UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2016

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Nevada |

|

001-36643 |

|

35-2496142 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 200 Powell Place

Brentwood, Tennessee |

|

37027 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(615) 732-1231

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

The information set forth under

Item 7.01 below is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information

included in this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2 hereto) shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by

specific reference in such filing.

| Item 7.01. |

Regulation FD Disclosure. |

On January 26, 2016, AAC Holdings, Inc. (the

“Company”) issued a press release (the “Press Release”) affirming its previously disclosed guidance for the fiscal year ended December 31, 2015. A copy of the Press Release is furnished herewith as Exhibit 99.1. In addition,

the Company has posted an investor presentation (the “Investor Presentation”) on the Investor Relations page of its website that includes an overview of certain 2015 matters and previews certain 2016 business objectives. A copy of the

Investor Presentation is furnished herewith as Exhibit 99.2.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Press Release dated January 26, 2016 |

|

|

| 99.2 |

|

Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| AAC HOLDINGS, INC. |

|

|

| By: |

|

/s/ Michael T. Cartwright |

|

|

Michael T. Cartwright |

|

|

Chief Executive Officer and Chairman |

Date: January 26, 2016

EXHIBIT INDEX

|

|

|

| No. |

|

Exhibit |

|

|

| 99.1 |

|

Press Release dated January 26, 2016 |

|

|

| 99.2 |

|

Investor Presentation |

Exhibit 99.1

|

|

|

|

|

|

|

| Investor Contact: |

|

Tripp Sullivan |

|

Media Contact: |

|

Cynthia Johnson |

|

|

SCR Partners |

|

|

|

(615) 587-7728 |

|

|

(615) 760-1104 |

|

|

|

Mediarequest@contactAAC.com |

|

|

IR@contactAAC.com |

|

|

|

|

AAC Holdings, Inc. Affirms 2015 Guidance

BRENTWOOD, Tenn. – (January 26, 2016) AAC Holdings, Inc. (NYSE: AAC) anticipates it will report its fourth quarter and full year 2015 financial and

operating results on February 23, 2016 and expects to report operating and financial results within the previous guidance provided for the year ended December 31, 2015. The Company will be speaking at investor meetings later this week and

will timely post a presentation on the Investor Relations page of its website that includes an overview of certain 2015 matters and a preview of certain 2016 business objectives.

For the fourth quarter and full year 2015, the Company reports the following:

| |

• |

|

Client admissions of 2,462 for the quarter and 7,763 for the year, up 93% and 64%, respectively, from comparable periods a year ago |

| |

• |

|

Average daily residential census of 670 for the quarter, up 60% from a year ago |

| |

• |

|

Outpatient visits at our ten stand-alone outpatient centers of 4,609 for the quarter and 13,160 for the year |

| |

• |

|

Bed count at December 31, 2015 of 897 compared with 493 a year ago |

| |

• |

|

Revenues, Adjusted EBITDA and Earnings per diluted share are anticipated to be within the previously issued guidance of $209 million to $212 million for revenues, $42 million to $43 million for Adjusted EBITDA and $0.89

to $0.91 for adjusted earnings per diluted share for 2015. This outlook does not include the impact of stock-based compensation, acquisition-related expense, litigation settlement and California related expense, de novo start-up expense or facility

losses and closure expense related to FitRx and the Academy. |

“Our operating metrics continue to be strong across the board leading to

our anticipated full year results,” noted Michael Cartwright, Chairman and Chief Executive Officer of AAC Holdings, Inc. “New client admissions have enabled us to drive census at River Oaks and our other facilities, including those

acquired in 2015, while we remain at capacity on outpatient visits until new facilities come online this year.”

Investor Earnings Conference Call

The Company will issue its fourth quarter 2015 earnings release prior to the market opening on February 23, 2016 and host a conference call and live audio

webcast, both open for the general public to hear, later that same day at 11:00 a.m. ET. The number to call for this interactive teleconference is (412) 542-4144. A replay of the conference call will be available one hour after the call through

March 2, 2016, by dialing (412) 317-0088 and entering the replay access code: 10079603.

