TIDMFDP

RNS Number : 2721F

First Derivatives PLC

11 November 2015

First Derivatives plc

("FD", the "Company" or the "Group")

Interim results for the six months ended 31 August 2015

FD (AIM:FDP.L, ESM:FDP.I), a leading provider of software and

consulting services, announces its results for the six months ended

31 August 2015.

Financial highlights

* Revenue GBP53.8m (H1 2015: GBP37.5m) +44%

* EBITDA GBP10.8m (H1 2015: GBP6.2m) +73%

* Profit before tax GBP4.6m (H1 2015: GBP3.7m) +27%

* Adjusted* profit before tax GBP7.6m (H1 2015:

GBP4.5m) +69%

* Reported diluted EPS 13.9p (H1 2015: 13.5p) +3%

* Adjusted* diluted EPS 23.9p (H1 2015: 16.5p) +44%

* Interim dividend 5.0p per share (H1 2015: 3.3p) +52%

* Net debt GBP10.5m (H1 2015: GBP9.1m)

*Adjusted for amortisation of acquired intangibles, share based

payments, profit on disposal of property, acquisition costs,

finance translation income/charges (and associated taxation impact

for EPS).

Business highlights

-- Multi-year investment in software continuing to pay off with

new clients within financial services markets driving software

revenue growth of 87%.

-- Further growth and strategic progress in consulting, with

increased scale and broader expertise resulting in revenue growth

of 28%.

-- Strategic acquisitions of Affinity Systems and

ActivateClients for a combined initial consideration of GBP7.1m

generating positive results in the digital marketing and utilities

sectors.

-- Pipeline of software opportunities outside financial services

growing, with increased sales and marketing effort.

-- Board further strengthened through the appointments of Virginia Gambale and Jon Robson.

Post period-end highlights

-- Formation of FD Labs to focus innovation and enable the

widespread adoption and deployment of kdb+.

Seamus Keating, Chairman of FD, commented: "This was another

period of strong progress across the Group. Our consulting division

delivered revenue growth of 28% and during the period a number of

initiatives laid the foundations for FD to continue our remarkable

track record of more than 20% per annum growth in consulting

revenue. Although we remain at an early stage of full

commercialisation of our software products we are pleased to report

an impressive 87% growth in software revenue as we continued to

penetrate our key target markets in the period.

"The positive performance in the first half of our financial

year has continued into the second half and the high visibility

within both consulting and software gives the Board confidence that

the Group expects to meet market expectations for the full year. We

will continue to invest to position ourselves to benefit from our

software's technology lead, to build upon this and look to convert

our pipeline of opportunities within capital markets and other

sectors. We continue to believe the work and investments we have

made, along with our market positioning in both consulting and

software, provide a strong platform to meet our exciting growth

ambitions."

For further information please contact:

First Derivatives plc +44(0)28 3025 2242

Brian Conlon, Chief Executive Officer www.firstderivatives.com

Graham Ferguson, Chief Financial Officer

Ian Mitchell, Head of Investor Relations

Investec Bank plc

(Nominated Adviser and Broker)

Dominic Emery

Carlton Nelson

Sebastian Lawrence +44 (0)20 7597 4000

Goodbody (ESM Adviser and Broker)

Linda Hickey

Finbarr Griffin +353 1 667 0420

Walbrook PR

Paul Cornelius

Nick Rome

Helen Cresswell

Sam Allen +44 (0)20 7933 8780

About FD

FD is a global technology provider with nearly 20 years of

experience of working with some of the world's largest finance,

technology and energy institutions. FD is the developer of the

world-leading database technology kdb+. FD employs over 1,500

people worldwide and has operations in London, New York, Stockholm,

Singapore, Hong Kong, Tokyo, Sydney, Palo Alto, Toronto,

Philadelphia, Dublin, Belfast and its headquarters in Newry.

