TIDMFPO

RNS Number : 6798A

First Property Group PLC

09 June 2016

Date: 9 June 2016

On Behalf of: First Property Group plc ("First Property", "the Company" or "the Group")

Embargoed: 0700hrs

First Property Group plc

Preliminary Results for the twelve months to 31 March 2016

First Property Group plc (AIM: FPO), the property fund manager

and investor, today announces its preliminary results for the

twelve months ended 31 March 2016.

Financial Summary:

Unaudited Audited Percentage

year to year change

31 March to

2016 31 March

2015

------------------------------ ----------- ----------- -----------

Income Statement:

------------------------------ ----------- ----------- -----------

Revenue GBP21.96m GBP18.52m +18.6%

Statutory profit before

tax GBP7.35m GBP8.08m -9.0%

Non-recurring income GBP1.29m GBP3.99m

Diluted earnings per

share 4.28p 6.93p -38.2%

Total dividend per

share 1.50p 1.35p +11.1%

Average EUR/ GBP rate 1.363 1.285 -6.1%

------------------------------ ----------- ----------- -----------

Balance Sheet at year-end:

------------------------------ ----------- ----------- -----------

Net assets GBP34.09m GBP31.02m +9.9%

Net assets per share 27.75p 26.30p +5.5%

Adjusted net assets

per share* 43.01p 35.75p +20.3%

Cash balances GBP8.98m GBP12.24m -26.6%

Period-end EUR/ GBP

rate 1.261 1.382 +8.8%

------------------------------ ----------- ----------- -----------

Group Direct Property Portfolio at year-end:

(excludes the Group's non-controlling interests

in six other FPAM managed funds)

---------------------------------------------------------------------

Book value GBP134.53m GBP126.90m +6.0%

Market value GBP156.92m GBP142.04m +10.5%

Gross debt (non-recourse

to Group) GBP114.82m GBP107.78m +6.5%

LTV% 73.17% 75.88%

Total Assets Under

Management: GBP353m GBP327m +8.0%

------------------------------ ----------- ----------- -----------

Poland 51% 65%

United Kingdom 44% 33%

Romania 5% 2%

------------------------------ ----------- ----------- -----------

* Calculated according to EPRA triple net

valuation methodology, which includes

adjustments for fair values of i) financial

instruments, ii) debt, and iii) deferred

taxes.

Highlights:

-- Total assets under management grew by 8% to GBP353 million, despite major fund expiry;

-- UK PPP fund life extended by five years to February 2022;

-- Two new investment companies established which invested

EUR24.08 million in a shopping centre in Swinoujście, in Poland and

EUR10.31 million in nine Lidl supermarkets in Romania

respectively;

-- Good cash generation - Group cash balances decreased by

GBP3.26 million but would have increased by some 15.4% to GBP14.13

million had the loan of EUR6.5 million (GBP5.15 million) made to

Fprop Romanian Supermarkets Ltd been included. This loan was repaid

after the year-end;

-- Improved earnings visibility - 94.8% of revenue now of a recurring nature (2015: 81.8%);

-- Total annualised fund management fees of GBP1.68 million at

the year-end (2015: GBP1.35 million), with a weighted average

unexpired fund management contract term of 6 years, 6 months (2015:

2 years, 10 months);

-- Final dividend increased to 1.115 pence per share (2015: 1

penny per share), an increase of 11.5%, which together with the

interim dividend of 0.385 pence per share (2015: 0.35 pence per

share) equates to a dividend for the year of 1.50 pence per share

(2015: 1.35 pence per share);

-- The impact of a weaker Euro versus Sterling during the year

resulted in profit before tax being some GBP671,000 lower than if

translated at last year's rate;

-- Funds under management once again ranked No.1 versus MSCI's

Investment Property Databank (IPD) Central & Eastern Europe

(CEE) Benchmark, now for the ten years from 2005 to 31 December

2015, and for the annualised periods from 2005 to the end of each

of the years between 31 December 2008 and 31 December 2015.

Commenting on the results, Ben Habib, Chief Executive of First

Property Group, said:

The Group is trading well across the board and the number and

value of assets under management is increasing.

In the financial year just ended the Group benefitted from a

full year of contributions from the investments made by it and

Fprop Opportunities plc in the previous financial year, all of

which have yielded income at or above our expectations at the time

of their purchase and are, without exception, valued at levels

exceeding their acquisition prices. The recurring nature of these

earnings should enable us to build on the impressive increase in

adjusted net assets, which together with dividend payments has

averaged 21% per annum since 1 April 2008, the onset of the credit

crunch.

The markets in which we operate are generally buoyant and offer

interesting investment opportunities which we hope to capitalise on

in due course.

A briefing for analysts will be held at 10.30hrs today at the

Group's headquarters, 32 St James's Street, London, SW1A 1HD. A

conference call facility will also be available on +44 (20) 3364

5721, passcode: 811985. A copy of the accompanying investor

presentation can be accessed simultaneously at

http://www.fprop.com/plc-results/81/88/. A recorded copy of the

call will subsequently be posted on the Company website,

www.fprop.com.

For further information please contact:

First Property Group plc Tel: +44 (20) 7340

0270

Ben Habib (Chief Executive www.fprop.com

Officer) investor.relations@fprop.com

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners (NOMAD & Tel: +44 (20) 7614

Broker) 5900

Chris Hardie (Director,

Corporate Finance)

Ben Cryer (Corporate Finance)

Redleaf Communications Tel:+ 44 (20) 7382

(PR) 4747

Henry Columbine / Rebecca firstproperty@redleafpr.com

Sanders-Hewett /

Susie Hudson

Notes to investors and editors:

First Property Group plc is a property fund manager and investor

with operations in the United Kingdom and Central Europe. Its

earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing on behalf of third parties in property;

o Management fees are levied by reference to the value of

properties under management;

o Performance fees are levied where appropriate, usually payable

upon realisation of profits above an agreed hurdle.

-- Group Properties - principal investments by the Group to earn

a return on its own capital, usually in partnership with third

parties.

FPAM funds rank No.1 versus MSCI's Investment Property Databank

(IPD) Central & Eastern Europe (CEE) Benchmark for the ten

years from the commencement of its operations in Poland in 2005 to

31 December 2015, and for the annualised periods from 2005 to the

end of each of the years between 31 December 2008 and 31 December

2015.

