.000% 13.800% B-

19 13.801% 31.000% 99.999% CCC to C

20 - 23 (Default) 100.000% 100.000% 100.000% Default

Table 5: Retail master scale

In the principal retail portfolios, EAD and loss given default

models are also in use. For reporting purposes, customers are

segmented into a number of rating grades, each representing a

defined range of default probabilities and exposures migrate

between rating grades if the assessment of the counterparty PD

changes. The Retail master scale comprises 13 non-default ratings

and one default rating.

Range

PD Grades Lower Mid Upper

0 0.000% 0.050% 0.100%

1 0.101% 0.251% 0.400%

2 0.401% 0.601% 0.800%

3 0.801% 1.001% 1.200%

4 1.201% 1.851% 2.500%

5 2.501% 3.501% 4.500%

6 4.501% 6.001% 7.500%

7 7.501% 8.751% 10.000%

8 10.001% 12.001% 14.000%

9 14.001% 17.001% 20.000%

10 20.001% 25.001% 30.000%

11 30.001% 37.501% 45.000%

12 45.001% 72.500% 99.999%

Default 100.000% 100.000% 100.000%

Analysis of credit risk exposures subject to the Foundation IRB

Approach

The section that follows provides a detailed analysis, by PD

Grade, of credit risk exposures subject to the Foundation IRB

approach.

Disclosures provided in the tables that follow take into account

PD floors and LGD floors specified by regulators in respect of the

calculation of regulatory capital requirements.

