By Chelsey Dulaney

The Jolly Green Giant is getting a new home, with General Mills

Inc. agreeing to sell its struggling frozen-and-canned vegetable

business as part of efforts to focus on items that better appeal to

consumers' hunger for fresher, less-processed food.

General Mills said it would sell Green Giant, along with sister

brand Le Sueur, for $765 million in cash to B&G Foods Inc.,

owner of more than 40 mostly older brands, including Molly McButter

cheese flavoring and Pirate's Booty rice-and-corn puffs.

The Green Giant brand, started 90 years ago, was long billed as

a symbol of healthful fare, its mascot famous for his hearty "ho ho

ho" chortle in television commercials. But U.S. views of what is

healthy have shifted sharply in recent years, with many shoppers

avoiding frozen and canned food for items perceived as more fresh

and wholesome.

General Mills and its peers are trying to reshape themselves to

address those broad changes in American eating habits. The maker of

Cheerios cereal and Yoplait yogurt last year bought organic-snack

maker Annie's Inc. for $820 million. In June, Campbell Soup Co.

said it would buy Garden Fresh Gourmet Inc., a refrigerated salsa

and hummus brand, for $231 million.

Green Giant--No. 2 in the $6 billion U.S. frozen-and-canned

vegetable business after Pinnacle Foods Inc.'s Birds Eye unit--has

been a loser in that process. General Mills said it shifted

resources away from Green Giant in the quarter that ended in May,

resulting in a $260 million charge.

The company said on Thursday that the sale "reinforces General

Mills' strategic priority to shape its portfolio for growth." It

said it would use the proceeds for share repurchases and debt

reduction.

Green Giant and Le Sueur together had $585 million in sales last

year, or about 3.3% of General Mills' total. Alexia Howard, analyst

at brokerage Bernstein, said Green Giant's frozen-vegetable sales

fell 11% in the past 52 weeks. She said the sale could be a

precursor to a broader purge by General Mills of slow-growing,

low-margin businesses to free it up to make more acquisitions in

the natural-foods area such as the Annie's deal.

B&G has built its business buying up prominent-but-passé

brands. With Green Giant, it said it plans to add people to its

sales force and marketing department in an effort to stabilize and

then revitalize sales growth.

"Although Green Giant has struggled recently, it's a truly

iconic brand, " B&G Chief Executive Bob Cantwell said in an

interview. "There is a lot of opportunity to move the needle up on

this brand by being more innovative and reinvigorating the brand,

as we've done with dozens of other acquired brands over the

years."

B&G bought Cream of Wheat from Kraft Foods Inc. eight years

ago and has reversed sales declines and increased profitability.

Adding frozen-food capabilities for the first time provides the

potential for more acquisitions down the road, Mr. Cantwell

said.

Shares of B&G added 1.8% to $31 in recent trading Thursday,

while General Mills shares were about flat.

B&G, which logged $848 million in revenue last fiscal year,

said it will double the marketing dollars that General Mills was

spending on Green Giant, especially geared toward the harder-hit

frozen section.

Gary Stibel, founder of the New England Consulting Group, said a

smaller company like B&G can make a difference with Green

Giant. "Not all frozen food is declining [in sales], just the old,

established brands that haven't figured it out," he said.

General Mills said after the sale, expected to close in the

fourth quarter, it would continue to operate Green Giant in Europe

and other export markets under license from B&G.

General Mills' moves echo those by rivals such as Campbell Soup

Co., which has acquired refrigerated juice and salsa brands to

offset sales declines in its stable of canned soups and V8

juices.

Campbell on Thursday said its revenue for the quarter ended Aug.

2 fell 8.6% from a year earlier to $1.69 billion, as sales volume

declined 1% and the stronger dollar decreased the value of

international revenue. Its iconic U.S. soup business posted a 2%

drop in sales.

Campbell Chief Executive Denise Morrison said changes in

consumer preferences for food, including a greater focus on health,

are pressuring grocery mainstays like canned soup and traditional

food makers like Campbell. That is compounded by "the prevailing

industry dynamics of consolidation and cost-cutting," she

added.

Ms. Morrison argues that creating the Campbell's fresh-foods

division and accelerating its efforts to get into grocery store

delis and refrigerated cases will drive sales and earnings growth

long term. Some analysts suggest Campbell will sell somewhat stale

brands like Hamburger Helper too.

Campbell's profit fell to $68 million, or 22 cents a share, from

$137 million, or 43 cents a share, a year earlier. Excluding

restructuring charges associated with Campbell's cost-cutting

program and other special items, per-share earnings from continuing

operations were 43 cents a share.

Chelsey Dulaney contributed to this article.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 03, 2015 15:15 ET (19:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

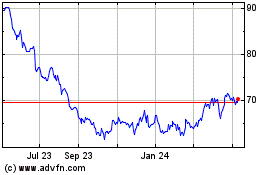

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

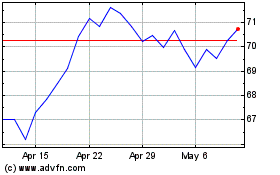

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024