For further information, please visit

www.firstderivatives.com

CHAIRMAN'S STATEMENT

I am pleased to report continued growth during the first half of

the Company's financial year. In the six months ended 31 August

2015 we increased our revenue by 44% to GBP53.8m, from GBP37.5m in

the corresponding period a year ago, while EBITDA was GBP10.8m

compared to GBP6.2m in the prior period, representing 73%

growth.

Software revenue increased by 87% to GBP18.3m (H1 2015: GBP9.8m)

with recurring software revenue, which is a key indicator for the

Company, increasing by 153%. This growth was mainly achieved within

the financial services segment, where our products are generating

momentum as we penetrate our client base further. We are seeing

continued growth in our software pipeline and are encouraged with

our progress during the period.

Outside financial services, we see our product suite providing

key advantages in the areas of Streaming Analytics, Operational

Intelligence and In Memory Computing coupled with our ability to

provide real time visualisation. We are identifying those markets

which offer the most compelling opportunities for these

characteristics and are progressing discussions with a number of

potential customers. Whilst we are currently working primarily on a

direct basis, we also are targeting selected partner organisations

to work with. As expected, we are making greatest progress in those

markets where we have made acquisitions to accelerate our route to

market, namely in digital marketing and utilities.

Consulting revenues continued to grow strongly, rising by 28% to

GBP35.5m (H1 2015: GBP27.7m). As our scale and range of

capabilities grow, we continue to see an increase in the size and

strategic importance of the engagements we undertake with clients.

We are increasingly viewed as a strategic partner in the delivery

of IT strategies for clients, further assisting our revenue

visibility and offering the potential to cross sell software

products. To support the growth plans of the Group we have worked

on enhancing recruitment and training programmes. Overall,

headcount now stands at more than 1,500 (H1 2015: 1,000). This

continued investment in our staff gives us a strong platform for

future growth.

The Group continues to generate positive operating cash flows

and the Board has again decided to increase the interim dividend,

by 52% to 5.00p per share (H1 2015: 3.30p per share). This will be

paid on 11 December 2015 to those shareholders on the register on

20 November 2015.

During the period we completed the acquisitions of Affinity

Systems and ActivateClients. Affinity Systems strengthens our

capabilities in utilities and sensor data management while

ActivateClients accelerated the development of our HTML5

capabilities. Both acquisitions continue to be integrated into the

Group and are performing in line with our expectations.

There were two new appointments to the Board during the period.

In addition to the appointment of Virginia Gambale as reported in

our full year results in June 2015, on 3 August 2015 we were

pleased to announce the appointment of Jon Robson as a

Non-Executive Director. Jon, based in the United States, is a

former CEO of NYSE Technologies and former President of the

Enterprise Division of Thomson Reuters and he brings a breadth of

global capital markets experience.

David Anderson will step down from the Board at the end of the

financial year. On behalf of the Company and my Board colleagues, I

thank David sincerely for the role he has played since joining as

chairman at the time of the Group's AIM listing in 2002. His

support and advice to Brian and the team have been invaluable as

the Company has grown from c. 20 to more than 1,500 people and

shareholders have enjoyed returns of more than 2,800% over that

period.

The positive performance in the first half of our financial year

has continued into the second half and the high visibility within

both consulting and software gives the Board confidence that the

Group expects to meet market expectations for the full year. The

Group will continue to invest to benefit from its software

technology lead position and to build and convert our pipeline of

opportunities within financial services and other sectors. The work

and investments we have made, along with our market positioning in

both consulting and software, provide a strong platform to meet our

exciting growth ambitions.

Seamus Keating

Chairman

CHIEF EXECUTIVE'S STATEMENT

I am pleased to report continued growth during the first half of

the Company's financial year. In the six months ended 31 August

2015 we increased our revenue by 44% to GBP53.8m, from GBP37.5m in

the corresponding period, while EBITDA was GBP10.8m compared to

GBP6.2m in the prior period, representing 73% growth.