Table 6: Corporate Main exposure by PD grade

June-16 June-16 June-16 Dec-15 Dec-15 Dec-15

Exposure Exposure

Credit weighted Average Credit weighted Average

risk average risk risk average risk

exposure PD weight exposure PD weight

GBPm % % GBPm % %

PD Grades

1 - 4 9,823 0.03% 22.82% 9,675 0.03% 22.93%

5 2,957 0.04% 25.91% 2,872 0.04% 28.29%

6 5,929 0.06% 21.68% 5,879 0.06% 22.61%

7 11,494 0.11% 32.41% 11,489 0.11% 32.37%

8 11,791 0.18% 41.34% 12,507 0.18% 42.08%

9 11,161 0.28% 55.01% 10,342 0.28% 55.17%

10 9,384 0.42% 65.15% 9,714 0.42% 65.34%

11 5,123 0.63% 77.50% 5,396 0.63% 78.40%

12 4,932 1.01% 92.06% 4,753 1.00% 92.06%

13 3,377 1.63% 108.87% 2,864 1.63% 110.86%

14 2,158 2.60% 126.05% 2,567 2.60% 127.72%

15 402 4.18% 144.87% 677 4.14% 134.21%

16 848 6.19% 154.58% 293 6.20% 155.32%

17 332 8.73% 201.26% 424 8.73% 176.91%

18 72 11.80% 217.89% 36 11.72% 230.78%

19 137 24.89% 240.42% 155 19.94% 227.16%

20 - 23 (Default) 967 100.00% - 986 100.00% -

--------- --------- ------- --------- --------- -------

Total 80,887 1.75% 53.29% 80,629 1.75% 53.34%

--------- --------- ------- --------- --------- -------

Table 7: Corporate SME exposure by PD grade

June-16 June-16 June-16 Dec-15 Dec-15 Dec-15

Exposure Exposure

Credit weighted Average Credit weighted Average

risk average risk risk average risk

exposure PD weight exposure PD weight

GBPm % % GBPm % %

PD Grades

1 - 4 139 0.03% 20.82% 142 0.03% 20.79%

5 140 0.04% 25.48% 157 0.04% 26.06%

6 330 0.06% 25.50% 284 0.06% 22.29%

7 430 0.11% 24.85% 393 0.11% 26.30%

8 498 0.18% 38.98% 299 0.18% 36.03%

9 547 0.28% 47.00% 565 0.28% 46.75%

10 770 0.43% 49.92% 782 0.43% 49.38%

11 2,522 0.63% 59.05% 2,535 0.63% 59.29%

12 2,151 1.06% 71.30% 2,089 1.06% 70.80%

13 1,363 1.66% 81.67% 1,327 1.66% 81.23%

14 1,589 2.60% 91.92% 1,600 2.60% 95.23%

15 380 4.23% 95.53% 389 4.23% 96.34%

16 498 5.88% 110.14% 808 6.02% 124.66%

17 271 8.66% 122.94% 265 8.61% 127.48%

18 231 10.80% 130.18% 220 10.73% 129.01%

19 155 29.01% 152.95% 148 24.88% 157.35%

20 - 23 (Default) 819 100.00% - 961 100.00% -

--------- --------- ------- --------- --------- -------

Total 12,833 8.32% 66.01% 12,964 9.39% 67.99%

--------- --------- ------- --------- --------- -------

--

Table 8: Central governments and central bank exposures by PD

grade

June-16 June-16 June-16 Dec-15 Dec-15 Dec-15

Exposure Exposure

Credit weighted Average Credit weighted Average

risk average risk risk average risk

exposure PD weight exposure PD weight

GBPm % % GBPm % %

PD Grades

1 - 4 20,687 0.01% 7.73% 15,716 0.01% 8.57%

5 - - - - - -

6 157 0.06% 39.24% - - -

7 - - - - - -

8 - - - - - -

9 - - - - - -

10 - - - - - -

11 - - - - - -

12 - - - - - -

13 - - - - - -

14 - - - - - -

15 - - - - - -

16 - - - - - -

17 - - - - - -

18 - - - - - -

19 - - - - - -

20 - 23 (Default) - - - - - -

--------- --------- ------- --------- --------- -------

Total 20,844 0.01% 7.97% 15,716 0.01% 8.57%

--------- --------- ------- --------- --------- -------

Table 9: Institution exposures by PD grade

June-16 June-16 June-16 Dec-15 Dec-15 Dec-15

Exposure Exposure

Credit weighted Average Credit weighted Average

risk average risk risk average risk

exposure PD weight exposure PD weight

GBPm % % GBPm % %

PD Grades

1 - 4 2,088 0.03% 10.47% 2,781 0.03% 11.25%

5 868 0.04% 8.65% 954 0.04% 9.23%

6 2,398 0.06% 11.97% 2,179 0.06% 10.40%

7 371 0.11% 16.11% 387 0.11% 21.98%

8 250 0.18% 36.52% 242 0.18% 43.38%

9 228 0.28% 60.16% 214 0.28% 62.82%

10 156 0.43% 55.12% 218 0.43% 65.24%

11 236 0.67% 61.69% 290 0.73% 75.00%

12 46 1.00% 89.51% 43 1.01% 93.53%

13 6 1.56% 102.61% 7 1.69% 110.81%

14 1 2.10% 103.72% 1 2.20% 132.33%

15 9 4.23% 149.25% 7 4.24% 157.47%

16 - - - - - -

17 - - - - - -

18 26 12.00% 200.46% - - -

19 1 30.62% 245.83% 24 14.50% 247.44%

20 - 23 (Default) 13 100.00% - 17 100.00% -

--------- --------- ------- --------- --------- -------

Total 6,697 0.35% 18.16% 7,364 0.39% 19.42%

--------- --------- ------- --------- --------- -------

Analysis of credit risk exposures subject to the Retail IRB

Approach

This section provides a detailed analysis, by PD Grade, of

credit risk exposures subject to the Retail IRB Approach.

Disclosures provided in the tables below take into account PD

floors and LGD floors specified by regulators in respect of the

calculation of regulatory capital requirements.

Table 10: Residential mortgages (SME) exposures by PD grade

June-16 June-16 June-16 June-16 June-16 June-16

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD(1) weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 - - - - - -

1 - - - - - -

2 4,755 0.62% 16.08% 11.94% 501 491

3 2,161 1.12% 17.82% 19.80% 147 143

4 1,018 1.67% 18.06% 26.00% 53 52

5 894 2.62% 18.58% 35.24% 40 38

6 632 5.67% 18.90% 53.42% 24 23

7 92 8.04% 18.77% 66.12% 1 1

8 378 10.61% 19.81% 75.50% 14 13

9 175 18.02% 20.01% 90.35% 5 5

10 - - - - - -

11 68 34.10% 19.79% 95.14% 1 1

12 17 78.18% 22.21% 47.33% - -

Default 272 100.00% 8.63% 147.58% 3 3

--------- --------- --------- ------- ------------ ------------

Total 10,462 4.94% 17.08% 27.63% 789 770

--------- --------- --------- ------- ------------ ------------

Dec-15 Dec-15 Dec-15 Dec-15 Dec-15 Dec-15

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitment

risk average average risk commitment (after

exposure PD LGD(1) weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 - - - - - -