First Property Asset Management Limited is authorised and

regulated by the Financial Conduct Authority. Further information

about the Company and its products can be found at:

www.fprop.com.

CHIEF EXECUTIVE'S STATEMENT

Financial Results

I am pleased to report final results for the twelve months ended

31 March 2016.

Revenue earned by the Group increased to GBP21.96 million (2015:

GBP18.52 million) yielding a profit before tax of GBP7.35 million

(2015: GBP8.08 million). The decrease in profit before tax is

principally attributable to the reduction in the contribution made

by Fprop PDR which has now wound down its activities. This

reduction was, to a material extent, offset by the increased

contribution made by Group Properties.

Diluted earnings per share were 4.28 pence (2015: 6.93 pence),

the decrease being principally due to a one off deferred tax credit

of GBP992,000 relating to acquisitions in 2015.

The Group ended the period with reported net assets of GBP34.09

million (2015: GBP31.02 million). It is the accounting policy of

the Group to carry its direct properties and interests in

associates at the lower of cost or market value. The net assets of

the Group when adjusted to their market value less any deferred tax

liabilities, stood at GBP51.03 million (2015: GBP42.41 million).

The increase in net assets is attributable mainly to higher

property values and a stronger Euro versus Sterling at the

year-end.

Group cash balances stood at GBP8.98 million (2015: GBP12.24

million) at the year-end but would have been some GBP14.13million

had the loan of EUR6.5 million (GBP5.15 million) made to Fprop

Romanian Supermarkets Ltd been included. This loan was repaid after

the year-end. Of the cash balances at year-end, GBP4.76 million

(2015: GBP3.26 million) was held by Fprop Opportunities plc (FOP,

76.2% owned by the Group) and GBP635,000 (2015: GBP573,000) was

held by Corp Sp. z o.o. (the property management company for Blue

Tower in Warsaw, 90% owned by the Group).

Dividend

The Directors have resolved to recommend increasing the final

dividend to 1.115 pence per share (2015: 1 penny per share), an

increase of 11.5%, which together with the interim dividend of

0.385 pence per share (2015: 0.35 pence per share) equates to a

dividend for the year of 1.50 pence per share (2015: 1.35 pence per

share).

The proposed final dividend will be paid on 30 September 2016 to

shareholders on the register at 2 September 2016, and is subject to

shareholder approval at the forth coming annual general

meeting.

REVIEW OF OPERATIONS

Key Points

The year just ended marked a period of financial consolidation

for the Group during which the visibility of its earnings has

increased, with some 94.8% (2015: 81.8%) of revenue now of a

recurring nature. This increase in the level of recurring earnings

is primarily the result of a full year of contributions from the

investments made by the Group and Fprop Opportunities plc

(FOP).

The average EUR/ GBP rate during the year was 6.1% lower at

EUR1.363 (2015: EUR1.285). This resulted in Group profit before tax

being GBP671,000 lower than if translated at last year's rate.

PROPERTY FUND MANAGEMENT (First Property Asset Management Ltd or

FPAM)

As at 31 March 2016 aggregate assets under management,

calculated by reference to independent third party valuations,

stood at GBP353 million (2015: GBP327 million), including some

GBP156 million (2015: GBP142 million) of properties owned directly

by the Group. Of these, 51% (2015: 65%) were located in Poland, 44%

(2015: 33%) in the UK, and 5% (2015: 2%) in Romania.

The reconciliation of movement in funds under management during

the year is shown below:

Funds managed Group Properties Totals

for third parties (including

(including funds FOP)

in which the Group

is a minority

shareholder)

---------------- ----------------------------------- ------------------- -----------------

UK CEE Total No. All No. AUM No.

GBPm. GBPm. GBPm. of CEE of GBPm. of

prop's GBPm. prop's prop's

---------------- ------- ------- ------- -------- -------- --------- ------- --------

As at

1 April

2015 108.3 76.8 185.1 44 142.0 11 327.1 55

---------------- ------- ------- ------- -------- -------- --------- ------- --------

Purchases 49.1 - 49.1 10 - - 49.1 10

Sales (3.6) - (3.6) (1) - - (3.6) (1)

New fund

mandates - 26.9 26.9 10 - - 26.9 10

Expiring

fund

mandate - (62.9) (62.9) (13) - - (62.9) (13)

Property

Depreciation - - - - (1.5) - (1.5) -

Property

Revaluation 0.9 (0.6) 0.3 - 2.8 - 3.1 -

FX Revaluation - 1.3 1.3 - 13.6 - 14.9 -

As at

31 March

2016 154.7 41.5 196.2 50 156.9 11 353.1 61

---------------- ------- ------- ------- -------- -------- --------- ------- --------

Fund management fees are levied monthly by FPAM by reference to

the value of funds under management excluding cash and cash

commitments, with the exception of Fprop PDR (which levies

performance fees on realised profits only).

Revenue earned by this division amounted to GBP2.90 million

(2015: GBP6.14 million), resulting in a profit before unallocated

central overheads and tax of GBP1.38 million (2015: GBP4.44

million) and representing 14% (2015: 40%) of Group profit before

unallocated central overheads and tax.

The decline in revenue was principally the result of lower fees

earned from the following funds:

1. Fprop PDR - from which we earned performance fees of GBP0.9

million (2015: GBP3.37 million). We have sold all eight investments

made by this fund and we do not expect to earn further fees from

it.

2. USS Fprop Managed Property Portfolio - from which we earned

fees of GBP301,000 (2015: GBP1.54 million) prior to the expiry of

the fund management contract in August 2015.

At the year-end FPAM's fund management fee income, excluding

performance fees, was being earned at an annualised rate of GBP1.68

million (2015: GBP1.35 million), with a weighted average unexpired

fund management contract term of 6 years, 6 months (2015: 2 years,

10 months).

First Property Asset Management Ltd (FPAM) now manages nine

(2015: eight) closed-end funds and joint venture investments. A

brief synopsis of the value of assets and maturity of each of these

vehicles is set out below:

Fund Country Fund Assets % of total Assets

of investment expiry under assets under

management under management

at market management at market

value value

at 31 at 31

March March

2016 2015

---------------- ---------------- ---------- ------------- ------------ ------------

GBPm. GBPm.

