Filed by: ACE Limited

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: The Chubb Corporation

Commission File No. 001-08661

The following is a

transcript of the conference call and webcast hosted by ACE Limited and The Chubb Corporation on July 1, 2015 at 8:30 a.m. (EDT).

THOMSON REUTERS STREETEVENTS

EDITED TRANSCRIPT

ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the

Definitive Agreement of ACE Ltd Acquiring Chubb Corp

EVENT DATE/TIME: JULY

01, 2015 / 12:30PM GMT

OVERVIEW:

ACE announced that Co. and The Chubb

Corporation have unanimously approved

a definitive agreement under which ACE will acquire Chubb. Under the agreement,

Chubb shareholders will receive aggregate consideration valued at $124.13 per

Chubb share in

stock and cash or approx. $28.3b.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated

companies.

C O R P O R A T E P A R T I C I P A N T S

Helen

Wilson ACE Ltd—IR

Evan Greenberg ACE Ltd—Chairman & CEO

John Finnegan Chubb—Chairman, President & CEO

Phil Bancroft ACE

Ltd—CFO

C O N F E R E N C E C A L L P A R T I C I P A N T S

Cliff

Gallant Nomura—Analyst

Jay Gelb Barclays Capital—Analyst

Ryan Tunis

Credit Suisse—Analyst

Charles Sebaski BMO Capital Markets—Analyst

Paul Newsome Sandler O’Neill—Analyst

Meyer Shields KBW—Analyst

Thomas Mitchell Miller Tabak—Analyst

John Heagerty Atlantic

Equities—Analyst

Josh Shanker Deutsche Bank—Analyst

Larry Greenberg

Janney Capital Markets—Analyst

Jay Cohen BofA Merrill Lynch—Analyst

P R E S E N T A T I O N

Operator

Welcome to the ACE-Chubb conference call. This call is being recorded.

(Operator Instructions)

Now for opening remarks and introductions, I’ll turn the call over to Helen Wilson, Investor Relations. Please, go ahead.

Helen Wilson—ACE Ltd—IR

Thank you. Good morning. This call is being webcast. A

replay will be available on ACE’s website. Earlier today, we issued a news release announcing

a definitive agreement under which ACE will acquire Chubb. A

copy of the release and the slides we are presenting today are available in the

Investor Relations sections of ACE’s and Chubb’s websites at ACEgroup.com

and Chubb.com. At the conclusion of our prepared remarks, we will

open the call for Q&A.

Before we begin to discuss the details of this transaction, I would like to remind everyone that during the call we will make forward-looking

statements. Please refer to the cautionary statement regarding forward-looking statements and the description of where to find additional

information and disclosures regarding participants and solicitations that are included in our press release issued this morning and on slides 2 and

3 in the accompanying investor presentation for additional details. Our speakers on today’s call are Evan Greenberg, Chairman and Chief Executive

of ACE and John Finnegan, Chairman, President and Chief Executive of Chubb. Now, it’s my pleasure to turn the call over to Evan.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

Good morning. Thank you for joining us on such short notice. I am delighted, simply thrilled, to have the opportunity to share this historic moment

with you, as we announce the joining together of two of the great companies in our industry. This is a combination occurring out of strength. We

are both great on our own, but the complementary and compelling strategic nature of this combination is the opportunity to create so much more

together. This is a growth story. Let me take a little time and describe the compelling rationale for bringing together ACE and Chubb, again, two

world-class insurance companies.

I’m going to begin on slide 4. This kind of captures it

all, with — in a very general fashion. This transaction simply advances our strategy in a meaningful

way and represents an outstanding opportunity to create

significant value for both ACE and Chubb shareholders, our companies and our policyholders.

We are combining two great, high-quality underwriting companies to

create a very well-balanced, broadly diversified, global leader in property

and casualty insurance with greater earning power and substantial future value creation

opportunities.

Our companies have complementary and exceptional strengths in product, distribution, customer segments and underwriting cultures. Where

one of us is not present, the other is. Where one of us is strong, the other is even stronger. Add to that, the increased data and insight we will gain

paired with our respective skills and experience, will drive profitable new growth opportunities in both developed and developing markets around

the world. The combined Company will be so well-balanced with a greater presence and capabilities in product areas that have less exposure to

the commercial P&C cycle.

In addition, we will have a substantially greater invested asset

base that will benefit from an eventual rise in interest rates. ACE and Chubb have

complementary cultures. We are both underwriting companies and share a passion

and discipline for underwriting excellence, as well as outstanding

client service. This underwriting passion and discipline have consistently produced world-class

levels of profitability. We are confident we will only

make each other better.

As we look more closely at the financial benefits of the combination, we expect to realize significant efficiencies in the shorter-term and greater

revenue growth medium-term that will drive returns and create opportunities to invest in our business in terms of more technology, products,

people, and geographic presence, further improving our competitive profile. Consistent with our track record and disciplined approach to M&A,

this transaction creates significant value for shareholders. First, through immediate accretion to earnings and book value per share. Looking out,

the transaction is projected to produce double-digit EPS accretion. It’s ROE accretive and will generate a double-digit ROI by year three. Additionally,

the ROI will exceed the companies’ cost of capital by year two and tangible book value per share will return to its current level in three years.

Finally, with aggregate total shareholder equity of nearly $46 billion and assets of $150 billion, the balance sheet of the combined company will

have exceptional size and strength. In a word, we will be so well-positioned to take advantage of both growth opportunities and significant

efficiencies to deliver greater growth and earning power together than the sum of the two companies separately.

