UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2015

On Assignment, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 000-20540 | 95-4023433 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

26745 Malibu Hills Road, Calabasas, California | 91301 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (818) 878-7900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

| o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

| o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

| o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

| o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 29, 2015, On Assignment, Inc. (the “Company”) announced its financial results for the second quarter of 2015. A copy of the press release is furnished pursuant to Item 2.02 of this Current Report on Form 8-K as Exhibit 99.1. The information in this report, including Exhibit 99.1 attached hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

| | |

99.1 |

| Press release of On Assignment, Inc. dated July 29, 2015. |

SIGNATURE

Pursuant to the requirements of the Exchange Act the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| On Assignment, Inc. |

| |

Date: July 29, 2015 | /s/ Edward L. Pierce |

| Edward L. Pierce |

| Executive Vice President and Chief Financial Officer |

|

| | |

| | For Release |

| | July 29, 2015 |

| | 1:05 p.m. PDT |

Contacts:

Ed Pierce

Chief Financial Officer

(818) 878-7900

On Assignment Reports Results for Second Quarter of 2015

Revenues & Adjusted EBITDA above Previously Announced Estimates

CALABASAS, Calif., July 29, 2015 -- On Assignment, Inc. (NYSE: ASGN), a leading global provider of diversified professional staffing solutions, today reported results for the quarter ended June 30, 2015.

Second Quarter Highlights

| |

• | Effective June 5, 2015, acquired Creative Circle, LLC ("Creative Circle"), one of the largest digital/creative staffing firms in North America, for $570 million in cash and stock, plus contingent consideration of up to $30 million. |

| |

• | Revenues were $485.3 million; up 11.7 percent year-over-year (12.8 percent on a constant currency basis). |

| |

• | Revenues, excluding the contribution from acquisitions, were $463.5 million ($468.1 million on a constant currency basis), up 6.7 percent (7.8 percent on a constant currency basis) and above the high-end of our financial estimates. |

| |

• | Adjusted EBITDA (a non-GAAP measure defined below) was $56.0 million. Adjusted EBITDA included $4.9 million from Creative Circle. Excluding the contribution from Creative Circle, Adjusted EBITDA was $51.1 million and towards the high-end of our financial estimates. |

| |

• | Adjusted income from continuing operations (a non-GAAP measure defined below) was $32.3 million ($0.61 per diluted share). Excluding the contribution from Creative Circle, Adjusted income from continuing operations was $28.8 million ($0.55 per share) and was towards the high-end of our financial estimates. |

| |

• | In conjunction with the Creative Circle acquisition, entered into a new $975 million credit facility, comprised of an $825 million seven-year term loan and a $150 million revolving credit facility. After the closing of Creative Circle, $875 million was outstanding under the facility. |

| |

• | Leverage ratio (total indebtedness to trailing 12 months Adjusted EBITDA) was 3.51 to 1 at June 30, 2015, up from 2.06 to 1 at December 31, 2014. |

Commenting on the results, Peter Dameris, President and Chief Executive Officer of On Assignment, Inc., said, "We are pleased with our strategic and operational accomplishments during the quarter. The acquisition of Creative Circle positions us well in the fast growing digital/creative staffing space allowing us to engage the CMO along with the CIO to provide solutions that meet the growing needs of both groups while driving greater demand for our traditional services.

Our financial performance for the quarter was enhanced by the acquisition of Creative Circle, which was accretive on a GAAP and an Adjusted Earnings basis. Excluding the contribution from Creative Circle, our results (adjusted mainly for acquisition-related costs and the write-off of loan costs associated with our old credit facility) were at or above the high-end of our previously announced financial estimates for the quarter. Our revenue growth rates were higher than expected and reflected a slight re-acceleration in our growth rate

for the first time in four quarters. Our cash generation during the quarter was strong and permitted us to pay down our indebtedness by $25 million prior to the end of the quarter and we expect to voluntarily pay down an additional $25 million by the end of July."

Second Quarter 2015 Financial Results

Revenues for the quarter were $485.3 million ($489.9 million on a constant currency basis), up 11.7 percent (12.8 percent on a constant currency basis) year-over-year. Constant currency revenues and growth rates for the quarter were calculated using the foreign currency exchange rates from the same period in the prior year.

Revenues included $21.8 million from two businesses acquired during the quarter (Creative Circle and a small Life Sciences business in Europe), which are included in consolidated results from the date of acquisition. The revenue contribution from Creative Circle was $19.6 million, and the contribution from the Life Sciences business was $2.2 million. Revenues, excluding the contribution from acquisitions, were $463.5 million ($468.1 million on a constant currency basis), up 6.7 percent (7.8 percent on a constant currency basis) and above the high-end of our financial estimates.

