TIDMGHE

RNS Number : 6826A

Gresham House PLC

28 March 2017

28 March 2017

Gresham House plc ("Gresham House" or "the Company")

(AIM: GHE)

Audited Results for Year Ended 31 December 2016

Delivering on Strategy, and Another Year of Significant

Development with 50% Growth in Assets Under Management

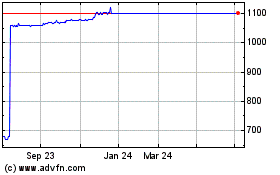

-- Assets under management ("AUM") in the year to 31 December

2016 increased 50% to GBP363 million (2015: GBP242 million)

-- Revenue growth of over 200% in the year to 31 December 2016

to GBP4.3 million (2015: GBP1.4 million), and reduced adjusted

operating loss in the year to GBP1.6 million (2015: GBP3.1

million)

-- Organic growth includes Gresham House Forestry LP and Gresham

House Strategic Public Equity LP, with potential value from carried

interest arrangements

-- New strategic shareholders invested to align with the Group

and support long-term growth, including the recently announced plan

for the new Gresham House British Strategic Investment Fund

-- Strong balance sheet with GBP26.9 million of

tangible/realisable assets at year end (2015: GBP27.7 million) and

a further GBP7.3 million received on the issuance of shares to a

new strategic shareholder, Berkshire Pension Fund, in March

2017

Platform

Strategic Equity

-- Gresham House Asset Management ("GHAM") appointed investment

manager to LMS Capital with AUM of GBP68 million at 31 December

2016

-- Gresham House Strategic Public Equity LP ("SPE LP") launched

with committed AUM of GBP24 million at first close on 15 August

2016

-- Gresham House Strategic plc ("GHS") has seen NAV grow 6% over

the period from 14 August 2015 to 31 December 2016, including a

significant cash weighting

Real Assets

-- Gresham House Forestry AUM grown by 20% to GBP247 million at

31 December 2016 (2015: GBP205 million)

-- Gresham House Forestry Fund LP launched with committed

capital of GBP15 million at first close on 31 October 2016

Process

-- Investment in compliance and regulatory functions

-- Integration and rebranding of Gresham House Forestry

completed in the year and performance in line with achievement of

15% return on invested capital acquisition criteria

-- LMS's transition to GHAM as an external manager progressing

to plan, implementing cost savings and GHAM value-add

-- Investment teams are performing well and delivering growth across the strategies

People

-- Continued investment in a strong and dedicated team

appointing a new Finance Director, Chief Operating Officer and

General Counsel, plus the lead fund manager for Gresham House

Forestry and experienced Investment Directors in the Strategic

Equity division

-- Chief Technology Officer also joined in February 2017

Post reporting period

-- Continued development in 2017, with Berkshire Pension Fund

becoming a 20% strategic shareholder.

Tony Dalwood, CEO of Gresham House, comments:

"In 2015 we established the foundations of a specialist asset

manager and 2016 has seen us build Gresham House into a credible

specialist player whilst developing the brand. This has been

enhanced by progress in early 2017, which has generated additional

momentum that will drive further growth in the coming year. Our

priority is to generate sustainable and increasing profits through

growth in AUM. The positive recent developments accelerate our path

to profitability in the nearer term and hence long-term value

creation for shareholders. We continue to work on a number of

organic and acquisition initiatives, including the recently

announced Gresham House British Strategic Investment Fund with

local government pension schemes and other long term

investors."

Enquiries:

Gresham House plc

Anthony (Tony) Dalwood

Kevin Acton +44 20 3837 6270

Liberum Capital Ltd

Neil Elliot

Jill Li +44 20 3100 2000

Montfort Communications greshamhouse@montfort.london

Gay Collins +44 7798 626282

Rory King +44 203 770 7906

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation ("MAR"). Upon the publication of this

announcement via Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public domain. If

you have any queries on this, then please contact John-Paul

Preston, Chief Operating Officer of the Company (responsible for

arranging release of this announcement) on +44 (0)203 837 6274.

Chairman's Statement

Activity in the year

Gresham House's development as a specialist asset manager has

continued in the year and I am pleased to advise shareholders that

the Company continues to deliver well against our stated

strategy.

Activity in the year has highlighted the progress made by the

management team, with assets under management growing 50% through

both organic and acquisition activity. Each of these elements of

growth has been approached in a diligent manner to ensure that the

investment management contracts acquired and funds launched are in

line with the Company's stated strategy to operate in alternative

and illiquid assets classes, which aim to generate superior returns

for clients and shareholders over the longer term.

Results

The Group has reduced its adjusted operating loss to GBP1.6

million in the year from a GBP3.1 million loss last year,

demonstrating great progress on the journey towards profitability.

We continue to build the Group from a solid balance sheet and have

the ability to approach opportunities from a strong position.

This performance is notable against a background of difficult

economic and political conditions during 2016, following Britain's

vote to leave the European Union in June and the US election

results in November. The weakening of sterling and slow growth

prospects for markets in general has impacted many companies. We

are still operating in uncertain times, however the Board is keen

to ensure that the business continues to be managed in a risk

focussed manner. We are not materially exposed to foreign currency

movements or interest rates and are using the current conditions to

ensure that we continue to invest in the value driven areas of the

market.

The management team

We have experienced some changes at the Board level in the year

and I would like to take this opportunity to thank Michael Phillips

on behalf of shareholders and the Board for his efforts in building

Gresham House and his important role in the early stages of the

Company's development. Mike stepped down from his role as Strategic

Development Director at the end of the year to focus on his other

business interests.

Shareholders will recall that we announced on 19 April 2016 that

Kevin Acton would be joining us as Finance Director. Kevin took up

his position on 6 June 2016 and very much hit the ground running;

he has been a very valuable addition to the team and it has been a

great pleasure working with him since then.

The Gresham House team has grown in the year to match the

management's ambitions and provide a sound infrastructure to

support the new funds launched and the investment management

contracts acquired. The hard work and dedication of the whole team

has driven the business to where it is today and I believe that we

have the right people in place to continue to deliver against our

strategic goals.

Shareholders

I am also pleased to welcome a number of new, long-term

strategic shareholders to our share register in the year. Our

supportive shareholder base has enabled the Company to use its

balance sheet to develop to date and we are excited about the

prospect of continuing to grow the business with this solid support

behind us.

The announcement on 21 February 2017 and issuance of ordinary

shares to the Royal County of Berkshire Pension Fund ("Berkshire"),

highlight that Gresham House is building its name as an established

specialist asset manager and becoming attractive to a wider

audience of investors. We also look forward to working with

Berkshire as the cornerstone investor in our new Gresham House

British Strategic Investment Fund, in which we are already getting

interest from local authority pension funds.

Annual General Meeting

Our Annual General Meeting this year is being held at 11.00am on

18 May 2017 at Travers Smith, 10 Snow Hill, London, EC1A 2AL. Given

how much has happened during the year and subsequently the Board

would encourage shareholders to attend and hear directly from the

management team on the progress to date. I therefore hope to see as

many of you as possible there.

Outlook

Overall it has been a very productive year for the Company and

we have the ambition to deliver further growth in 2017. We will

continue to harness our existing relationships and grow the

business in line with our stated strategy and I look forward to

updating you with further progress later in the year.