Let me now spend a few minutes reviewing the terms of the transaction. As you see on slide 5, under the agreement, Chubb shareholders will

receive aggregate consideration valued at $124.13 per share in stock and cash or approximately $28.3 billion. This is the equivalent of $125.87 per

Chubb share using ACE’s 20-day volume weighted average share price for the period ending June 30, 2015. Specifically, Chubb shareholders will

receive an aggregate consideration mix of approximately 50% stock and 50% cash, which equates to $62.93 per share in cash and 0.6019 shares

of ACE stock.

The consideration represents a 30% premium to Chubb’s closing price of

$95.14 on June 30. On a pro forma, fully diluted basis, ACE shareholders

will own 70% of the combined entity and Chubb shareholders will own 30%. We expect

the transaction to close during the first quarter of 2016

following the receipt of customary regulatory and shareholder approvals. The combined organization will

operate under the Chubb name, an

acknowledgment of the distinctiveness and recognition of its brand particularly in the US. Our companies share a great mutual

respect. We are

both conservative in how we take and manage risk and how we manage our balance sheets.

Chubb has so many talented people who will be a great addition to the ACE family. I and my colleagues look forward to welcoming them and

working with them. Upon completion of the transaction, I will serve as Chairman and CEO of the combined company. John Finnegan, Chubb’s

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Chairman, President and CEO will serve as Executive

Vice Chairman for External Affairs of North America and will assist me with integration efforts.

I look forward to working with John. I also look forward to

leading this new organization together with ACE’s current Executive management team

and colleagues from Chubb.

Four Chubb Directors will join the ACE Board. The combined company will remain a Swiss company with principal offices in Zurich. Chubb’s

headquarters in Warren, New Jersey will house a substantial portion of the headquarters functions for the combined companies’ North American

division, as well as a number of our major businesses; while ACE will continue to maintain a significant presence in Philadelphia, where its current

North American division headquarters is located.

As I mentioned earlier, we intend to finance

the cash portion of the transaction through an aggregate cash consideration of $14.3 billion funded

by cash on hand and new senior debt. The cash consideration is

a combination of $9 billion of cash on hand between both companies and $5.3

billion of new long-term debt. Regarding the stock consideration, we will be issuing

137 million shares of ACE to Chubb shareholders with a fixed

exchange ratio of 0.6019 ACE shares for each Chubb share based on ACE’s closing price

yesterday of $101.68, which I consider cheap. This

consideration represents approximately $13.9 billion. With that, I will now turn the call over to John.

John Finnegan—Chubb—Chairman, President & CEO

Thank you,

Evan. You and your team have built a great company at ACE. We’re delighted to be partnering with you to create a new leader in the

global commercial,

specialty and personal P&C industry. We believe this transaction will deliver strong intermediate and longer-term value to

Chubb shareholders. As Evan

mentioned, Chubb shareholders will receive total consideration of $124.13 per Chubb share and cash and ACE stock,

representing a 30% premium to Chubb’s

closing stock price yesterday, June 30. Following the close, Chubb shareholders will own 30% of the

combined company, giving them a meaningful stake in an

even stronger global P&C leader.

When Evan and I first discussed the possibility of an ACE-Chubb combination, we both saw a lot of potential benefits. But as

our discussion

progressed, it became increasingly clear that the strategic fit, immediate value creation and superb prospects for the combined company would

in fact be compelling. We have complementary capabilities, assets and geographic footprints; combined with a larger, stronger balance sheet, we

will be even better positioned to compete and win in the market environment in which size, global reach and differentiated capabilities are

increasingly key to long-term success.

At Chubb, we have great respect for ACE and its

management team. I’m pleased and proud that ACE has recognized the strength of Chubb’s brand

and the attributes of quality and service it represents and

has chosen to adopt the Chubb name and brand for the combined company. ACE has

also committed to add four of Chubb’s independent Directors to the Board of the

new company. In conclusion, we are convinced that this is a

compelling transaction for Chubb. Now, I will turn the call back over to Evan.

Evan Greenberg—ACE Ltd—Chairman & CEO

Thank you, John. Again, what makes

this transaction exceptional is that it’s both strategically compelling and financially compelling because of

the attractive shareholder returns. As outlined

on slide 8, we expect the transaction will be immediately accretive to EPS and book value per share.

By year three, the transaction will be accretive to EPS on a

double-digit basis and will be accretive to ROE. It is anticipated that the ROI, again, will

exceed ACE’s cost of capital within two years resulting in a

double-digit return by year three. Tangible book value per share will return to its current

level in three years.

We expect goodwill payback will be realized in approximately 5.5 years. Looking at further — at future value creation and savings, we expect to

realize approximately $650 million of annual run rate expense savings by 2018. These savings will result from duplication in corporate overhead,

functional areas and overlap in operations. We will improve the competitive profile of the combined enterprise. The company also expects to

achieve meaningful growth that will result in substantial additional revenue. After all, this is the strategic purpose of the transaction.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Together, we will grow revenue and earnings more

quickly than the sum of the two companies separately. We expect by year five earnings accretion

will be balanced between revenue and expense-related synergies. The

efficiencies created will provide greater flexibility for the company to invest

in people, technology, product, distribution and geographic presence, again,

ultimately enhancing the competitive profile of the company.

Slide 9 demonstrates how well our two companies fit together and how our complementary strengths will

create a company with superior product

offerings, many of which are less sensitive to the commercial P&C industry cycle. In the US, where Chubb has a major

presence, the combination

makes us a leading insurer of commercial business in the large corporate segment to the middle market with a broad variety of coverages.