Operating results of Creative Circle are included in the Apex Segment. The Life Sciences European business is now included in the Oxford Segment for reporting purposes. The operating and statistical data for the Oxford Segment have been adjusted to reflect this change in reporting.

Direct hire and conversion revenues were $28.7 million, up 33.8 percent year-over-year, which included $1.5 million from Creative Circle. CyberCoders accounted for 72.6 percent of the total and was up 28.0 percent year-over-year. Direct hire and conversion revenues were 5.9 percent of total revenues for the quarter, up from 4.9 percent in the second quarter of 2014.

Our largest segment, Apex, accounted for 69.8 percent of total revenues. Apex grew 13.7 percent year-over-year, on a reported basis, which included $19.6 million in revenues from Creative Circle. Excluding the contribution from Creative Circle, Apex grew 7.1 percent year-over-year for the quarter.

Our Oxford Segment accounted for 30.2 percent of total revenues. Oxford grew 7.4 percent year-over-year on a reported basis, which included $2.2 million in revenues from an acquired business. On a constant currency basis and excluding the contribution from the acquired Life Sciences business, Oxford grew 9.1 percent year-over-year for the quarter.

Gross profit was $158.5 million, up $16.6 million or 11.7 percent year-over-year. Gross margin for the quarter was 32.7 percent.

Selling, general and administrative (“SG&A”) expenses were $118.9 million (24.5 percent of revenues), up from $99.6 million (22.9 percent of revenues) in the second quarter of 2014. SG&A expenses for the quarter included SG&A from Creative Circle of $4.0 million, acquisition, integration and strategic planning expenses of $6.9 million, and $0.5 million related to the write-off of an IT application. Excluding these expenses, SG&A expense was approximately $107.5 million and within our previously announced financial estimates.

Amortization of intangible assets was $7.0 million, compared with $5.5 million in the second quarter of 2014. The increase in amortization mainly related to the acquisition of Creative Circle.

Interest expense for the quarter was $4.7 million compared with $3.1 million in the second quarter of 2014. Interest expense for the quarter was comprised of interest on the credit facility of $4.2 million and amortization of deferred loan costs of $0.5 million.

Write-off of loan costs totaled $3.8 million ($2.3 million, $0.04 per diluted share, after tax) and related to the refinancing of the credit facility in June.

The leverage ratio (total indebtedness to trailing 12 months Adjusted EBITDA) at June 30, 2015 was 3.51 to 1, up from 2.06 to 1 at December 31, 2014. The increase in the leverage ratio related to borrowing to fund the acquisition of Creative Circle.

The effective income tax rate for the quarter was 40.8 percent, a slight decrease from the 41.2 percent for the full year 2014.

Adjusted EBITDA (a non-GAAP measure defined below) was $56.0 million. The Adjusted EBITDA contribution from Creative Circle was $4.9 million. Excluding the contribution from Creative Circle, Adjusted EBITDA was $51.1 million and towards the high-end of our previously announced financial estimates.

Adjusted income from continuing operations (a non-GAAP measure as calculated in an accompanying table) was $32.3 million ($0.61 per diluted share). Net income on a GAAP basis was $14.3 million ($0.27 per diluted share). Net income included acquisition, integration and strategic planning expenses of $6.9 million ($4.6 million after tax, or $0.09 per diluted share), $0.5 million related to the write-off of an IT application ($0.3 million after tax or $0.01 per diluted share) and the write-off of deferred loan costs of $3.8 million ($2.3 million after tax or $0.04 per diluted share).

Creative Circle Acquisition

On June 5, 2015 the Company completed its acquisition of privately-held Creative Circle, LLC for $570 million, and up to an additional $30 million based on operating performance during 2015. In connection with the acquisition, the Company obtained a secured financing commitment for $975 million from Wells Fargo Bank, National Association. The new credit facility consists of a $150 million revolving credit facility and an $825 million term loan. Proceeds from the facility were used to fund the cash portion of the purchase price and refinance the Company's existing debt.

Financial Estimates for Q3 2015

On Assignment is providing financial estimates for continuing operations for the third quarter of 2015. These estimates do not include acquisition, integration, or strategic planning expenses and assume no deterioration in the staffing markets that On Assignment serves. The following estimates assume billable days of 63.5 for the quarter, which is the same as the preceding quarter. These estimates also assume no deterioration in foreign exchange rates.