The live audio webcast of the Company’s quarterly

conference call will be available online in the Investor Relations section of the Company’s website at www.americanaddictioncenters.org, and the online replay will be available approximately one hour after the end of the call.

About American Addiction Centers

American Addiction

Centers is a leading provider of inpatient substance abuse treatment services. We treat clients who are struggling with drug addiction, alcohol addiction, and co-occurring mental/behavioral health issues. We currently operate 18 substance abuse

treatment facilities. Located throughout the United States, these facilities are focused on delivering effective clinical care and treatment solutions. For more information, please find us at AmericanAddictionCenters.org or follow us on Twitter

@AAC_Tweet.

Forward Looking Statements

This

release contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are made only as of the date of this release. In some cases, you can identify forward-looking statements by terms such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “may,” “potential,” “predicts,” “projects,” “should,” “will,”

“would,” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements may include information concerning AAC Holdings, Inc.’s

(collectively with its subsidiaries; “Holdings” or the “Company”) possible or assumed future results of operations, including descriptions of Holdings’ revenues, profitability, outlook and overall business strategy. These

statements involve known and unknown risks, uncertainties and other factors that may cause our actual results and performance to be materially different from the information contained in the forward-looking statements. These risks, uncertainties and

other factors include, without limitation: (i) our inability to operate our facilities; (ii) our reliance on our sales and marketing program to continuously attract and enroll clients; (iii) a reduction in reimbursement rates by

certain third-party payors for inpatient and outpatient services and point of care and definitive lab testing; (iv) our failure to successfully achieve growth through acquisitions and de novo expansions; (v) uncertainties regarding the

timing of the closing of acquisitions; (vi) the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of acquisitions; (vii) our failure to achieve anticipated financial results from

prior or pending acquisitions; (viii) a disruption in our ability to perform definitive drug testing services; (ix) maintaining compliance with applicable regulatory authorities, licensure and permits to operate our facilities and lab;

(x) a disruption in our business related to the recent indictment of certain of our subsidiaries and current and former employees; (xi) our inability to agree on conversion and other terms for the balance of convertible debt;

(xii) our inability to meet our covenants in the loan documents; (xiii) our inability to obtain senior lender consent to exceed the current $50 million limit in unsecured subordinated debt; (xiv) our inability to integrate newly

acquired facilities; (xv) a disruption to our business and reputational and potential economic risks associated with the civil securities claims brought by shareholders; and (xvi) general economic

conditions, as well as other risks discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K, and other filings with the Securities and Exchange

Commission. As a result of these factors, we cannot assure you that the forward-looking statements in this release will prove to be accurate. Investors should not place undue reliance upon forward looking statements.

###

Exhibit 99.2

2015 YEAR IN REVIEW

2016 LOOK AHEAD

IMPORTANT PRESENTATION INFORMATION 2

Notice to We

use market data and industry forecasts and projections throughout this presentation, including data from publicly available information and industry publications.

These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the

Investors information are not guaranteed. The forecasts and projections are based on industry surveys and the

preparers’ experience in the industry, and there can be no

assurance that any of the forecasts or

projections will be achieved. We believe that the surveys and market research others have performed are reliable, but we have

not independently investigated or veri?ed this information. Forecasts and other forward-looking information obtained from these sources are subject to the same

quali?cations and uncertainties as the other forward-looking statements contained in this presentation.

Forward-Looking Some of the statements made in this presentation constitute forward-looking statements within the meaning

of federal securities laws. Forward-looking statements

re?ect our current views with respect to future events

and performance. In some cases you can identify forward-looking statements by terminology such as “may,”

Statements “might, “will,” “should,” “could” or the negative thereof. Generally, the words “anticipate,” “believe,”

“continues,” “expect,” “intend,” “estimate,” “project,” “plan” and similar

expressions identify forward-looking statements. In particular, statements about our pipeline, industry growth opportunities, disclosure of key performance indicators,

business growth strategy and pro forma financial results in this presentation are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While

we believe these expectations,

assumptions, estimates and projections are reasonable, such forward-looking

statements are only predictions and involve known and unknown risks, uncertainties and

other factors, many of

which are outside of our control, which could cause our actual results, performance or achievements to di?er materially from any results,

performance or achievements expressed or implied by such forward-looking statements. For additional discussion of risks, uncertainties and other factors, see the

section titled “Risk Factors” in our Annual Report on Form 10-K and other ?lings with the SEC.