Chubb’s

strong distribution relationships in the US, through independent agents, will complement our traditional strength in P&C brokerage.

Outside of the US, ACE is a premier global P&C insurer with a presence in 54 countries and a broad product, customer and distribution capability.

Chubb is a more US-centric company with operations in 25 countries which will complement and significantly deepen ACE’s global presence and

capabilities. Globally, depending on where we find opportunity, the combined company will serve commercial customers of all sizes from the

largest corporations with complex multi-national exposures to the middle market and small commercial companies.

The company will have a significant and complementary presence in personal lines that serve the insurance needs of individuals and their families.

In addition, the combined company will have a leading position in professional lines globally, as well as one of the largest excess and surplus lines

in specialty product portfolios in the industry.

Let me give you simply a glimmer through

three simple anecdotal examples of how our strengths complement each other. First, Chubb will enhance

ACE’s product and underwriting expertise in the upper

middle market. Secondly, ACE will provide more products, particularly specialty, to serve

middle market clients. Third, together our strengths will enable the

combined entity to pursue both the small and micro markets around the world.

Importantly, another reason for this — this combination is so attractive is our

shared commitment to underwriting profitability and superior financial

performance. As you can see on the chart on slide 10, both of our companies’ combined

ratio has exceeded our global and North American peer

set over the past 10 years. This is a testament to a common, relentless, disciplined approach to underwriting

standards. Complementing sustained

long-term underwriting profit, the combined company will also benefit from a substantially larger fixed income-oriented invested

asset base, as

interest rates rise.

As I said, ACE and Chubb together will

create a global P&C leader with highly complementary business lines, distribution channels, customer

segments and underwriting culture. As you can see on slide

11, the combined organization will have a number of leadership positions in the

industry. It will be the number one global P&C insurance company by P&C

underwriting income, the number two US publicly traded P&C insurer

and the fourth largest global insurer by book value and operating income.

I mentioned this briefly before, but together we will become the second-largest commercial lines insurer in the US and the leader in high net worth

personal lines coverages. ACE is deeply committed to and has a great track record building and managing businesses in Asia and Latin America.

Together, our presence will be further enhanced in these fast-growing developing markets where together, our companies write $7 billion in total

premium.

Slide 12 is a great visual depiction and provides a breakdown of the increased size

and breadth of our product offerings and how each organization

will contribute to the combined companies’ business segment. As I said, the combined company

will have a broad product offering for commercial

customers of all sizes. This includes professional lines such as: D&O and professional liability; risk

management; all forms of excess and primary

casualty; workers comp; property; marine; aviation; and energy.

In commercial lines, Chubb has a larger US professional lines and surety business, contributing 62% to the combined companies’ net premiums.

While ACE has a greater international presence, contributing nearly 75% of net premiums. Otherwise, the contributions for commercial lines are

quite balanced. On the personal insurance side, you can see Chubb’s much larger contribution in US high net worth with nearly 70% of the combined

companies’ net premiums. On the other side of the coin, the combined companies’ personal lines business internationally as well as our global

A&H and life areas benefit primarily from contributions from ACE.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Together, the combined company will be substantial

in size and strength by any measure, as outlined on slide 13. For example, as of December

31, 2014, on an aggregate basis, gross premiums exceeded $37 billion and

operating income exceeded $5 billion. The combined company had

cash and invested asset investments of approximately $107 billion and total assets of approximately

$150 billion.

Slide 14 provides another way to look at the combined companies’ extensive diversification by both geographic presence and business line. I

happen to like that slide a lot. But turning to slide 15, we have always emphasized the importance of maintaining a conservative and flexible capital

structure. As a combined company, on a pro forma basis, at 12/31/15, shareholder equity would be nearly $44 billion with total capital of about

$57 billion. In terms of leverage, the combined company will have a pro forma debt-to-capital ratio of 20%, which we expect to decrease over time.

In summary, this transaction offers a highly compelling story for our combined shareholder base as well as the clients we serve and our distribution

partners across the globe. At ACE, we have a clear long-term strategy that we have patiently pursued both organically and through acquisitions.

We have built with determination a presence and capability to produce sustained long-term growth and peer-leading shareholder returns. We are

first and foremost builders. Insurance is a long-term business. We are patient. Consummating this transaction will certainly accelerate our growth

and earning power.

We have been good stewards of shareholder capital through the years, as the

slide on the last page demonstrates. Through industry cycles and

major risk-related events, ACE has performed at a consistently high level including good book

value per share growth and strong operating ROEs.

It’s a track record that stands up well over any reasonable period of time on both an absolute and relative

basis.

Upon closing of this transaction, we will have created a global P&C industry leader with superior product, customer and distribution channel

capabilities, greater growth in earning power and substantial opportunities for value creation. I am very enthusiastic, in fact, beyond words about

the benefits that this transaction will bring ACE and Chubb and all of our stakeholders. Thank you again for your time today. I will now turn the call

back over to Helen.

Helen Wilson—ACE Ltd—IR

Thank you. At this point, we’ll be happy to take your questions.

Q U E S T I O N S A N D

A N S W E R S

Operator

(Operator Instructions)

Cliff Gallant, Nomura.

Cliff Gallant—Nomura—Analyst

Congratulations. It’s quite a deal, very compelling. I was wondering, when you think about just the management of such a large organization, could

you compare the management structure of ACE to that of Chubb? Organizationally, what kind of changes do think you’re going to have to make

to the Chubb organization? Then, secondarily below that, what have you done to identify key people at Chubb that you need to keep? How do

you incentivize them to stay?

