EKF Diagnostics Holdings PLC Trading Update & Structure Update (6548E)

May 10 2017 - 2:00AM

UK Regulatory

TIDMEKF

RNS Number : 6548E

EKF Diagnostics Holdings PLC

10 May 2017

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 (MAR).

EKF Diagnostics Holdings plc

("EKF", the "Company")

Trading update &

Update re: possible demerger and share buyback

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed

point-of-care business, wishes to update shareholders on its

current trading and the proposals it set out in its announcement on

20 March 2017.

Trading update

The Company is pleased to announce that trading in the first

quarter of the current financial year was comfortably ahead of

budget. The strong start to the financial year is entirely

attributable to organic growth. However, whilst the Board remain

optimistic about the Company's prospects for the full year, there

can be no guarantee that this will continue for the remainder of

the year given the relatively short lead time on new orders.

In addition, as anticipated in its announcement on 9 January

2017, the Company was net cash positive in the first quarter of the

2017 financial year following continued strong cash generation.

Possible demerger and share buyback

The Directors are continuing to evaluate plans under which they

would split the Company into two separate legal entities based on

the business divisions, namely Point of Care and Lab Diagnostics.

As previously announced, whilst both these business divisions are

valuable in their own right, the Directors consider that separating

them into distinct legal entities represents a better route for

shareholders and one under which they are more likely to achieve a

fair reflection of the value of each separate business.

Whilst tax advice and work on the possible deal structure is

ongoing, it is the Board's latest understanding that the demerger

can be carried out at subsidiary level and therefore, initially at

least, remain within the existing EKF group. EKF Diagnostics plc

will remain as the ultimate parent company of both legal entities

and importantly also remain quoted on AIM. Further, whilst the

initial demerger can be carried out intra-group, the Board's

current expectation is that the Lab Diagnostics business will

nevertheless be spun-out of the EKF Group at an appropriate

point.

The Company continues to evaluate the possibility of a share

buyback offer to shareholders at 21.5p enabling them to exit their

shareholding in cash. However, in view of the fact that the current

advice is suggesting that EKF can, for the time being at least,

remain both the ultimate parent of both business divisions and

quoted on AIM, the original purpose of the proposed share buyback,

namely to provide a potential exit for shareholders that could not

or did not wish to hold shares in private companies, now seems less

important. Accordingly, the Board is now contemplating a more

limited share buyback offer of up to 15% of the Company's current

issued share capital.

There can of course be no guarantee that the above proposals,

including any share buyback, will be capable of being completed in

the manner currently anticipated. Further announcements will be

made at the appropriate time.

EKF Diagnostics Holdings plc www.ekfdiagnostics.com

Christopher Mills, Non-Executive Tel: 029 2071 0570

Chairman

Julian Baines, CEO

Richard Evans, FD & COO

N+1 Singer (Nomad & Broker) Tel: 020 7496 3000

Alex Price / Shaun Dobson

/ Ali Laughton-Scott

Walbrook PR Limited Tel: 020 7933 8780 or ekf@walbrookpr.com

Paul McManus / Lianne Cawthorne Mob: 07980 541 893 / 07584 391 303

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSSDFMUFWSESI

(END) Dow Jones Newswires

May 10, 2017 02:00 ET (06:00 GMT)

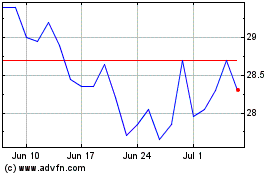

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

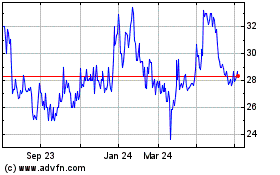

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Apr 2023 to Apr 2024