Within the capital markets sector, market conditions for our

services remained healthy, driven by complex and widespread

regulatory change with pressure to introduce efficiencies and

reduce costs. As these require the use of new technology or changes

to the way that technology is delivered it has a positive impact on

both our consulting and software activities.

Outside capital markets, we are establishing a pipeline of

opportunities across a number of markets. Within digital marketing

and utilities, our activities have been bolstered by the

acquisitions of Prelytix and Affinity Systems. We have also been

pleased with the progress we have made in markets such as pharma as

we seek to assist leading companies in these markets address their

data analytics challenges.

(MORE TO FOLLOW) Dow Jones Newswires

November 11, 2015 02:01 ET (07:01 GMT)

We are positioning the Group to benefit from the growing need

for organisations to deploy technology to deal with real time,

structured data. We believe kdb+, which has a proven track record

for in-memory analytics solutions, is ideally placed to meet this

requirement.

The global market opportunity for our software is significant

and we recognise that to fulfil our potential requires a commitment

to increasing awareness of the capabilities of our platform and an

understanding of our competitive advantages. During the period we

have introduced a range of initiatives to achieve these aims

including: increasing our investment in our direct sales team;

holding discussions with potential sales partners; working with

industry analysts such as Gartner to provide greater understanding

of our capabilities; and organising tutorials on our technology

with potential customers in 62 cities across 37 countries. In

addition we are relaunching our corporate web site to clearly

communicate the strengths and range of use cases for our

software.

Market positioning

FD is a world leader in Big Fast Data, the capture and analysis

of large data sets and/or streaming data. Our software products are

based on kdb+, a proven world-leading time series database, that

time stamps data to the nanosecond and has geolocation capability

built in. Our platform is complete and has been used extensively

within capital markets for more than a decade, ensuring it is a

robust technology. Furthermore, a key attraction of our technology

is that it is hardware efficient and thus total cost of ownership

of a solution is lower than competing solutions.

We see evidence that Big Fast Data is increasing in importance

to user organisations, both in the context of our conversations

with potential clients and also through industry analyst comment.

For example, Gartner recommends to its clients that they use

high-performance messaging infrastructure to transport data; adopt

event stream processing for real time pattern detection; leverage

in-memory database management systems for faster and deeper

analysis of data; and deploy in-memory analytics for data at rest.

These recommendations are all attributes and capabilities of our

technology and are already contained in a complete, integrated

solution deployed in many of the world's leading banks.

Our research and development efforts are aimed at maintaining

the performance lead kdb+ enjoys over competing solutions,

increasing the ease of deployment of the platform and building

applications applicable to our target markets. Our development

spend is heavily geared to the commercialisation of the technology,

but we also recognise that the technology landscape is evolving

rapidly and that we need to innovate constantly. To this end we

announced the formation of FD Labs in September, with the

additional remit to aid the deployment of kdb+ wherever it is

required, be that at device level within embedded systems, across

enterprise deployments or within Cloud/SaaS environments.

Software

Software sales during the period increased by 87% to GBP18.3m

(H1 2015: GBP9.8m). The technical capabilities of our software

continue to assist us develop a market share within capital

markets. Kdb+, our enterprise platform, can be sold on a standalone

basis or as a horizontal play. In addition we have developed a

suite of applications on top to address a number of areas within

capital markets, such as market surveillance, trading, regulatory

reporting, transaction cost analysis and algorithmic testing. Our

software products address market opportunities valued at hundreds

of millions of dollars per annum. They can be deployed or hosted in

multi-tenanted solutions so that the incremental cost of signing

new customers is low. Key wins over the year to date have

included:

- kdb+: In July the Group was awarded a contract by the U.S.

Security and Exchange Commission (SEC) for the use of kdb+ and the

Shenzhen Stock Exchange also signed a deal. It is now used by more

than 100 organisations and there were 12 new deals signed across

hedge funds, banks and technology suppliers during the period.