Anthony Townsend

Chairman

27 March 2017

Chief Executive's Statement

It has been a further year of significant development for the

Group. Having firmly established Gresham House as a specialist

asset manager focused on alternative and illiquid assets we have

made progress on our journey to scale the business. This was a key

objective we set out at the beginning of last year. We continue to

focus on addressing the demand for long-term alternative investment

strategies and providing alternatives asset management solutions to

institutions, family offices, charities and endowments. We are

delivering against our stated strategy of growing the business

organically and through acquisitions that enhance the platform. The

Gresham House brand is gaining increased recognition from investors

and the market as a result.

Building on the solid foundations we have established for a

long-term sustainable and successful group, the management team

continues to focus on the three pillars of "Platform, Process and

People".

The Gresham House Platform

The demand for illiquid assets is increasing and so too are the

opportunities for Gresham House. We have formed a scalable platform

to offer a range of alternative investment products through our two

specialist divisions: Strategic Equity covering public and private

equity and Real Assets. This has resulted in significant growth of

50% in Assets Under Management ("AUM") to GBP363 million in the

year to 31 December 2016 (2015: GBP242 million).

Growing AUM and thereby sustainable management fees including

associated performance fees or carried interest is critical to the

Group's success. The growth in AUM during the year has increased

revenues by over 200% to GBP4.3 million (2015: GBP1.4 million). The

annualised management fees for the funds being managed at the end

of December 2016 is GBP3.9 million from zero at the beginning of

our journey in December 2014.

The Strategic Equity division has continued to develop and the

team now manages three funds. Gresham House Asset Management

Limited ("GHAM") was awarded the mandate in August 2015 to manage

Gresham House Strategic plc ("GHS"), the AIM quoted company

investing and actively engaging with management teams of

undervalued smaller UK public companies. Subsequent to this, in

August 2016 we launched the Gresham House Strategic Public Equity

Fund LP ("SPE LP") with GBP24 million committed capital and

co-investment. Following shareholder approval, GHAM was also

appointed as investment manager to LMS Capital plc ("LMS") in

August 2016, the London Stock Exchange listed private equity

company with a Net Asset Value ("NAV") of GBP68 million at 31

December 2016.

The Real Assets division, currently comprising Gresham House

Forestry Limited (formerly Aitchesse Limited), the specialist asset

manager of UK commercial forestry, accounted for AUM of GBP247

million at the end of the year (2015: GBP205 million). The first

close of the Gresham House Forestry Fund LP ("GHF LP") was in

October 2016 and the subsequent purchase of a portfolio of six

forests in West Scotland added GBP15 million to AUM in the year. We

have also seen promising growth in the value of forests managed by

Gresham House, making up the remaining GBP232 million of AUM.

The importance of technology in the daily lives of individuals

is increasingly significant within asset management. Gresham House

has identified an opportunity to materially enhance the client

service proposition and create value through utilising digital

platforms. We are therefore pleased to have recently added a new

strategic objective to our development plan based around a new

addition to our team, Andy Hampshire, who has joined us as Chief

Technology Officer from Lloyds Development Capital. Andy has been

tasked with creating value through developing a client platform to

provide a high-quality service for investors that facilitates

co-investment opportunities.

The Gresham House Process

To continue to build a successful business and meet client

expectations, we have robust processes in place that require us to

maintain exceptionally high standards in delivering sustainable

value creation over the long term. Our view is that the investment

discipline needed to manage funds is also required to manage the

Group and as significant shareholders ourselves, the management

team is focused on value creation for all shareholders over the

long-term. The Investment Committee adds to this discipline and

provides external challenge and an independent industry expert view

to ensure that potential acquisitions or capital allocation

considered by the management team exceed Group hurdles.

We have drawn on the Investment Committee's experience in the

year and are benefitting from the acquisitions that we have made to

date. All of these are meeting or performing ahead of the Group's

investment return requirement to deliver long-term return on

capital of 15%.

Process is also essential to integrating new businesses into the

Gresham House family. The integration and rebrand of Gresham House

Forestry was completed in the year, with the forestry team now

fully embedded in the Group. The transition for LMS from

self-managed to an externally managed company is progressing well

and we continue to work closely with the board of LMS and increase

our direct interaction and engagement with LMS' portfolio

companies. This has included members of the GHAM team joining

investee company boards.

The Gresham House People

Gresham House is a people business and behind the platform and

process we have built a strong and dedicated team supporting a

culture built on long-term shareholder value, alignment and

teamwork.

As mentioned in our Interim Results announcement on 28 September

2016, over the year, we made several key hires within the senior

management team, a number of whom have previously worked with

existing members of the Gresham House team.

Kevin Acton joined as Finance Director and John-Paul Preston as

Chief Operating Officer in 2016, both adding to the strength of the

senior management team.

The specialist investment teams have also been enhanced with the

addition of several significant appointments. Richard Davidson

joined as the Chairman of the Investment Committee of the forestry

business and Pardip Khroud was appointed as an Investment Director

in the Strategic Equity division. Nick Friedlos and Tony Sweet have

also joined as Investment Directors, following the appointment of

GHAM as investment manager to LMS.

As set out above, Andy Hampshire also joined us as our Chief

Technology Officer in February 2017.

I would like to thank Mike Phillips for his contribution to

establishing the initial foundations of Gresham House. Mike stepped

down from his role as Strategic Development Director at the end of

the year.

Outlook

Gresham House is well positioned to offer a range of specialist

products to address the increasing demand in the alternative

market.

The Company has developed significantly under the new management

team in a relatively short two year period and momentum is driving

us into the coming year. Long-term shareholder value creation

continues to be at the forefront of the Board's strategic

focus.

Growth in AUM to generate sustainable profit growth remains a

priority and we are pleased with the developments to date, as shown

by the 50% AUM growth in 2016, which gives us greater visibility on

near-term profitability.

We continue to work on a number of initiatives for both organic

and acquisition growth. The recently announced Gresham House

British Strategic Investment Fund, with the Royal County of

Berkshire Pension Fund ("Berkshire") acting as a cornerstone

investor, is a good example of the Group's ambition to innovate and

grow. This new platform for the Group aims to provide solutions to

pension schemes and endowments who want to access smaller niche

alternative investments with longer term investment horizons in a

more engaged and cost efficient manner.

The ambition of the Group has also been recognised externally

with a number of new strategic long-term investors becoming

shareholders, including LMS in the year and recently Berkshire in

March 2017. This helps to create a supportive and long term

investor base from which to grow the business. We are also pleased

that the Gresham House Forestry acquisition is achieving the

Group's intended long term hurdles of 15%.

We aim to close both the SPE LP and GHF LP funds in the second

half of 2017 alongside managing both GHS and LMS portfolios to

achieve their target returns for their respective shareholders.

There is also a renewed focus on realising value from the legacy

portfolio, with both the Southern Gateway site and the remaining

land at Newton-le-Willows entering marketing processes.

As we have grown the team alongside AUM we have also reviewed

our London office needs. In February 2017, the London office moved

to flexible office space at Octagon Point near St Paul's in London,

with sufficient space to foreseeably accommodate the team for the

next 18 month's development.

2017 strategic initiatives aim to achieve operating

profitability in the near-term with a focus on achieving attractive

operating margins in the medium term. We have a strong balance

sheet with longer term asset management contracts, and we are

growing additional value through balance sheet carried interests in

the asset management products we manage.