---------------- ---------------- ---------- ------------- ------------ ------------

Sam Property UK Rolling * * *

Company

Ltd (SAM)

Regional

Property

Trading

Ltd (RPT) Poland Aug 2020 6.83 1.9% 6.21

5(th)

Property

Trading

Ltd (5PT) Poland Dec 2017 7.77 2.2% 7.68

UK Pension

Property

Portfolio

LP (UK

PPP) UK Feb 2022 94.93 27.0% 94.35

-

Fprop (commitment

PDR LP UK May 2018 of GBP42m) - 3.61

SIPS Property 59.80

Nominee (commitment

Ltd UK Jan 2025 of GBP125m) 16.9% 10.33

NEW -

Fprop

Romanian

Supermarkets

Ltd Romania Jan 2026 8.17 2.3% -

NEW -

Fprop

Galeria

Corso

Ltd Poland Mar 2026 18.68 5.3% -

EXPIRING

- USS

Contract Poland Aug 2015 - - 62.9

---------------- ---------------- ---------- ------------- ------------ ------------

Sub Total 196.18 55.6% 185.08

---------------------------------------------- ------------- ------------ ------------

Fprop

Opportunities

plc (FOP) Poland Oct 2020 61.46 17.4% 54.44

Group

properties

(excluding Poland

FOP) & Romania n/a 95.47 27.0% 87.6

---------------- ---------------- ---------- ------------- ------------ ------------

Sub Total 156.93 44.4% 142.04

---------------------------------------------- ------------- ------------ ------------

Total 353.11 100% 327.12

---------------------------------------------- ------------- ------------ ------------

* Not subject to recent revaluation

Independent Fund Performance Analysis:

Our investments in Poland and Romania once again ranked No.1

against MSCI's Investment Property Databank (IPD) Central &

Eastern Europe (CEE) Benchmark, now for the ten years from the

commencement of our operations in Poland in 2005 to 31 December

2015, and for the annualised periods from 2005 to the end of each

of the years between 31 December 2008 and 31 December 2015.

We were also:

-- awarded "Best fund manager" by Alternative Investment Awards

and by Acquisition International; and

-- shortlisted for awards by Pensions Age, Property Week and Property Investor Europe.

GROUP PROPERTIES

Group Properties comprise eleven commercial properties held

directly by the Group (including five held by FOP (in which the

Group is a 76.2% shareholder), and non-controlling interests in six

of the nine funds and joint ventures managed by FPAM, as set out in

the tables below. It is the Group's policy to carry its direct

properties and interest in associates at the lower of cost or

market value for accounting purposes and to recognise dividends

when received.

1. Directly held Properties at 31 March 2016:

Property No. Book Market Contribution Contribution

/ Country of properties value value to Group to Group

profit profit

before before

tax - tax -

year to year to

31 March 31 March

2016 2015

----------------- --------------- ------- ------- ------------- -------------

GBPm. GBPm. GBPm. GBPm.

Poland 3 74.6 86.9 5.7 2.7

Romania 3 5.5 8.5 0.9 0.6

FOP (Poland

- consolidated

undertaking). 5 54.4 61.5 3.3 1.5

----------------- --------------- ------- ------- ------------- -------------

Total 11 134.5 156.9 9.9 4.8

----------------- --------------- ------- ------- ------------- -------------

2. Non-controlling interests in funds and joint ventures managed by FPAM at 31 March 2016:

Fund % owned Book Current Group's Group's

by value market share share

First of First value of pre-tax of pre-tax

Property Property's of holdings profits profits

Group share earned earned

in by fund by fund

fund 31 March 31 March

2016 2015

--------------- ---------- ------------ ------------- ------------ ------------

GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- ------------ ------------- ------------ ------------

Interest in associates

5(th)

Property

Trading

Ltd (5PT) 37.8% 563 923 121 153

Regional

Property

Trading

Ltd (RPT) 28.6% 159 219 20 32

Fprop

Romanian

Supermarkets

Ltd 24.1% 737 802 12 Nil

Fprop

Galeria

Corso

Ltd 28.2% 1,585 1,607 17 Nil

--------------- ---------- ------------ ------------- ------------ ------------

Share of results

in associates 3,044 3,551 170 185

--------------------------- ------------ ------------- ------------ ------------

Investments

UK Pension

Property

Portfolio

LP (UK

PPP) 0.9% 900 900 60 64

Fprop

PDR LP 4.9% 13 13 163 630

------------ ----- ---- ---- ---- ----

Sub Total 913 913 223 694

------------------- ---- ---- ---- ----

Total 3,957 4,464 393 879

------- ------ ------ ---- ----

Revenue from Group Properties, including FOP, amounted to

GBP19.06 million (2015: GBP12.38 million), generating a profit

before unallocated central overheads and tax of GBP8.85 million

(2015: GBP6.57 million) and representing 87% (2015: 60%) of Group

profit before unallocated central overheads and tax. The increase

in revenue and profit before tax prior to the deduction of

unallocated central overhead costs was primarily attributable to a

full year of income from investments made by the Group and FOP.

The contribution to Group earnings by the eleven directly held

properties is detailed below:

Year to Year to

31 March 2016 31 March 2015

EURm. EURm.

--------------------- --------------- ---------------

Net operating

income (NOI) 19.74 11.08

Interest expense

on bank loans

/ finance leases (3.59) (2.70)

--------------------- --------------- ---------------

NOI after interest

expense 16.15 8.38

Current tax (1.25) (0.56)

Debt amortisation (7.11) (4.14)

Capital expenditure (1.94) (0.71)

--------------------- --------------- ---------------

Free cash 5.85 2.97

--------------------- --------------- ---------------

Market value

of properties EUR197.92 EUR196.33

Average yield 9.97% 5.64%*

on market value

Bank loans/ finance

leases outstanding EUR144.82 EUR148.97

Loan to value

(LTV) 73.17% 75.88%

Weighted average 4 yrs, 1 mth 4 yrs, 9mths

unexpired lease

term (WAULT)

Vacancy rate 2.4% 4.1%

--------------------- --------------- ---------------

* reflects partial contributions to NOI from the six

acquisitions not held for the full year.

The loans secured against these properties are each held in

separate non-recourse special purpose vehicles.