- Market Surveillance and Algo Testing: The Group implemented

Surveillance at IEX, a high-growth equity trading venue based in

New York and the National Stock Exchange of India (NSE). The latter

was for a platform that allows NSE clients to test their algorithms

before they go live on the Exchange. This is a strategically

important win as many market regulations, including MiFID II that

comes into effect in 2017, state that algorithms must be tested

prior to live use. We believe there is likely to be global market

demand, from Exchanges and Regulators as well as market

participants, for testing solutions, such as that developed by FD

for the NSE, which provides a measurable and objective test of the

efficacy of algorithms.

- Energy Markets: We secured our first customer within energy

trading surveillance - a leading European oil and gas company is

using our product to monitor trading activity in the futures market

as regulators tighten controls within the industry.

- Liquidity Management: Our kdb+ Flow platform signed a

significant global player, EBS, ICAP's market leading electronic FX

business, who are using our software for streaming analytics. ICAP

also purchased Molten Markets, one of FD's customers. The fact that

Molten Markets will continue to use our technology post the

transaction is further validation of the strength of our

solution.

- Operations: Our kdb+ SCOUT solution has been successfully

deployed at six banks in Europe and is offered as a managed

service. These tools cover areas such as application monitoring,

regulatory reporting, single customer views, reconciliations and

testing.

While our revenues to date have mostly been derived from within

capital markets, we are convinced that our competitive advantages

in dealing with Big Fast Data are applicable to additional markets.

During the period we continued discussions with a range of

organisations that face challenges due to their need to capture and

analyse very large data sets and we are encouraged by the reaction.

We will continue to work through the use cases with these potential

clients in the coming months.

In sectors where we have acquired companies we are significantly

more advanced with our development and our commercialisation is

significantly more advanced, namely digital marketing and

utilities.

Digital Marketing

Our Marketing Cloud product was successfully launched earlier

this year and is now being used by many of the world's leading

technology companies such as Cisco, Commvault and Citrix. Using the

Marketing Cloud platform, powered by kdb+, we analyse 93% of the

B2B web to determine the buying intent of organisations. We are

able to marry that intent data to our clients' data and our own

proprietary databases of corporate technology environments and

decision makers. This enables us to provide fully qualified leads

to our clients and to execute those leads on their behalf.

The business model for the Marketing Cloud is subscription

based, which will add to the Group's recurring revenues. New client

wins during the period included several global technology firms and

we are pleased with the level of growth and the pipeline of

opportunities.

Unlike many of the heavily funded start-ups that have emerged in

this area, we believe that the unique combination of our global

presence, our hosting capability, our data science credentials, the

maturity of our platform, the domain knowledge of our marketing

team and our ability to deal with vast amounts of data leaves us

strongly placed to win significant market share in this fast

growing market. We believe that our investment in this area can

generate significant returns for the Group.

Other vertical markets

Within the utilities space, our relationship with a major

American Independent System Operator (ISO) continues to deepen as

it evaluates the use of FD's Sensor Data Management (SDM) platform.

Our platform is applicable to smart meters and other connected

devices. We are engaged in discussions with a number of utilities

and other organisations regarding the potential for our software to

solve their analytics challenges for streaming data from devices

and these discussions reinforce our view of the market leading

performance of our platform.

As reported in June, we continue to advance discussions with

prospects in areas such as:

- Telecoms: customer profile monitoring/analysis; customer

marketing; sensor data monitoring; network optimisation.

- Pharma: drug trial data capture, analysis and simulation; gene

sequencing and analysis; regulatory reporting.

- Others: automotive plant monitoring; proximity marketing;

preventative maintenance in manufacturing, web analytics.

Our product roadmap includes a number of exciting new

initiatives to accelerate our penetration in these markets such as

the creation of a sensors analytics product. We have identified a

number of partnership opportunities and we hope to cement some of

these relationships in the near future. The establishment of FD

Labs is a clear statement of our intent to continue to push the

boundaries of what our technology can achieve and to keep kdb+ at

the forefront of innovation.

