United

States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 14, 2015

| CHINA GREEN AGRICULTURE, INC. |

| (Exact name of Registrant as specified in charter) |

| Nevada |

|

001-34260 |

|

36-3526027 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

3rd Floor, Borough A, Block A. No. 181,

South Taibai Road, Xi’an, Shaanxi

Province

People’s Republic of China 710065

| |

| (Address of principal executive offices) (Zip Code) |

Registrant's telephone number, including

area code: +86-29-88266368

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17CFR230.425) |

| ¨ | Soliciting material pursuant to Rule14a-12 under the Exchange

Act (17CFR240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17CFR240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17CFR240.13e-4(c)) |

| Item 2.02 | Results

of Operations and Financial Condition. |

On September 14, 2015,

China Green Agriculture, Inc., a corporation incorporated in the State of Nevada (the “Company”), issued a press release

announcing (i) certain financial results for the fiscal year ended June 30, 2015; (ii) guidance for the revenues and net incomes

for the fiscal year ended June 30, 2016 and the first quarter ended September 30, 2015; and (iii) a conference call to be held

by the Company on Monday, September 14, 2014 at 7:00 a.m. Eastern Time to discuss the results of operations for the year ended

June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

| |

Item 9.01 |

Financial Statements and Exhibits. |

The following is filed as an exhibit to

this report:

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release, dated September 14, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: September 14, 2015

| |

CHINA GREEN AGRICULTURE, INC. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Tao Li |

| |

Name: |

Tao Li |

| |

Title: |

President and Chief Executive Officer |

Exhibit 99.1

China

Green Agriculture Reports Fiscal Year 2015 Financial Results

Provides Guidance

on the First Fiscal Quarter 2016 and Fiscal Year 2016 Revenues and Net Incomes

XI'AN, China, September

14, 2015 /PRNewswire-Asia-FirstCall/ --

China Green Agriculture,

Inc. (NYSE: CGA) ("China Green Agriculture" or the "Company"), a company mainly produces and distributes

humic acid-based compound fertilizers, varieties of compound fertilizers and agricultural products through its subsidiaries in China,

today announced its financial results for the Fiscal Year ended June 30, 2015 and guidance on revenues and net incomes of

the First Fiscal Quarter 2016 and Fiscal Year 2016.

Highlights:

- Sales increased 12.8% to $263.4

million; Net Income increased 23.2% to $31.4 million; Earning per Share (EPS) of $0.93 in Fiscal Year 2015.

- Guidance for First Fiscal Quarter

2016: Revenue of $50 million to $52.5 million; Net Income of $4.3 million to $5.1 million; EPS of $0.13 to $0.15 based on 34 million

fully diluted shares.

- Guidance for Fiscal Year 2016: Revenue

of $257.6 million to $269.4 million; Net Income of $21.1 million to $24.1 million; EPS of $0.62 to $0.71 based on 34 million fully

diluted shares.

Financial Summary

| Fourth Fiscal Quarter 2015 Results (USD) | |

| |

| (Three Months ended June 30, 2015) | |

| |

| | |

| Q4 FY2015 | | |

| Q4 FY2014 | | |

| CHANGE (%) | |

| Net Sales | |

| $78.5 million | | |

| $72.2 million | | |

| 8.7 | % |

| Gross Profit | |

$ | 28.2 million | | |

| $23.7 million | | |

| 19.0 | % |

| Net Income | |

| $8.2 million | | |

| $4.3 million | | |

| 90.7 | % |

| EPS (Diluted) | |

$ | 0.23 | | |

$ | 0.11 | | |

| 109.1 | % |

| Weighted Average Shares Outstanding(Diluted) | |

| 34.0 million | | |

| 31.4 million | | |

| 8.2 | % |

| Fiscal Year 2015 Results (USD) |

| (Fiscal Year ended June 30, 2015) |

| | |

| FY2015 | | |

| FY2014 | | |

| CHANGE (%) | |

| Net Sales | |

| $263.4 million | | |

| $233.4 million | | |

| 12.8 | % |

| Gross Profit | |

$ | 104.0 million | | |

$ | 91.2 million | | |

| 14.0 | % |

| Net Income | |

$ | 31.4 million | | |

$ | 25.5 million | | |

| 23.2 | % |

| EPS (Diluted) | |

$ | 0.93 | | |

$ | 0.81 | | |

| 13.9 | % |

| Weighted Average Shares Outstanding (Diluted) | |

| 34.0 million | | |

| 31.4 million | | |

| 8.2 | % |

“As we concluded

our recent fiscal year, we look forward to the new fiscal year to place a particular focus on building Jinong’s and Gufeng’s

fertilizer franchises as well as consolidating Yuxing’s operations to pursue growth in agriculture product revenue. Furthermore,

as we enter into the new fiscal year, China Green Agriculture is on its way to achieve the early benchmarks of our ten-year plan

announced in the year of 2011.”