In order to mitigate potential interest rate rises we have fixed

the interest rate on a proportion of the loans. A one percentage

point increase from current market interest rates would increase

the annual interest bill by GBP663,000 per annum. The current

weighted average borrowing cost is 2.96% (2015: 3.10%)

The income return from our six minority shareholdings in funds

managed by FPAM contributed GBP393,000 to Group profit before tax

prior to the deduction of unallocated central overheads,

representing 3.8% of the contribution by Group Properties. This

should increase as we benefit from a full period contribution from

the two new investments in Fprop Romanian Supermarkets Ltd and

Fprop Galeria Corso Ltd, which were established in the second half

of the year.

Commercial property markets outlook

Poland:

GDP is forecast to grow by 3.9% in 2016 and 3.5% in 2017,

maintaining its status as one of Europe's fastest growing

economies. Inflation is beginning to trend upwards and is expected

to turn positive later this year. Government debt as a percentage

of GDP remains relatively low at some 52%.

The election of a new populist government in October 2015 has,

however, resulted in increased fiscal risks which have led to

increased volatility in the price of Polish government bonds and

the Zloty and the downgrading of the country's credit rating by

S&P from A- to BBB+.

Rent levels for office property in Warsaw and other main cities

have generally softened over the past couple of years, as the pace

of new development has increased. Capital values for prime property

have increased but for good secondary property, of the sort we

favour, values remain largely unchanged from their credit crunch

lows, yielding some 2% per annum more than equivalent property in

Western Europe. Transaction volumes in 2016 are expected to exceed

the EUR4 billion recorded in 2015, which was the second highest

year on record in Poland and the highest since the onset of the

credit crunch.

Romania:

GDP is forecast to grow by 4.2% in 2016 and 3.7% in 2017, as the

economy recovers from the credit crunch. Average net wages grew by

some 20% in 2015 and private consumption is accelerating, aided by

cuts in VAT from 24% to 20%, and from 24% to 9% on food sales.

Inflation is not expected to turn positive until 2017. Government

debt as a percentage of GDP is low at 38%, the fifth lowest in the

EU. Anti-corruption measures are being implemented with zeal - in

2015 the former Prime Minister Victor Ponta was forced to resign,

five other ministers were indicted, as were twenty one members of

the combined Houses of Parliament, and the Bucharest Mayor.

Such an economic and political backdrop should provide a

favourable environment for property investment.

Occupier demand for commercial property is improving as the

economy recovers and rent levels are broadly stable, subject to

location. Transaction data in the investment market is thin but

rising. Generally the mismatch between buyer and seller

expectations which has been prevalent through the credit crunch

still persists. However the banking market is improving and

commercial property investment volumes in 2016 are expected to

exceed those of 2015.

United Kingdom:

GDP growth slowed to 2.1% per annum in the first quarter and is

forecast to grow at just over 2% per annum for the next few years,

a figure which could be higher but for the continued scale of

fiscal tightening required to eliminate the budget deficit.

Occupier demand for commercial property continues to gradually

improve, particularly in the South East. Yields for well let

investment property are at post credit crunch lows and we are of

the view that in general there is little room for further yield

compression, but rather that future gains are more likely to come

from rental growth. Transaction levels for investment property have

declined in recent months. Attractive investment opportunities are

hard to find and tend to require active management in order to add

value.

Current Trading and Prospects

The Group is trading well across the board and the number and

value of assets under management is increasing.

In the financial year just ended the Group benefitted from a

full year of contributions from the investments made by it and

Fprop Opportunities plc in the previous financial year, all of

which have yielded income at or above our expectations at the time

of their purchase and are, without exception, valued at levels

exceeding their acquisition prices. The recurring nature of these

earnings should enable us to build on the impressive increase in

adjusted net assets, which together with dividend payments has

averaged 21% per annum since 1 April 2008, the onset of the credit

crunch.

The markets in which we operate are generally buoyant and

offering interesting investment opportunities which we hope to

capitalise on in due course.

Ben Habib

Chief Executive

9 June 2016

CONSOLIDATED INCOME STATEMENT

for the year ended 31 March 2016

Notes Year ended Year ended

31 March 31 March

2016 (unaudited) 2015

Total (audited)

results

Total

results

GBP'000 GBP'000

-------------------------------- ------ ------------------- ---------------------

Revenue - existing operations 21,955 14,325

- business acquisitions - 4,198

-------------------------------- ------ ------------------- ---------------------

21,955 18,523

-------------------------------- ------ ------------------- ---------------------

Cost of sales (4,255) (3,156)

-------------------------------- ------ ------------------- ---------------------

Gross profit 17,700 15,367

Recognition of negative

goodwill on refinancing

of subsidiary - 1,123

Recognition of negative

goodwill on acquisition

of subsidiaries - 716

Fair value adjustment

to investment properties 462 (876)

Operating expenses (8,404) (6,925)

-------------------------------- ------ ------------------- ---------------------

Operating profit 9,758 9,405

-------------------------------- ------ ------------------- ---------------------

Share of results in associates 170 185

Distribution income 223 694

Interest income 4 126 145

Interest expense 4 (2,931) (2,346)

-------------------------------- ------ ------------------- ---------------------

Profit before tax 7,346 8,083

Tax (charge)/ credit 5 (1,687) 328

-------------------------------- ------ ------------------- ---------------------

Profit for the year 5,659 8,411

-------------------------------- ------ ------------------- ---------------------

Attributable to:

Owners of the parent 5,008 8,172

Non-controlling interest 651 239

-------------------------------- ------ ------------------- ---------------------

5,659 8,411

-------------------------------- ------ ------------------- ---------------------

Earnings per share:

Basic 6 4.37p 7.21p

Diluted 6 4.28p 6.93p

-------------------------------- ------ ------------------- ---------------------

All operations are continuing.