Consulting

Our consulting business continues to grow strongly with revenue

increasing by 28% to GBP35.5m (H1 2015: GBP27.7m). Demand for our

consulting services has been high during the first six months of

the year as the market continues to value the skills and

capabilities of our staff. In addition our growing scale allows us

to deliver more complex and comprehensive assignments.

(MORE TO FOLLOW) Dow Jones Newswires

November 11, 2015 02:01 ET (07:01 GMT)

FD is one of the leading niche capital marketing consulting

companies in the world, with ongoing contracts with the majority of

the largest global investment banks. We provide implementation,

support and development services across a range of asset classes

including credit, interest rate, foreign exchange, equity, cash and

derivatives markets. Our breadth of expertise and delivery

capability provides a broad base for growth and our focus on

mission critical applications protects us from over reliance on any

particular trend within our clients' workload. Currently, many of

our clients are involved in meeting complex regulatory requirements

such as MiFID II and the European Market Infrastructure Regulation

(EMIR).

As well as growing our presence in established clients we

continue to win new customers, with a number of major, multi-year

assignments initiated during the period. These assignments

typically involve a combination of on site and near shore resources

and also increasingly comprise our own software tools. Our

increasing range of capabilities has elevated our standing within

many clients to partner with internal IT as a trusted advisor on

their mission critical systems. We continue to see significant

growth opportunities within our consulting business.

We were pleased to be recognised recently for the quality of the

training and opportunities we provide to staff through our

inclusion, for the first time, in the Times Top 100 Graduate

Employers. This is an influential publication that will assist our

ongoing mission to recruit leading talent from around the world.

The strength of our training programmes and the range and quality

of opportunities we provide to graduates is a key differentiator

for FD.

Acquisitions

We announced two acquisitions during the period:

- Affinity Systems: Affinity Systems, an Ontario, Canada based

software company specialising in utility, retail and healthcare

data management, was acquired in March 2015 for an initial

consideration of GBP3.8m. This acquisition boosts our non-financial

software solution delivery capabilities and provides us with an

accelerated path to market in the utilities sector as well as

domain expertise in sensor analytics.

- ActivateClients: ActivateClients, a software business with a

deep pedigree in producing sophisticated visualisation software and

based in Dublin, was acquired in March 2015 for an initial GBP3.3m.

The visualisation of large streaming data sets in real-time is the

unique selling point of the recent beta version of our new

dashboards, which has been well received by the market.

We will continue to evaluate acquisition opportunities where

they meet our strict acquisition criteria which is focused on

growth acceleration in target markets. Our ability to fund any such

deals we may identify is assisted by the strength of our cash

generation and EBITDA growth.

Management and personnel

The Group now employs more than 1,500 people, up from more than

1,000 people at the same time last year. We continue to attract

highly-qualified talent and achieve high retention rates. I would

like to pay tribute to all FD employees for their hard work,

talent, flexibility and dedication in what has been another period

of strong growth for the Group.

Summary

The first half of our financial year has seen important

operational progress as we build the capability to win and deliver

larger contracts across our business in both software and

consulting. At the same time, our financial performance has been

strong, delivering growth for our shareholders. Our high levels of

revenue visibility across the Group and the continued strengthening

of our pipeline gives us confidence in our ability to achieve full

year expectations and we remain excited about the potential of the

business.

Brian Conlon

Chief Executive Officer

Financial Review

The Company performed strongly in the first six months of the

year with revenue increasing by 44% to GBP53.8m, of which 27% was

organic and the remainder attributable to the strategic

acquisitions made during the past year. Software revenue increased

by 87% to GBP18.3m, with consulting revenue growing by 28% to

GBP35.5m. The Group's EBITDA margin increased to 20.0% for the

period (H1 2015: 16.6%) the principal driver being the greater

proportion of higher margin software sales achieved in the period

against consulting sales.

The Group continued to invest in R&D to maintain its

technology lead and to enable the deployment of its software on

devices, across the enterprise and in Cloud/SaaS environments.

