TIDMHOC

RNS Number : 7786K

Hochschild Mining PLC

12 July 2017

__________________________________________________________________________________

12 July 2017

Production Report for the 6 months ended 30 June 2017

Ignacio Bustamante, Chief Executive Officer said:

Hochschild has continued to deliver a strong and steady

production performance in the first half of the year and we are

therefore pleased to reiterate both our 2017 output and cost

forecasts. During the second half, we can look forward to

increasing contributions from our new Pablo vein at Pallancata as

well as starting the key portion of our 2017 brownfield exploration

programme."

Operational highlights

-- Robust Q2 2017 attributable production(1)

o 4.8 million ounces of silver

o 60,815 ounces of gold

o 9.3 million silver equivalent ounces

o 126,007 gold equivalent ounces

-- H1 2017 attributable production in line with expectations

o 8.9 million ounces of silver

o 121,430 ounces of gold

o 17.9 million silver equivalent ounces (H1 2016: 17.0 million

silver equivalent ounces)

o 242,208 gold equivalent ounces (H1 2016: 229,063 gold

equivalent ounces)

-- On track to deliver overall 2017 production target of 37

million silver equivalent ounces

-- 2017 all-in sustaining costs per silver equivalent ounce

expected to meet $12.2-12.7 guidance

-- 22,000 metres of drilling scheduled for H2 2017

Strengthening financial position

-- Total cash of approximately $144 million as at 30 June 2017

($140 million as at 31 December 2016)

-- $18.5 million of debt repaid in H1 2017

-- Net debt of approximately $160 million as at 30 June 2017

($187 million as at 31 December 2016)

-- Current Net Debt/LTM EBITDA of approximately 0.5x as of 30

June 2017

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Wednesday 12 July 2017 for analysts and investors.

Dial in details as follows:

International Dial in: +44 333 300 0804

UK Toll-Free Number: 0800 358 9473

Pin: 27820958#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 333 300 0804

UK Toll Free: 0800 358 9473

Pin: 07800091#

_________________________________________________________________________________

(1) All equivalent figures assume a gold/silver ratio of 74x

Overview

In H1 2017, the Company delivered attributable production of

242,208 gold equivalent ounces or 17.9 million silver equivalent

ounces. Pallancata is delivering grades above expectations and was

significantly ahead of the H1 2016 result despite a

community-related stoppage in the first quarter. At Inmaculada,

mining operations were boosted by a contribution from existing high

grade stockpiles whilst there was also another solid performance

from the 51% owned San Jose operation.

The Company reiterates that its all-in sustaining cost per

silver equivalent ounce for 2017 is on track to be between $12.2

and $12.7.

TOTAL GROUP PRODUCTION

Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

----------------------- -------- -------- -------- -------- --------

Silver production

(koz) 5,599 4,830 5,415 10,429 9,744

Gold production

(koz) 73.29 70.98 79.39 144.27 139.43

Total silver

equivalent (koz) 11,022 10,083 11,290 21,105 20,062

Total gold equivalent

(koz) 148.95 136.26 152.57 285.21 271.11

Silver sold

(koz) 5,908 4,600 5,614 10,508 10,085

Gold sold (koz) 75.70 67.72 83.55 143.42 146.10

----------------------- -------- -------- -------- -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

------------------- -------- -------- -------- -------- --------

Silver production

(koz) 4,824 4,113 4,548 8,938 8,210

Gold production

(koz) 60.81 60.62 67.04 121.43 118.12

Silver equivalent

(koz) 9,324 8,599 9,509 17,923 16,951

Gold equivalent

(koz) 126.01 116.20 128.50 242.21 229.06

------------------- -------- -------- -------- -------- --------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