Evan Greenberg—ACE Ltd—Chairman & CEO

Sure. First of all, there is nothing more important to John and me than retaining the best across the two organizations. This combination is going

to create more opportunity because of the growth potential for the good people across both organizations. We know who our good people are.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

We have a lot of respect and a lot of regard for

them. We are a meritocracy. We reward performance. All those great performers, we will motivate

and retain them to the team. The management structures of both

companies are a bit different but they make sense for each organization. While

we are making plans for integration, it’s premature to discuss exactly how the

organization will look. But it will follow — I can tell you that the

organization structure will follow commonsense strengths of each company.

Cliff Gallant—Nomura—Analyst

Okay. When I think of both companies — you

don’t sell cookie-cutter products. There’s always a specialty aspect to both companies. It’s always

been a strength of the franchise. But when you

get — can you get to a point where you are so big that you lose some of that strength? I would think

there might be opportunities for niche players to try to

nip at your feels a bit. Maybe one off, that’s not a big deal, but collectively it could be

meaningful.

Evan Greenberg—ACE Ltd—Chairman & CEO

You know what? That will always

happen. When ACE was — 10 years ago, when I could manage ACE from line of sight; one hand you could ensure

underwriting excellence in a very deliberate, clear

fashion. As ACE got bigger, I’ve hear that question over and over and over again. How do you

manage — I mean we’ve talked about it for years. How do

you — as the organization will grow on a global basis, how do continue to manage

underwriting excellence and quality excellence across all of your business

lines, across the globe?

I think we have demonstrated that we have the management talent. We have the organizational structure in how we organize ourselves. We

behave

like a small company though we are large. We have the ability in terms of the flow of information in all the checks and balances that we have. You

know what? Chubb has the same thing. As we put this together, I’m not worried about that part. When you get at the part of people nipping at

our heels, well, this is a competitive market. It is a market-oriented economy. If you are good and you have capabilities and you’re compelling in

the marketplace, then have at it.

We always welcome competition. I’m not concerned about

that. But when you look at the combination here, in products, even that we overlap in,

there are so many areas — like, take professional lines. ACE is great

at the upper middle market and the large account. Chubb in particular at the

middle market and into the upper middle. So it’s complimentary to us. When you

look at it on an international basis, you find the same thing. That’s

just one small example. Frankly, we are just going to cover more of the marketplace

landscape together. We’re going to be nimble. We’re going

to be efficient. We are going to be entrepreneurial. We’re going to maintain that hallmark

of ACE.

Cliff Gallant—Nomura—Analyst

Impressive. Congratulations.

Thank you.

Evan Greenberg—ACE Ltd—Chairman & CEO

Thank you

very much.

Operator

Jay Gelb, Barclays.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Jay Gelb—Barclays Capital—Analyst

Congratulations on the deal. First, I just want to see if we could get your perspective on what the initial dilution the tangible book value per share

is?

Phil Bancroft—ACE Ltd—CFO

Bear with me, Jay. I will be right with you.

Evan Greenberg—ACE

Ltd—Chairman & CEO

Jay, we’ll get that for you in a minute.

Jay Gelb—Barclays Capital—Analyst

Okay. Thanks. Then one of the

things I wanted to touch base on and I’m sure we will see this in the proxy. Can you tell us a bit about the — how the

transaction came about? Was this

ACE approaching Chubb? Was Chubb shocked at all?

Evan Greenberg—ACE Ltd—Chairman & CEO

Well, these things happen when the moment is right for both. We approached them a few weeks ago. We put the deal together rapidly but

thoughtfully. Because it made so much sense to both sides for all our constituents.

Jay

Gelb—Barclays Capital—Analyst

Okay. Then, if you could give us a bit more insight on the potential revenue synergies? Why you feel those would come about

in the combination?

Evan Greenberg—ACE Ltd—Chairman & CEO

Oh, yes. ACE, when I look at it — I’m going to give you a little broader vision of this. When I look at the combination where it is so compelling to me

about — it’s about complementary strengths that will drive that. I look at Chubb in the Unite States, such a great middle market company with a

large agency distribution. It’s selling traditional middle market product and some specialties. ACE has been building a retail middle market specialty

presence. We’ll combine that with Chubb’s middle market. We will put so much more product that ACE has broadly across the organization through

that distribution to those Chubb customers that we can add more product offering; that we can add to the agents who have within their portfolios

more product to serve customers that they have today.

On another side of the coin, ACE is good

in the large account and upper middle market. We are very good. But some of our product offerings aren’t

as broad as they could be. Chubb’s capabilities

will add to that. Just think commercial auto and workers comp, where ACE is not great and present

in that. That will benefit us. When I look across the globe, but

including the United States, we’ve been endeavoring in the small commercial and

micro business, both on a wholesale and a retail basis. Chubb, itself, has

been contemplating that. Together, we will drive into those markets on a

global basis in a very meaningful way between ourselves.

When I look at some of the overlap in businesses, particularly — and I’d said this earlier. If you take professional lines or some of the other businesses

— we actually — we overlap but we don’t overlap that much. We’re both extremely present in the area but one is more dominant or more present

in the larger end and the other more present in the smaller end. That will be complementary to us. I think that gives you a few examples.