1 - - - - - -

2 4,523 0.62% 16.46% 12.28% 475 464

3 2,257 1.12% 17.94% 20.04% 146 142

4 1,054 1.67% 18.48% 26.79% 58 56

5 934 2.62% 18.93% 36.01% 39 38

6 616 5.67% 19.32% 56.39% 27 27

7 72 8.04% 20.70% 72.77% 1 1

8 398 10.61% 20.13% 76.77% 16 15

9 198 18.02% 20.84% 93.75% 5 5

10 - - - - - -

11 70 34.10% 20.19% 98.73% 1 1

12 20 78.18% 21.92% 45.43% - -

Default 375 100.00% 7.91% 164.85% 5 5

--------- --------- --------- ------- ----------- -----------

Total 10,517 5.98% 17.35% 30.56% 773 754

--------- --------- --------- ------- ----------- -----------

Table 11: Residential mortgages (non-SME) exposures by PD

grade

June-16 June-16 June-16 June-16 June-16 June-16

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD(1) weight (gross)(2) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 191,947 0.11% 9.43% 2.86% 9,032 8,617

1 89,697 0.46% 11.01% 10.04% 1,758 1,601

2 17,946 1.40% 13.46% 23.88% 196 191

3 6,139 2.29% 15.30% 35.17% 43 40

4 7,656 3.78% 18.01% 51.51% 170 38

5 3,073 6.73% 19.84% 78.80% 2 1

6 2,302 14.22% 14.96% 79.63% - -

7 880 17.54% 14.12% 91.15% - -

8 665 24.55% 15.39% 102.03% - -

9 896 33.65% 11.96% 80.58% - -

10 903 43.85% 12.35% 83.70% - -

11 670 58.76% 12.54% 73.07% 2 2

12 909 74.42% 13.53% 54.42% - -

Default 4,119 100.00% 14.68% 74.33% - -

--------- --------- --------- ------- ------------ ------------

Total 327,802 2.45% 10.65% 11.03% 11,203 10,490

--------- --------- --------- ------- ------------ ------------

Dec-15 Dec-15 Dec-15 Dec-15 Dec-15 Dec-15

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD(1) weight (gross)(2) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 187,636 0.10% 9.34% 2.50% 8,287 7,759

1 94,669 0.47% 10.96% 9.49% 2,038 1,931

2 17,081 1.39% 13.29% 22.32% 155 150

3 7,299 2.27% 14.43% 31.55% 106 106

4 8,954 3.85% 16.44% 45.81% 181 43

5 3,671 7.27% 18.42% 69.99% 6 5

6 2,981 13.49% 14.76% 74.82% - -

7 455 19.15% 19.34% 109.26% - -

8 1,066 25.06% 13.68% 84.77% - -

9 988 31.89% 12.54% 81.54% - -

10 938 43.64% 12.84% 78.48% - -

11 830 56.80% 12.93% 67.77% 2 2

12 703 73.07% 14.07% 51.99% 1 -

Default 4,019 100.00% 14.46% 61.54% - -

--------- --------- --------- ------- ------------ ------------

Total 331,290 2.46% 10.59% 10.58% 10,776 9,996

--------- --------- --------- ------- ------------ ------------

(1) The 10 per cent LGD floor that applies to residential

mortgage exposures is applied at portfolio level

rather than at account level. This means that LGD

per cent for a given grade can be less than 10

per cent but that for the relevant portfolio cannot.

(2) Undrawn commitments predominantly relate to pipeline

mortgages, offered but not drawn down by the customer.

Table 12: Qualifying revolving retail exposures by PD grade

June-16 June-16 June-16 June-16 June-16 June-16

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)(1)

GBPm % % % GBPm GBPm

PD Grade

0 11,237 0.05% 76.09% 2.66% 15,407 10,665

1 9,861 0.22% 75.66% 9.12% 14,180 8,088

2 4,601 0.58% 79.41% 21.13% 4,541 2,997

3 2,269 1.00% 79.48% 32.16% 1,820 1,151

4 3,544 1.75% 79.74% 48.94% 2,142 1,457

5 2,229 3.32% 79.84% 77.77% 908 720

6 1,882 6.16% 80.70% 118.65% 890 721

7 480 8.55% 80.38% 144.84% 108 119

8 354 11.59% 80.63% 172.53% 66 84

9 219 16.56% 80.60% 205.94% 35 51

10 134 24.34% 80.51% 239.12% 17 28

11 79 36.08% 80.39% 258.76% 9 15

12 96 66.61% 81.23% 195.97% 6 16

Default 439 100.00% 35.09% 226.57% 40 -

--------- --------- --------- ------- ------------ ------------

Total 37,424 2.70% 77.07% 32.24% 40,169 26,112

--------- --------- --------- ------- ------------ ------------

Dec-15 Dec-15 Dec-15 Dec-15 Dec-15 Dec-15

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)(1)

