Glaxo Sets Deal For Bristol's HIV Drugs

December 21 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 12/21/15)

By Denise Roland

LONDON -- GlaxoSmithKline PLC has agreed to pay Bristol-Myers

Squibb up to $1.5 billion to acquire the U.S. company's pipeline of

HIV drugs, a move which will bolster one of the U.K. drugmakers'

strongest-performing areas.

Glaxo said it would pay Bristol $317 million upfront for the

company's late-stage HIV drugs, plus $518 million depending on the

drugs hitting particular development and commercial milestones.

It will also pay Bristol $33 million upfront for its early-stage

HIV portfolio, plus $587 million in contingent milestone

payments.

The deal will strengthen the pipeline at ViiV Healthcare, an HIV

business largely owned by Glaxo. Pfizer Inc. and Japan's Shionogi

are minority partners. ViiV is the second-largest HIV business by

market share, after Gilead Sciences Inc.

ViiV has been a bright spot for Glaxo over the past year thanks

to strong sales of two new drugs. Revenue from the HIV business

increased 65% in the third quarter, offsetting falling sales

elsewhere in the company's large pharmaceuticals unit.

The U.S. company in June announced plans to end its virology

research efforts, which span HIV and hepatitis. Bristol said around

20 employees would be offered the opportunity to transfer to ViiV

following the transaction.

The deal doesn't include Bristol's marketed HIV drugs, which

include Reyataz, Evotaz, Sustiva and Atripla.

The companies said they expected the transactions to close in

the first half of 2016.

(END) Dow Jones Newswires

December 21, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

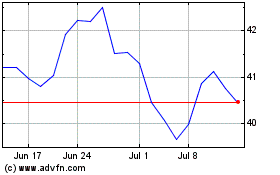

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

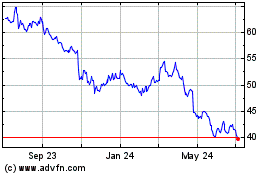

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024