We have a busy year ahead of us and I am confident that we have

the right team in place to achieve our goals including growing the

brand and client satisfaction. These initiatives alongside an

aligned and capable management team are supporting the execution of

the growth vision, with the near term aim of achieving

profitability.

Anthony Dalwood

Chief Executive Officer

27 March 2017

Financial Review

Financial performance for the year ended 31 December 2016

2016 2015

GBP'000 GBP'000

Income 4,264 1,358

-------- --------

Property outgoings (290) (339)

Administration overheads (excluding

amortisation and depreciation) (5,459) (2,700)

Finance costs (442) (144)

Gains/(losses) on investments/property

and associates 342 (1,229)

Adjusted operating loss (1,585) (3,054)

-------- --------

Amortisation and depreciation (1,433) (4)

Movement in fair value of deferred

receivable/contingent consideration (51) -

Exceptional items - (773)

-------- --------

Net operating loss after exceptional

items (3,069) (3,831)

-------- --------

The Group's operating loss after exceptional items has decreased

to GBP3,069k from GBP3,831k in the prior year. To measure the

Group's performance, we focus on the trading profits, which is

defined as the adjusted operating loss. The adjusted operating loss

for the year to 31 December 2016 has reduced to GBP1,585k from

GBP3,054k a year earlier. This non-GAAP measure reflects the

Group's improved trading performance before the deduction of

amortisation, depreciation, the fair value movement in contingent

consideration and deferred receivable and exceptional items in the

year. There has been a substantial improvement in income generated,

primarily driven by AUM growth throughout the year. The cost base

has also increased as the business has scaled and the right

infrastructure and team are put in place. It should be noted that

the balance sheet improvement in the period, from the gains on

investments/property, are primarily driven by the share of profits

recognised by the Group from its holding in GHS at GBP628k.

The net operating loss after exceptional items of GBP3,069k

(2015: GBP3,831k) includes the deduction of amortisation and

depreciation of GBP1,433k (2015: GBP4k), the increase in the fair

value of the contingent consideration for Gresham House Forestry of

GBP253k (2015: nil), the fair value movement in deferred receivable

from Persimmon on the sale of Newton-le-Willows of GBP202k (2015:

nil) and no exception items (2015: GBP773k).

Income

2016 2015

GBP'000 GBP'000

Asset management income 3,202 333

Rental income 741 746

Dividend and investment

income 249 228

Other income 72 51

-------- --------

Total income 4,264 1,358

-------- --------

Asset management income

In line with the growth in AUM outlined in the Chief Executive's

Report there has been a substantial increase in asset management

fee income to GBP3,202k in the year to 31 December 2016 (2015:

GBP333k). This was the result of new funds being launched and

investment management contracts acquired as part of Gresham House's

development as a specialist asset manager. The annualised asset

management fee income for funds managed as at 31 December 2016 is

GBP3.9 million.

The Real Assets division delivered income from the forestry

business of GBP2,120k in the year (2015: GBP206k related to six

weeks' income). This is the first full year of the forestry

business being part of the Group and also recognises the launch of

GHF LP in October 2016, which generated management fee and

transaction fee income of GBP249k.

Strategic Equity earned fees from all three of the funds managed

by the division, totalling GBP1,082k in the year (2015: GBP127k).

The Group earned management fee income of GBP542k from its contract

with GHS, reflecting NAV growth and a full year of management

services (2015: GBP127k). SPE LP, the sister fund to GHS, had its

first close on 15 August 2016 and subsequently the Group earned

GBP61k of management fees in the later part of 2016. The LMS

management contract was awarded on 16 August 2016 and delivered

management and transition fee income in the year of GBP479k.

Rental income

The legacy property portfolio includes the Southern Gateway site

and the remaining land at Newton-le-Willows, which generated

GBP741k in the year (2015: GBP747k). Southern Gateway rental income

was GBP724k (2015: GBP738k), representing improvements in rent from

a number of tenants being offset by a vacant period of six months.

The vacant area of the site has since been let at a premium to its

original rent.

Dividend and investment income

Dividend and investment income of GBP249k (2015: GBP228k) mainly

represents interest earned on the Attila loan of GBP238k, which was

earned and paid in the period (2015: GBP95k).

Property outgoings

The cost of managing the legacy property portfolio has reduced

to GBP290k in 2016 (2015: GBP339k) as we rationalised the use of

external consultants on the site and focused on readying the site

for sale.

Administrative overheads

Administrative overheads excluding amortisation, depreciation

and the fair value movement in contingent consideration payable and

deferred receivable have grown to GBP5,459k in the year (2015:

GBP2,700k). The development and transformation of Gresham House to

a specialist asset manager has required investment in people and

infrastructure to grow AUM. The increase of GBP2,759k is primarily

driven by the growth of the business and costs relating to people,

office and also recognising the first full year of the forestry

business.

The Gresham House team has grown from 23 to 26 at the end of

2016 as we put in place the right support and investment team to

deliver the ambitious growth plan. The Gresham House Forestry team

has remained consistent with a team of eleven people throughout the

year and the growth in headcount has therefore been in the Group

and Strategic Equity teams, with key hires including the Finance

Director, Chief Operating Officer and Investment Directors. People

costs have consequently increased by GBP1,925k from GBP1,760k to

GBP3,685k at the end of 2016. It should be noted that a cost

reduction exercise has been identified including synergies, and is

in the process of being implemented.

Office costs have also increased as the business has scaled.

Early in 2016 the London office moved to flexible office space at

Cheapside in London as an interim step to accommodate the increase

in headcount and activity, which contributed to office costs of

GBP307k (2015: GBP131k).

This is the first full year of owning Gresham House Forestry

Limited and the administrative overheads from the business of

GBP441k are now included in the Group income statement (2015:

GBP32k).

Finance costs

In April 2016, the group refinanced the existing Co-operative

bank facility of GBP2.85 million with a new Kleinwort Benson Bank

facility of GBP7.0 million. The finance costs associated with both

of these loans over the year was GBP442k (2015: GBP144k). Further

details of the Kleinwort Benson Bank facility are included in the

borrowings section of this Financial Review.

Gains/(losses) on investments

2016 2015

GBP'000 GBP'000

Share of associates' profits 628 -

Gains/(losses) on investments

held at fair value (147) (485)

Fair value movement on investment

properties (242) (586)

Profit/(loss) on disposal

of investment properties 103 (158)

Total gains/(losses) on

investments 342 (1,229)

The gains/(losses) on investments table above represents the

investment that the Group has made in the funds that it manages as

well as the legacy investments in property and securities.

The share of associates' profits relates to the 19.2% holding

that the Group has in GHS. The last results announcement from GHS

was on 25 November 2016 for the six month period to 30 September

2016. Under associate accounting, the Group has therefore

recognised its share of the profits in the period of GBP628k.

The fair value movement on investments reflects the Group's

co-investment with SPE LP in IMI Mobile, which reduced in value by

GBP113k in the period to 31 December 2016.

The capital expenditure at Southern Gateway has been offset by

slower general market conditions and therefore although the

valuation increased by GBP100k a value decrease of GBP242k was

noted in the year (2015: GBP586k decrease).

The Group did however receive an overage payment of GBP103k in

the year relating to the sale of the Vincent Lane site in 2013 as a

result of housing sales in excess of the sale and purchase

agreement.