Risks, uncertainties and other factors include, without limitation: (i) our inability to operate our facilities;

(ii) our reliance on our sales and marketing program to

continuously attract and enroll clients;

(iii) a reduction in reimbursement rates by certain third-party payors for inpatient and outpatient services and point of care and

de?nitive lab testing; (iv) our failure to successfully achieve growth through acquisitions and de novo expansions; (v) uncertainties regarding the timing of the closing of

pending acquisitions; (vi) our failure to achieve anticipated ?nancial results from prior or pending

acquisitions; (vii) the possibility that a governmental entity may

prohibit, delay or refuse to grant

approval for the consummation of the acquisitions; (viii) a disruption in our ability to perform diagnostic drug testing services; (ix)

maintaining compliance with applicable regulatory authorities, licensure and permits to operate our facilities and lab; (x) a disruption in our business related to the

recent indictment of certain of our subsidiaries and current and former employees; (xi) our inability to agree on

conversion and other terms for the balance of

convertible debt; (xii) our inability to meet our covenants

in the loan documents; (xiii) our inability to obtain senior lender consent to exceed the current $50 million limit

in unsecured subordinated debt; (xiv) our inability to integrate newly acquired facilities; (xv) a disruption to our business and reputational and potential economic risks

associated with the civil securities claims brought by shareholders; and (xvi) general economic

conditions, as well as other risks discussed in the “Risk Factors” section of

the Company’s

Annual Report on Form 10-K and other ?lings with the Securities and Exchange Commission.

Given these risks and

uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties may cause our

actual future results to be materially di?erent than those expressed in our forward-looking statements. These forward-looking statements are made only as of the date

of this presentation. We do not undertake and speci?cally decline any obligation to update any such statements or to

publicly announce the results of any revisions to

any such statements to re?ect future events or developments.

PRESENTERS

Michael T. Cartwright

Chairman

(since 2011)

Chief Executive Officer

(since 2013)

Founder and CEO of Foundations Recovery Network

At Foundations, opened notable treatment facilities including the Canyon in Malibu, La Paloma in Memphis and

Michael’s House in Palm Springs

Started Moments of Change & Lifestyle Intervention, two of the

leading national industry conferences Author of Believable Hope

20+ years industry experience

Kirk R. Manz

Chief Financial Officer

(since 2011)

Founder and Managing Member of Private Capital Securities, a boutique investment banking firm Former Vice President at

Piper Jaffray and Fixed Income Specialist with

Stephens Inc.

Co-founder and CEO of four communications companies including Igaea, an international VoIP Company

23+ years management experience

3

2015 LOOK BACK

Increased Bed Capacity 82%

increase in bed capacity (from 493 to 897)

Increased Admissions 64% increase in admits (from 4,728 to 7,763)

Improved Avg. Daily Residential Census 43% increase in census (from 395 to 563 ADC)

Diversi?ed Payor Mix In-network beds as of 12/31/15 are 19% of capacity up from 0%

Diversi?ed Geography Added operations in RI, MS, NJ

Divested Unpro?table Units Closed Fit-Rx and The Academy

Added Outpatient Capabilities Opened Las Vegas and Arlington outpatient centers

Acquired 8 outpatient centers (CSRI, Oxford, Sunrise)

Completed 5 Acquisitions Recovery First, FL (in-network)

CSRI, RI (in-network)

Recovery Brands, CA (marketing acquisition)

Oxford Center, MS (out-of-network)

Sunrise House, NJ (in-network)

Announced 2

Acquisitions Solutions Recovery, NV (in-network beds & sober living)

Townsend, LA (in-network

outpatient and laboratory)

Expanded Lab Capabilities High complexity lab testing added in CA, FL, MS, NJ, RI

