Global Stocks Boosted By Energy Shares

October 07 2015 - 5:00AM

Dow Jones News

Global stocks were mostly higher Wednesday as gains in oil

prices boosted energy shares.

The Stoxx Europe 600 rose 0.3% in early trade, with shares in

energy companies rising 1.5%.

Brent crude was up almost 1% at $52.95 a barrel. It had jumped

more than 5% overnight to a one-month high on expectations of

production cuts in the U.S. and global markets.

Germany's DAX climbed 0.4%, while France's CAC 40 was up 0.1%.

Gains were somewhat limited after German industrial output came in

below expectations in August, a day after data showed manufacturing

orders in Europe's largest economy slumped.

The FTSE 100 rose 0.2%. In corporate news, Tesco PLC, Britain's

largest retailer, swung to an interim net loss as it incurred costs

related to the sale of its Korean business. Shares in Tesco were

down 2.0%.

Stocks in Asia were mostly higher as the rise in oil prices

supported energy stocks. Japan's benchmark Nikkei Stock Average

gained 0.8%, recovering after stocks were pressured on news the

Bank of Japan had decided to keep its policy unchanged. Many

analysts still expect further easing measures at the BOJ's next

meeting at the end of the month.

The Hang Seng Index was up 2.3%. Shares in Hong Kong also gained

after Chinese authorities reported that foreign-exchange reserves

fell by a slower pace in September.

"With today's FX reserves above expectations, it adds to the

building momentum that perhaps China is not going to implode

anytime soon," said Chris Weston, chief market strategist at IG.

China's domestic markets will reopen from a week-long holiday on

Thursday.

Futures pointed to 0.4% opening gains for Dow Jones Industrial

Average and the S&P 500. Changes in futures aren't necessarily

reflected in market moves after the opening bell.

A rally in U.S. stocks lost momentum Tuesday as a selloff in

health-care shares prompted the S&P 500 to snap its five-day

winning streak. Global stocks had rallied earlier in the weak after

a disappointing U.S. jobs report pushed back investors'

expectations for the Federal Reserve to raise interest rates.

Ultralow interest rates have boosted global stocks in recent

years.

The next major catalyst for Wall Street is expected to be the

start of the third-quarter corporate earnings season as companies

grapple with a stronger U.S. dollar and weakness overseas.

In currencies, the euro was down 0.3% against the dollar at

$1.1228. The dollar was 0.2% lower against the yen at Y119.9830.

The greenback had weakened against the Japanese currency in Asian

trade after the BOJ left its policy intact.

Write to Riva Gold at riva.gold@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 04:45 ET (08:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

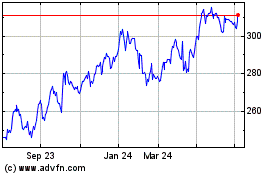

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

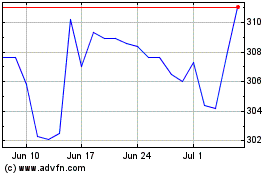

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024