CONSOLIDATED SEPARATE STATEMENT

OF OTHER COMPREHENSIVE INCOME

for the year ended 31 March 2016

Year ended Year ended

31 March 31 March

2016 2015

(unaudited) (audited)

Total Total

results results

GBP'000 GBP'000

----------------------------------- --- ------------- -----------

Profit for the year 5,659 8,411

---------------------------------------- ------------- -----------

Other comprehensive income

Exchange differences

on retranslation of foreign

subsidiaries (1,346) 272

Revaluation of available-for-sale

financial assets 11 37

Taxation - -

----------------------------------- --- ------------- -----------

Total comprehensive income

for the year 4,324 8,720

Total comprehensive income

for the year attributable

to:

Owners of the parent 3,486 8,505

Non-controlling interest 838 215

4,324 8,720

--------------------------------------- ------------- -----------

CONSOLIDATED BALANCE SHEET

As at 31 March 2016

Notes As at As at

31 March 31 March

2016 2015

(unaudited) (audited)

GBP'000 GBP'000

Non-current assets

Goodwill 7 153 153

Investment properties 8 120,718 114,262

Property, plant and equipment 186 43

Interest in associates 9(a) 3,044 671

Other financial assets 9(b) 914 1,531

Other receivables 11 186 283

Deferred tax assets 3,016 3,803

------------------------------- ------ ------------- -----------

Total non-current assets 128,217 120,746

------------------------------- ------ ------------- -----------

Current assets

Inventories - land and

buildings 10 13,894 12,639

Current tax assets 56 236

Trade and other receivables 11 10,128 5,744

Cash and cash equivalents 8,975 12,240

------------------------------- ------ ------------- -----------

Total current assets 33,053 30,859

------------------------------- ------ ------------- -----------

Current liabilities

Trade and other payables 12 (7,938) (8,134)

Financial liabilities 13 (7,668) (11,788)

Current tax liabilities (200) (108)

------------------------------- ------ ------------- -----------

Total current liabilities (15,806) (20,030)

------------------------------- ------ ------------- -----------

Net current assets 17,247 10,829

------------------------------- ------ ------------- -----------

Total assets less current

liabilities 145,464 131,575

------------------------------- ------ ------------- -----------

Non-current liabilities:

Financial liabilities 13 (108,992) (97,925)

Deferred tax liabilities (2,382) (2,631)

Net assets 34,090 31,019

------------------------------- ------ ------------- -----------

Equity

Called up share capital 1,166 1,149

Share premium 5,773 5,505

Foreign exchange translation

reserve (2,151) (618)

Revaluation reserve (38) (49)

Share-based payment reserve 203 203

Retained earnings 27,231 23,735

------------------------------- ------ ------------- -----------

Equity attributable to

the owners of the parent 32,184 29,925

Non-controlling interest 1,906 1,094

------------------------------- ------ ------------- -----------

Total equity 34,090 31,019

------------------------------- ------ ------------- -----------

Net assets per share 6 27.75p 26.30p

------------------------------- ------ ------------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2016

Group Share Share Share-based Foreign Purchase Investment Retained Non-controlling Total

capital premium payment exchange of own revaluation earnings interest

reserve translation shares reserve

reserve

GBP'000 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1

April

2015 1,149 5,505 203 (618) (173) (49) 23,908 1,094 31,019

Profit

for the

period - - - - - - 5,659 - 5,659

Fair

value

(or revaluation)

gains

on

available-for-sale

financial

assets

to profit

or loss - - - - - 11 - - 11

Movement

on foreign

exchange - - - (1,533) - - - 187 (1,346)

Sale

of treasury

shares - 10 - - 70 - - - 80

New shares

issued 17 258 - - - - - - 275

Non-controlling

interest - - - - - - (651) 651 -

Dividends

paid - - - - - - (1,582) (26) (1,608)

-------------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31

March

2016 1,166 5,773 203 (2,151) (103) (38) 27,334 1,906 34,090

-------------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1

April

2014 1,149 5,498 203 (914) (310) (86) 17,027 895 23,462

Profit

for the

period - - - - - - 8,411 - 8,411

Fair

value

(or revaluation)

gains

on

available-for-sale

financial

assets

to profit

or loss - - - - - 37 - - 37

Movement

on foreign

exchange - - - 296 - - - (24) 272

Sale

of treasury

shares - 7 - - 137 - - - 144

Non-controlling

interest - - - - - - (239) 239 -

Dividends

paid - - - - - - (1,291) (16) (1,307)

-------------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31

March

2015 1,149 5,505 203 (618) (173) (49) 23,908 1,094 31,019

-------------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 March 2016

2016 2015

Notes Group Group

GBP'000 GBP'000

----------------------------------- ------ --------- ---------

Cash flows from operating

activities

----------------------------------- ------ --------- ---------

Operating profit 9,758 9,405

Adjustments for:

Depreciation of investment

property and property

plant & equipment 1,704 384

Fair value adjustment

on investment properties (462) 876

Negative goodwill - (1,839)

(Increase)/decrease in

inventories (291) (258)

Decrease/(increase) in

trade and other receivables 903 (486)

Increase/(decrease) in

trade and other payables (356) 577

Other non-cash adjustments 460 84

Cash generated from operations 11,716 8,743

Taxes paid (922) (826)

----------------------------------- ------ --------- ---------

Net cash flow from operating

activities 10,794 7,917

----------------------------------- ------ --------- ---------

Cash flow from/ (used

in) investing activities

----------------------------------- ------ --------- ---------

Purchase of investments 9(b) - (353)

Capital expenditure on

investment properties 8 (1,216) (383)

Proceeds from partial

disposal of available-for-sale

assets 9(b) 628 565

Purchase of property,

plant & equipment (197) (14)

Cash paid on control/

acquisitions of new subsidiaries - (4,638)

Cash and cash equivalents

received on control/

acquisitions of new subsidiaries - 3,055

Investment in shares

of new associates 9(a) (2,293) -

Interest received 4 126 145

Dividends from associates 9(a) 90 189

Distributions received 223 694

Net cash flow from/ (used

in) investing activities (2,639) (740)

----------------------------------- ------ --------- ---------

Cash flow from/ (used

in) financing activities

Net repayment of shareholder

loan in subsidiary (95) (293)

Proceeds from bank loan 8,993 3,547

Repayment of bank loans (9,341) (4,574)

Short term loan to an (4,729) -

associate

Repayment of finance

lease (2,446) (1,202)

Sale of shares held in

treasury 80 144

Proceeds from the issue 275 -

of share capital

Interest paid (2,825) (2,266)

Dividends paid (1,582) (1,291)

Dividends paid to non-controlling

interest (26) (16)

----------------------------------- ------ --------- ---------

Net cash flow from/ (used

in) financing activities (11,696) (5,951)

----------------------------------- ------ --------- ---------

Net (decrease)/ increase

in cash and cash equivalents (3,541) 1,226

----------------------------------- ------ --------- ---------

Cash and cash equivalents

at the beginning of the

year 12,240 11,279

----------------------------------- ------ --------- ---------

Currency translation

gains/ (losses) on cash

and cash equivalents 276 (265)