Expanded lab capacity

Relocated Corp. O?ces Expanded call center and billing capabilities

Unless otherwise stated, comparative information presents operating metrics as of December 31, 2015 compared to operating metrics as of December 31, 2014

4

HISTORICAL GROWTH

REVENUE

$250MM

$200MM $209

-

$212

$150MM GR**

CA $133

$100MM 65% $116

$50MM $66

$28

$0MM

2011 2012 2013 2014 2015E**

ADJUSTED EBITDA*

$50MM

$40MM $42

-

GR** $43

$30MM A CA

AEBITD

$20MM 114% $21

$10MM $12

$7

$2

$0MM

2011 2012 2013 2014 2015E**

AAC HAS EXPERIENCED 65% CAGR REVENUE GROWTH AND 114% CAGR AEBITDA GROWTH SINCE 2011

* Represents a non-GAAP financial measure. For reconciliations to net income, the corresponding GAAP financial measure,

see the Appendix.

* * This outlook for the fiscal year 2015 does not include the impact of stock-based

compensation, acquisition-related expense, litigation settlement and California matter related expense, de novo start-up expense, or facility losses and closure expense related to FitRx and the Academy. This outlook is based on information available

to management as of the date of this presentation and is subject to revision upon finalization of the Company’s quarterly and full year accounting and financial reporting procedures.

5

2015 ADMISSIONS AND CENSUS GROWTH

ADMISSIONS

2,500

Post CA 2,462

Indictment

24%

2,000 QOQ

1,980

1,806

1,500 1,515

1,000

500

0

Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15

AVG. DAILY RESIDENTIAL CENSUS

700

Post CA

Indictment 670

600 20%

QOQ

560

500 539

494

400

300

200

100

0

Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15

AAC EXPERIENCED 33% ADMISSION GROWTH IN THE SECOND HALF OF THE YEAR

6

2015: ACQUISITION UPDATES

Recovery First

22% revenue growth in 2015

Beds When Acquired 56 Current Beds 63 Residential Beds In Development 22 Organic Residential Bed Growth* 2%

Oxford Center

28% revenue growth in 2015

Beds When Acquired 76

Current Beds 76

Residential Beds In Development

44

Organic Residential Bed Growth* 58%

Sober Living Beds in Development 48

Recovery Brands

23% revenue growth in 2015

AAC cost per admit has been reduced by approximately $1,000 post acquisition representing a potential

to reduce admission costs by up to $10MM annually**

* Assumes completion of beds in development. * *Estimated cost savings per admit based on 4th Quarter sales and marketing

expenses and admissions data.

7

2015: ORGANIC GROWTH

Desert Hope

Desert Hope’s 2015 outpatient addition facilitated 18% revenue growth for Las Vegas operations for 2015

2014 1,549 2014 0

2015 2,022 2015 7,332

Residential Admissions

Outpatient Visits

Greenhouse

Greenhouse’s 2014 bed expansion and 2015 outpatient addition facilitated 70% revenue growth for Arlington operations for 2015

2014 1,068 2014 0

2015 1,546 2015 3,748

Residential Admissions

Outpatient Visits

8

RIVER OAKS CENSUS GROWTH

175

162 licensed beds

150

125

110 staffed beds

100 95

90

80 staffed beds

75

58

48

50

25

0

0

9/30/15 10/31/15 11/30/15 12/31/15 1/15/16

STRONG#RIVER#OAKS#RESIDENTIAL#CENSUS#GROWTH

9

ANCILLARY REVENUE

> Drug testing is an

essential component to providing high quality clinical care

> We anticipate Ancillary Services* as a % of

Client Related Revenue will continue to decline in 2016 and stabilize by year end

100%

66% 62% 74% 78%

75%

50%

38%

25% 34% 26%

22%

0%

Q1 Q2 Q3 Q4

‘15 ‘15 ’15 ‘15

Ancillary Services as % of Facility Charges

Client Related Revenue

* Includes point of care drug testing, definitive laboratory services, professional groups, and other ancillary services

