Italian Prosecutors Request Eni CEO, Shell Stand Trial--2nd Update

February 08 2017 - 4:48PM

Dow Jones News

By Eric Sylvers and Sarah Kent

MILAN -- Italian prosecutors are pursuing a criminal trial for

Royal Dutch Shell PLC and the chief executive of Italian oil

company Eni SpA on charges of corruption tied to a controversial

Nigerian deal, according to a person familiar with the matter.

The prosecutors' request -- if granted by a judge over the next

several months -- could lay bare the operations of Shell and the

actions of Eni executives in pursuit of a potentially giant

Atlantic Ocean oil discovery that has come to symbolize pervasive

graft in Nigeria's energy industry.

The investigation targets 11 individuals, including Eni's

current CEO, Claudio Descalzi and his predecessor Paolo Scaroni.

Charges are being pursued against Shell as a corporation, though no

executives are named, the person familiar with the matter said.

Eni's board on Wednesday expressed support for Mr. Descalzi,

saying he was innocent. A spokeswoman for Shell declined to

comment. Messrs. Descalzi and Scaroni didn't immediately respond to

requests for comment.

The move to prosecute the two companies is the latest twist in a

decadeslong saga involving allegations that their 2011 deal to buy

the oil block for over $1 billion amounted to an enormous bribe.

The block, known as OPL 245, is believed to hold 9 billion barrels

of crude oil.

Shell -- long the dominant Western oil company in Nigeria -- had

been pursuing the right to develop the block for years, fighting

over ownership with successive Nigerian governments and a former

Nigerian oil minister, Dan Etete, whose company claimed

ownership.

Shell made headway in 2011 when it teamed up with Eni to buy the

block from the Nigerian government, according to court records

viewed by The Wall Street Journal.

Days after Eni paid a $1.1 billion sum to the Nigerian

government for the block, the money was transferred to bank

accounts held by Mr. Etete, according to the documents. From there

the money filtered down to numerous companies associated with

Nigerian government officials, the court records show. Mr. Etete

and his lawyers were unable to be reached for comment.

Italian prosecutors have maintained that Messrs. Scaroni and

Descalzi, then a top Eni executive, knew the government escrow

account was a stopover for the money before it moved onto an

account controlled by Mr. Etete and was eventually paid as

kickbacks.

Mr. Descalzi and Eni have denied wrongdoing. The company has

maintained that it doesn't use middlemen and that its executives

only dealt with the Nigerian government in the deal for the

offshore block. Eni has said that it bears no responsibility for

where the money subsequently went.

The Nigerian case has proved embarrassing not only for Eni,

which has long been dogged by corruption allegations, but also the

Italian government that owns 30% of the company and appoints the

top management.

The accusations have been a distraction for Mr. Descalzi as he

tries to right Eni's finances during a tumultuous term as CEO.

Since he took over in 2014, oil prices nose-dived, and the company

was forced to cut its dividend amid heavy losses.

Mr. Descalzi's three-year term is set to expire in April and his

renewal could be complicated by the court case. A trial and

eventual appeals could drag on for more than five years.

The request for indictments comes after a Nigerian court ordered

Eni and Shell to give up control of OPL 245. Indictments in Italy

could further embolden Nigerian officials to take on the two oil

companies, according to analysts.

Shell said in its fourth quarter results earlier this month that

it is appealing the Nigerian court order.

--Manuela Mesco contributed to this article.

Write to Eric Sylvers at eric.sylvers@wsj.com and Sarah Kent at

sarah.kent@wsj.com

(END) Dow Jones Newswires

February 08, 2017 16:33 ET (21:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

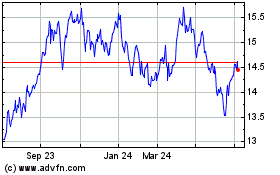

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024