Intesa Sanpaolo SpA 4Q 2015 - Forecast

February 03 2016 - 8:17AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

Intesa Sanpaolo SpA (ISP.MI) fourth-quarter results, based on a

poll of eight analysts conducted by Dow Jones Newswires (figures in

million euros, dividend and target price in euro, according to

IFRS). Earnings figures are scheduled to be released February

5.

===

Net int. Net comm. Trading Net adj.

4th Quarter income income profit to loans

AVERAGE 1,901 1,979 90 1,010

Prev. Year 2,056 1,813 76 1,043

+/- in % -7.5 +9.2 +18 -3.2

MEDIAN 1,903 1,982 90 956

Maximum 1,915 2,125 110 1,230

Minimum 1,875 1,853 73 928

Amount (a) 8 7 6 5

Citi 1,899 2,007 79 947

Credit Suisse 1,910 1,853 110 --

Deutsche Bank 1,915 1,982 102 928

Kepler Cheuvreux 1,897 2,052 75 --

Morgan Stanley 1,892 1,931 100 989

Societe Generale 1,915 2,125 -- 1,230

Operating Net

4th Quarter margin profit

AVERAGE 1,666 135

Prev. Year 1,773 48

+/- in % -6.0 +181

MEDIAN 1,749 74

Maximum 1,905 327

Minimum 1,372 51

Amount (a) 8 8

Citi 1,434 66

Credit Suisse 1,372 81

Deutsche Bank 1,861 51

Kepler Cheuvreux 1,421 150

Morgan Stanley 1,838 56

Societe Generale 1,905 286

Target price Rating DPS 2015

AVERAGE 3.49 positive 7 AVERAGE 0.13

Prev. Quarter 3.77 neutral 1 Prev. Year 0.07

+/- in % -7.5 negative 0 +/- in % +90

MEDIAN 3.50 MEDIAN 0.14

Maximum 3.70 Maximum 0.15

Minimum 2.99 Minimum 0.11

Amount (a) 8 Amount 7

Barclays 3.70 Overweight 0.12

Citi 3.50 Buy 0.14

Credit Suisse 3.30 Outperform --

Deutsche Bank 3.50 Buy 0.14

Kepler Cheuvreux 3.70 Buy 0.15

Morgan Stanley 3.50 Overweight 0.11

Societe Generale 2.99 Hold 0.12

===

Year-earlier figures are as restated by the company.

(a) Including anonymous estimates from two more analysts.

DJG/voi

(END) Dow Jones Newswires

February 03, 2016 08:02 ET (13:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

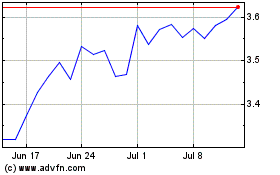

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

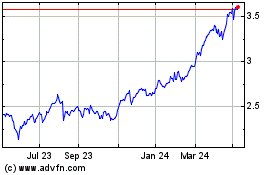

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024