Lenovo Group 3rd-Quarter Net Profit Rises 18.6%, Beating Forecasts -- 2nd Update

February 03 2016 - 6:14AM

Dow Jones News

By Eva Dou

BEIJING--To the chagrin of electronics makers, the world's

consumers appear to have decided that they have plenty of gadgets

already.

The world's largest personal-computer maker Lenovo Group Ltd. is

the latest company grappling with slack demand. It posted sales

declines in its PC and smartphone businesses for its fiscal third

quarter and warned Wednesday of "market challenges," despite

reporting a surprise net profit increase from cost cuts and growth

in sales of enterprise products.

For the past few years, electronics makers such as Lenovo have

offset a slowdown in PC sales by doubling down on smartphones. But

this strategy is reaping diminishing returns.

Worldwide smartphone shipment growth has eased from 80% in 2010

to 11% in 2015 and is expected to slow further, according to market

research firm Canalys. Global PC sales have slumped for several

years in a row, with vendors hoping for the bottom in 2016.

Consumers have yet to embrace new technologies like smartwatches

and virtual-reality headsets on a scale that can replace the

slowdown in PCs and smartphones.

"The golden years have passed," said Zhou Hao, an economist at

Commerzbank AG, of global electronics sales growth. "We maybe have

to wait for the next generation of products that can trigger new

consumption."

Even the strongest players haven't escaped the trend. Apple Inc.

forecast last month that its revenue in the current quarter would

decline for the first time in 13 years, as the world's appetite for

iPhones is finally sated. Samsung Electronics Co. posted a sharp

slowdown in profit from chips last week and warned that smartphone

competition would intensify.

Many smaller vendors have fared worse. Taiwanese smartphone

maker HTC Corp. reported Wednesday it swung to a net loss of 3.4

billion New Taiwan dollars ($101.4 million) in the fourth

quarter.

Lenovo Chairman Yang Yuanqing said in an interview Wednesday

that his company faced a "really challenging market," but aimed to

carve out top-line and profit growth this year by taking over

market share from PC rivals and redoubling smartphone efforts in

emerging markets.

"We think we can win through our efficiency," he said. "How we

can make money in this downturn period? Because we have the most

competitive cost structure."

Lenovo posted a surprise net profit gain Wednesday for the

quarter that ended Dec. 31 due to cost cuts, although its sales

fell. The company said its net profit for the quarter rose 18.6%

from a year earlier to $300 million, beating the $226.3 million

average estimate of 19 analysts surveyed by Thomson One Analytics.

Revenue fell 8.5% to $12.9 billion from $14.1 billion a year

earlier.

Depreciating currencies in emerging markets have hit gadget

makers, which generally pay their suppliers in U.S. dollars and

ring up sales in local currencies. Lenovo said its revenue decline

in the quarter would have only been 2%, not 8%, without currency

depreciation. Chief Financial Officer Wong Wai Ming said on an

investor call that Lenovo would consider raising product prices in

emerging markets if depreciation continues.

Lenovo reported its Motorola handset business broke even for the

first time in the past quarter, meeting its forecast of turning the

business profitable within a year and a half of acquiring it from

Google Inc. It helped that Lenovo had taken a massive write-down on

smartphone inventory clearing and restructuring in its fiscal

second quarter, which had dragged it into its first quarterly loss

in more than six years.

A bright spot for Lenovo was its enterprise business, which

includes servers and networking products. The group's revenue rose

8% in the quarter, while its business groups catering more to

regular consumers--PCs and smartphones--saw sales fall.

With the addition of the Motorola business, Lenovo was the

world's fourth-largest smartphone maker by shipments in the fourth

quarter with 5.1% of the global market, according to market

research firm IDC. It trailed Samsung, Apple and Huawei

Technologies Co.

Canalys analyst Nicole Peng said much of Lenovo's headway in

smartphone sales in recent months has been due to competitively

priced devices in emerging markets like India, as the company has

lost share in China to rivals like Huawei. Lenovo's smartphone

shipments in India rose 75% last year, while they fell 53% in

China, she said.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

February 03, 2016 05:59 ET (10:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

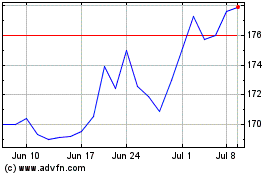

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

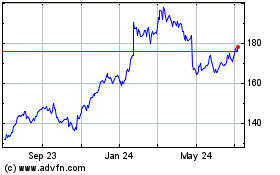

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024