----------------------------------- ------ --------- ---------

Cash and cash equivalents

at the year-end 8,975 12,240

----------------------------------- ------ --------- ---------

1. Basis of preparation

These preliminary financial statements have not been audited and

are derived from the statutory accounts within the meaning of

section 434 of the Companies Act 2006. They have been prepared in

accordance with the Group's accounting policies that will be

applied in the Group's annual financial statements for the year

ended 31 March 2016. These are consistent with the policies applied

for the year ended 31 March 2015. These accounting policies are

drawn up in accordance with International Accounting Standards

(IAS) and International Financial Reporting Standards (IFRS) as

issued by the International Accounting Standards Board and as

adopted by the European Union (EU). Whilst the financial

information included in this preliminary statement has been

prepared in accordance with IFRS, this announcement does not itself

contain sufficient information to fully comply with IFRS. The

comparative figures for the financial year ended 31 March 2015 are

not the statutory accounts for the financial year but are derived

from those accounts prepared under IFRS which have been reported on

by the Group's auditors and delivered to the Registrar of

Companies. The report of the auditors was unqualified, did not

include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

These preliminary financial statements were approved by the

Board of Directors on 8 June 2016.

2. Revenue

Revenue from continuing operations consists of revenue arising

in the United Kingdom 10% (2015: 20%), Poland 82% (2015: 74%) and

Romania 8% (2015: 6%). All revenue relates solely to the Group's

principal activities.

3. Segment reporting 2016

Property Group Group Unallocated Total

fund properties fund central

management and other properties overheads

co-investments "FOP"

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ---------------- ------------ ------------ ----------

Total revenue 2,895 12,894 6,166 - 21,955

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation

and amortisation (31) (1,535) (138) - (1,704)

-------------------- ------------ ---------------- ------------ ------------ ----------

Operating

profit 1,384 7,316 3,962 (2,904) 9,758

-------------------- ------------ ---------------- ------------ ------------ ----------

Share of results

in associates - 170 - - 170

-------------------- ------------ ---------------- ------------ ------------ ----------

Distribution

income - 223 - - 223

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest income - 101 5 20 126

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest payable - (1,424) (1,507) - (2,931)

-------------------- ------------ ---------------- ------------ ------------ ----------

Profit/ (loss)

before tax 1,384 6,386 2,460 (2,884) 7,346

-------------------- ------------ ---------------- ------------ ------------ ----------

Analysed as:

-------------------- ------------ ---------------- ------------ ------------ ----------

Before performance

fees and related

items 783 8,268 2,321 (899) 10,473

-------------------- ------------ ---------------- ------------ ------------ ----------

Fair value

adjustment

to investment

properties - - 462 - 462

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation - (1,450) - - (1,450)

-------------------- ------------ ---------------- ------------ ------------ ----------

Provision (49) (17) (17) (663) (746)

-------------------- ------------ ---------------- ------------ ------------ ----------

Performance

and related

fees 1,131 - - - 1,131

-------------------- ------------ ---------------- ------------ ------------ ----------

Staff incentives (481) (169) (164) (1,610) (2,424)

-------------------- ------------ ---------------- ------------ ------------ ----------

Realised foreign

currency loss - (246) (142) 288 (100)

-------------------- ------------ ---------------- ------------ ------------ ----------

Total 1,384 6,386 2,460 (2,884) 7,346

-------------------- ------------ ---------------- ------------ ------------ ----------

Assets - Group 497 88,670 62,283 6,776 158,226

-------------------- ------------ ---------------- ------------ ------------ ----------

Share of net

assets of

associates - 3,352 - (308) 3,044

-------------------- ------------ ---------------- ------------ ------------ ----------

Liabilities (249) (76,454) (48,132) (2,345) (127,180)

-------------------- ------------ ---------------- ------------ ------------ ----------

Net assets 248 15,568 14,151 4,123 34,090

-------------------- ------------ ---------------- ------------ ------------ ----------

Additions

to

non-current

assets

-------------------- ------------ ---------------- ------------ ------------ ----------

Property,

plant and

equipment 197 - - - 197

-------------------- ------------ ---------------- ------------ ------------ ----------

Investment

properties - 968 248 - 1,216

-------------------- ------------ ---------------- ------------ ------------ ----------

Inventories - 291 - - 291

-------------------- ------------ ---------------- ------------ ------------ ----------

Investments - - - - -

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest in

associates - 2,293 - - 2,293

-------------------- ------------ ---------------- ------------ ------------ ----------

Segment reporting 2015-

Property Group Group Unallocated Total

fund properties fund central

management and other properties overheads

co-investments "FOP"

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ---------------- ------------ ------------ ----------

External revenue

- Existing

operations

- Sale of

inventory 6,140 2,968 5,217 - 14,325

- Business - - - - -

acquisitions - 3,479 719 - 4,198

-------------------- ------------ ---------------- ------------ ------------ ----------

Total 6,140 6,447 5,936 - 18,523

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation

and amortisation (18) (360) (6) - (384)

-------------------- ------------ ---------------- ------------ ------------ ----------

Operating

profit 4,435 5,454 2,454 (2,938) 9,405

-------------------- ------------ ---------------- ------------ ------------ ----------

Share of results

in associates - 185 - - 185

-------------------- ------------ ---------------- ------------ ------------ ----------

Distribution

income - 694 - - 694

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest income - 36 89 20 145

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest payable - (730) (1,616) - (2,346)

-------------------- ------------ ---------------- ------------ ------------ ----------

Profit/ (loss)

before tax 4,435 5,639 927 (2,918) 8,083

-------------------- ------------ ---------------- ------------ ------------ ----------

Analysed as:

-------------------- ------------ ---------------- ------------ ------------ ----------

Before performance

fees and related

items 1,605 4,489 2,272 (963) 7,403

-------------------- ------------ ---------------- ------------ ------------ ----------

Negative goodwill

on refinancing

of subsidiary - 1,123 - - 1,123

-------------------- ------------ ---------------- ------------ ------------ ----------

Negative goodwill

on acquisition

of subsidiaries - 716 - - 716

-------------------- ------------ ---------------- ------------ ------------ ----------

Fair value

adjustment

to investment

properties - - (876) - (876)

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation - (357) - - (357)

-------------------- ------------ ---------------- ------------ ------------ ----------