R&D capitalisation was GBP3.7m (H1 2015: GBP3.0m) with

amortisation of our capitalised software GBP1.8m, up from GBP1.3m a

year ago.

Reported profit before tax for the period was GBP4.6 million (H1

2015: GBP3.7 million) representing growth of 27%. Adjusting for

non-operational costs and income results in an adjusted profit

before tax of GBP7.6m (H1 2015: GBP4.5m), an increase of 69% over

the prior year.

The Group's effective tax rate has increased to 25% from 20% in

H1 2015. The main driver for this has been increased revenue in

higher rate tax jurisdictions such as the U.S. Adjusted after tax

profits for the period were GBP6.0m (H1 2015: GBP3.6m), a 67%

increase over the prior year. A reconciliation to reported profit

is provided below.

Six months ended 31 August 2015 2014 Increase

GBP'000 GBP'000 %

Reported profit for the

period 3,479 2,936 18.5%

Adjustments for:

Amortisation of acquired

intangibles 2,015 776

Share based payment charges 504 607

Profit on disposal of

property - (554)

Acquisition costs 442 -

Finance translation income (28) (12)

Tax effect of the above (434) (173)

Adjusted profit for the

period 5,978 3,580 67.0%

Reported tax 1,151 723

Tax effect of the above 434 173

Adjusted profit before

tax 7,563 4,476 69.0%

EPS (fully diluted) 23.87 16.52 44.5%

Net debt was GBP10.5m at the period end (H1 2015: GBP9.1m)

reflecting the continuing good conversion of operating profit into

cash. Net assets at the period end were GBP106.6m, up from GBP54.3m

a year ago.

Consolidated Statement of Comprehensive Income (unaudited)

6 months ended 6 months ended

31 August 31 August

2015 2014

Notes GBP'000 GBP'000

Revenue 2 53,834 37,506

Cost of sales (37,976) (28,213)

Gross profit 15,858 9,293

Other income 544 938

Administrative expenses (11,144) (6,575)

Results from operating activities 5,258 3,656

Acquisition costs 442 -

Share based payments 504 607

Gain on disposal of property, plant

and equipment - (554)

Depreciation and amortisation 2,542 1,729

Amortisation of acquired intangible

assets (IFRS3) 2,015 776

Adjusted EBITDA 10,761 6,214

---------------------------------------- ------ --------------- ---------------

Financial income 5 1

Financial expense (661) (249)

Gain on foreign currency translation 28 12

Net financing expense (628) (236)

Profit before tax and associate income 4,630 3,420

Income from associates - 239

Profit before tax 4,630 3,659

Income tax expense (1,151) (723)

Profit for the period 3,479 2,936

=============== ===============

Pence Pence

Earnings per Share

Basic 4 15.0 14.6

Diluted 4 13.9 13.5

=============== ===============

(MORE TO FOLLOW) Dow Jones Newswires

November 11, 2015 02:01 ET (07:01 GMT)

Consolidated Statement of changes in equity

Share Currency

Share Share option Revaluation translation Retained Total

capital premium reserve reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2014 98 22,251 6,627 167 (3,040) 25,959 52,062

-------- -------- -------- ----------- ------------ --------- -------

Total comprehensive income for the period

Profit for the period - - - - - 2,936 2,936

Other comprehensive income

Net loss on net investment in foreign

subsidiary and associate - - - - (443) - (443)

Net profit on hedge of movement in

foreign

subsidiary and associate - - - - 4 - 4

-------- -------- -------- ----------- ------------ --------- -------

Total other comprehensive income - - - - (439) - (439)

Total comprehensive income for the period - - - - (439) 2,936 2,497

Transactions with owners, recorded

directly

in equity

Income tax on share options - - (1,146) - - - (1,146)

Exercise or issue of shares 3 3,139 (715) - - - 2,427

Share based payment charge - - 308 - - - 308

Transfer or forfeiture - - (20) - - 20 -

Dividends to equity holders - - - - - (1,813) (1,813)