GBPm % % % GBPm GBPm

PD Grade

0 10,807 0.05% 76.00% 2.71% 14,803 10,238

1 9,869 0.22% 76.10% 9.21% 13,656 8,271

2 4,220 0.57% 78.41% 20.64% 4,583 2,715

3 2,290 0.99% 79.13% 31.89% 1,901 1,198

4 3,571 1.75% 79.46% 48.80% 2,196 1,544

5 2,345 3.33% 79.58% 77.57% 973 774

6 1,675 6.03% 80.59% 116.86% 788 563

7 722 8.31% 79.99% 141.84% 166 255

8 401 11.47% 80.29% 170.88% 74 91

9 234 16.39% 80.45% 204.68% 36 52

10 148 24.14% 80.05% 237.07% 18 30

11 85 36.15% 79.90% 257.23% 10 15

12 108 67.90% 80.82% 188.61% 7 17

Default 500 100.00% 33.37% 243.96% 38 -

--------- --------- --------- ------- ------------ ------------

Total 36,975 2.97% 76.88% 33.81% 39,249 25,763

--------- --------- --------- ------- ------------ ------------

(1) Undrawn commitments post credit conversion can

exceed the gross undrawn equivalents where there

is an assumption that future drawings will be higher

than the current limit.

Table 13: Other SME exposures by PD grade

June-16 June-16 June-16 June-16 June-16 June-16

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 - - - - - -

1 - - - - - -

2 929 0.61% 76.11% 58.40% 516 516

3 417 1.12% 76.47% 66.47% 142 142

4 228 1.67% 76.87% 76.96% 59 59

5 306 2.62% 75.83% 85.01% 46 46

6 147 5.67% 78.38% 95.60% 29 29

7 72 8.04% 70.89% 105.65% 5 5

8 91 10.61% 81.32% 113.26% 18 18

9 32 18.02% 79.45% 137.79% 4 4

10 - - - - - -

11 12 34.10% 83.64% 178.63% - -

12 7 78.18% 85.48% 117.98% 1 1

Default 252 100.00% 9.65% 46.59% 4 4

--------- --------- --------- ------- ------------ ------------

Total 2,493 12.58% 69.76% 70.85% 824 824

--------- --------- --------- ------- ------------ ------------

Dec-15 Dec-15 Dec-15 Dec-15 Dec-15 Dec-15

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 - - - - - -

1 - - - - - -

2 990 0.61% 75.29% 48.52% 517 517

3 480 1.12% 75.07% 65.46% 148 148

4 249 1.67% 75.94% 76.44% 60 60

5 332 2.62% 75.63% 85.21% 49 49

6 165 5.67% 76.75% 94.24% 30 30

7 72 8.04% 70.76% 106.61% 5 5

8 104 10.61% 80.64% 113.06% 17 17

9 37 18.02% 80.78% 141.22% 4 4

10 - - - - - -

11 15 34.10% 81.21% 174.25% 1 1

12 8 78.18% 86.66% 119.12% 1 1

Default 209 100.00% 11.21% 48.63% 3 3

--------- --------- --------- ------- ------------ ------------

Total 2,661 10.43% 70.63% 67.91% 835 835

--------- --------- --------- ------- ------------ ------------

Table 14: Other non-SME exposures by PD grade

June-16 June-16 June-16 June-16 June-16 June-16

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 316 0.08% 34.22% 7.65% - -

1 3,138 0.36% 40.58% 24.83% 7 1

2 2,506 0.68% 57.11% 50.01% 12 2

3 1,129 1.00% 86.74% 93.40% 9 2

4 4,840 1.68% 64.24% 83.50% 16 3

5 1,816 3.29% 74.50% 111.21% 11 2

6 688 5.91% 72.96% 116.06% 4 1

7 145 8.86% 81.53% 139.53% 1 1

8 131 11.26% 72.87% 136.09% 1 -

9 93 18.00% 90.77% 204.58% 1 1

10 79 21.95% 52.88% 130.65% - -

11 106 34.82% 42.84% 119.27% - -

12 70 72.97% 78.20% 139.39% 1 -

Default 294 100.00% 31.31% 222.57% - -

--------- --------- --------- ------- ------------ ------------

Total 15,351 4.34% 60.50% 75.06% 63 13

--------- --------- --------- ------- ------------ ------------

Dec-15 Dec-15 Dec-15 Dec-15 Dec-15 Dec-15

Exposure Exposure Undrawn

Credit weighted weighted Average Undrawn commitments

risk average average risk commitments (after

exposure PD LGD weight (gross) CCF)