Performance

fees 3,365 - - - 3,365

-------------------- ------------ ---------------- ------------ ------------ ----------

Staff incentives (535) (194) (184) (1,955) (2,868)

-------------------- ------------ ---------------- ------------ ------------ ----------

Realised foreign

currency loss - (138) (285) - (423)

-------------------- ------------ ---------------- ------------ ------------ ----------

Total 4,435 5,639 927 (2,918) 8,083

-------------------- ------------ ---------------- ------------ ------------ ----------

Assets - Group 1,633 84,478 58,522 6,301 150,934

-------------------- ------------ ---------------- ------------ ------------ ----------

Share of net

assets of

associates - 979 - (308) 671

-------------------- ------------ ---------------- ------------ ------------ ----------

Liabilities (289) (72,437) (45,666) (2,194) (120,586)

-------------------- ------------ ---------------- ------------ ------------ ----------

Net assets 1,344 13,020 12,856 3,799 31,019

-------------------- ------------ ---------------- ------------ ------------ ----------

Additions

to

non-current

assets

-------------------- ------------ ---------------- ------------ ------------ ----------

Property,

plant and

equipment 8 - - - 8

-------------------- ------------ ---------------- ------------ ------------ ----------

Investment

properties - 66,909 8,864 - 75,773

-------------------- ------------ ---------------- ------------ ------------ ----------

Inventories - 258 - - 258

-------------------- ------------ ---------------- ------------ ------------ ----------

Investments - 353 - - 353

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest in - - - - -

associates

-------------------- ------------ ---------------- ------------ ------------ ----------

4. Interest income

2016 2015

Group Group

GBP'000 GBP'000

--------------------------------- --------- ---------

Interest income - bank deposits 36 63

Interest income - other 90 82

Total interest income 126 145

--------------------------------- --------- ---------

2016 2015

Group Group

GBP'000 GBP'000

----------------------------- --------- ---------

Interest expense - property

loans (2,254) (1,730)

Interest expense - bank and

other (106) (80)

Finance charges on finance

leases (571) (536)

----------------------------- --------- ---------

Total interest expense (2,931) (2,346)

----------------------------- --------- ---------

5. Tax expense

2016 2015

GBP'000 GBP'000

---------------------------- --------- ---------

Analysis of tax charge for

the year

Current tax (1,203) (525)

Deferred tax (484) 853

Total tax charge for the

year (1,687) 328

---------------------------- --------- ---------

The tax charge includes actual current and deferred tax for

continuing operations.

As in prior years, brought forward and current UK tax losses

have not been recognised as a deferred tax asset due to

insufficient foreseeable taxable income being earned in the UK. As

a result of this treatment the effective tax rate for the Group has

increased to 23% (2015: -4.1%), which is higher than both the main

stream corporation tax rates of 19% in Poland and 16% in

Romania.

The deferred tax credit in the prior year was largely

attributable to three acquisitions made during that year, amounting

to GBP992,000. This was created as a result of the nil value paid

for the deferred tax asset on acquisition. The deferred tax asset

has been restricted to two years worth of profits.

6. Earnings/ NAV per share

2016 2015

Basic earnings per share 4.37p 7.21p

Diluted earnings per share 4.28p 6.93p

GBP'000 GBP'000

Basic earnings 5,008 8,172

Diluted earnings assuming

full dilution 5,016 8,187

The following numbers of shares have been used to calculate both

the basic and diluted earnings per share:

2016 2015

Number Number

--------------------------------- ------------ ------------

Weighted average number

of Ordinary shares in issue

(used for basic earnings

per share calculation) 114,543,523 113,348,847

--------------------------------- ------------ ------------

Number of share options 2,700,000 4,850,000

--------------------------------- ------------ ------------

Total number of Ordinary

shares used in the diluted

earnings per share calculation 117,243,523 118,198,847

--------------------------------- ------------ ------------

The following earnings have been used to calculate both the

basic and diluted earnings per share:

2016 2015

GBP'000 GBP'000

---------------------------------- --------- ---------

Basic earnings per share

Basic earnings 5,008 8,172

---------------------------------- --------- ---------

Diluted earnings per share

Basic earnings 5,008 8,172

Notional interest on share

options assumed to be exercised 8 15

---------------------------------- --------- ---------

Diluted earnings 5,016 8,187

---------------------------------- --------- ---------

2016 2015

Net assets per share 27.75p 26.30p

Adjusted net assets per share 43.01p 35.75p

------------------------------- ------- -------

The following numbers have been used to calculate

both the net assets and adjusted net assets

per share:

Net assets per share Number Number

--------------------------------- ------------ ------------

Number of shares in issue

at year-end 115,967,111 113,792,541

Net assets per share GBP'000 GBP'000

--------------------------------- ------------ ------------

Net assets excluding non

controlling interest 32,184 29,925

Number Number

Adjusted net assets per share

Number of shares in issue

at year-end 115,967,111 113,792,541

Number of share options assumed

to be exercised 2,700,000 4,850,000

--------------------------------- ------------ ------------

Total 118,667,111 118,642,541

--------------------------------- ------------ ------------

GBP'000 GBP'000

Adjusted net assets per share

Net assets excluding non

controlling interest 32,184 29,925

Investment properties at

fair value net of deferred

tax 16,338 11,018

Inventories at fair value

net of deferred tax 1,795 1,248

Other items 716 222

------------------------------- -------- --------

Total 51,033 42,413

------------------------------- -------- --------

7. Goodwill

2016 2015

Group Group

GBP'000 GBP'000

------------- --------- ---------

At 1 April 153 153

Additions - -

At 31 March 153 153

------------- --------- ---------

The Directors have carried out an annual impairment test and

concluded that no impairment write down is necessary because the

estimated recoverable amount was higher than the value stated.

8. Investment properties

2016 2015

Group Group

GBP'000 GBP'000

------------------------------ --------- ---------

Investment properties

At 1 April 114,262 48,759

Business acquisitions - 75,390

Capital expenditure 1,216 383

Depreciation (1,654) (357)

Fair value adjustment 462 (876)

Foreign exchange translation 6,432 (9,037)

------------------------------ --------- ---------

At 31 March 120,718 114,262

------------------------------ --------- ---------

Investment properties owned by the Group, and indirectly via FOP

are stated at cost less depreciation and accumulated impairment

losses. The properties were valued by CBRE, Polish Properties and

BNP Paribas at the Group's financial year-end at EUR177.73 million

(2015: EUR176.73 million), the Sterling equivalent at closing

foreign exchange rates being GBP140.91 million (2015: GBP127.86

million). On acquisition of the Gdynia Podolska property the

Directors took the decision to depreciate the property over the

lease term. In the Director's opinion the property's estimated

residual value at the end of the period of ownership will be lower

than the carrying value. No other property has been depreciated as

the estimated residual value is expected to be higher than the

carrying value.

