Finance Watch -- WSJ

December 06 2016 - 3:02AM

Dow Jones News

GOLDMAN SACHS

Financial Institution Unit Revamps Top

Goldman Sachs Group Inc. has reshuffled the leadership of the

banking unit that counts other banks as clients.

Mike Esposito, who currently co-heads the global financial

institutions group, known as FIG, will be promoted to chairman of

that unit effective next month, according to a memo reviewed by The

Wall Street Journal.

He will be succeeded by Luke Sarsfield, who is chief operating

officer of Goldman's investment-banking division and will split the

role with FIG co-chief Todd Leland, based in London. The

reshuffling comes as Goldman has sought to deepen its reach among

financial institutions.

--Liz Hoffman

DELOITTE TOUCHE

Brazil Arm to Pay $8 Million Penalty

The Brazil affiliate of accounting firm Deloitte Touche Tohmatsu

agreed to pay $8 million to settle a U.S. regulator's allegations

that it issued false audit reports and tried to cover it up.

The fine for Deloitte Touche Tohmatsu Auditores Independentes,

Deloitte's Brazilian member firm, is the largest ever imposed by

the Public Company Accounting Oversight Board, the U.S.

audit-industry regulator. Twelve former Deloitte Brazil partners

and other personnel were sanctioned as well.

In settling, Deloitte Brazil admitted it violated

quality-control standards and failed to cooperate with the PCAOB's

inspection and investigation. Deloitte Brazil said in a statement

that "unethical behavior is not tolerated in our firm," and that

the conduct of the individuals involved was "wholly incompatible

with our culture." The firm is under new leadership now, and "we

have full confidence in the quality of our audits," the firm

said.

--Michael Rapoport

ROYAL BANK OF SCOTLAND

Lawsuits Are Settled On Rights Disclosure

Royal Bank of Scotland Group PLC said it would pay as much as

GBP800 million ($1.02 billion) to settle claims with shareholder

groups over allegations that it misled them in the run-up to an

emergency rights issue during the financial crisis.

RBS said that it had concluded settlements with three out of the

five shareholder groups without admitting fault and said that it

would "vigorously defend" claims from any parties that wouldn't

settle.

The dispute relates to a GBP12 billion cash call just before RBS

was bailed out by taxpayers in 2008. The GBP800 million already has

been set aside in RBS's accounts. RBS continues to negotiate with

the remaining two groups. If no agreement is reached, a trial is

due to commence next year.

--Max Colchester

PENSION FUNDS

Dallas Mayor Sues To Stop Withdrawals

Dallas Mayor Mike Rawlings filed a lawsuit to halt exits from

the city's police and fire pension fund following more than $500

million in withdrawals since early August.

The retreat by the city's police officers and firefighters is

heightening the risk that a major U.S. pension could run out of

money. Pension officials say the fund could be insolvent in 10

years.

Officers say they are pulling their money because of concerns

about the financial standing of the Dallas Police and Fire Pension

Fund following a series of investment blunders that produced more

than half a billion dollars in losses.

The fund made an ill-fated foray into real estate that included

luxury homes and shopping centers in Hawaii, student housing in

Texas and raw land in Idaho and Colorado.

The Dallas mayor, who said he is acting in his private capacity

as a Dallas taxpayer and paying for the suit himself, has been

publicly critical of the fund and has said the city doesn't intend

to bail out the retirement plan.

--Heather Gillers

(END) Dow Jones Newswires

December 06, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

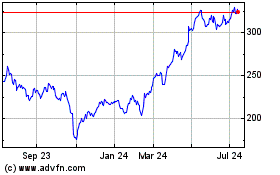

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024