J.P. Morgan's James Dimon: Make it a Double -- Ahead of the Tape

February 09 2017 - 1:38PM

Dow Jones News

By Steven Russolillo

James Dimon can savor his martini this weekend.

Saturday marks the first anniversary of the J.P. Morgan Chase

& Co. boss's big bet on the bank's stock. With the market down

more than 10% at this point last year and J.P. Morgan shares down

20%, Mr. Dimon bought $26.6 million worth of his company's

shares.

Mr. Dimon's purchase marked the bottom in bank stocks and the

market overall, and the start of a strong rally, especially in bank

shares. The S&P 500 has surged 26%, including the sharp

postelection bump, and hovers near record highs. Financials have

been the best-performing sector, up more than 40%. J.P. Morgan

itself is up 62% since Mr. Dimon added to his already substantial

holdings.

The trade earned the CEO a roughly $17 million paper profit.

If the eight-year bull market has taught investors anything, it

is that "buying the dip" has been an extremely profitable exercise.

The S&P 500's 11% drop at the beginning of last year was fully

recovered by the end of March. And after that, there were two

separate instances in which the S&P 500 fell 5%; one was in

June and the other was before the election. Both times, the market

regained its losses within weeks.

An even longer time frame tells a similar story. Since Black

Monday in 1987, the S&P 500 has suffered 21 separate pullbacks

of at least 10%, according to Strategas Research Partners. Those

declines include the bursting of the tech bubble and the financial

crisis as well as other, non-bear-market-related declines.

Collectively, these pullbacks have averaged about a 19% decline and

have lasted roughly three months. The financial crisis as a whole

was an anomaly, with shares falling more than 50% and taking six

years to recover.

The recovery, whenever it comes, is usually strong. Following

all but one of those 21 pullbacks, the S&P 500 gained more than

10% just three months later, averaging a 16% gain. "These are

buying opportunities," says Strategas analyst Nicholas Bohnsack.

Even during the financial crisis, there were several dips worth

buying.

There have been no dips to buy on recently. Through Wednesday's

close, the S&P 500 went 82 trading days without a one-day drop

of at least 1%, the longest such streak since 2006, according to

Bespoke Investment Group. The CBOE Volatility Index, or VIX is

around 11, below all but 1% of readings throughout its history.

It is inevitable volatility will pick up again. And when it

does, buying the dip will likely be a fruitful exercise. Just ask

Mr. Dimon how that has worked out.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

February 09, 2017 13:23 ET (18:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

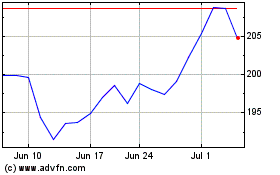

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024