10

2016 LOOK AHEAD: ADDICTION LABS

Objective is to

materially diversify the laboratory business in 2016

Add in-network laboratory

Townsend acquisition (anticipated closing Q2 ’16)

Expand service lines (anticipated Q2 ’16)

Hematology

Genetics

Offer services to third party providers

Focus on addiction treatment providers

Build out

national sales force

11

2016 LOOK AHEAD: DE NOVO AND ACQUISITIONS

Laguna

Treatment Center, CA—Q2 ‘16

Chemical Dependency Recovery Hospital

84 beds

Solutions Recovery, NV—Q2 ‘16

70

in-network beds in Las Vegas

3 in-network outpatient centers

100+ sober living beds

Townsend, LA—Q2 ‘16

In-network

laboratory

6 in-network outpatient centers

20 in-network beds

174 BEDS, 9 OUTPATIENT CENTERS AND AN IN-NETWORK LAB CURRENTLY ANTICIPATED TO COME ONLINE Q2 ‘16

LAGUNA BEACH, CA

84 CDRH BEDS

12

2016 LOOK AHEAD BED CAPACITY

1,500

1,200

1,117 1,117 1,139 1,115

1,061

996

900 897 915

782 823

600 638 638

548 548 587 587

300

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 ‘

‘15 ‘15

‘15 ‘15 ‘16E ‘16E ‘16E 16E

Total Bed Capacity Sta?ed Beds (E?ective Total Bed

Capacity)

13

DEBT AND ASSETS OVERVIEW

Current senior and

subordinated debt was approximately $145MM on 12/31/15

Real estate book value was approximately $88MM as of

12/31/15 (management estimates higher market values)

Book Value

River Oaks, FL $20,096,839

Laguna, CA $16,261,246

Greenhouse, TX $15,411,079

Desert Hope, NV $10,327,287

Ringwood, NJ $6,500,000

Sunrise, NJ $6,400,000

Oxford, MS $6,139,675

Desert Hope Outpatient, NV $2,913,515

Greenhouse

Outpatient, TX $2,893,721

Recovery First, FL $1,318,912

Total $88,262,274

DESERT HOPE

148 BEDS

14

COLLECTIONS

> While Days Sales Outstanding

(DSOs) have fluctuated quarter over quarter, trailing Twelve Months Cash Deposits to Net Revenue (revenue less allowance for doubtful accounts) has remained consistently between 99% and 101%

100

93 96

89

83

75 80 79 80

69 71

50

25

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Dec ‘

‘14 ‘14 ‘14 ‘14 ‘15 ‘15 ‘15 ‘15E 15 E

DSOs

99.3% 100.4% 100.1% 100.4% 100.4% 99.3%

101.8% 100.9%

102.0%

51.0%

0.0%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

‘14 ‘14 ‘14 ‘14 ‘15 ‘15 ‘15 ‘ 15E

TTM Cash Deposits to Net Revenue

Issues impacting

2H 2015 DSOs

Q3—Acquired AR

Q3/Q4—Conversion to new lab billing software

Q4—ICD-10 conversion (healthcare industry wide dynamic)

Management believes DSOs should return to normalized levels (80-85 days) in Q2 ‘16

15

CASE UPDATE: 995 MOTION 16

> 995 motions were

filed on January 22, 2016. Key arguments presented by Company and other Defendants to dismiss the case include:

Failing to call the coroner and instead calling a paid consultant to the plaintiff in the civil case and misrepresenting to the Grand Jury the coroner’s findings and the contents of

his records to make it appear that the client’s death was a homicide

Repeated violations of the

prosecutor’s duty to present exculpatory evidence

Repeatedly presenting inadmissible evidence to the

Grand Jury including hearsay and opinion testimony

Presenting no evidence of probable cause that any of the

Defendants had the requisite malice required for a second degree murder case

Incorrectly advising the Grand

Jury that it could interpret licensing statutes to find the client was a dependent adult

Failing to instruct

on essential elements of some offenses and affirmatively mis-instructing on the law for other offenses