Mr. Tao Li, Chairman

and Chief Executive Officer of the Company, stated, “We are very pleased with our performance in business operation, generating

$31.4 million net income in the year ended June 30, 2015,” he concluded, " Looking

ahead to the Fiscal Year 2016, we expect revenue of $257.6 to $269.4 million; net income of $21.1 to $24.1 million; and

EPS of $0.62 to $0.71 based on 34 million fully diluted shares. Moreover, we will implement a series of development process

along with our corporate restructuring to the use of our resource. Therefore we expect to update our fiscal year guidance when

we announce the financial results of the First Fiscal Quarter 2016"

Fourth Fiscal

Quarter 2015 Results of Operations

For the three months ended June 30,

2015, net sales were $78.5 million, an increase of $6.3 million, or 8.7%, from $72.2 million for the three

months ended June 30, 2014. Among which, Gufeng contributed $45.9 million or 48.9% of total net sales, as compared to

$41.7 million, or 57.8% of total net sales in the same period last year; Jinong's net sales increased $1.9 million, or 6.4%,

to $31.4 million from $29.5 million in the same period last year; Yuxing’s net sales increased $0.2 million

or 20.0%, to $1.2 million, as compared to $1.0 million for the same period last year. This Net Sales increase was mainly

attributable to the greater sales of humic acid fertilizer products, including our liquid and powder fertilizers, as a result of

our increased distributors and the aggressive marketing strategy.

Cost of goods

sold increased $1.8 million, or 3.7%, to $50.3 million for the three months ended June 30, 2015, as compared to $48.5 million

in the same period last year; gross profit increased by $4.5 million, or 19.0%, to $28.2 million as compared to $23.7

million in the same period last year; gross profit margin was approximately 35.9% and 32.9% of net sale for the three months ended June

30, 2015 and 2014, respectively.

Besides, general

and administrative expenses were $2.4 million or 3.1% of net sales, as compared to $3.1 million, or 4.4% of net sales in the

same period of last year, a decrease of $0.7 million or 22.6%; total operating expenses as a percentage of sales were 21.7%,

as compare to 23.7% in the same period of last year; Operating income was $11.2 million, an increase of $4.6 million or 69.7%,

from $6.6 million in the same period last year. Operating margin was 14.3%, compared to 9.1% in the same quarter of Fiscal

Year 2014.

Finally, net income

was $8.2 million, an increase of $3.9 million or 90.7% as compared to $4.3 million in the same period last year. The increase

was attributable to the increase in net sales.

Fiscal Year 2015 Results of Operations

Total net sales for the year ended June

30, 2015 were $263,354,288, an increase of $29,952,200 or 12.8%, from $233,402,088 for the year ended June 30, 2014. This increase

was due to an increase in Gufeng’s and Jinong’s net sales.

For the year ended June 30, 2015, Jinong’s

net sales increased $12,649,135, or 10.7%, to $130,355,168 from $117,706,033 for the year ended June 30, 2014. This increase was

mainly attributable to the greater sales of humic acid fertilizer products including our liquid and powder fertilizers during this

period as a result of our aggressive marketing strategy and the increased number of our distributors.

For the year ended June 30, 2015, Gufeng’s

net sales were $128,675,606, an increase of $16,664,373, or 14.9% from $112,011,233 for the year ended June 30, 2014. The increase

was mainly attributable to Gufeng’s expanding of its marketing promotion strategy, especially the large amount sale to Sino-agri

Group during the last fiscal year.

For the year ended June 30, 2015, Yuxing’s

net sales were $4,323,514, an increase of $638,692 or 17.3%, from $3,684,822 for the year ended June 30, 2014. The increase

was mainly attributable to the increase in market demand and the higher prices on Yuxing’s top grade flowers during the last

fiscal year.

Total cost of goods sold for the year ended

June 30, 2015 was $159,398,386, an increase of $17,195,071, or 12.1%, from $142,203,315 for the year ended June 30, 2014. This

increase was mainly due to the 13.7% increase in net sales.

Cost of goods sold by Jinong for the year

ended June 30, 2015 was $51,948,851, an increase of $3,319,756, or 6.8%, from $48,629,095 for the year ended June 30, 2014. The

increase in cost of goods was primarily attributable to Jinong’s higher net sales.

Cost of goods sold by Gufeng for the year

ended June 30, 2015 was $104,361,828, an increase of $13,613,288, or 15.0%, from $90,748,540 for the year ended June 30, 2014.

This increase was primarily attributable to an increase in the cost of raw materials and an increase in the sales of fertilizer

products.