GBPm % % % GBPm GBPm

PD Grade

0 232 0.08% 34.93% 7.84% - -

1 2,832 0.35% 42.14% 24.40% 4 1

2 2,237 0.68% 58.00% 50.61% 7 1

3 1,122 1.00% 86.69% 93.11% 5 1

4 4,526 1.70% 66.36% 86.41% 9 2

5 1,728 3.30% 76.52% 114.30% 6 1

6 688 5.82% 76.19% 120.98% 3 1

7 174 8.82% 80.60% 137.67% 1 -

8 128 11.35% 75.27% 140.95% 1 -

9 84 17.94% 91.48% 205.90% 1 -

10 66 22.00% 55.27% 136.61% - -

11 98 34.91% 43.77% 121.90% - -

12 75 71.81% 80.23% 148.34% - -

Default 341 100.00% 28.29% 236.37% - -

--------- --------- --------- ------- ------------ ------------

Total 14,331 4.87% 62.41% 79.22% 37 7

--------- --------- --------- ------- ------------ ------------

Corporate Specialised Lending Exposures Subject to Supervisory

Slotting

The Group applies the Supervisory Slotting Approach to certain

corporate specialised lending exposures (including the Group's

commercial real estate exposures).

As at 30 June 2016 corporate specialised lending exposures

subject to supervisory slotting amounted to GBP19.8 billion (31

December 2015: GBP19.9 billion). Risk-weighted assets arising from

this amounted to GBP14.3 billion (31 December 2015: GBP14.4

billion) as analysed in the table below.

Table 15: Corporate specialised lending exposures subject to

supervisory slotting

Remaining Remaining Remaining Remaining

maturity maturity maturity maturity

<2.5 years >2.5 years <2.5 years >2.5 years

------------------- ------------------- ------------------- -------------------

June-16 June-16 June-16 June-16 Dec-15 Dec-15 Dec-15 Dec-15

Risk- Risk- Risk- Risk-

weighted weighted weighted weighted

Exposure assets Exposure assets Exposure assets Exposure assets

Grade GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

1) Strong(1) 2,712 1,180 5,220 3,389 1,597 798 6,260 3,864

2) Good 2,534 1,771 5,683 5,026 2,799 1,955 4,942 4,358

3) Satisfactory 845 968 1,312 1,494 912 1,045 1,596 1,822

4) Weak 20 48 169 420 5 13 214 531

5) Default(2) 930 - 411 - 1,099 - 463 -

-------- --------- -------- --------- -------- --------- -------- ---------

Total 7,041 3,967 12,795 10,329 6,412 3,811 13,475 10,575

-------- --------- -------- --------- -------- --------- -------- ---------

(1) The average risk weight percentage in the Strong

slotting grade is below the specified regulatory

value as a result of exposures to customers which

are classed as Strong, typically in the shipping

industry, having facilities which have been structured

such that the Group also benefits from additional

financial collateral from third parties which is

not ordinarily part of the security package for

Slotting transactions. As a result, recognition

of the collateral is applied outside the standard

Slotting risk weights, in line with the IRB approach,

resulting in a risk weight that is below that ordinarily

used in Slotting.

(2) Exposures categorised as 'default' do not attract

a risk weighting but are instead treated as expected

loss deductions at a rate of 50 per cent of the

exposure value.

Table 16: Lloyds Banking Group own funds template

Transitional Fully loaded

rules rules

------------------ ------------------

At 30 At 31 At 30 At 31

June Dec June Dec

2016 2015 2016 2015

GBPm GBPm GBPm GBPm

Common equity tier 1 (CET1)

capital: instruments and

reserves

Capital instruments and

related share premium accounts 24,558 24,558 24,558 24,558

-------- -------- -------- --------

of which: called up share

capital 7,146 7,146 7,146 7,146

of which: share premium 17,412 17,412 17,412 17,412

-------- -------- -------- --------

Retained earnings(2) 8,128 7,755 8,128 7,755

Accumulated other comprehensive

income and other reserves

(including unrealised gains

and losses) 12,264 10,182 12,264 10,182

Foreseeable dividend (911) (1,427) (911) (1,427)