THE

FULL 995 MOTION CAN BE DOWNLOADED AT AACTHETRUTH.COM

16

CASE UPDATE: CORONER DECLARATION

> Declaration

from Dr. Fajardo filed on January 22, 2016

Original coroner of the client case and former Chief

Forensic Pathologist of Riverside County

Currently Chief Medical Examiner-Coroner for Los Angeles County

Dr. Fajardo was never called to testify before the Grand Jury

Declaration reaffirms original diagnosis of natural cause death due to hypertensive cardiovascular disease, with chronic

obstructive pulmonary disease as another significant condition

Declaration reaffirms that drugs in the

client’s system did not cause death

Declaration reaffirms Dr. Fajardo’s prior knowledge that

the client was on supplemental oxygen

Declaration reaffirms that the lack of supplemental oxygen did not cause

or contribute to the client death

THE FULL DECLARATION CAN BE DOWNLOADED AT AACTHETRUTH.COM

17

2016 BUSINESS OBJECTIVES

> Key business

objectives for 2016

Ramp River Oaks census

Open Laguna CDRH in Q2

Close and integrate pending acquisitions of Solutions Recovery and Townsend

Achieve consistent occupancy rates at legacy centers

Expand outpatient business

Diversify lab business

Lower customer acquisition costs

Continue in-network payor diversification

18

APPENDIX: NON-GAAP FINANCIAL MEASURES

Adjusted

EBITDA and Adjusted Earnings Per Share (EPS) are non-GAAP financial measures” as defined under the rules and regulations promulgated by the U.S. Securities and Exchange Commission. Management defines Adjusted EBITDA as net income adjusted for

interest expense, depreciation and amortization expense, income tax expense, stock-based compensation and related tax reimbursements, litigation settlement, restructuring charges, reorganization expense (which includes certain reorganization

transactions in April 2014 and expenses associated with the amendment and restatement of our then-existing credit facility in April 2014), acquisition-related expense, and de novo startup expense. Where applicable, these include professional

services for accounting, legal, valuation services and licensing expenses. Adjusted EBITDA and Adjusted EPS are considered supplemental measures of the Company’s performance and are not required by, or presented in accordance with, generally

accepted accounting principles, or GAAR Adjusted EBITDA and Adjusted EPS are not measures of the Company’s financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in

accordance with GAAR Management has included information concerning Adjusted EBITDA and Adjusted EPS because they believe that such information is used by certain investors as a measure of a company’s historical performance.

Management believes these measures are frequently used by securities analysts, investors and other interested parties in

the evaluation of issuers of equity securities, many of which present

EBITDA, Adjusted EBITDA and Adjusted EPS

when reporting their results. Because Adjusted EBITDA and Adjusted EPS are not determined in accordance with GAAP, they are subject to varying

calculations and may not be comparable to the Adjusted EBITDA and Adjusted EPS (or similarly titled measures) of other companies. Management’s presentation of Adjusted EBITDA and

Adjusted EPS should not be construed as an inference that our future results will be unaffected by unusual or

nonrecurring items.

19

RECONCILIATION OF NON-GAAP DISCLOSURES

AAC

Holdings, Inc.

Reconciliation of Adjusted EBITDA to Net Income

Year Ended December 31,

2011 2012 2013 2014

(Dollars in thousands)

Net Income $ 871 $ 1,099 $ 1,492 $ 6,366

Non-GAAP Adjustments:

Interest expense 337 980 1,390 1,872

Depreciation

and amortization 195 1,288 3,003 4,662

Income tax expense 652 1,148 615 2,555

Stock-based compensation and related tax reimbursements — 2,408 1,649 3,030

Litigation settlement — — 2,588 487

Restructuring — — 806 -

Reorganization

— — 15 1,176

Acquisition-related expense — 150 — 845

De novo start-up expense — 95 — 99

Adjusted EBITDA $ 2,055 $ 7,168 $ 11,558 $ 21,092

20

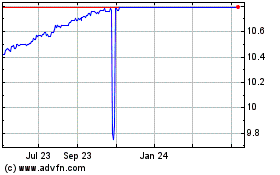

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024