For year ended June 30, 2015, cost of goods

sold by Yuxing was $3,087,707, an increase of $262,027, or 9.3%, from $2,825,680 for the year ended June 30, 2014. This increase

was mainly due to the increase in Yuxing’s net sales.

Total gross profit for the year ended June

30, 2015 increased by $12,757,129 to $103,955,902, as compared to $91,198,773 for the year ended June 30, 2014. Gross profit margin

was 39.5% and 39.1% for the year ended June 30, 2015 and 2014, respectively.

Gross profit generated by Jinong increased

by $9,329,379, or 13.5%, to $78,406,317 for the year ended June 30, 2015 from $69,076,938 for the year ended June 30, 2014. Gross

profit margin from Jinong’s sales was approximately 60.1% and 58.7% for the year ended June 30, 2015 and 2014, respectively.

The increase in gross profit margin was mainly due to the increased weight for higher-margin products sales in Jinong’s

total sales due to Jinong’s sales strategy. Jinong has adjusted its production process to focus on producing high-margin

liquid fertilizer during the last fiscal year.

For the year ended June 30, 2015, gross

profit generated by Gufeng was $24,313,778, an increase of $3,051,085, or 14.3%, from $21,262,693 for the year ended June 30, 2014.

Gross profit margin from Gufeng’s sales was approximately 18.9% and 19.0% for the year ended June 30, 2015 and 2014, respectively.

The decrease in gross profit percentage was not significant.

For the year ended June 30, 2015, gross

profit generated by Yuxing was $1,235,807, an increase of $376,665, or 43.8% from $859,142 for the year ended June 30, 2014. The

gross profit margin was approximately 28.6% and 23.3% for the year ended June 30, 2015 and 2014, respectively. The increase in

gross profit percentage was mainly due to the higher priced top grade flowers that Yuxing sold during the last fiscal year.

Our selling expenses consisted primarily

of salaries of sales personnel, advertising and promotion expenses, freight-out costs and related compensation. Selling expenses

were $9,010,486, or 3.4%, of net sales for the year ended June 30, 2015, as compared to $8,812,457 or 3.8% of net sales for the

year ended June 30, 2014, an increase of $198,029, or 2.2%. The selling expenses of Yuxing were $45,594 or 1.1% of Yuxing’s

net sales for the year ended June 30, 2015, as compared to $50,760, or 1.4% of Yuxing’s net sales for the year ended June

30, 2014. The selling expenses of Gufeng were $1,152,297 or 0.9% of Gufeng’s net sales for the year ended June 30, 2015,

as compared to $1,304,511, or 1.2% of Gufeng’s net sales for the year ended June 30, 2014. The selling expenses of Jinong

for the year ended June 30, 2015 were $7,812,595 or 5.9% of Jinong’s net sales, as compared to selling expenses of $7,457,186,

or 6.3% of Jinong’s net sales for the year ended June 30, 2014. The increase in Jinong’s selling expenses was due to

Jinong’s expanded marketing efforts and the increase in shipping costs which was caused by the increased sales.

The selling expenses - amortization of

our deferred assets were $41,902,052, or 15.8%, of net sales for the year ended June 30, 2015, as compared to $27,390,957 or 11.7%

of net sales for the year ended June 30, 2014, an increase of $14,511,095, or 53.0%. This increase was due to the increased amortization

of the deferred tax assets for the year ended June 30, 2015 related to our business strategy implemented since December 2013 that

assists distributors in certain marketing efforts and develops standard stores to expand our competitive advantages and market

shares.

General and administrative expenses consisted

primarily of related salaries, rental expenses, business development, depreciation and travel expenses incurred by our general

and administrative departments and legal and professional expenses including expenses incurred and accrued for certain litigations.

General and administrative expenses were $11,330,440, or 4.3% of net sales for the year ended June 30, 2015, as compared to $14,515,884,

or 6.2%, of net sales for the year ended June 30, 2014, a decrease of $3,185,444, or 21.9%. The decrease in general and administrative

expenses was mainly due to the related expense in the stock compensation awarded to the employees which amounted to $5,186,870

for the year ended June 30, 2015 as compared to $8,119,724 for the year ended June 30, 2014.

Net income for the year ended June 30,

2015 was $31,445,126, an increase of $5,930,431, or 23.2%, compared to $25,541,695 for the year ended June 30, 2014. The increase

was attributable to the increase in net sales, offset by an increase in selling expenses and selling expenses – amortization

of deferred asset. Net income as a percentage of total net sales was approximately 11.9% and 10.9% for the year ended June 30,

2015 and 2014, respectively.