| |

• | Revenues of $550.0 million to $555.0 million |

| |

• | Gross margin of 33.5 percent to 33.8 percent |

| |

• | SG&A expense (excludes amortization of intangible assets) of $124.8 to $125.8 million (includes $4.3 million in depreciation and $5.5 million in equity-based compensation expense) |

| |

• | Amortization of intangible assets of $11.4 million |

| |

• | Adjusted EBITDA of $69.0 million to $71.5 million |

| |

• | Effective tax rate of 40.9 percent |

| |

• | Adjusted income from continuing operations of $39.7 million to $41.2 million |

| |

• | Adjusted income from continuing operations per diluted share of $0.74 to $0.77 |

| |

• | Income from continuing operations of $22.6 million to $24.1 million |

| |

• | Income from continuing operations per diluted share of $0.42 to $0.45 |

| |

• | Diluted shares outstanding of 53.4 million |

Conference Call

On Assignment will hold a conference call today at 4:30 p.m. EDT to review its second quarter financial results. The dial-in number is 800-553-0318 (+1-612-332-0107 for callers outside the United States) and the conference ID number is 364192. Participants should dial in ten minutes before the call.

A replay of the conference call will be available beginning today at 6:30 p.m. EDT and ending at 11:59 p.m. EDT on August 13, 2015. The access number for the replay is 800-475-6701 (+1-320-365-3844 outside the United States) and the conference ID number is 364192.

This call is being webcast by Thomson/CCBN and can be accessed via On Assignment's web site at www.onassignment.com. Individual investors can also listen at Thomson/CCBN's site at www.fulldisclosure.com or by visiting any of the investor sites in Thomson/CCBN's Individual Investor Network.

About On Assignment

On Assignment, Inc. is a leading global provider of in-demand, skilled professionals in the growing technology, life sciences, and creative sectors, where quality people are the key to success. The Company goes beyond matching résumés with job descriptions to match people they know into positions they understand for temporary, contract-to-hire, and direct hire assignments. Clients recognize On Assignment for its quality candidates, quick response, and successful assignments. Professionals think of On Assignment as career-building partners with the depth and breadth of experience to help them reach their goals.

On Assignment, which is based in Calabasas, California, was founded in 1985 and went public in 1992. The Company has a network of branch offices throughout the United States, Canada, United Kingdom, and Europe. To learn more, visit http://www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial Measures

Statements in this release and the accompanying Supplemental Financial Information include non-GAAP financial measures. Such information is provided as additional information, not as an alternative to our consolidated financial statements presented in accordance with Generally Accepted Accounting Principles in the United States ("GAAP"), and is intended to enhance an overall understanding of our current financial performance. The Supplemental Financial Information sets forth financial measures reviewed by our management to evaluate our operating performance. Such measures also are used to determine a portion of the compensation for some of our executives and employees. We believe the non-GAAP financial measures provide useful information to management, investors and prospective investors by excluding certain charges and other amounts that we believe are not indicative of our core operating results. These non-GAAP measures are included to provide management, our investors and prospective investors with an alternative method for assessing our operating results in a manner that is focused on the performance of our ongoing operations and to provide a more consistent basis for comparison between quarters. One of the non-GAAP financial measures presented is EBITDA (earnings before interest, taxes, depreciation, and amortization of intangible assets), other terms include Adjusted EBITDA (EBITDA plus equity-based compensation expense, impairment charges, write-off of loan costs, and acquisition, integration and strategic planning expenses) and Non-GAAP income from continuing operations (Income from continuing operations, plus write-off of loan costs, and acquisition, integration and strategic planning expenses, net of tax) and Adjusted income from continuing operations and related per share amounts. These terms might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures reported by other companies. The financial statement tables that accompany this press release include a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure.

Safe Harbor

Certain statements made in this news release are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and involve a high degree of risk and uncertainty. Forward-looking statements include statements regarding the Company's anticipated financial and operating performance in 2015. All statements in this release, other than those setting forth strictly historical information, are forward-looking statements. Forward-looking statements are not guarantees of future performance, and actual results might differ materially. In particular, the Company makes no assurances that the estimates of revenues, gross margin, SG&A, Adjusted EBITDA, income from continuing operations, adjusted income from continuing operations, earnings per share or earnings per diluted share set forth above will be achieved. Factors that could cause or contribute to such differences include actual demand for our services, our ability to attract, train and retain qualified staffing consultants, our ability to remain competitive in obtaining and retaining temporary staffing clients, the availability of qualified temporary professionals, management of our growth, continued performance of our enterprise-wide information systems, our ability to manage our potential or actual litigation matters, the successful integration of our recently acquired subsidiaries, the successful implementation of our five-year strategic plan, and other risks detailed from time to time in our reports filed with the Securities and Exchange Commission ("SEC"), including our Annual Report on Form 10-K for the year ended December 31, 2014, as filed with the SEC on March 2, 2015, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 as filed with the SEC on May 8, 2015, and our Current Report on Form 8-K filed with the SEC on June 5, 2015. We specifically disclaim any intention or duty to update any forward-looking statements contained in this news release.

