GM, Fiat Chrysler Shares Climb As Investors Focus on Future -- Update

October 24 2017 - 5:41PM

Dow Jones News

By Mike Colias and Chester Dawson

Wall Street is finally rewarding Detroit's old guard auto

companies for the direction they are taking, leading them to garner

strong stock gains even as the car market is softening.

The industry developments Tuesday highlight a strategy shift

that is well under way in the Motor City. Caught off guard by rapid

developments and sizable investments in driverless cars and other

innovative transportation ideas coming from Silicon Valley tech

giants, including Alphabet Inc., Tesla Inc. and Uber Technologies

Inc., domestic auto companies have fought back by slimming down or

dumping old lines of business and focusing on efforts to reshape

the way people get from Point A to B.

On Tuesday, General Motors Co. recorded one of its worst

quarterly net-incomes since filing for bankruptcy in 2009, spilling

nearly $3 billion in red ink during the July through September

period. GM's performance is primarily due to decisions to dump its

unprofitable European operations and pare back on low-margin

businesses, such as passenger-car production and sales to rental

companies. A strong balance sheet, allows the company to plow

resources into autonomous driving and electric vehicles.

Delphi Automotive PLC, meanwhile, purchased a popular

driverless-car developer, the latest attempt to supercharge the

American auto-supply sector's role in reinventing personal

transportation.

Ahead of Ford Motor Co.'s third-quarter results Thursday. Chief

Executive Jim Hackett unveiled a management shake-up after five

months at the helm. Mr. Hackett has said he wants to speed decision

making and "attack" costs at Ford, targeting $14 billion in annual

savings within five years, aimed at streamlining the core business

so it can steer more investment toward driverless cars and electric

vehicles.

Fiat Chrysler Automobiles NV, meanwhile, reported a 50% increase

in net earnings, but sales and North American profit growth

flatlined over the summer. Still, the company maintained an

ambitious outlook and higher-than-expected cash inflows helped chip

away a debt load that is seen as a hurdle to the Italian-American

auto maker's pursuit of a merger partner.

Citi analyst Itay Michaeli said GM's ability to post an 8.3%

margin in North America amid a 26% production cut and

"downturn-like conditions," demonstrates the type of resiliency

that cyclical domestic car companies once lacked.

Revenue took hit, falling 12% to $33.6 billion. The shrinking

top line reflects GM Chief Executive Mary Barra's strategy to

pursue profits and game-changing tech over market share.

GM shares touched $46.76 Tuesday, with a $67.5 billion market

capitalization representing the highest value since its 2010

initial public offering and an $11 billion lead over Tesla, which

is under pressure to launch a mass-market electric car. GM Chief

Financial Officer Chuck Stevens said he was "pleased" investors are

rewarding progress on the core business and future technology

bets.

Mr. Stevens says he believes investors are rewarding "actions

we've been taking over the last number of years to build a

stronger, more resilient core business."

Meanwhile, Fiat Chrysler has benefited by doubling down on

production of popular SUVs and trucks. Chief Executive Sergio

Marchionne says the company will remain disciplined once it climbs

back to positive net cash.

"I don't want to chase rainbows," Mr. Marchionne told financial

analysts on a conference call, saying memories of being starved of

capital a decade ago after Chrysler emerged from bankruptcy are

still fresh. "The scars that this last crisis caused I still have,"

he said.

Shares in Fiat Chrysler closed $17.45 Tuesday, a 5.45% increase,

one of the highest points since the company's formation earlier in

the decade.

Ford's market value, which is roughly 25% lower than GM, has

barely budged during the short tenure of its new CEO. The shake-up

on Tuesday led to the surprise departure of John Casesa, a former

investment banker and star auto analyst who was charged with

running strategy in 2015 under ex-CEO Mark Fields. The heads of

marketing, quality and human resources all elected to leave the

company as well.

Ford's board installed Mr. Hackett in May after ousting Mr.

Fields amid questions about Ford's direction and culture. Earlier

this month, Mr. Hackett briefed investors on broad plans to

accelerate Ford's development of autonomous vehicles and electric

cars, though his outline left some wanting more specifics.

Delphi's $450 million acquisition of Boston-based NuTonomy Inc.

could help the Michigan-headquartered company bring autonomous

vehicles to market by the turn of the decade. This is a boost for

Detroit's car companies, which have deep ties with Delphi dating

back to the days when it was a subsidiary of GM.

Delphi acquired other startups in recent years, including its

2015 purchase of Carnegie Mellon University spinoff Ottomatika

Inc., another company that provides software for self-driving cars.

This further changes Delphi's profile in the industry from a

company that many analysts saw ripe for acquisition into a

potential power player.

The deal for NuTonomy -- a spinoff of MIT that attracted

attention with its public driverless-car tests in Singapore -- adds

top robotic talent to Delphi's growing stable of acquisitions and

partnerships as it looks to create an entire autonomous vehicle

system that it can sell to auto makers. For NuTonomy, Delphi's

scale provides leverage to hasten the industrialization of

self-driving technology, allowing it to put its stamp on software

installed in millions of future vehicles.

This is a win for the domestic auto-supply chain following the

recent acquisition of Harman International Industries by Korea's

Samsung Electronics, and the acquisition of Mobileye NV by Intel

Corp. earlier this year. Harman and Mobileye are considered

pioneers in the development of connected cars that can drive

themselves. Delphi wants to join with auto makers on speeding up

autonomous-car research and offer its own off-the-shelf solution

for car companies that don't have deep pockets.

--Tim Higgins contributed to this article.

Write to Mike Colias at Mike.Colias@wsj.com and Chester Dawson

at chester.dawson@wsj.com

(END) Dow Jones Newswires

October 24, 2017 17:26 ET (21:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

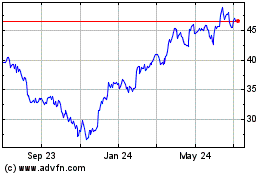

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

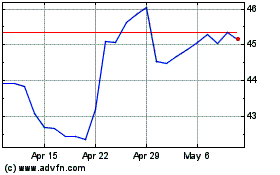

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024