Financial Condition

As of June

30, 2015, the Company held cash and cash equivalents of $93.0 million, an increase of $66.1 million, or 245.8%, from $26.9 million

as of June 30, 2014. Net cash provided in financing activities for the year ended June 30, 2015 was $1.1 million, a decrease of

$7.4 million or 86.8% from cash provided by financing activities of $8.5 million for the year ended June 30, 2014. The Company

had $23.6 million in short-term loans as of June 30, 2015, a decrease of $0.4 million, as compared to $24.0 million as of

June 30, 2014. Net accounts receivable was $68.5 million, a decrease of $20.3 million as compared to $88.8 million for

the same period last year.

First Fiscal

Quarter 2016 and Fiscal Year 2016 Guidance

For the first

quarter ending September 30, 2015, management expects net sales of $50 to $52.5 million, net income of $4.3 to $5.1 million, and

EPS of $0.13 to $0.15 based on 34 million fully diluted shares. For the Fiscal Year 2016, management expects net sales of $257.6

million to $269.4 million, net income of $21.1 million to $24.1 million, and an EPS of $0.62 to $0.71 based on 34 million

fully diluted shares. Management expects to update the Company’s fiscal year guidance when it announces the financial results

of the First Fiscal Quarter 2016

Conference

Call

The Company will

hold a conference call at 7:00 a.m. ET on Monday, September 14, 2015. Any interested participants are welcome to

join in the call by following the dial-in details as set out below. When prompted by the operator, please indicate "China

Green Agriculture's Fiscal Year 2015 Financial Results" to join the call.

| Event: |

CGA Fiscal Year 2015 Conference Call |

|

| Date: |

September 14, 2015 |

|

| Time: |

7:00 a.m. ET |

|

| US Dial In: |

1- 888-346-8982 |

|

| Int'l Dial In: |

1- 412-902-4272 |

|

| Conference ID#: |

10072272 |

|

| |

|

|

The call is being

webcast by Vcall and can be accessed at China Green Agriculture's website at http://www.ir-site.com/cgagri/events.asp.

Investors can also access the webcast at http://www.InvestorCalendar.com.

A playback will

be available through September 21, 2015. To listen, please call 1- 877-344-7529 within the United States or 1-412-317-0088

when calling internationally. Replay Access Code# 10072272.

About China Green Agriculture, Inc.

The Company

produces and distributes humic acid-based compound fertilizers, other varieties of compound fertilizers and agricultural products

through its wholly-owned subsidiaries, i.e.: Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. (“Jinong”), Beijing

Gufeng Chemical Products Co., Ltd ("Gufeng") and a variable interest entity, Xi'an Hu County Yuxing Agriculture Technology

Development Co., Ltd. ("Yuxing"). Jinong produced and sold 127 different kinds of fertilizer products as of June

30, 2015, all of which are certified by the government of the People's Republic of China

(the "PRC") as Green Food Production Materials, as stated by the China Green Food Development Center. Jinong currently

markets its fertilizer products to private wholesalers and retailers of agricultural farm products in 27 provinces, four autonomous

regions, and three central-government-controlled municipalities in the PRC. Jinong had 1,010 distributors in the PRC as

of June 30, 2015. Gufeng, and its wholly-owned subsidiary, Beijing Tianjuyuan Fertilizer Co., Ltd., are Beijing-based

producers of compound fertilizers, blended fertilizers, organic compound fertilizers, and mixed organic-inorganic compound fertilizers.

As of June 30, 2015, Gufeng produced and sold 332 different kinds of fertilizer products, and had 282 distributors in the

PRC. For more information, visit http://www.cgagri.com. The Company routinely posts

important information on its website.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning the Company's business, products

and financial results. The Company's actual results may differ materially from those anticipated in the forward-looking statements

depending on a number of risk factors including, but not limited to, the following: general economic, business and environment

conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology,

the execution of its ten-year growth plan, the foreign exchange risk amid the unexpected announcement by the PRC government in

August 2015 sending the yuan to a 3% devaluation and various other factors beyond the Company's control. All forward-looking statements

are expressly qualified in their entirety by this Safe Harbor Statement and the risk factors detailed in the Company's reports

filed with the SEC. China Green Agriculture undertakes no duty to revise or update any forward-looking statements to reflect events

or circumstances after the date of this release, except as required by applicable law or regulations.

For more information, please contact:

China Green Agriculture, Inc.

Mr. Fang Wang (English and Chinese)

Tel: +86-29-88266383

Email: wangfang@cgagri.com

SOURCE: China Green Agriculture, Inc.

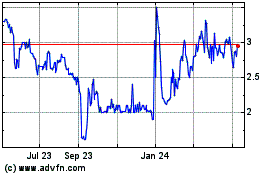

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

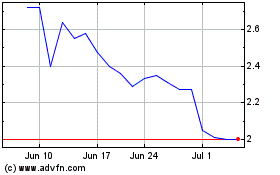

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Apr 2023 to Apr 2024