State Street Global Advisors (SSGA), the asset management

business of State Street Corporation (NYSE: STT) today announced

the appointment of Kathryn Sweeney as head of SPDR Americas

Institutional sales, reporting into Nick Good, co-head with Rory

Tobin of the global SPDR business. Sweeney will be responsible for

defining and leading the execution of the SPDR Americas

Institutional Sales Strategy in the Americas. Sweeney will also be

responsible for collaborating with the Americas Institutional

Client Group (ICG) team under Barry F.X. Smith, head of the

Americas ICG at SSGA, to drive ETF sales with asset owners.

“ETFs are being used by a greater number of institutional

investors seeking to reduce fees and increase the liquidity and

transparency of their holdings,” said Good. “Our global SPDR ETF

business has a strong track record of product innovation, including

working with large institutional clients to develop products such

as SHE, LOWC and SPYX to meet their specific investment needs.

Given Kathryn’s visibility and relationships within the ETF

industry we are confident that she will continue to advance the

SPDR position in the institutional market, and we are excited to

have her join our Global SPDR team.”

Sweeney joins SSGA from Goldman Sachs, where throughout her more

than 19 year tenure, she played a strategic role in building out

its ETF business, first in London and then in New York. She held a

variety of roles, most recently as Global Head of Distribution and

Product Strategy for the Securities Division. In this capacity

Sweeney worked closely with ETF Asset Managers, Institutional

Trading desks and internal stakeholders to increase ETF activity.

Prior to this, she held roles as Head of US ETF Execution and Risk,

and as an ETF trader in London and New York.

SSGA is one of the largest ETF providers in the US and globally,

with $558 billion in ETF assets under management.1

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of

international and domestic asset classes. SPDR ETFs are managed by

SSGA Funds Management, Inc., a registered investment adviser and

wholly owned subsidiary of State Street Corporation. The funds

provide investors with the flexibility to select investments that

are precisely aligned to their investment strategy. Recognized as

an industry pioneer, State Street created the first US listed ETF

in 1993 and has remained on the forefront of responsible

innovation, as evidenced by the introduction of many

ground-breaking products, including first-to-market launches with

gold, international real estate, international fixed income, and

sector ETFs. For more information, visit www.spdrs.com.

About State Street Global Advisors

For nearly four decades, State Street Global Advisors has been

committed to helping financial professionals and those who rely on

them achieve their investment objectives. We partner with

institutions and financial professionals to help them reach their

goals through a rigorous, research-driven process spanning both

active and index disciplines. We take pride in working closely with

our clients to develop precise investment strategies, including our

pioneering family of SPDR ETFs. With trillions* in assets under

management, our scale and global footprint provide access to

markets and asset classes, and allow us to deliver expert insights

and investment solutions.

State Street Global Advisors is the investment management arm of

State Street Corporation.

*Assets under management were $2.56 trillion as of March 31,

2017. AUM reflects approx. $33.33 billion (as of March 31, 2017)

with respect to which State Street Global Advisors Funds

Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and

State Street Global Advisors are affiliated.

Important Information

Investing involves risk including the risk of loss of

principal.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

No fossil fuel reserve ownership may have an adverse

effect on a company’s profitability and, in turn, the returns of

the fund.

Concentrated investments in a particular industry or

sector may be more vulnerable to adverse changes in that industry

or sector.

Gender diversity risk: The returns on a portfolio of

securities that excludes companies that are not gender diverse may

trail the returns on a portfolio of securities that includes

companies that are not gender diverse.

Equity securities may fluctuate in value in response to

the activities of individual companies and general market and

economic conditions.

Passively managed funds hold a range of securities that,

in the aggregate, approximates the full Index in terms of key risk

factors and other characteristics. This may cause the fund to

experience tracking errors relative to performance of the

index.

Standard & Poor’s®, S&P® and SPDR® are registered

trademarks of Standard & Poor’s Financial Services LLC

(S&P); Dow Jones is a registered trademark of Dow Jones

Trademark Holdings LLC (Dow Jones); and these trademarks have been

licensed for use by S&P Dow Jones Indices LLC (SPDJI) and

sublicensed for certain purposes by State Street Corporation. State

Street Corporation’s financial products are not sponsored,

endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their

respective affiliates and third party licensors and none of such

parties make any representation regarding the advisability of

investing in such product(s) nor do they have any liability in

relation thereto, including for any errors, omissions, or

interruptions of any index.

Distributor: State Street Global Advisors Funds

Distributors, LLC, member FINRA, SIPC, an indirect wholly owned

subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain

State Street affiliates provide services and receive fees from the

SPDR ETFs.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

866.787.2257 or visit spdrs.com and respective fund's website. Read

it carefully.

State Street Corporation, One Lincoln Street, Boston, MA

02111-2900

© 2017 State Street Corporation - All Rights Reserved

Not FDIC Insured –No Bank Guarantee – May Lose Value

CORP-3041

1 As of 3/31/17

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170614006072/en/

State Street CorporationAndrew Hopkins, +1

617-664-2422Ahopkins2@StateStreet.com

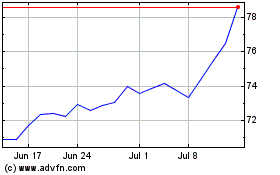

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

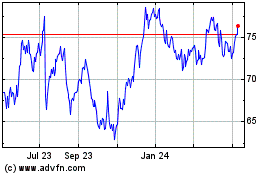

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024