-------- -------- -------- ----------- ------------ --------- -------

Total contributions by and distributions

to owners 3 3,139 (1,573) - - (1,793) (224)

-------- -------- -------- ----------- ------------ --------- -------

Balance at 31 August 2014 101 25,390 5,054 167 (3,479) 27,102 54,335

======== ======== ======== =========== ============ ========= =======

Consolidated Statement of changes in equity (continued)

Share Currency

Share Share option Revaluation translation Retained Total

capital premium reserve reserve adjustment earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 March 2015 114 55,286 6,262 - (1,690) 38,352 98,324

-------- -------- -------- ----------- ------------ --------- -------

Total comprehensive income for the period

Profit for the period - - - - - 3,479 3,479

Other comprehensive income

Net loss on net investment in foreign

subsidiary and associate - - - - (410) - (410)

Net profit on hedge of movement in

foreign

subsidiary and associate - - - - 76 - 76

-------- -------- -------- ----------- ------------ --------- -------

Total other comprehensive income - - - - (334) - (334)

Total comprehensive income for the period - - - - (334) 3,479 3,145

Transactions with owners, recorded

directly

in equity

Income tax on share options - - 246 - - - 246

Exercise or issue of shares 2 4,198 - - - - 4,200

Issue of shares as purchase consideration 1 2,599 - - - - 2,600

Share based payment charge - - 420 - - - 420

Dividends to equity holders - - - - - (2,371) (2,371)

-------- -------- -------- ----------- ------------ --------- -------

Total contributions by and distributions

to owners 3 6,797 666 - - (2,371) 5,095

-------- -------- -------- ----------- ------------ --------- -------

Balance at 31 August 2015 117 62,083 6,928 - (2,024) 39,460 106,564

======== ======== ======== =========== ============ ========= =======

Consolidated statement of financial position (unaudited)

As at As at As at

31 August 31 August 28 February

2015 2014 2015

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 6,010 5,335 5,948

Intangible assets 136,399 39,415 134,293

Investment in associate - 5,488 -

Trade and other receivables 2,648 2,721 2,634

Deferred tax asset 7,289 4,344 6,450

----------- ----------- -------------

Non-current assets 152,346 57,303 149,325

Trade and other receivables 29,015 22,022 29,952

Cash and cash equivalents 19,965 2,569 14,705

Assets held for sale - 1,840 -

----------- ----------- -------------

Current assets 48,980 26,431 44,657

Total assets 201,326 83,734 193,982

----------- ----------- -------------

Equity

Share capital 117 101 114

Share premium 62,083 25,390 55,286

Share option reserve 6,928 5,054 6,262

Revaluation reserve - 167 -

Currency translation adjustment

reserve (2,024) (3,479) (1,690)

Retained earnings 39,460 27,102 38,352

Equity attributable to shareholders 106,564 54,335 98,324

=========== =========== =============

Liabilities

Interest bearing borrowings 25,534 7,101 27,025

Trade and other payables 29,489 2,042 29,490

Deferred tax liability 11,641 4,328 11,284

Contingent deferred consideration 1,134 - 1,132

Non-current liabilities 67,798 13,471 68,931

Interest bearing borrowings 4,899 4,531 3,429

Trade and other payables 16,135 7,774 18,936

Current tax payable 2,117 755 490

Employee benefits 3,813 2,868 3,872

Current liabilities 26,964 15,928 26,727

Total liabilities 94,762 29,399 95,658

----------- ----------- -------------

Total equity and liabilities 201,326 83,734 193,982

=========== =========== =============

(MORE TO FOLLOW) Dow Jones Newswires

November 11, 2015 02:01 ET (07:01 GMT)

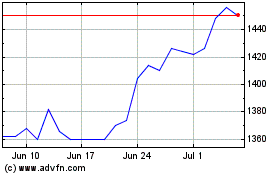

Fd Technologies Public (LSE:FDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fd Technologies Public (LSE:FDP)

Historical Stock Chart

From Apr 2023 to Apr 2024