------------------- -------- -------- -------- -------- ------------------

Ore production

(tonnes treated) 330,393 283,959 338,630 614,352 619,161

Average grade

silver (g/t) 148 135 142 142 132

Average grade

gold (g/t) 3.80 4.33 4.42 4.04 4.25

Silver produced

(koz) 1,405 1,239 1,396 2,644 2,370

Gold produced

(koz) 38.03 41.79 45.18 79.82 79.20

Silver equivalent

(koz) 4,219 4,331 4,739 8,550 8,231

Gold equivalent

(koz) 57.01 58.53 64.04 115.55 111.23

Silver sold

(koz) 1,448 1,195 1,585 2,642 2,468

Gold sold (koz) 38.35 39.98 50.26 78.32 82.17

------------------- -------- -------- -------- -------- ------------------

Inmaculada's second quarter production was 38,029 ounces of gold

and 1.4 million ounces of silver which amounts to gold equivalent

production of 57,014 ounces. Following the stoppage at the

operation in Q1 2017, mining operations were steadily ramped up

back to full production in the second quarter with throughput and

grades reverting to the budgeted level. Overall in the first half,

the operation was ahead of the same period of 2016, with gold

equivalent production of 115,547 ounces (H1 2016: 111,233 ounces),

consisting of 79,820 ounces of gold and 2.6 million ounces of

silver. Inmaculada remains on track to meet its full year forecast

of approximately 230,000 gold equivalent ounces (17 million silver

equivalent ounces).

Arcata

Product Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

------------------- -------- -------- ------------ -------- --------

Ore production

(tonnes treated) 129,215 132,428 172,305 261,643 333,397

Average grade

silver (g/t) 308 310 345 309 327

Average grade

gold (g/t) 1.06 1.12 1.31 1.09 1.22

Silver produced

(koz) 1,138 1,165 1,592 2,303 2,970

Gold produced

(koz) 3.90 4.14 5.68 8.04 10.36

Silver equivalent

(koz) 1,427 1,471 2,013 2,898 3,736

Gold equivalent

(koz) 19.28 19.88 27.20 39.16 50.49

Silver sold

(koz) 1,139 1,121 1,572 2,261 2,922

Gold sold (koz) 3.71 4.23 5.70 7.94 10.14

------------------- -------- -------- ------------ -------- --------

At Arcata, silver production in the second quarter was 1.1

million ounces with gold production of 3,901 ounces which resulted

in silver equivalent production of 1.4 million ounces. Overall in

the first half, production was 2.9 million silver equivalent ounces

(H1 2016: 3.7 million ounces) as tonnage and silver grades were

reduced following a revision of the mine plan to accommodate a

reduced number of stopes and narrower veins. The focus at Arcata is

to improve its cost position by increasing the quality of resources

through the brownfield exploration programme as well as other

efficiency and productivity measures.

Pallancata

Product Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

------------------- -------- -------- ------------- -------- --------

Ore production

(tonnes treated) 121,282 71,662 66,313 192,744 135,736

Average grade

silver (g/t) 424 468 358 440 341

Average grade

gold (g/t) 1.75 1.94 1.85 1.82 1.77

Silver produced

(koz) 1,475 964 658 2,439 1,273

Gold produced

(koz) 5.90 3.89 3.32 9.79 6.37

Silver equivalent

(koz) 1,912 1,252 903 3,163 1,745

Gold equivalent

(koz) 25.83 16.92 12.21 42.75 23.58

Silver sold

(koz) 1,558 878 757 2,437 1,315

Gold sold (koz) 6.23 3.49 3.76 9.72 6.50

------------------- -------- -------- ------------- -------- --------

Production in Q2 2017 at Pallancata was 1.5 million ounces of

silver and 5,899 ounces of gold bringing the silver equivalent

total to 1.9 million ounces. The first half of the year's

performance was thus a better-than-expected 3.2 million silver

equivalent ounces (H1 2016: 1.7 million ounces) with a significant

improvement versus the same period of 2016.

