Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 22 2015 - 6:02AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-200740

January 21, 2015

PRICING

TERM SHEET

$2,900,000,000

$500,000,000 2.625% Senior Notes due 2020

$500,000,000 3.200% Senior Notes due 2022

$1,000,000,000 3.600% Senior Notes due 2025

$900,000,000 4.700% Senior Notes due 2045

Unless otherwise indicated, terms used but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus Supplement dated January

21, 2015.

|

|

|

|

|

|

|

|

|

| Issuer: |

|

Laboratory Corporation of America Holdings |

|

|

| Expected Ratings:* |

|

Baa2 (Moody’s) / BBB (S&P) |

|

|

| Trade Date: |

|

January 21, 2015 |

|

|

| Expected Settlement Date: |

|

January 30, 2015 (T+7) |

|

|

|

|

|

| Security: |

|

2.625% Notes due 2020 (the “2020 Notes”) |

|

3.200% Notes due 2022 (the “2022 Notes”) |

|

3.600% Notes due 2025 (the “2025 Notes”) |

|

4.700% Notes due 2045 (the “2045 Notes”) |

|

|

|

|

|

| Principal Amount: |

|

$500,000,000 |

|

$500,000,000 |

|

$1,000,000,000 |

|

$900,000,000 |

|

|

|

|

|

| Maturity Date: |

|

February 1, 2020 |

|

February 1, 2022 |

|

February 1, 2025 |

|

February 1, 2045 |

|

|

|

|

|

| Interest Payment Dates: |

|

February 1 and August 1, commencing August 1, 2015 |

|

February 1 and August 1, commencing August 1, 2015 |

|

February 1 and August 1, commencing August 1, 2015 |

|

February 1 and August 1, commencing August 1, 2015 |

|

|

|

|

|

| Coupon: |

|

2.625% |

|

3.200% |

|

3.600% |

|

4.700% |

|

|

|

|

|

| Price to Public: |

|

99.888% |

|

99.919% |

|

99.850% |

|

99.236% |

|

|

|

|

|

| Net Proceeds to Issuer (before expenses): |

|

$496,440,000 |

|

$496,470,000 |

|

$992,000,000 |

|

$885,249,000 |

|

|

|

|

|

| Benchmark Treasury: |

|

1.625% due December 31, 2019 |

|

2.125% due December 31, 2021 |

|

2.250% due November 15, 2024 |

|

3.125% due August 15, 2044 |

|

|

|

|

|

| Benchmark Treasury Price /Yield: |

|

101-10 / 1.349% |

|

103-00+ / 1.663% |

|

103-13 / 1.868% |

|

114-06 / 2.448% |

|

|

|

|

|

| Spread to Benchmark Treasury: |

|

+ 130 basis points |

|

+ 155 basis points |

|

+ 175 basis points |

|

+ 230 basis points |

|

|

|

|

|

|

|

|

|

| Reoffer Yield: |

|

2.649% |

|

3.213% |

|

3.618% |

|

4.748% |

|

|

|

|

|

| Make-Whole Spread: |

|

+ 20 basis points |

|

+ 25 basis points |

|

+ 30 basis points |

|

+ 35 basis points |

|

|

| Optional Redemption: |

|

We may, at our option, redeem some or all of the 2020 Notes or the 2022 Notes at any time or from time to time, at a redemption price equal to the greater of 100% of the principal amount of each Note being

redeemed plus accrued and unpaid interest to the redemption date, and the Make-Whole Amount. |

|

|

|

|

We may, at our option, redeem some or all of the 2025 Notes or the 2045 Notes, in the case of the 2025 Notes, at any time or from time to time prior to November 1, 2024 (three months prior to their maturity

date) or in the case of the 2045 Notes, at any time or from time to time prior to August 1, 2044 (six months prior to their maturity date), at a redemption price equal to the greater of 100% of the principal amount of each Note being redeemed plus

accrued and unpaid interest to the redemption date, and the Make-Whole Amount. |

|

|

|

|

On and after November 1, 2024 (three months prior to their maturity date), we may at our option redeem the 2025 Notes at any time or from time to time, either in whole or in part, and on and after August 1,

2044 (six months prior to their maturity date), we may at our option redeem the 2045 Notes at any time or from time to time, either in whole or in part, in each case at a redemption price equal to 100% of the principal amount of each Note to be

redeemed, plus accrued and unpaid interest to the redemption date. |

|

|

| Special Mandatory Redemption: |

|

In the event that we do not consummate the Acquisition on or prior to June 30, 2015, or the Merger Agreement is terminated at any time prior thereto, we will redeem all of the 2020 Notes, the 2022 Notes, the

2025 Notes and the 2045 Notes, on the special mandatory redemption date at a redemption price equal to 101% of the principal amount of each series of Notes, plus accrued and unpaid interest from the date of initial issuance to, but excluding, the

special mandatory redemption date (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date). |

|

|

|

|

|

| CUSIP/ISIN: |

|

50540R AR3 / US50540RAR30 |

|

50540R AP7 / US50540RAP73 |

|

50540R AQ5 / US50540RAQ56 |

|

50540R AS1 / US50540RAS13 |

|

|

| Joint Book-Running Managers: |

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Wells Fargo Securities, LLC Credit Suisse Securities (USA)

LLC |

|

|

| Co-Managers: |

|

Barclays Capital Inc.

KeyBanc Capital Markets Inc. Mitsubishi UFJ Securities (USA),

Inc. PNC Capital Markets LLC TD Securities (USA) LLC

U.S. Bancorp Investments, Inc. BNY Mellon Capital Markets,

LLC Credit Agricole Securities (USA) Inc. Fifth Third

Securities, Inc. |

| * |

Note: A security rating is not a recommendation to buy, sell or hold securities, and may be subject to revision or withdrawal at any time. Each of the security ratings above should be evaluated independently of any

other security rating |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

2

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the

issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch, Pierce, Fenner & Smith Incorporated toll-free at 1-800-294-1322, Wells Fargo Securities, LLC

toll-free at 1-800-645-3751 or Credit Suisse Securities (USA) LLC toll-free at 1-800-221-1037.

Any

disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email

system.

3

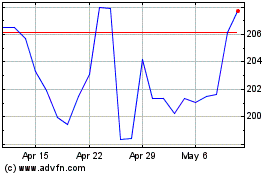

Laboratory Corporation o... (NYSE:LH)

Historical Stock Chart

From Apr 2024 to May 2024

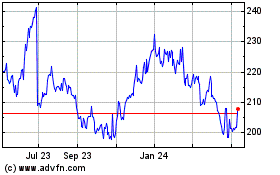

Laboratory Corporation o... (NYSE:LH)

Historical Stock Chart

From May 2023 to May 2024