9. Investment in associates and other financial assets and investments

The Group has the following investments:

2016 2015

Group Group

GBP'000 GBP'000

---------------------------- --------- ---------

a) Associates

At 1 April 671 675

Additions 2,293 -

Disposals - -

Share of associates profit

after tax 170 185

Dividends received (90) (189)

---------------------------- --------- ---------

At 31 March 3,044 671

---------------------------- --------- ---------

The Group's investments in associated companies is held at cost

plus its share of post-acquisition profits assuming the adoption of

the cost model for accounting for investment properties under IAS40

and comprises the following:

2016 2015

Group Group

GBP'000 GBP'000

----------------------------------- --------- ---------

Investments in associates

5(th) Property Trading Ltd 871 827

Regional Property Trading

Ltd 159 152

Fprop Romanian Supermarkets 737 -

Ltd

Fprop Galeria Corso Ltd 1,585 -

----------------------------------- --------- ---------

3,352 979

----------------------------------- --------- ---------

Less: Share of profit after

tax withheld on sale of property

to 5(th) Property Trading

Ltd in 2007 (308) (308)

----------------------------------- --------- ---------

3,044 671

----------------------------------- --------- ---------

If the Group had adopted the alternative fair value model for

accounting for investment properties, the carrying value of the

investment in associates would have increased to GBP3,551,159

(2015: GBP1,175,000).

2016 2015

Group Group

GBP'000 GBP'000

------------------------------- --------- ---------

b) Other financial assets

and investments

At 1 April 1,531 1,706

Additions - 353

Disposals (628) (565)

Increase in fair value during

the year 11 37

------------------------------- --------- ---------

At 31 March 914 1,531

------------------------------- --------- ---------

The Group holds two unlisted investments in funds managed by it.

Both are held at fair value. All of the assets have been classified

as available for sale. In the Directors' view the fair value has

been estimated to be not materially different from their carrying

value. Fair value has been arrived at by applying the Group's

percentage holding in the investments of the fair value of their

net assets.

10. Inventories - land and buildings

2016 2015

Group Group

GBP'000 GBP'000

------------------------------ --------- ---------

Group properties for resale

at cost

At 1 April 12,639 12,304

Purchases - -

Capital expenditure 291 258

Disposals - -

Foreign exchange translation 964 77

------------------------------ --------- ---------

At 31 March 13,894 12,639

------------------------------ --------- ---------

The Group's total interest in Blue Tower (an office block in

Warsaw) is 48.2% with a fair value of GBP16.01 million (2015:

GBP14.18 million), and is shown at cost under inventories.

11. Trade and other receivables

2016 2015

Group Group

GBP'000 GBP'000

-------------------------------- --------- ---------

Current assets

Trade receivables 2,589 2,304

Less provision for impairment

of receivables (905) (649)

-------------------------------- --------- ---------

Trade receivables net 1,684 1,655

Other receivables 7,554 3,147

Prepayments and accrued income 890 942

-------------------------------- --------- ---------

10,128 5,744

-------------------------------- --------- ---------

Other receivables include a short term loan

to an associate for EUR6.5m (GBP5.15m) which

was repaid after the year end in May 2016.

Non-current assets

-------------------------------- --------- ---------

Other receivables 186 283

-------------------------------- --------- ---------

12. Trade and other payables

2016 2015

Group Group

GBP'000 GBP'000

----------------------------- --------- ---------

Current liabilities

Trade payables 2,189 2,605

Other taxation and social

security 575 580

Other payables and accruals 5,163 4,938

Deferred income 11 11

----------------------------- --------- ---------

7,938 8,134

----------------------------- --------- ---------

13. Financial liabilities

2016 2015

Group Group

GBP'000 GBP'000

------------------------------------ --------- ---------

Current liabilities

Loans repayable by subsidiary 1,841 -

(FOP) to third party shareholders

Bank loan 3,014 9,382

Finance leases 2,813 2,406

------------------------------------ --------- ---------

7,668 11,788

------------------------------------ --------- ---------

Non-current liabilities

Loans repayable by subsidiary

(FOP) to third party shareholders - 1,936

Bank loans 62,038 50,610

Finance leases 46,954 45,379

------------------------------------ --------- ---------

108,992 97,925

------------------------------------ --------- ---------

2016 2015

Group Group

GBP'000 GBP'000

------------------------------- --------- ---------

Total obligations under bank

loans and finance leases

Repayable within one year 7,668 11,788

Repayable within one and five

years 93,150 57,928

Repayable after five years 15,842 39,997

------------------------------- --------- ---------

116,660 109,713

------------------------------- --------- ---------

Loans repayable by FOP to third party shareholders are unsecured

and repayable on demand.

Eight bank loans and three finance leases all denominated in

Euros totalling GBP114,819,000 (2015: GBP107,777,000) included

within financial liabilities are secured against investment

properties owned by the Group and Fprop Opportunities plc (FOP) and

the property owned by the Group shown under inventories. These bank

loans and finance leases are otherwise non-recourse to the Group's

assets.

The preliminary results are being circulated to all shareholders

and can be downloaded from the Company's web-site (www.fprop.com).

Further copies can be obtained from the registered office at 32 St

James's Street, London, SW1A 1HD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SSEEDAFMSELM

(END) Dow Jones Newswires

June 09, 2016 02:00 ET (06:00 GMT)

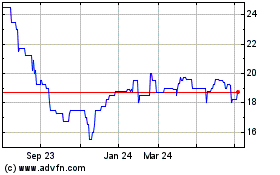

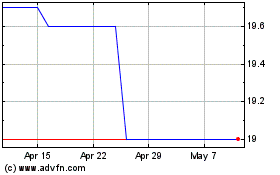

First Property (LSE:FPO)

Historical Stock Chart

From Aug 2024 to Sep 2024

First Property (LSE:FPO)

Historical Stock Chart

From Sep 2023 to Sep 2024