Amortisation and depreciation

The acquisition of Aitchesse Limited (now Gresham House Forestry

Limited) in November 2015 and the LMS investment management

contract in August 2016 requires the recognition of goodwill and

other intangible assets. In line with the Group's accounting

policies, the intangible assets are amortised over their useful

lives. This is the first full year over which the intangible assets

are being amortised, with GBP1,364k being recognised as

amortisation.

Depreciation of GBP69k in the year (2015: GBP4k) has a lesser

impact on the Group's income statement and relates primarily to

motor vehicles used by the forestry business.

Fair value movement in deferred receivable and contingent

consideration

Persimmon purchased the Newton-le-Willows site in September 2015

and agreed a schedule of payments to the Group with annual

instalments up until 22 March 2019. The deferred receivable is

initially recognised at fair value and the GBP202k movement in the

fair value in the year represents the reduction in time to payment,

in line with International Financial Reporting Standards. Further

details of the repayment profile are included in note 14 to the

financial statements.

The fair value movement in the contingent consideration payable

to the sellers of Aitchesse has increased by GBP253k in the year as

there is less impact from the discount applied over time. Further

details are in the following section.

Exceptional items

There were no exceptional items in the year compared to GBP773k

in 2015. The 2015 exceptional items related to the re-admission to

AIM and the acquisition of Aitchesse.

Financial position

2016 2015

GBP'000 GBP'000

Assets

Investments* 8,873 7,470

Property 10,000 9,900

Deferred receivable - Persimmon 5,180 5,916

Cash 2,802 4,390

------------ ----------

Tangible/realisable

assets 26,855 27,676

Intangible assets 6,630 6,588

Other assets 2,037 1,559

------------ ----------

Total assets 35,522 35,823

Liabilities

Borrowing 5,896 2,850

Contingent consideration 3,237 2,726

Other creditors 2,256 4,421

------------ ----------

11,389 9,997

Net assets 24,133 25,826

============ ==========

*IFRS requires the consolidation of the Gresham House Forestry

Friends and Family Fund LP. This has been adjusted here for the

GBP491k non-controlling interest to show the Group's position on an

investment basis.

Tangible/realisable assets

The above highlights the strong balance sheet position that the

Group has at the end of 2016. The tangible/realisable assets

supporting this total GBP26.9 million (2015: GBP27.7 million),

comprising investments, property, accrued income receivable from

Persimmon on the sale of the Newton-le-Willows site and cash.

Investments

Investments include the value of the Group's holding at the end

of the year in GHF LP of GBP1.2 million, co-investment in SPE LP of

GBP468k and the Group's associate holding in GHS of GBP6.5 million

(2015: GBP5.9 million). The remaining balance of GBP675k related to

the legacy portfolio at the end of 2016. Good progress has been

made in the year with realisations of GBP918k to 31 December 2016

from an opening value at the beginning of the year of

GBP1,568k.

Property

The value of the property portfolio of Southern Gateway GBP7.75

million (2015: GBP7.65 million) and the remaining land at

Newton-le-Willows GBP2.25 million (2015: GBP2.25 million) have both

been valued independently at the end of the year. Both are now in

active sales processes and we envisage selling these properties in

the coming year.

Deferred receivable - Persimmon

The Persimmon deferred receivable relates to the instalments

that are due from Persimmon annually up to 22 March 2019. In the

year GBP0.9 million was paid early by Persimmon as a result of

selling houses quicker than expected. The next instalment due on 22

March 2017 has therefore been reduced by this amount, and a further

GBP0.1 million received early in January 2017, to GBP1.0 million.

The deferred receivable have been fair valued as this was

designated at fair value through profit or loss at inception.

Intangible assets

Intangible assets of GBP6.6 million (2015: GBP6.6 million)

relate to the Aitchesse Limited (now Gresham House Forestry

Limited) acquisition and the LMS management contract award. The

intangible assets recognised at the end of the year for Aitchesse

of goodwill, management contracts and customer relationships

totalled GBP5.5 million. The performance of the business has

supported the goodwill recognised and the management contract and

customer relationships have been amortised in line with their

expected useful lives.

The LMS contract has been recognised at a fair value of GBP1.4

million at acquisition, including acquisition costs, in August 2016

and amortised over three years, reducing to GBP1.2 million as at 31

December 2016.

Borrowing

In April 2016 the Group refinanced the loan that was in place

with the Co-operative Bank (GBP2.85 million), which was secured on

the property portfolio. A new facility with Kleinwort Benson Bank

Limited was agreed to lend the Group GBP7.0 million with security

over the Group's property portfolio as well as deferred receivable

due from Persimmon. The facility is repayable over three years,

matching the deferred receivable settlement by Persimmon. Interest

is charged at LIBOR plus 4.5%.

Contingent consideration

The contingent consideration payable to the original owners of

Aitchesse requires EBITDA generation by the Aitchesse business of

between GBP1.7 million and GBP3.5 million in the period from 1 July

2015 to 28 February 2018. The current assessment is that the

maximum EBITDA is expected to be achieved, with the Group incurring

a full deferred consideration, which after discounting indicates a

fair value of GBP3.0 million (2015: GBP2.7 million).

The remaining GBP258k relates to the fair value of the second

tranche payment due to LMS for the management contract in August

2018.

Kevin Acton

Finance Director

27 March 2017

Strategic Report

This report has been prepared by the Directors in accordance

with the requirements under section 414 of the Companies Act 2006.

The purpose of this report is to inform shareholders about how the

Group fared during the year ended 31 December 2016.

Short forms and abbreviations are defined above in the

Chairman's and Chief Executive's Reports.

Strategic objective

Gresham House is a specialist asset manager focussed on

alternative and illiquid asset classes, aiming to generate superior

returns for clients and shareholders over the longer term.

Shareholder value creation will be driven by long-term growth in

earnings as a result of increasing AUM and returns from invested

capital.

Gresham House currently manages investments and co-investments

through its investment management platform on behalf of

institutions, family offices, charities and endowments and private

individuals.

Gresham House's strategy is to grow AUM organically and through

appropriate acquisitions, using its balance sheet to acquire

businesses, attract talent, seed new funds and create new divisions

with the aim of creating a sustainable and profitable business

together with carried interest and performance fees.

Business model

The Group's business model as a specialist asset manager focuses

on alternative investment strategies in illiquid assets over

long-term horizons and clear alignment between shareholders and the

management team.

Specialist asset management vehicle

Gresham House, with its FCA regulated subsidiary Gresham House

Asset Management Limited, provides investors with the opportunity

to access a London Stock Exchange listed vehicle and so benefit

from the sustainable management fees earned from its specialist

asset management business. An experienced team with strong track

records in their respective specialist sectors lead the

business.

Alignment

Alignment with shareholders is critical to delivering value. The

management team and close advisors ensure alignment by directly

owning 5% of the business and the wider team is motivated to grow

the value of Gresham House plc through long-term incentive schemes.

It is also important for Gresham House to be aligned with the

investors in the funds that it manages and therefore the Group

typically holds a stake in these funds. This approach when combined

with the talent at Gresham House and the development of a

best-in-class client technology platform will allow Gresham House

to deliver value to its shareholders and clients alike.