San Jose (the Company has a 51% interest in San Jose)

Product Q2 2017 Q1 2017 Q2 2016 H1 2017 H1 2016

------------------- -------- -------- ------------ -------- --------

Ore production

(tonnes treated) 135,439 114,956 146,829 250,396 248,766

Average grade

silver (g/t) 418 458 428 436 446

Average grade

gold (g/t) 6.68 6.50 6.09 6.60 6.16

Silver produced

(koz) 1,581 1,463 1,770 3,044 3,132

Gold produced

(koz) 25.46 21.15 25.21 46.62 43.49

Silver equivalent

(koz) 3,465 3,029 3,635 6,494 6,350

Gold equivalent

(koz) 46.82 40.93 49.12 87.75 85.81

Silver sold

(koz) 1,763 1,405 1,699 3,168 3,380

Gold sold (koz) 27.41 20.02 23.83 47.43 47.29

------------------- -------- -------- ------------ -------- --------

The Company's 51% owned San Jose mine in Argentina has continued

to be a solid performer with production of 1.6 million ounces of

silver and 25,463 ounces of gold (3.5 million silver equivalent

ounces). The first half's production was therefore 3.0 million

ounces of silver and 46,618 ounces of gold which is 6.5 million

silver equivalent ounces, a 2% improvement on the same period of

2016 principally driven by better gold grades.

Average realisable prices and sales

Average realisable precious metal prices in Q2 2017 (which are

reported before the deduction of commercial discounts) were

$1,262/ounce for gold and $16.2/ounce for silver (Q2 2016:

$1,213/ounce for gold and $17.9/ounce for silver). For H1 2017,

average realisable precious metal prices were $1,251/ounce for gold

and $17.1/ounce for silver (H1 2016: $1,236/ounce for gold and

$17.1/ounce for silver).

Brownfield exploration

At Arcata, 5,419m of resource drilling was carried out at the

Ramal Marion and Paralela veins whilst long horizontal drilling for

potential resources also started in the Pamela and Paralelas vein

systems with results still pending.

At Pallancata, during the quarter 1,000m of resource drilling

was carried out in the Marco vein, a structure identified close to

the Pablo vein with selected results below:

Vein Results

------ -------------------------------

Marco DLYU-A92A: 1.4m @ 0.7g/t Au &

235g/t Ag

DLYU-A88: 1.1m @ 2.2g/t Au &

1,108g/t Ag

DLNE-A05: 0.6m @ 1.1g/t Au &

470g/t Ag

DLYU-A92A: 2.0m @ 0.7g/t Au &

169g/t Ag

DLNE-A07: 0.6m @ 1.1g/t Au &

152g/t Ag

------ -------------------------------

During the second half of 2017, just over 22,000 metres of

drilling will be executed as part of the Company's brownfield

exploration programme. Targets include: 3,100 metres of long

horizontal drilling for potential resources at Arcata as well as a

further 10,000 metres of resource drilling; 1,000 metres of

potential drilling to test the Millet structure at Inmaculada;

2,500 metres of potential drilling to the north east of Inmaculada

at the Puquiopata area; and 5,500 metres at the Aguas Vivas zone to

the north west of San Jose. Further drilling campaigns are subject

to the receipt of the requisite permits.

Financial position

Total cash was approximately $144 million as at 30 June 2017

resulting in net debt of approximately $160 million. The Company's

cash balance has, as expected, significantly improved in the second

quarter following stoppage related delays in the first quarter at

Pallancata and Inmaculada and a commercial delay at Arcata

temporarily impacting working capital.

Outlook

The Company remains on track to deliver its overall production

target for 2017 of 37.0 million silver equivalent ounces or 500

thousand gold equivalent ounces and also reaffirms its all-in

sustaining cost per silver equivalent ounce forecast of between

$12.2 and $12.7.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3709 3264

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

__________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLDFLFFDDFZBBB

(END) Dow Jones Newswires

July 12, 2017 02:00 ET (06:00 GMT)

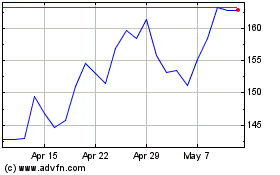

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024