-------- -------- -------- --------

Common equity tier 1 (CET1)

capital before regulatory

adjustments 44,039 41,068 44,039 41,068

-------- -------- -------- --------

Common equity tier 1 (CET1)

capital: regulatory adjustments

Additional value adjustments (744) (372) (744) (372)

Intangible assets (net of

related tax liability) (1,627) (1,719) (1,627) (1,719)

Deferred tax assets that

rely on future profitability,

excluding those arising

from temporary differences

(net of related tax liability

where the conditions in

Article 38 (3) of the CRR

are met) (4,213) (3,874) (4,213) (3,874)

Fair value reserves related

to gains or losses on cash

flow hedges (2,809) (727) (2,809) (727)

Negative amounts resulting

from the calculation of

expected loss amounts - (270) - (270)

Gains or losses on liabilities

valued at fair value resulting

from changes in own credit

standing (120) 5 (120) 5

Defined benefit pension

fund assets (818) (721) (818) (721)

Direct and indirect holdings

by the Group of own CET1

instruments (90) (177) (90) (177)

Direct, indirect and synthetic

holdings by the Group of

the CET1 instruments of

financial sector entities

where the Group has a significant

investment in those entities

(amount above 10% threshold

and net of eligible short

positions) (2) (4,287) (4,500) (4,287) (4,500)

Exposure amount of the following

items which qualify for

a risk weight of 1,250%,

where the Group has opted

for the deduction alternative (220) (169) (220) (169)

-------- -------- -------- --------

of which: securitisation

positions (220) (169) (220) (169)

-------- -------- -------- --------

Amount exceeding the 15%

threshold - - (193) (39)

-------- -------- -------- --------

of which: direct and indirect

holdings by the institution

of the CET1 instruments

of financial sector entities

where the institution has

a significant investment

in those entities - - (142) (29)

of which: deferred tax assets

arising from temporary differences - - (51) (10)

-------- -------- -------- --------

Total regulatory adjustments

applied to common equity

tier 1 (CET1) (14,928) (12,524) (15,121) (12,563)

-------- -------- -------- --------

Common equity tier 1 (CET1)

capital 1 29,111 28,544 28,918 28,505

-------- -------- -------- --------

Table 16: Lloyds Banking Group own funds template

(continued)

Transitional Fully loaded

rules rules

At 30 At 31 At 30 At 31

June Dec June Dec

2016 2015 2016 2015

GBPm GBPm GBPm GBPm

Additional tier 1 (AT1)

capital: instruments

Capital instruments and

related share premium accounts 5,355 5,355 5,355 5,355

------- ------------------------ ------- -------------------------

of which: classified as

equity under applicable

accounting standards 5,355 5,355 5,355 5,355

------- ------------------------ ------- -------------------------

Amount of qualifying items

referred to in Article 484

(4) of the CRR and the related

share premium accounts subject

to phase out from AT1 791 818 - -

Qualifying Tier 1 capital

included in consolidated

AT1 capital (including minority

interests not included in

CET1) issued by subsidiaries

and held by third parties 2,480 3,004 - -

------- ------------------------ ------- -------------------------

of which: instruments issued

by subsidiaries subject

to

phase out 2,480 3,004 - -

------- ------------------------ ------- -------------------------

Additional tier 1 (AT1)

capital before regulatory

adjustments 8,626 9,177 5,355 5,355

------- ------------------------ ------- -------------------------

Additional tier 1 (AT1)

capital: regulatory adjustments

Residual amounts deducted

from AT1 capital with regard

to deduction from Tier 2

capital during the transitional

period pursuant to Article

475 of the CRR (1,288) (1,177) - -

------- ------------------------ ------- -------------------------

of which: significant investments

in Tier 2 instruments of

other financial sector entities (1,288) (1,177) - -

------- ------------------------ ------- -------------------------

Total regulatory adjustments

applied to additional tier

1 (AT1) capital (1,288) (1,177) - -

------- ------------------------ ------- -------------------------

Additional tier 1 (AT1)

