Dollar Weakening As Investors Await Yellen Testimony

February 09 2016 - 9:10AM

RTTF2

The dollar is losing ground against all its major rivals Tuesday

afternoon. Continued concerns over global growth prospects continue

to drive trading action, as economic data remains on the light

side.

Investors are looking forward to 2 days of testimony by Fed

Chair Janet Yellen before Congress tomorrow and Thursday. Yellen's

statement and her responses to questions will be highly scrutinized

for clues regarding future Fed rate hikes.

With a drop in inventories of durable goods more than offsetting

an uptick in inventories of non-durable goods, the Commerce

Department released a report on Tuesday showing a modest decrease

in U.S. wholesale inventories in the month of December.

The report said wholesale inventories edged down by 0.1 percent

in December after sliding by a revised 0.4 percent in November. The

modest drop in inventories matched economist estimates.

The dollar dropped to over a 3-month low of $1.1337 against the

Euro Tuesday, but has since rebounded to around $1.1295.

Germany's industrial production dropped unexpectedly in

December, figures published by Destatis revealed Tuesday.

Industrial production fell 1.2 percent from November, confounding

expectations for an increase of 0.5 percent. This was the second

consecutive fall in production. Output had decreased 0.1 percent in

November.

German exports and imports set new highs in 2015, leading to the

biggest ever trade surplus, preliminary data from Destatis showed

Tuesday.

Exports rose 6.4 percent to EUR 1,195.8 billion and imports

increased 4.2 percent to EUR 948.0 billion. The trade surplus grew

to a record EUR 247.8 billion from the previous peak of EUR 213.6

billion.

The UK central bank should take action to tackle risks to

financial stability sooner than later if lending starts to grow

faster than national output, Bank of England Deputy Governor Jon

Cunliffe said Tuesday.

"Given the vulnerability that already exists and the powerful

drivers in the UK, particularly the housing market, if credit began

again to grow faster than GDP, I would want to think about action

to manage the financial stability risks sooner rather than later,"

Cunliffe said in a speech at a British Property Federation

conference in London.

The household debt situation has become sustainable after a

correction since the financial crisis, the policymaker noted.

"Household balance sheets, however, remain large by historic

standards," Cunliffe said. "The position is sensitive to the

unwinding, were it to occur, of some of the forces that pushed

rates down over the past 40 years."

The buck slipped to a low of $1.4515 against the pound sterling

Tuesday, but has since risen back to around $1.4450.

The U.K. merchandise trade deficit narrowed in December despite

exports falling for the third straight month, suggesting that weak

trade dragged economic growth at the end of 2015. The visible trade

deficit decreased to GBP 9.9 billion from GBP 11.5 billion in

November, preliminary data from the Office for National Statistics

showed Tuesday.

Economists had forecast a shortfall of GBP 10.4 billion in

December. A year ago, the deficit was GBP 13.5 billion.

Like-for-like sales in the United Kingdom spiked 2.6 percent on

year in January, the British Retail Consortium said on Tuesday.

That shattered forecasts for an increase of 0.3 percent following

the 0.1 percent gain in December.

The greenback fell to over a 1-year low of Y114.184 against the

Japanese Yen Tuesday, but has since bounced back to around

Y114.900.

The M2 money stock in Japan was up 3.2 percent on year in

January, the Bank of Japan said on Tuesday, worth 923.7 trillion

yen. That topped forecasts for an increase of 0.3 percent following

the 0.1 percent gain in December.

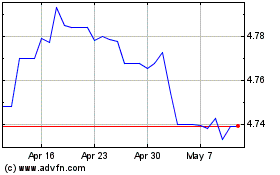

US Dollar vs MYR (FX:USDMYR)

Forex Chart

From Aug 2024 to Sep 2024

US Dollar vs MYR (FX:USDMYR)

Forex Chart

From Sep 2023 to Sep 2024