Developing asset classes

The Strategic Equity and Real Assets divisions currently house a

number of funds that have either been launched organically or been

acquired through existing businesses and management contracts. The

Group will continue to develop the business by growing AUM through

the purchase of existing companies, the raising of new funds and

from sustainable management fee income from the two current

divisions and any subsequent divisions that are yet to be

established.

Key performance indicators

The key indicators of performance relevant for the Group are the

trading profits of the investment management business, measured

through the adjusted operating profit metric and AUM.

In the year to 31 December 2016 the adjusted operating loss had

reduced to GBP1,585k (2015: GBP3,054k) and included net gains

totalling GBP342k from associates, losses from investments and

(2015: GBP1,229k losses).

AUM grew to GBP363 million by the end of the year (2015: GBP242

million), further detail is included in the business review

below.

Business review

Assets under Management

The AUM of the Group has grown by over 50% in the year to GBP363

million at 31 December 2016 (2015: GBP242 million).

Growth in AUM has been both organic, through the raising of SPE

LP (GBP24 million committed and co-investment) and GHF LP (GBP15

million), as well as acquisition, with the award of the LMS

investment management contract (GBP68 million).

Real Assets - "Uncorrelated with traditional asset classes"

The Group's Real Assets division was established with the

acquisition of Aitchesse Limited (now Gresham House Forestry

Limited) in November 2015. The Real Assets division targets asset

classes that are uncorrelated with traditional debt and equity

classes and forestry is a great example of this. Forestry is a

physical asset that generates income, provides inflation protection

and is unaffected by the performance of financial markets, since

trees continue to grow irrespective of the economic environment

Gresham House Forestry is a specialist asset manager that

manages over 30,000 hectares of UK commercial forestry on behalf of

endowments, family offices, limited partnerships and high-net-worth

investors. The forestry business has completed its first full year

of results since the acquisition and is now integrated with the

Gresham House business. The figures below demonstrate that it has

experienced good growth in the year to 31 December 2016.

The forestry business' 20% growth in AUM in the year to

GBP247million (2015: GBP205 million) was driven by the increase in

value of the existing forests managed by the team, combined with

new forest acquisitions and the launch of the Gresham House

Forestry Fund LP ("GHF LP") on 31 October 2016.

GHF LP targets net returns of 10% per annum, with expected

annual distribution of 2% to 4% from timber sales. GHF LP had its

first close with GBP15 million of commitments and finance raised,

which included GBP1.25 million from Gresham House. GHF LP has

subsequently invested in six forests at a price of GBP12.3 million

as at 31 December 2016 and is targeting a final close in the second

half of 2017 at a size of GBP50 million.

Market conditions for Forestry continue to be favorable with GBP

remaining weak and timber prices high. The UK timber harvest

accounts for only 25% of the 60 million tonnes of timber used each

year in the UK. Imports are therefore a key part of the timber

industry in the UK. A large portion of these imports come from

Scandinavia and a weak GBP against the Swedish Krone makes imported

timber more expensive, benefiting the UK forestry market. The UK

government has also renewed its commitment to house building and

with the timber content of new houses continuing to rise, this is

further positive news for UK forestry.

While timber prices are back to their 2014 highs, fuel prices

are not. This dynamic has had a positive impact on UK forestry

returns since the costs of harvesting and haulage are considerable

and are significantly affected by the price of fuel.

Strategic Equity - "Bridging public and private markets"

The Strategic Equity division focuses on inefficient areas of

public and private markets to capture value over the long-term.

This division covers both public market and private equity

investment opportunities.

Gresham House applies its Strategic Equity approach to small

public and private companies in the UK that are typically below

GBP100m in size, generate healthy cash flows and produce good

return on capital, but have been overlooked by the market,

so-called "value stocks".

Given the current economic backdrop and political uncertainty we

believe the UK market is expensive relative to historic ranges with

the valuation of companies within the FTSE All-Share Index, as a

multiple of prospective earnings, trading close to 10 year

highs.

It is also clear that much of the uplift in company valuations

in the UK over the last 12 months has been down to market

re-rating, and then dividend pay-out rather than supported by

earnings growth.

Gresham House Asset Management flagged this concern at the

beginning of 2016 in its H1 2016 Investment Perspectives

publication titled "Alpha generation from investing in value

companies" that highlighted that while value stocks generally

remain overlooked we are beginning to see a rotation away from

growth and momentum stocks that are highly priced and into value.

Earlier this year GHAM published its H1 2017 perspectives flagging

the attractions of smaller companies that tend to be valued

significantly below their larger peers, reiterating that within

that opportunity set, those stocks with value characteristics offer

significant scope to generate superior returns over the

long-term.

Investment in smaller, value stocks requires a considerably

higher level of engagement with investee company stakeholders.

First, in order to identify market pricing inefficiencies, and

catalysts for value creation, and then to support a clear strategic

plan to create equity value over the long term (3-5 years) thereby

targeting above market returns.

The Strategic Equity division provides access to this investment

strategy through three vehicles, Gresham House Strategic plc

("GHS") and Gresham House Strategic Public Equity LP ("SPE LP"),

both of which primarily target public markets, and LMS Capital plc

("LMS"), which targets direct private equity in the UK.

Gresham House Strategic plc

GHS was the first investment mandate awarded to GHAM in August

2015 and the Group holds a 19.2% interest in GHS creating alignment

between the two.

The existing GHS portfolio managed by GHAM continues to perform

well with low volatility in difficult macro-economic and

geo-political conditions. NAV growth to 31 December 2016 was 6%

since GHAM's appointment on 14 August 2015. A resilient performance

relative to the FTSE Small-Cap Index (excluding investment trusts)

, which also grew by 7% over the same period. Through buying GHS

shares which currently trade at a 25% discount to the NAV per

share, investors gain exposure to a portfolio of eight companies

that are attractively valued at c.6x EV/EBITDA (stripping out cash

from the portfolio) and growing earnings in excess of 30%*

*Using the latest corporate broker forecasts for the underlying

portfolio companies and stripping out the cash position in the

company. Gresham House EV is based on the market capitalisation and

cash position as at 20 March 2017, the latest data available.

Gresham House Strategic Public Equity LP

SPE LP held its first close on 15 August 2016 with commitments

and co-investment agreements of GBP24 million and is targeting a

final close in the second half of 2017. SPE LP is a sister fund to

GHS and will invest and divest alongside, utilising the same

investment committee and investment team. Gresham House has entered

into a co-investment agreement with SPE LP and has committed to an

amount of GBP1.5 million.

LMS Capital plc

GHAM was appointed as the investment manager of LMS in August

2016. Over the past seven months there has been significant

progress in the transition to external management and the

generation of targeted annualised cost savings for LMS. Through

this period, members of the investment team have actively engaged

with underlying portfolio companies.

LMS is listed on the main market of the London Stock Exchange.

It has a private equity portfolio that includes small to medium

sized private and public companies in the consumer, energy and

business services sectors, with investments held both directly and

indirectly through third party investment funds. LMS had been

undergoing a realisation programme ahead of GHAM's appointment in

August 2016 and the adoption of a new investment policy focused

predominantly on private equity investment. As the manager, GHAM

will aim to achieve shareholder objectives through a staged

approach.

The mandate to manage LMS involves maximising long-term value.

