Current Report Filing (8-k)

April 13 2017 - 6:03AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D. C. 20549

|

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 12, 2017

Commission file number 1-13163

________________________

YUM! BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

North Carolina

|

|

13-3951308

|

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

|

Identification No.)

|

|

|

|

|

|

|

|

1441 Gardiner Lane, Louisville, Kentucky

|

|

40213

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

Registrant's telephone number, including area code: (502) 874-8300

|

|

|

|

Former name or former address, if changed since last report: N/A

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition

As previously disclosed, effective with the beginning of fiscal 2017 YUM changed its fiscal year from a year ending on the last Saturday of December to a year beginning on January 1 and ending December 31 of each year. Because the new 2017 fiscal year commenced with the end of our 2016 fiscal year ended December 31, 2016, there was no transition period in connection with the change in the fiscal year.

In connection with the new fiscal year, the Company has moved from a 52-week periodic fiscal calendar with three 12-week interim quarters and a 16-week fourth quarter that requires adding a 53rd week every five or six years, to a monthly reporting calendar with each quarter comprised of three months. Our U.S. subsidiaries will continue to report fiscal calendars ending in late December that include three 12-week interim quarters and a 16-week fourth quarter in fiscal years with 52 weeks and a 17-week fourth quarter in fiscal years with 53 weeks. Our next fiscal year with 53 weeks will occur in 2019.

The change in the Company’s fiscal year was made primarily to accommodate the removal of reporting lags from our international subsidiary fiscal calendars, which will significantly improve the alignment of our global reporting calendars. As a result of removing these reporting lags each international subsidiary will now operate either on a monthly calendar consistent with the Company’s new calendar or on a periodic calendar consistent with the calendars of our U.S. subsidiaries. We have not restated amounts to reflect any calendar shift for the financial results of our China business prior to its separation into an independent, publicly-traded company on October 31, 2016 which have been reflected in Discontinued Operations.

As a result of this change we are required to restate our financial results for the historic periods presented. This Form 8-K provides a summary of certain consolidated and segment financial results for 2016 and 2015 restated as if they had been reported under our new calendar.

Additionally, these restated results reflect the impact of Accounting Standards Update No. 2017-07,

Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post retirement Benefit Cost

, which we adopted in the first quarter of 2017 on a retrospective basis. For 2016, the adoption of this standard had no effect on previously reported Net Income but resulted in the reclassification of non-service cost components of pension and post-retirement benefit expense of $32 million from General and administrative expenses to Other pension income (expense). This amount comprised a $3 million credit allocated to our Brand Divisions and a $35 million charge that was not allocated to any of our segment operating results (of which $26 million was classified within Special Items). This restated information is attached hereto as Exhibit 99.1, which is being furnished pursuant to Item 2.02, Results of Operation and Financial Condition.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

99.1 Restated Consolidated and Segment Financial Results

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

YUM! BRANDS, INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Date:

|

April 12, 2017

|

|

/s/ David E. Russell

|

|

|

|

|

|

Senior Vice President, Finance and Corporate Controller

|

|

|

|

|

|

|

|

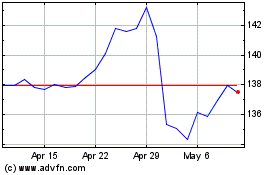

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

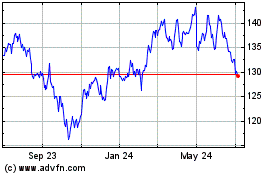

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024