HONG KONG—With China set to give global investors greater access

to shares listed in the southern boomtown of Shenzhen, some remain

wary of a stock market known for its rampant speculation.

A new trading link starting Dec. 5 will give international

investors access to more than 800 stocks listed on the $3.3

trillion Shenzhen stock market via Hong Kong's stock exchange. The

Shenzhen market, just across the border from the former British

colony, is home to some of China's fastest-growing technology

companies. It is also rife with speculative trading in small-cap

stocks with little institutional research coverage.

The market is drawing interest from investors hunting for

undiscovered gems, as some global stock indexes are hitting record

highs. It is also forcing investors to do their homework on

potential investments in different ways.

William Ma, chief investment officer at wealth manager Noah

Holdings (Hong Kong), said fund managers should seek on-the-ground

knowledge of a company before buying. "It's difficult to apply

traditional metrics to something like tech firms, which have less

business visibility. It's hard for management to make projections

about earnings when the industry changes so fast," he said.

Fund managers have used creative methods to get such

information, including visiting warehouses to see how much

inventory has piled up and checking expiration dates on products in

supermarkets to see how fast they are being sold, Mr. Ma said.

A few global investors already trade shares in Shenzhen through

a quota system, but it is too cumbersome and expensive for many

investors to access. As a result, foreign ownership of

Shenzhen-listed shares is tiny, just 1.2% early this year,

according to HSBC Holdings PLC.

Because foreign funds have had limited access to Shenzhen, few

large global investment banks have provided research reports on

companies trading there. The vacuum of institutional research, poor

disclosure by some listed companies, and a flood of retail traders

make Shenzhen one of the world's most volatile stock markets.

Shenzhen's benchmark stock index is down 7.7% this year, while

Hong Kong's Hang Seng Index is up 3.7% and the Dow Jones Industrial

Average is up 9.9% at a record high.

Trading in many of Shenzhen's small-cap stocks is driven by

rumors or speculation. Retail traders call these "demon stocks,"

when shares mysteriously rise in the absence of news or any change

in a company's fundamentals.

Chinese regulators hope the possible influx of foreign

institutional investors from the new stock link with Hong Kong,

called the Shenzhen-Hong Kong Stock Connect, will help damp

volatility in the Shenzhen market and boost transparency.

Yet foreign investors may be wary of buying in now, as Shenzhen

stocks are, on average, relatively expensive. Shenzhen's main index

trades at 50.4 times expected earnings for next year, while the

Nasdaq, to which it is often compared, trades at 28.18 times

forward earnings, according to Thomson Reuters data.

As a result, stock pickers are looking at some of the bigger

companies in Shenzhen, rather than to richly priced small caps.

Many foreign investors and global investment banks suggest buying

established companies with proven earnings and strong market

positions, including top Chinese brewer Wuliangye Yibin Co. and

video-surveillance-equipment maker Hangzhou Hikvision Digital

Technology Co.

Still, it is difficult to sort promise from peril.

LeEco Holdings, a tech company that creates online content and

sells smartphones and smart TVs, is one example. Acquisitive and

attractive to investors, it has showed much promise. But it said

recently that it faced a cash crunch after expanding too quickly.

Its Shenzhen-listed subsidiary, Leshi Internet Information &

Technology Corp., dropped nearly 5% on the news.

Sean Chen, director of strategy at Blackpeak, a firm that has

done due-diligence research for those looking to get into the

Shenzhen market, said investors often want a better understanding

of how management plans to expand a business. They also ask about

the background of management teams, their reputation and

competency, style and track record, he said.

Anthony Ho, chief investment officer of Asia ex-Japan equities

at asset manager Amundi, emphasizes the importance of channel

checks—or independent research on a company's business—to verify

the accuracy of company information. He said when earnings growth

is taken into account, high valuations may be justified.

Dennis Lam, head of Hong Kong and China markets at PineBridge

Investments, said, "In Shenzhen, it is even more important to know

management. It takes many, many meetings."

He said the firm will also speak to a company's suppliers and

factory line managers before investing.

Goldman Sachs Group Inc. recommends investors take a closer look

at "new economy" companies trading below 30 times this year's

expected earnings. Their list of names to buy in Shenzhen includes

Han's Laser Technology Industry Group Co., a laser-machine

manufacturer, and Sungrow Power Supply Co., a manufacturer of

renewable-energy hardware.

Macquarie recommends Shenzhen Rapoo Technology Co., which boasts

stable sales of its wireless-gaming software and is expanding into

robotics and drones. Another favorite is GoerTek Inc., which sells

a mix of digital consumer products and is expanding into virtual

reality.

Write to Anjie Zheng at Anjie.Zheng@wsj.com

(END) Dow Jones Newswires

November 27, 2016 20:55 ET (01:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

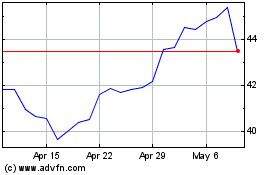

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

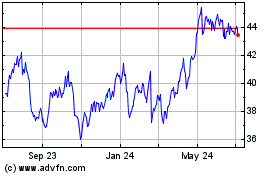

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024