This includes appropriate realisations of the existing portfolio

and returning a further GBP11 million to shareholders alongside

reinvestment in direct private equity investments in the UK in the

longer term and focusing on options to scale LMS thereafter.

Gresham House paid a first tranche consideration of GBP1 million

in Gresham House plc ordinary shares for the management contract in

August 2016, with a second tranche amount of up to GBP1.25 million

being payable in two years' time. The second tranche is payable on

a sliding scale from zero to GBP1.25 million when the NAV in two

years' time is between GBP67.5 million and GBP85 million. The

investment management contract is for a minimum term of three

years. Management fees of 1.5% per annum are earned on the average

annual NAV of LMS of up to GBP100 million, 1.25% where NAV is

greater than GBP100 million but lower than GBP150 million and 1.0%

where NAV is greater than GBP150 million. Performance fees of 15%

will be payable where new investments have had cumulative compound

growth in excess of 8% per annum, with the first measurement being

the period to 31 December 2017. No new investments have been made

in the period to 31 December 2016.

LMS announced its annual results for the year to 31 December

2016 on 14 March 2017 and the positive foreign currency impact of

the US dollar from LMS' US portfolio has been offset by weak

trading performance in some of LMS' portfolio companies. As such,

the year-end NAV was reduced to GBP68 million.

GHAM has engaged with portfolio companies and is working with

the management teams to identify catalysts for growth, to drive

long-term value creation and to reverse the disappointing portfolio

performance in 2016. As stated above the company has committed to

return up to GBP11 million to LMS shareholders from realisations of

the existing portfolio and is focused on progressing and initiating

sale processes for certain holdings. Alongside any return to

shareholders we will look to reinvest in direct private equity

opportunities at the smaller end of the market, leveraging the

expertise and experience of our investment team and new investment

committee.

Legacy portfolio

The orderly disposal of the legacy portfolio has been ongoing in

the year to 31 December 2016. The majority of the legacy portfolio

relates to property, namely the Southern Gateway site and the

remaining land at Newton-le-Willows, with a combined gross value of

GBP10 million as at 31 December 2016 (2015: GBP9.9 million).

Southern Gateway

The Southern Gateway site is approximately 370,000 square feet

of mixed commercial and warehouse property in Speke, Liverpool and

is now in an active marketing process. During the year a number of

initiatives have been implemented to improve the value of the site

in preparation for sale. The current gross valuation of GBP7.75

million (2015: GBP7.65 million) has been assessed by an independent

valuer and factors in the improvement initiatives as well as the

general market conditions, which have been felt in the property

market since the Brexit vote in the summer. We have entered a

process to realise value in the short-term.

Newton-le-Willows

The majority of the Newton-le-Willows site was sold to Persimmon

Homes in September 2015 for housing development. We have since been

working on preparing the remaining land at Newton-le-Willows for

sale and have recently applied for planning permission to build 82

homes. The valuation as at 31 December 2016 for the land is GBP2.25

million (2015: GBP2.25 million) as assessed by an independent

valuer. The land is now in an active sales process and we are also

aiming to realise value in the short-term.

Remaining securities

We have made good progress in disposing of the legacy security

portfolio, realising GBP918k in the year. We continue to seek value

as we dispose of these assets and focus on the current business as

a specialist asset manager.

Financial Tables

Group Statement of Comprehensive Income

FOR THE YEARED 31 DECEMBER 2016

2016 2015

Notes

GBP'000 GBP'000

Income 1

Asset management income 3,202 333

Rental income 741 746

Dividend and interest income 249 228

Other operating income 72 51

--------- ---------

Total income 4,264 1,358

Operating costs 3

Property outgoings (290) (339)

Administrative overheads (6,892) (2,704)

Net operating loss before exceptional items (2,918) (1,685)

Finance costs 6 (442) (144)

Exceptional items * - (773)

--------- ---------

Net operating loss after exceptional items (3,360) (2,602)

Gains and losses on investments:

Share of associate's profit 16 628 -

Movement in fair value of investment property 11 (139) (744)

Gains and (losses) on investments held at fair value 10 (147) (485)

Movement in fair value of contingent consideration (253) -

Movement in fair value of deferred receivable 202 -

Operating loss before taxation (3,069) (3,831)

Taxation 7 33 -

---------

Total comprehensive income (3,036) (3,831)

========= =========

Attributable to:

Equity holders of the parent (3,027) (3,807)

Non-controlling interest (9) (24)

--------- ---------

(3,036) (3,831)

========= =========

Basic and diluted loss per ordinary share (pence) 8 (30.3) (40.5)

========= =========

* Exceptional items in 2015 relate to professional fees incurred

in respect of the re-admission to AIM and the acquisition of

Aitchesse Limited which took place on 23 November 2015 and on the

reorganisation of the Group's legacy subsidiaries.

Statements of Changes in Equity

Group

YEARED 31 DECEMBER 2016

Equity

Ordinary Share attributable

share Share warrant Retained to equity Non-controlling Total

Notes capital premium reserve reserves share-holders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December

2015 2,463 1,688 64 21,611 25,826 - 25,826

Comprehensive income for

the year

Loss for the year - - - (3,027) (3,027) (9) (3,036)

--------- --------- --------- ---------- --------------- ---------------- --------

Total comprehensive

income

for the year - - - (3,027) (3,027) (9) (3,036)

Contributions by

and distributions

to owners - - - - - - -

Non controlling

interest in Gresham

House Friends &

Family Fund LP - - - - - 500 500

Share warrants

issued 25 - - 255 - 255 - 255

Share based payments 26 - - - 73 73 - 73

Issue of shares 24 83 923 - - 1,006 - 1,006

--------- --------- --------- ---------- --------------- ---------------- --------

Total contributions

by and

distributions

to owners 83 923 255 73 1,334 500 1,834

--------- --------- --------- ---------- --------------- ---------------- --------

Balance at 31

December

2016 2,546 2,611 319 18,657 24,133 491 24,624

========= ========= ========= ========== =============== ================ ========

YEARED 31 DECEMBER 2015

Equity

Ordinary Share attributable

share Share warrant Retained to equity Non-controlling Total

Notes capital premium reserve reserves share-holders interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December

2014 2,336 12,508 64 12,934 27,842 - 27,842

Comprehensive income for

the year

Loss for the year - - - (3,807) (3,807) (24) (3,831)

--------- --------- --------- ---------- --------------- ---------------- --------

Total comprehensive

income for the year - - - (3,807) (3,807) (24) (3,831)

Contributions by

and distributions

to owners

Transfer of

non-controlling

interest deficit - - - (24) (24) 24 -

Issue of shares 24 127 1,688 - - 1,815 - 1,815

Cancellation of

share premium 27 - (12,508) - 12,508 - - -

--------- --------- --------- ---------- --------------- ---------------- --------

Total contributions

by and

distributions

to owners 127 (10,820) - 12,484 1,791 24 1,815

--------- --------- --------- ---------- --------------- ---------------- --------

Balance at 31

December

2015 2,463 1,688 64 21,611 25,826 - 25,826

========= ========= ========= ========== =============== ================ ========

Company

YEARED 31 DECEMBER 2016

Ordinary Share

share Share warrant Retained Total

Notes capital premium reserve reserves equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2015 2,463 1,688 64 16,939 21,154

Comprehensive income for the year

Loss for the year - - - (786) (786)