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution

of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’

and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Jay Gelb—Barclays Capital—Analyst

It does. Thank you, Evan. Phil, I don’t know if you have that —

Phil Bancroft—ACE Ltd—CFO

I do. That dilution is about 29%.

Initially, we expect that to recover to the same level in about three years.

Evan Greenberg—ACE Ltd—Chairman & CEO

In three years.

Jay Gelb—Barclays Capital—Analyst

When you have a chance, if you could give us the components of that. That would be helpful.

Phil Bancroft—ACE Ltd—CFO

Okay.

Evan Greenberg—ACE Ltd—Chairman & CEO

Sure.

Operator

Ryan Tunis, Credit Suisse.

Ryan Tunis—Credit Suisse—Analyst

My first question is just on the pro forma tax rate

of the combined entity. Should we be thinking about the Chubb earnings as tax-affected at what

we’re used to modeling for ACE?

John Finnegan—Chubb—Chairman, President & CEO

No. I would expect you to use

the rate that you would have used for Chubb. We don’t see any significant change in our tax rate.

Ryan Tunis—Credit Suisse—Analyst

So no tax efficiencies from the Chubb deal despite the fact you’re keeping the same jurisdiction for domicile?

John Finnegan—Chubb—Chairman, President & CEO

That’s right. Maybe some

around the margin —

9

THOMSON REUTERS STREETEVENTS |

www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing

or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered

trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

Around the margin, nothing material.

Ryan Tunis—Credit

Suisse—Analyst

Then I guess just thinking about the Fireman’s Fund deal. One thing I think that’s sort of interesting about this one, is you guys

have spent the

better part of the last few year’s trying to build a competitor to Chubb. I guess, are you more confident now than you have been that you

can’t

really build an agency juggernaut in personal lines to compete with Chubb there in high net worth personal lines?

Evan Greenberg—ACE Ltd—Chairman & CEO

Of course not. Are you kidding me? We

have built a good personal lines business and a good business in the high net worth that’s a dynamic open

area within the personal lines marketplace. I think

ACE did a great job with it. We’ve been building. I think the combination of the two will be

compelling.

Ryan Tunis—Credit Suisse—Analyst

Understood.

Evan Greenberg—ACE Ltd—Chairman & CEO

A lot of compatibilities. It will be

in efficiencies.

Ryan Tunis—Credit Suisse—Analyst

Got you.

Evan Greenberg—ACE Ltd—Chairman & CEO

We’ve been good

competitors.

Ryan Tunis—Credit Suisse—Analyst

I guess the last one

is just — any early reaction to the Chubb reserves? Was there any contemplation of recovery built into their — in your valuation

for Chubb?

Evan Greenberg—ACE Ltd—Chairman & CEO

Would you say that again?

John Finnegan—Chubb—Chairman, President & CEO

The answer is no.

10

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Ryan Tunis—Credit Suisse—Analyst

No? Okay. That’s all for me, thanks.

Operator

Charles Sebaski, BMO Capital Markets.

Charles Sebaski—BMO Capital Markets—Analyst

Just, I have a question on the high net worth personal business. I know, Evan, after the Fireman’s Fund, you talked about the growth potential for

you guys in the US in that space. Now with the combination of Chubb and its market-leading position, what’s the growth potential in that space

given the now — scale of the combined entity?

Evan Greenberg—ACE

Ltd—Chairman & CEO

Good question. We sized that marketplace as in excess of $40 billion or more. There are lots of companies that are serving the

high net worth space

from: Allstate — you saw them talking about it in the paper the other day, to State Farm, to ACE and Chubb and AIG and a whole plethora

of players.

I see tremendous opportunity. I mean, you see what we are combined, about $5 billion. I see tremendous growth opportunity in that area.

Charles Sebaski—BMO Capital Markets—Analyst

Excellent. Then on the cost saves on the

future $650 million that you identified, is this just standard fixed cost overlap? Or anything in particular

on where that might be coming from?

Evan Greenberg—ACE Ltd—Chairman & CEO

On the cost overlap, look, it comes

from — we have redundancies in so many functional areas, everything is two by two, both domestically and

internationally. Understand, that this transaction

— the first compelling nature of it is not the cost efficiencies. It’s the growth opportunities that

we see. But at the same time, we see a great

opportunity to improve our competitive profile, while at the same time preserving and coveting the

cultures and the franchised strengths that make each company

great. But the simple fact is, there is tremendous redundancy between the two

across functional areas, across corporate overhead areas and within structures —

statutory structures. So we’re going to create an elegant organization

over time.

Charles Sebaski—BMO Capital Markets—Analyst

Then finally I guess, just regard to the

debt and the financial leverage. I know the pro forma is a bit higher than either company was running solo.

Do think this organization just will have the

opportunity to run a bit higher debt leverage? Or do think it comes back down over time just conceptually?

We’d appreciate any thoughts.

Evan Greenberg—ACE Ltd—Chairman & CEO

When you look at the — I’m

going to let Phil answer it. But when you look at the cash generation and earning power generation of this company

and think about that flexibility —

11

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Phil Bancroft—ACE Ltd—CFO

Even at the outset, we’re well within the range that will be targeted for our ratings level. So we’re not concerned about the leverage. As Evan says,

we would expect it to drop over time.

Charles Sebaski—BMO Capital Markets—Analyst

Thank you very much for the answers.

Operator

Paul Newsome, Sandler O’Neill.

