Herbalife Nears Resolution of FTC Probe

May 05 2016 - 8:20PM

Dow Jones News

Herbalife Ltd. said it was nearing a resolution to a regulatory

investigation into whether the company was operating as a pyramid

scheme.

The nutritional-supplement maker said in a statement that it had

progressed to an "advance stage" in talks with the Federal Trade

Commission and that, while litigation remained a possibility, a

settlement would include an estimated payment of $200 million.

Shares, up 44.6% over the past year, rose 12% to $65.32 in

after-hours trading. Herbalife's comments about a possible

settlement came as the company reported better-than-expected

first-quarter results and raised its guidance for the year.

The FTC opened an investigation into Herbalife in 2014 as the

company was battling comments from hedge-fund manager William

Ackman. Beginning in 2012, Mr. Ackman publicly accused the direct

marketer of being a pyramid scheme, the salespeople of which rely

more on signing up new recruits than selling product.

Mr. Ackman repeatedly called for a probe by the FTC, and his

firm, Pershing Square Capital Management LP, bet about $1 billion

that the company's shares would fall.

Founded in 1980, Herbalife, based in the Cayman Islands, sells

protein shakes, snacks and other weight-management products along

with other dietary and nutritional supplements.

For the first quarter, Herbalife reported a profit of $95.8

million, or $1.12 a share, compared with $78.2 million, or 92 cents

a share, a year earlier. Excluding certain items, adjusted profit

climbed to $1.36 a share from $1.29 a year earlier.

Sales rose 1.3% to $1.12 billion. Excluding the impact of

currency, sales grew 11%.

Analysts surveyed by Thomson Reuters had projected adjusted

profit of $1.09 a share on $1.07 billion in revenue.

Sales in North America jumped 9%, offsetting a 21% decline in

South and Central America, with troubled Venezuela in particular

dragging on results.

Herbalife also raised guidance for the year. It now sees

adjusted per-share earnings between $4.40 and $4.75, up from its

previous view of $4.05 and $4.50, with sales climbing between 1.5%

to 4.5%, above its earlier guidance for sales rising up to

2.5%.

For the second quarter, Herbalife sees adjusted per-share

earnings between $1.10 and $1.20 and sales rising up to 3%.

Herbalife said the guidance excludes the effect of any legal

settlement.

Analysts, on average, were expecting adjusted per-share earnings

of $1.16 in the second quarter and $4.65 for the year, and sales

rising 2% in the second quarter and 3% for the year, according to

Thomson Reuters.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

May 05, 2016 20:05 ET (00:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

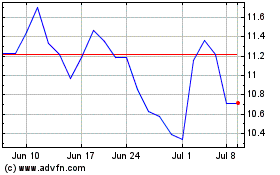

Herbalife (NYSE:HLF)

Historical Stock Chart

From Aug 2024 to Sep 2024

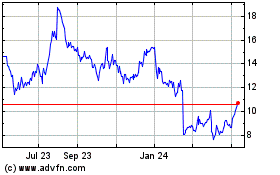

Herbalife (NYSE:HLF)

Historical Stock Chart

From Sep 2023 to Sep 2024