--------- --------- --------- ---------- --------

Total comprehensive income for the year - - - (786) (786)

Contributions by and distributions

to owners

Issue of shares 24 83 923 - - 1,006

Share warrants issued 25 - - 255 - 255

--------- --------- --------- ---------- --------

Total contributions by and distributions

to owners 83 923 255 - 1,261

Balance at 31 December 2016 2,546 2,611 319 16,153 21,629

========= ========= ========= ========== ========

YEARED 31 DECEMBER 2015

Ordinary Share

share Share warrant Retained Total

Notes capital premium reserve reserves equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2014 2,336 12,508 64 6,946 21,854

Comprehensive income for the year

Loss for the year - - - (2,515) (2,515)

--------- --------- --------- ---------- --------

Total comprehensive income for the year - - - (2,515) (2,515)

Contributions by and distributions

to owners

Issue of shares 24 127 1,688 - - 1,815

Cancellation of share premium 27 - (12,508) - 12,508 -

--------- --------- --------- ---------- --------

Total contributions by and distributions

to owners 127 (10,820) - 12,508 1,815

Balance at 31 December 2015 2,463 1,688 64 16,939 21,154

========= ========= ========= ========== ========

Statements of Financial Position

AS AT 31 DECEMBER 2016

Group Company

Notes 2016 2015 2016 2015

Assets GBP'000 GBP'000 GBP'000 GBP'000

Non current assets

Investments - securities 10 2,834 1,568 1,116 1,568

Investment property 11 - 9,559 - -

Tangible fixed assets 12 179 154 13 -

Investment in subsidiaries 15 - - 16,292 2,822

Investment in associate 16 6,530 5,902 - 5,902

Intangible assets 13 6,630 6,588 - -

Long-term receivables 14 4,095 5,916 - -

20,268 29,687 17,421 10,292

-------- ---------- -------- ---------

Current assets

Trade receivables 17 1,259 665 - -

Accrued income and prepaid expenses 917 1,081 219 383

Deferred receivable 14 1,139 - - -

Other current assets 18 - - 9,734 11,568

Cash and cash equivalents 2,802 4,390 858 372

Non-current assets held for sale

Property investments 11 9,628 - - -

-------- ---------- -------- ---------

Total current assets and non-current

assets held for sale 15,745 6,136 10,811 12,323

---------- -------- ---------

Total assets 36,013 35,823 28,232 22,615

-------- ---------- -------- ---------

Current liabilities

Trade and other payables 19 2,229 4,390 87 1,435

Short term borrowings 20 1,015 2,850 1,377 26

3,244 7,240 1,464 1,461

Total assets less current liabilities 32,769 28,583 26,768 21,154

Non-current liabilities

Deferred taxation 21 - - - -

Long term borrowings 22 4,881 - 4,881 -

Other creditors 23 3,264 2,757 258 -

-------- ---------- -------- ---------

8,145 2,757 5,139 -

Net assets 24,624 25,826 21,629 21,154

======== ========== ======== =========

Capital and reserves

Ordinary share capital 24 2,546 2,463 2,546 2,463

Share premium 27 2,611 1,688 2,611 1,688

Share warrant reserve 27 319 64 319 64

Retained reserves 27 18,657 21,611 16,153 16,939

Equity attributable to equity

shareholders 24,133 25,826 21,629 21,154

Non-controlling interest 27 491 - - -

Total equity 24,624 25,826 21,629 21,154

======== ========== ======== =========

Basic and diluted net asset value

per ordinary share (pence) 28 236.9 262.2 212.4 214.7

======== ========== ======== =========

The loss after tax for the Company for the year ended 31 December

2016 was GBP786,000. The financial statements were approved and

authorised for issue by the Board and were signed on its behalf

on 27 March 2017

Kevin Acton

Finance Director

Group Statement of Cash Flows

FOR THE YEARED 31 DECEMBER 2016

Notes 2016 2016 2015 2015

GBP'000 GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Dividend income received 7 48

Interest received 470 317

Rental income received 728 549

Other cash payments (4,542) (2,940)

-------- --------

Net cash utilised in

operations 29 (3,337) (2,026)

Corporation tax paid (204) -

Interest paid on loans (226) (175)

-------- --------

(430) (175)

-------- --------

Net cash flow from operating

activities (3,767) (2,201)

Cash flow from investing

activities

Acquisition of Aitchesse

Limited - (1,074)

Purchase of investments (1,831) (5,000)

Sale of investments 918 -

Sale of investment properties - 2,222

Deferred proceeds received 1,041 -

on sale of investment

properties

Expenditure on investment

properties (353) (329)

Purchase of fixed assets (125) (24)

Sale of fixed assets 37 15

Purchase of contracts (148) -

-------- --------

(461) (4,190)

Cash flow from financing

activities

Repayment of loans (4,454) (428)

Receipt of loans 6,833 -

Share issue proceeds 6 -

LMS warrants issued 255 -

-------- --------

2,640 (428)

-------- --------

Decrease in cash and cash equivalents (1,588) (6,819)

Cash and cash equivalents at start

of year 4,390 11,209

Cash and cash equivalents at end

of year 2,802 4,390

======== ========

Company Statement of Cash Flows

FOR THE YEARED 31 DECEMBER 2016

Notes 2016 2016 2015 2015

GBP'000 GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Investment income received 7 48

Interest received 470 316

Other cash payments (883) (1,711)

-------- --------

Net cash flow from operating

activities 29 (406) (1,347)

Interest paid on loans (194) -

-------- ---------

Net cash flow from operating

activities (600) (1,347)

Cash flow from investing

activities

Purchase of investments (581) (5,000)

Sale of investments 918 -

Investment in subsidiary (1,250) (2,500)

Advanced to Group undertakings (4,789) (8,621)

Repaid by Group undertakings 1,314 6,957

Purchases of fixed assets (16) -

-------- --------

(4,404) (9,164)

Cash flow from financing

activities

Repayment of loans (1,604) -

Receipt of loans 6,833 -

Share issue proceeds 6 -

LMS warrants issued 255 -

-------- --------

5,490 -

-------- ---------

Increase / (decrease) in cash and cash

equivalents 486 (10,511)

Cash and cash equivalents

at start of year 372 10,883

Cash and cash equivalents

at end of year 858 372

======== =========

Principal Accounting Policies

The Group's principal accounting policies are as follows:

(a) Basis of preparation

The financial statements of the Group and the Company have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS.

The Group has considerable financial resources and ongoing

investment management contracts. As a consequence, the directors

believe that the Group is well placed to manage its business risks

successfully. The directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Thus, the directors continue to adopt

the going concern basis of accounting in preparing the financial

statements.