Paul Newsome—Sandler O’Neill—Analyst

Congratulations on the deal. Quite amazing. I wanted to ask — some of the assumptions with respect to accretion of the deal or just the success of

the deal. Are — any of those underlying assumptions dependent on a particular market environment for the industry? Or — you’ve already mentioned

interest rates. But if you could kind of go through your thoughts as to what the sensitivity we should look at for how well this all works out in the

end depending upon what happens with pricing and things of that nature?

Evan

Greenberg—ACE Ltd—Chairman & CEO

Hey, Paul, you’ve known me a long time. I am a realist. I hardly make strategy and plans based on what I

wish things would be. We face reality and

what it is. We all know where the marketplace is today. We understand the surplus capital, the amount of capital that is

sloshing around. We

understand the moderate economic to low economic growth in the world, the kind of interest rate environment we’re in.

We understand the shape of the balance sheets of the industry. We understand what drives cycles. So we face reality. I can guarantee you, as we

looked at the few years out of this thing and looking out a prolonged period. We looked out, one, two, three, four, five years. You don’t do something

like this — it’s not a bolt-on where you’re looking at it for a year or two. But we’re realists, as we looked at it. Our assumptions were based all around

that.

Paul Newsome—Sandler O’Neill—Analyst

Well, that’s fantastic. Could you — what do think of as the current cost of ACE’s capital at the moment?

Evan Greenberg—ACE Ltd—Chairman & CEO

I think of it as roughly 8.5%.

Paul Newsome—Sandler O’Neill—Analyst

Okay. Congratulations on

the deal. I think you got a great price for Chubb.

12

THOMSON REUTERS

STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content,

including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo

are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

Hey, thanks a lot.

Operator

Meyer Shields, KBW.

Meyer Shields—KBW—Analyst

Evan, you mentioned a couple times that this will enhance your competitive positioning. I think that’s clearly true, but I was wondering whether

there are specific expectations in terms of pricing that this allows? In other words, can you maintain your current returns at pricing 2% below where

you are now? Or 5%? Or something like that?

Evan Greenberg—ACE

Ltd—Chairman & CEO

Meyer, I didn’t think of it that way. It’s a far messier marketplace than that. It all varies by line of business and by

geography. The one thing you

know, we will not allow premium underwriting to destroy book value. So we will always underwrite to an underwriting profit. One of the

things I

want to tell you that I think a lot about, the combined data of both organizations along with the skills and experience in complementary areas —

you just imagine it.

If we manage this right, over a period of time,

it’s going to give us so much more insight into risk and into dissecting risk into more granular cohorts.

Given our skills and insights of underwriters, the

ability to use those insights — to use that data. Then with the distribution power of the two and

the geographic presence of them — well, there you go.

That’s the way to think about it. It’s a fool’s game to think about, well, I have this — maybe

I’ve got another 0.5 point or 1 point

because I took out some expense and that will — that’s a fool’s game.

Meyer Shields—KBW—Analyst

Okay. No, that’s helpful. That makes sense. Does the much larger investment portfolio allow for any change in allocation by class?

Evan Greenberg—ACE Ltd—Chairman & CEO

It’s premature to say that. But

as you can imagine as we put the two portfolios together and given the construct of ACE as Chubb comes in, our

corporate structure, et cetera and where assets and

capital are located, there will be a thoughtful view on allocation of the invested asset. As you

know, we are both conservative in how we manage it. We take —

we both have operated under a philosophy that we take a lot of risk on the liability

side of the balance sheet. We are levered the liability side. So therefore,

it’s both policyholder and shareholder money we’re investing. We will do

that — we’ll continue to do that in a conservative way.

Meyer Shields—KBW—Analyst

Okay, perfect. Thanks so much.

Evan Greenberg—ACE Ltd—Chairman & CEO

You’re welcome.

13

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Operator

Thomas Mitchell, Miller Tabak.

Thomas Mitchell—Miller Tabak—Analyst

First of all, I know it’s a little early to think about it, but is there any reason to think that you would continue share repurchases after the closing of

the deal given the amount of debt you are taking on?

Phil Bancroft—ACE Ltd—CFO

We don’t expect to for some time. We’ll manage the capital as it emerges. But as I said, we all believe that the combined companies will generate

a significant amount of capital. We’ll manage it over time. But for the near-term, we don’t see any buybacks.

Evan Greenberg—ACE Ltd—Chairman & CEO

You know what? It is premature. We

will — you said that right. We will update you following the close.

Thomas Mitchell—Miller Tabak—Analyst

Okay. Thank you.

Evan Greenberg—ACE Ltd—Chairman & CEO

You’re welcome.

Operator

John Heagerty, Atlantic Equities.

John Heagerty—Atlantic Equities—Analyst

Just on slide 6, you have got some statements on deck, you think cash on hand is $9 million. I was wondering where that’s coming from because

when I looked at the combined balance sheet, I get about $1 billion worth of cash on hand. So I was wondering if some of that’s undrawn debt

commitments.

Phil Bancroft—ACE Ltd—CFO

Is not literally cash. It’s undeployed capital in both of the companies. So right — while we have our undeployed capital invested in our investment

portfolio, it’s available to use for acquisitions or buybacks or whatever.

John

Heagerty—Atlantic Equities—Analyst

Okay.

14

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters.

All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written

consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

You can’t see it but we’re telling — we know where it is.

John Heagerty—Atlantic Equities—Analyst

Thanks. The cost of debt

you are expecting for the $5.3 billion?

Phil Bancroft—ACE Ltd—CFO

In the 3.5% range.