capital 7,338 8,000 5,355 5,355

------- ------------------------ ------- -------------------------

Tier 1 capital 36,449 36,544 34,273 33,860

Tier 2 (T2) capital: Instruments

and provisions

Capital instruments and

related share premium accounts 4,027 2,134 4,818 2,952

Amount of qualifying items

referred to in Article 484

(5) of the CRR and the related

share premium accounts subject

to phase out from T2 10 10 - -

Qualifying own funds instruments

included in consolidated

T2 capital (including minority

interests and AT1 instruments

not included in CET1 or

AT1) issued by subsidiaries

and held by third parties 9,580 10,843 5,065 6,016

------- ------------------------ ------- -------------------------

of which: instruments issued

by subsidiaries subject

to

phase out 4,450 4,763 - -

------- ------------------------ ------- -------------------------

Credit risk adjustments 114 221 114 221

------- ------------------------ ------- -------------------------

Tier 2 (T2) capital before

regulatory adjustments 13,731 13,208 9,997 9,189

------- ------------------------ ------- -------------------------

Tier (T2) capital: regulatory

adjustments

Direct and indirect holdings

by the Group of the T2 instruments

and subordinated loans of

financial sector entities

where the Group has a significant

investment in those entities

(net of eligible short positions) (1,509) (1,756) (2,797) (2,933)

------- ------------------------ ------- -------------------------

Total regulatory adjustments

applied to tier 2 (T2) capital (1,509) (1,756) (2,797) (2,933)

------- ------------------------ ------- -------------------------

Tier 2 (T2) capital 12,222 11,452 7,200 6,256

------- ------------------------ ------- -------------------------

Total capital 48,671 47,996 41,473 40,116

------- ------------------------ ------- -------------------------

Total risk-weighted assets 222,778 222,845 222,297 222,747

------- ------------------------ ------- -------------------------

Table 16: Lloyds Banking Group own funds template

(continued)

Transitional Fully loaded

rules rules

-------------- --------------

At 30 At 31 At 30 At 31

June Dec June Dec

2016 2015 2016 2015

GBPm GBPm GBPm GBPm

Capital ratios and buffers

Common Equity Tier 1

(as a percentage of risk

exposure amount) 13.1% 12.8% 13.0% 12.8%

Tier 1 (as a percentage

of risk exposure amount) 16.4% 16.4% 15.4% 15.2%

Total capital (as a percentage

of risk exposure amount) 21.8% 21.5% 18.7% 18.0%

Institution specific buffer

requirement (CET1 requirement

in accordance with article

92(1)(a) plus capital conservation

and countercyclical buffer

requirements, plus systemic

risk buffer, plus the systemically

important institution buffer

(G-SII or O-SII buffer),

expressed as a percentage

of risk exposure amount) 0.628% 0.001% 0.628% 0.001%

------ ------ ------ ------

of which: capital conservation

buffer requirement(3) 0.625% - 0.625% -

of which: countercyclical

buffer requirement 0.003% 0.001% 0.003% 0.001%

------ ------ ------ ------

Common Equity Tier 1 available

to meet buffers (as a percentage

of risk exposure amount)(1) 8.6% 8.3% 8.5% 8.3%

------ ------ ------ ------

Amounts below the threshold

for deduction

(before risk weighting)

Direct and indirect holdings

of the capital of financial

sector entities where the

Group does not have a significant

investment in those entities

(amount below 10% threshold

and net of eligible short

positions) 1,379 1,552 1,379 1,552

Direct and indirect holdings

by the Group of the CET1

instruments of financial

sector entities where the

Group has a significant

investment in those entities

(amount below 10% threshold

and net of eligible short

positions) 3,340 3,127 3,340 3,127

Deferred tax assets arising

from temporary differences

(amount below 10% threshold,

net of related tax liability

where the conditions in

38 (3) are met) 1,191 1,188 1,191 1,188

------ ------ ------ ------

Applicable caps on the inclusion

of provisions in Tier 2

Credit risk adjustments

included in T2 in respect

of exposures subject to

internal ratings-based approach

(prior to the application

of the cap) 114 221 114 221

Cap on inclusion of credit

risk adjustments in T2 under

internal ratings-based approach 958 953 958 953

------ ------ ------ ------

Capital instruments subject

to phase-out arrangements

(only applicable between

1 Jan 2013 and 1 Jan 2022)

Current cap on AT1 instruments

subject to phase out arrangements 3,305 3,856 - -

Amount excluded from AT1

due to cap (excess over

cap after redemptions and

maturities) 1,861 671 - -

Current cap on T2 instruments

subject to phase out arrangements 8,600 10,034 - -

------ ------ ------ ------

(1) Excluding CET1 required to meet Pillar 2A requirements under

fully loaded.