The following standards and interpretations which have not been

applied in these financial statements were in issue but not yet

effective at year end. The following standards and interpretations

which have not been applied in these financial statements were in

issue but not yet effective at year end. The Directors do not

anticipate that the adoption of these standards and interpretations

will have a material impact on the Group's financial statements in

the period of initial application, other than presentation or

disclosure, and a full assessment will be conducted subsequent to

the year end:

(i) IFRS 9 Financial Instruments

(ii) IFRS 10 (amended) Consolidated Financial Statements

(iii) IFRS 11 (amended) Accounting for Acquisitions of Interests in Joint Operations

(iv) IFRS 12 (amended) Disclosures of Interest in Other entities

(v) IFRS 14 Regulatory Deferral Accounts

(vi) IFRS 15 Revenue From Contracts With Customers

(vii) IFRS 16 Leases

(viii) IAS 16 (amended) Property, Plant and Equipment

(ix) IAS 28 (amended) Investments in Associates and Joint Ventures

(x) IAS 38 (amended) Intangibles

(b) Basis of consolidation

Subsidiaries

Where the Company has control over an investee, it is classified

as a subsidiary. The Company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control. The

consolidated financial statements incorporate the financial

statements of the Company and its subsidiary undertakings made up

to the year-end as if they formed a single entity. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

Associates

Where the Group has significant influence, it has the power to

participate in (but not control) the financial and operating policy

decisions of another entity, it is classified as an associate.

Associates are initially recognised in the Group Statement of

Financial Position at cost. Subsequently, associates are accounted

for using the equity method, where the Group's share of

post-acquisition profits and losses and other comprehensive income

is recognised in the Group Statement of Comprehensive Income.

Profits and losses arising on transactions between the Group and

its associates are recognised only to the extent of unrelated

investors' interests in the associate. The investor's share in the

associate's profits and losses resulting from these transactions is

eliminated against the carrying value of the associate.

Where there is objective evidence that the investment in an

associate has been impaired, the carrying amount of the investment

will be tested for impairment in the same way as other

non-financial assets.

(c) Presentation of Statement of Comprehensive Income

As permitted by section 408 of the Companies Act 2006, the

Company has not presented its own Statement of Comprehensive

Income. Details of the Company's results for the year are set out

in note 27, the loss for the year being GBP786,000 (2015:

GBP2,515,000).

(d) Segment reporting

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the Board in order to allocate resources to

the segments and to assess their performance.

The Group's reportable segments, which are those reported to the

Board are, "Real Assets", "Strategic Equity", "Legacy Property" and

"Central".

(e) Revenue recognition

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. Revenue is measured at the fair value of the

consideration received or receivable is stated net of value added

tax and is earned within the United Kingdom.

(i) Asset management income

Revenue represents management and advisory fees for the

provision of fund management and forestry management services and

is recognised in the Statement of Comprehensive Income when the

services are performed net of VAT.

(ii) Rental income

Rental income comprises property rental income receivable net of

VAT, recognised on a straight line basis over the lease term and

excludes service charges recoverable from the tenant.

(iii) Dividend and interest income

Income from listed securities is recognised when the right to

receive the dividend has been established. Interest receivable is

recognised when it is probable that the economic benefits will flow

to the Group and the amount of revenue can be reliably measured.

Interest income is accrued on a time basis by reference to the

principal outstanding.

(iv) Performance fees

Performance fees will be recognised on the date of entitlement

in accordance with the management contract.

(f) Expenses

All expenses and interest payable are accounted for on an

accruals basis.

(g) Property, plant and equipment

Each class of property, plant and equipment is carried at cost

less, where applicable, any accumulated depreciation.

The carrying amount of property, plant and equipment is reviewed

annually by the directors to ensure it is not in excess of the

recoverable amount from those assets. The recoverable amount is

assessed on the basis of the expected net cash flows which will be

received from the assets' employment and subsequent disposal.

The depreciable amount of all fixed assets are depreciated on a

straight line basis over their estimated useful lives to the Group

commencing from the time the asset is held ready for use, and are

depreciated using rates of between 2% and 25%.

(h) Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit before tax as reported in

the Statement of Comprehensive Income because it excludes items of

income or expense that are taxable or deductible in other years and

it further excludes items that are never taxable or deductible. The

Group's liability for current tax is calculated using tax rates

that have been enacted or substantively enacted by the Statement of

Financial Position date.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

statement of financial position liability method. Deferred tax

liabilities are recognised for all taxable temporary differences

and deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Deferred tax is

also provided for on revaluation surpluses on investment

properties.

The carrying amount of deferred tax assets is reviewed at each

Statement of Financial Position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the assets to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled or the asset

realised. Deferred tax is charged or credited in the Statement of

Comprehensive Income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

dealt with in equity.

(i) Operating leases and hire purchase contracts

Amounts payable under operating leases are charged directly to

the Statement of Comprehensive Income on a straight line basis over

the period of the lease. The aggregate costs of operating lease

incentives provided by the Group are recognised as a reduction in

rental income on a straight line basis over the lease term.

(j) Investments

Financial assets designated as at fair value through profit and

loss ("FVTPL") at inception are those that are managed and whose

performance is evaluated on a fair value basis, in accordance with

the documented investment strategy of the Company. Information

about these financial assets is provided internally on a fair value

basis to the Group's key management. All equity investments that

were previously classified as held at fair value through profit or

loss have been reassessed as at the date the Company became a

trading company. The equity investments which do not meet the

definitions of an associate or subsidiary remain held at fair value

through profit and loss.

(i) Properties

Property investments are included in the Statement of Financial

Position at fair value and are not depreciated.

Sale and purchase of property assets is generally recognised on

unconditional exchange except where completion is expected to occur

significantly after exchange. For conditional exchanges, sales are

recognised when the conditions have been satisfied. Profits and

losses are calculated by reference to the carrying value at the end

of the previous financial year, adjusted for subsequent capital

expenditure and less directly related costs of sale.

(ii) Assets held for sale

Non-current assets held for sale are measured at the lower of

carrying amount and fair value less costs to sell (except where the

exemptions of paragraph 5 of IFRS 5 apply) and are classified as

such if their carrying amount will be recovered through a sale

transaction rather than through continuing use. Investment property

that is held for sale is measured at fair value in accordance with

paragraph 5 of IFRS 5.

This is the case when the asset is available for immediate sale

in its present condition subject only to terms that are usual and

customary for sales of such assets and the sale is considered to be

highly probable. A sale is considered to be highly probable if the

appropriate level of management is committed to a plan to sell the

asset and a further active programme to locate a buyer and complete

the plan has been initiated. Further, the asset has to be marketed

for sale at a price that is reasonable in relation to its current

fair value. In addition, the sale is expected to qualify for

recognition as a completed sale within one year from the date that

it is classified as held for sale.

(iii) Securities

Purchases and sales of listed investments are recognised on the

trade date, the date on which the Group commit to purchase or sell

the investment. All investments are designated upon initial

recognition as held at fair value, and are measured at subsequent

reporting dates at fair value, which is either the market bid price

or the last traded price, depending on the convention of the

exchange on which the investment is quoted. Fair values for

unquoted investments, or for investments for which there is only an

inactive market, are established by taking into account the

International Private Equity and Venture Capital Valuation

Guidelines as follows:

(i) Investments which have been made in the last 12 months are

valued at cost in the absence of overriding factors;

(ii) Investments in companies at an early stage of development

are also valued at cost in the absence of overriding factors;

(iii) Where investments have gone beyond the stage in their

development in (ii) above, the shares may be valued by having

regard to a suitable price-earnings ratio to that company's

historical post-tax earnings or the net asset value of the

investment; and

(iv) Where a value is indicated by a material arm's length

market transaction by a third party in the shares of a company,

that value may be used.

(iv) Loans and receivables

Unquoted loan stock is classified as loans and receivables in

accordance with IAS 39 and carried at amortised cost using the

Effective Interest Rate method. Movements in both the amortised

cost relating to the interest income and in respect of capital