John Heagerty—Atlantic Equities—Analyst

Thanks. Then last one, just on the ROE accretion — So, the EPS accretion you’re talking — pointing to in that year three. Wondering what number

you’re using for that because I look at consensus on Bloomberg, there’s only one number up there. Or if it’s only one analyst providing a number?

Evan Greenberg—ACE Ltd—Chairman & CEO

Yes. We’re not

providing that number.

John Heagerty—Atlantic Equities—Analyst

So

—

Evan Greenberg—ACE Ltd—Chairman & CEO

So,

you’ll figure it out. We gave you what we’re going to give you. We told you it will be ROE accretive, but we’re not putting a number.

John

Heagerty—Atlantic Equities—Analyst

But how about EPS accretion side?

Evan Greenberg—ACE Ltd—Chairman & CEO

We’re not

giving you the number. We’ve given you what we —

John Heagerty—Atlantic Equities—Analyst

You did give us double-digits but we still don’t have a starting point, do we?

15

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015

Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the

prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated

companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

Well, you’ll figure that out, won’t you. That is up to you. We’ve given you what we’re going to give you. No arguments here, John. You have

another

question?

John Heagerty—Atlantic Equities—Analyst

No. That’s all. Thanks.

Evan Greenberg—ACE

Ltd—Chairman & CEO

You’re welcome.

Operator

Josh Shanker, Deutsche Bank.

Josh Shanker—Deutsche Bank—Analyst

Congratulations on a landmark deal. I was curious looking through Chubb’s financial statements to some extent — you said you’ve been working

on this for a couple of weeks but you’re very confident about the cost savings. Can you talk about the process you went through on identifying

the cost saves? How much is going to occur in the underwriting part of the business versus corporate expenses and whatnot? Do you have any

granularity there?

Evan Greenberg—ACE Ltd—Chairman & CEO

No, Josh, we’ve given as much as we are going to give on that. But what you can imagine is, this isn’t our first time going around this. We are quite

experienced at M&A. We understand how to do analysis in this regard. We have experienced people in doing that. We have a very good process

both pre-acquisition, during acquisition transition and post-acquisition. We are quite thoughtful in how we imagine all this. That’s as far as I’m

going to go now on that subject.

Josh Shanker—Deutsche Bank—Analyst

No, that is fine. Legally, are there any things going to be to think about in the Swiss domicile given the proportion of business in the United States?

Or the changing of the name? Are there any considerations that we should be aware of?

Evan

Greenberg—ACE Ltd—Chairman & CEO

No, there’s not. There’s nothing — it will be status quo.

Josh Shanker—Deutsche Bank—Analyst

Okay. Thank you very much.

16

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Evan Greenberg—ACE Ltd—Chairman &

CEO

You’re welcome.

Operator

Larry Greenberg, Janney Capital.

Larry Greenberg—Janney Capital Markets—Analyst

Congratulations to both organizations. Clearly, you both believe that the time is right to combine given where each of your respective organizations

are in their life cycles. I’m just wondering if you could put the timing of this deal in context in terms of property casualty industry structure today.

Is there something about the industry today that makes this a more compelling transaction than perhaps it would have been 5 years ago or 10

years ago?

Evan Greenberg—ACE Ltd—Chairman & CEO

Yes. That’s a good question. I think there is, to me. The industry — the world is more globalized than it was a decade ago. That is simply a trend that

is going to continue. When you look at financial markets, how they’ve globalized. Technology and what it does to allow knowledge and people

and data to move around the world so rapidly. When you look at what technology has done in so many industries and is doing in ours to give an

opportunity to create insights, new businesses, different exposures and an ability to manage and have a competitive advantage with the insights

around all of that.

When you look at the value particularly because of the way the world is

moving online of brands and the meaning of brands and how they are

created and how they are recognized. To me, those are just a few examples of, we’re not in

the same world today that we were a decade ago. The

playbook you use today is not the same one that you would have used precisely then. We’re in a world of

low growth. We’re in a world of low

inflation. We’re in a world where economic realities of countries are interconnected to each other. I think that is a

world that we’re going to be in

for quite some time. I think that’s a reality that we need to face. I think all of that is part of the backdrop, in my

own thinking, when I think about

the compelling, strategic nature of this transaction.

Larry Greenberg—Janney Capital Markets—Analyst

Thank you.

Evan Greenberg—ACE Ltd—Chairman & CEO

You’re welcome.

Helen Wilson—ACE Ltd—IR

Okay, operator, we’ll take questions from one more

person, please.

Operator

Jay Cohen, Bank of America Merrill Lynch.

17

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

Jay Cohen—BofA Merrill Lynch—Analyst

Yes, a couple of questions. I guess, one is will the Chubb business be available to be seeded through ABR rate?

Evan Greenberg—ACE Ltd—Chairman & CEO

Oh, I don’t — well, yes, is

the answer in the general term. But I have to be honest, I’ve hardly thought about that.

Jay Cohen—BofA Merrill Lynch—Analyst

Okay. I guess a question for John Finnegan. The question came up about where we are in the cycle, but the question for you really is, why now for

Chubb? Was there anything particular that caused you to sell to ACE?

John

Finnegan—Chubb—Chairman, President & CEO

No. I think that the answer is that after discussion, Evan’s proposal made a lot of sense. We

worked hard at it. We came up with what we thought

was a compelling transaction. We weren’t driven by timing in particular. I think, as Evan says, there are

some more reasons today that you might

want to do a merger of this type than maybe five years ago. But we weren’t out shopping it, this was a proposal that

came to us. We thought it was

a very good one. So it was driven more by the nature of the proposal, the nature of the company we’re merging with and the

economics of the

deal and the strategy going forward.

