HSBC Agrees $470 Million Settlement Over Alleged U.S. Mortgage Abuses--Update

February 05 2016 - 1:16PM

Dow Jones News

By Margot Patrick

LONDON-- HSBC Holdings PLC agreed Friday to pay $470 million to

settle federal and state allegations of abusive practices in its

U.S. mortgage business.

The British bank must make major changes to how it services

mortgages and handles foreclosures in the U.S. and will compensate

some customers who lost their homes or had their loans modified. An

independent monitor will oversee its compliance with the agreement

for a year.

The civil settlement with the U.S. Justice Department, other

federal agencies and U.S. states adds to a list of penalties around

HSBC's mortgage lending and servicing business, which authorities

say was rife with problems and rushed people out of their homes.

HSBC paid $249 million in 2013 to settle similar allegations by the

Federal Reserve and the Office of the Comptroller of the

Currency.

The alleged abuses took place in the aftermath of the financial

crisis when many U.S. homeowners struggled to keep up with their

mortgage payments. Millions lost their homes when a housing bubble

inflated by loose lending popped in 2008. Authorities said HSBC

will pay $100 million to the federal agencies and states, and

around $370 million to borrowers and homeowners through various

channels including modifying loan terms.

"There has to be one set of rules for everyone, no matter how

rich or how powerful, and that includes lenders who engage in

abusive business practices," said New York Attorney General Eric

Schneiderman.

The Justice Department "remains committed to rooting out

financial fraud and holding bad actors accountable for their

actions," said Associate Attorney General Stuart Delery.

U.S. authorities started cracking down on foreclosure procedures

around 2010, after some banks were found to be serially submitting

bogus mortgage documents when attempting to repossess homes. The

same federal agencies and states entered a $25 billion settlement

over similar allegations with five large U.S. banks in 2012. The

Justice Department said it had been in negotiations with HSBC since

then to reach a separate accord.

"We are pleased to have reached this settlement and believe it

is a positive result that benefits American homeowners and the U.S.

housing industry," said Kathy Madison, chief executive of HSBC

Finance Corp. "Throughout the housing market downturn, HSBC stayed

focused on home preservation and approached foreclosure as a last

resort option, and this agreement affirms our commitment to

assisting customers who are facing financial difficulties."

HSBC, across its operations, has paid out billions of dollars in

fines and settlements in the past several years, including $1.9

billion over failures in its systems that allegedly allowed drug

traffickers and sanctioned nations to move money through its U.S.

bank. The settlements have weighed on the bank's earnings and

helped jack up its compliance costs. It is due to report full-year

results on Feb. 22.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

February 05, 2016 13:01 ET (18:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

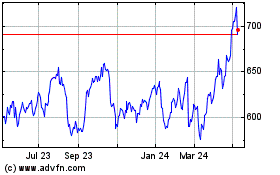

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

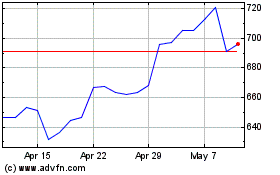

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024