(2) The presentation of the deconsolidation of the Group's insurance

entities has been amended at June 2016 with comparative figures

restated accordingly.

(3) The capital conservation buffer requirement is the percentage

applicable at the reporting date. This will increase to 2.5 per

cent by 2019.

Table 17: Lloyds Banking Group leverage ratio common

disclosure

At 30 At 31

June Dec

2016 2015

Fully Fully

loaded loaded

GBPm GBPm

On-balance sheet exposures (excluding

derivatives and SFTs)

On-balance sheet items (excluding derivatives,

SFTs and fiduciary assets,

but including collateral) 626,734 609,110

Asset amounts deducted in determining

Tier 1 capital (10,627) (9,112)

-------- ------------------------

Total on-balance sheet exposures (excluding

derivatives, SFTs and fiduciary assets) 616,107 599,998

-------- ------------------------

Derivative exposures

Replacement cost associated with all

derivatives transactions (i.e. net

of eligible cash variation margin) 9,923 6,392

Add-on amounts for PFE associated with

all derivatives transactions (mark-to-market

method) 13,050 12,966

Gross-up for derivatives collateral

provided where deducted from the balance

sheet assets pursuant to the applicable

accounting framework 762 2,371

Deductions of receivables assets for

cash variation margin provided in derivatives

transactions (3,527) (3,689)

Adjusted effective notional amount

of written credit derivatives 857 813

Adjusted effective notional offsets

and add-on deductions for written credit

derivatives (158) (131)

-------- ------------------------

Total derivative exposures 20,907 18,722

-------- ------------------------

Securities financing transaction exposures

Gross SFT assets (with no recognition

of netting), after adjusting for sales

accounting transactions 38,586 39,604

Netted amounts of cash payables and

cash receivables of gross SFT assets (3,356) (5,909)

Counterparty credit risk exposure for

SFT assets 1,793 3,361

-------- ------------------------

Total securities financing transaction

exposures 37,023 37,056

-------- ------------------------

Other off-balance sheet exposures

Off-balance sheet exposures at gross

notional amount 129,834 129,491

Adjustments for conversion to credit

equivalent amounts (69,961) (73,067)

-------- ------------------------

Other off-balance sheet exposures 59,873 56,424

-------- ------------------------

Capital and total exposure measure

Tier 1 capital 34,273 33,860

Leverage ratio total exposure measure 733,910 712,200

-------- ------------------------

Leverage ratio

-------- ------------------------

Leverage ratio 4.7% 4.8%

-------- ------------------------

Table 18: Lloyds Banking Group summary reconciliation of

accounting assets and leverage ratio exposures

At 30 At 31

June Dec

2016 2015

Fully Fully

loaded loaded

GBPm GBPm

Total assets as per published financial

statements 848,232 806,688

Adjustment for entities which are consolidated

for accounting purposes but are outside

the scope of regulatory consolidation (140,421) (135,926)

Adjustments for derivative financial

instruments (23,587) (9,235)

Adjustments for securities financing

transactions (SFTs) 440 3,361

Adjustment for off-balance sheet items

(i.e. conversion to credit equivalent

amounts of

off-balance sheet exposures) 59,873 56,424

Other adjustments (10,627) (9,112)

--------- ---------

Leverage ratio total exposure measure 733,910 712,200

--------- ---------

CONTACTS

For further information please contact:

INVESTORS AND ANALYSTS

Douglas Radcliffe

Group Investor Relations Director

020 7356 1571

douglas.radcliffe@finance.lloydsbanking.com

Mike Butters

Director of Investor Relations

020 7356 1187

mike.butters@finance.lloydsbanking.com

Andrew Downey

Director of Investor Relations

020 7356 2334

andrew.downey@finance.lloydsbanking.com

CORPORATE AFFAIRS

Ed Petter

Group Media Relations Director

020 8936 5655

ed.petter@lloydsbanking.com

Matt Smith

Head of Corporate Media

020 7356 3522

matt.smith@lloydsbanking.com

Registered office: Lloyds Banking Group plc, The Mound,

Edinburgh, EH1 1YZ

Registered in Scotland no. 95000

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EADXPAEDKEFF

(END) Dow Jones Newswires

July 28, 2016 11:00 ET (15:00 GMT)

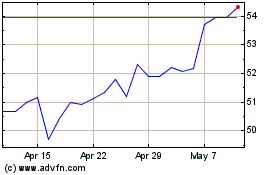

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Sep 2023 to Sep 2024