Jay Cohen—BofA

Merrill Lynch—Analyst

Got it. Thanks for the answer. Good luck with everything.

John Finnegan—Chubb—Chairman, President & CEO

Thanks a lot, Jay.

Helen Wilson—ACE Ltd—IR

Thank you everyone for joining us this

morning. Thank you. Good day.

Operator

Ladies and gentlemen, this does

conclude your conference for today. We do thank you for your participation.

18

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015

Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the

prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated

companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb Corp

D I S C L A I M E R

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such

forward-looking statements are based upon

current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any

forward-looking statement based on a number of important factors and risks, which are more

specifically identified in the companies’ most recent SEC filings.

Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the

assumptions could prove

inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION

CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY’S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION,

THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME

ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO

REVIEW THE APPLICABLE

COMPANY’S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2015, Thomson Reuters. All Rights Reserved. 5758647-2015-07-01T18:47:02.987

19

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited

without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its

affiliated companies.

JULY 01, 2015 / 12:30PM, ACE—ACE Ltd and Chubb Corp Joint

Conference Call to Discuss the Definitive

Agreement of ACE Ltd Acquiring Chubb CorpTI

Cautionary Statement Regarding Forward-Looking Statements

All forward-looking statements made in this communication, related to the acquisition of Chubb, potential post-acquisition performance or otherwise, reflect

ACE’s current views with respect to future events, business transactions and business performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify

forward-looking statements by words such as “may,” “will,” “should,” ”expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “could,” “future,” “project” or other words of similar meaning. All forward-looking statements involve risks and uncertainties, which may cause actual results to differ,

possibly materially, from those contained in the forward-looking statements.

Forward-looking statements include, but are not limited to, statements about

the benefits of the proposed transaction involving ACE and Chubb, including future financial results; ACE’s and Chubb’s plans, objectives, expectations and intentions; the expected timing of completion of the transaction and other

statements that are not historical facts. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, without limitation, the following: the inability to complete

the transaction in a timely manner; the inability to complete the transaction due to the failure of Chubb’s shareholders to adopt the transaction agreement or the failure of ACE shareholders to approve, among other matters, the issuance of ACE

common shares in connection with the acquisition; the failure to satisfy other conditions to completion of the transaction, including receipt of required regulatory approvals; the failure of the proposed transaction to close for any other reason;

the possibility that any of the anticipated benefits of the proposed transaction will not be realized; the risk that integration of Chubb’s operations with those of ACE will be materially delayed or will be more costly or difficult than

expected; the challenges of integrating and retaining key employees; the effect of the announcement of the transaction on ACE’s, Chubb’s or the combined company’s respective business relationships, operating results and business

generally; the possibility that the anticipated synergies and cost savings of the merger will not be realized, or will not be realized within the expected time period; the possibility that the transaction may be more expensive to complete than

anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; general competitive, economic, political and market conditions and fluctuations; and

actions taken or conditions imposed by the United States and foreign governments and regulatory authorities. In addition, you should carefully consider the risks and uncertainties and other factors that may affect future results of the combined

company described in the section entitled “Risk Factors” in the joint proxy statement/prospectus to be delivered to ACE’s and Chubb’s respective shareholders, and in ACE’s and Chubb’s respective filings with the

Securities and Exchange Commission (“SEC”) that are available on the SEC’s website, located at www.sec.gov, including the sections entitled “Risk Factors” in ACE’s Annual Report on Form 10–K for the year ended

December 31, 2014, which was filed with the SEC on February 27, 2015, and “Risk Factors” in Chubb’s Annual Report on Form 10–K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015. You should

not place undue reliance on forward-looking statements, which speak only as of the date of this communication. ACE undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This

communication may be deemed to be solicitation material in respect of the proposed transaction between ACE and Chubb. In connection with the proposed transaction, ACE intends to file a registration statement on Form S-4, containing a joint proxy

statement/prospectus with the SEC. The final joint proxy statement/prospectus will be delivered to the shareholders of ACE and Chubb. This communication is not a substitute for the registration statement, definitive joint proxy statement/prospectus

or any other documents that ACE or Chubb may file with the SEC or send to shareholders in connection with the proposed transaction. SHAREHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Shareholders will be able to obtain copies of the

joint proxy statement/prospectus and other documents filed with the SEC (when available) free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by ACE will be made available free of charge on ACE’s

website at www.acegroup.com. Copies of documents filed with the SEC by Chubb will be made available free of charge on Chubb’s website at www.chubb.com.

Participants in Solicitation

ACE, Chubb and their

respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of

ACE is set forth in the proxy statement for ACE’s 2015 Annual General Meeting, which was filed with the SEC on April 8, 2015, and ACE’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on

February 27, 2015. Information about the directors and executive officers of Chubb is set forth in the proxy statement for Chubb’s 2015 Annual Meeting of Shareholders, which was filed with the SEC on March 13, 2015, and Chubb’s Annual

Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. You may obtain free copies of these documents as described above.

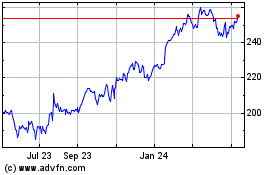

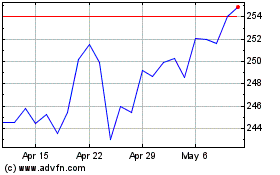

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Mar 2024 to Apr 2024

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Apr 2023 to Apr 2024