SUMMARY CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

June 30, | | March 31, | | June 30, |

| 2015 | | 2014 (1) |

| | 2015 | | 2015 | | 2014 (1) |

| | | | | | | | | |

Revenues | $ | 485,323 |

| | $ | 434,424 |

| | $ | 430,045 |

| | $ | 915,368 |

| | $ | 841,275 |

|

Cost of services | 326,789 |

| | 292,519 |

| | 294,170 |

| | 620,959 |

| | 571,215 |

|

Gross profit | 158,534 |

| | 141,905 |

| | 135,875 |

| | 294,409 |

| | 270,060 |

|

Selling, general and administrative expenses | 118,867 |

| | 99,614 |

| | 105,935 |

| | 224,802 |

| | 195,723 |

|

Amortization of intangible assets | 6,957 |

| | 5,522 |

| | 4,869 |

| | 11,826 |

| | 11,060 |

|

Operating income | 32,710 |

| | 36,769 |

| | 25,071 |

| | 57,781 |

| | 63,277 |

|

Interest expense, net | (4,736 | ) | | (3,103 | ) | | (3,067 | ) | | (7,803 | ) | | (6,431 | ) |

Write-off of loan costs | (3,751 | ) | | — |

| | — |

| | (3,751 | ) | | — |

|

Income before income taxes | 24,223 |

| | 33,666 |

| | 22,004 |

| | 46,227 |

| | 56,846 |

|

Provision for income taxes | 9,888 |

| | 14,025 |

| | 8,981 |

| | 18,869 |

| | 23,600 |

|

Income from continuing operations | 14,335 |

| | 19,641 |

| | 13,023 |

| | 27,358 |

| | 33,246 |

|

Gain on sale of discontinued operations, net of tax | — |

| | — |

| | 25,703 |

| | 25,703 |

| | — |

|

Income (loss) from discontinued operations, net of tax | (83 | ) | | 1,148 |

| | 409 |

| | 326 |

| | 1,460 |

|

Net income | $ | 14,252 |

| | $ | 20,789 |

| | $ | 39,135 |

| | $ | 53,387 |

| | $ | 34,706 |

|

| | | | | | | | | |

Basic earnings per common share: | | | | | | | | | |

Income from continuing operations | $ | 0.28 |

| | $ | 0.36 |

| | $ | 0.25 |

| | $ | 0.53 |

| | $ | 0.61 |

|

Income (loss) from discontinued operations | (0.01 | ) | | 0.02 |

| | 0.51 |

| | 0.50 |

| | 0.03 |

|

| $ | 0.27 |

| | $ | 0.38 |

| | $ | 0.76 |

| | $ | 1.03 |

| | $ | 0.64 |

|

| | | | | | | | | |

Diluted earnings per common share: | | | | | | | | | |

Income from continuing operations | $ | 0.27 |

| | $ | 0.36 |

| | $ | 0.25 |

| | $ | 0.52 |

| | $ | 0.60 |

|

Income from discontinued operations | — |

| | 0.02 |

| | 0.50 |

| | 0.50 |

| | 0.03 |

|

| $ | 0.27 |

| | $ | 0.38 |

| | $ | 0.75 |

| | $ | 1.02 |

| | $ | 0.63 |

|

| | | | | | | | | |

Number of shares and share equivalents used to calculate earnings per share: | | | | | | | | | |

Basic | 51,978 |

| | 54,372 |

| | 51,519 |

| | 51,749 |

| | 54,239 |

|

Diluted | 52,633 |

| | 55,173 |

| | 52,209 |

| | 52,435 |

| | 55,098 |

|

| | | | | | | | | |

|

______

| |

(1) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. The results of these businesses are included in discontinued operations for all periods presented. Accordingly, the results shown above differ from the results in our previous filings with the Securities and Exchange Commission ("SEC"). |

SUPPLEMENTAL SEGMENT FINANCIAL INFORMATION(1) (Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

June 30, | | March 31, | | June 30, |

| 2015 | | 2014 (2) | | 2015 | | 2015 | | 2014 (2) |

Revenues: | | | | | | | | | |

Apex | $ | 338,704 |

| | $ | 297,893 |

| | $ | 294,293 |

| | $ | 632,997 |

| | $ | 576,301 |

|

Oxford | 146,619 |

| | 136,531 |

| | 135,752 |

| | 282,371 |

| | 264,974 |

|

| $ | 485,323 |

| | $ | 434,424 |

| | $ | 430,045 |

| | $ | 915,368 |

| | $ | 841,275 |

|

| | | | | | | | | |

Gross profit: | | | | | | | | | |

Apex | $ | 97,652 |

| | $ | 84,677 |

| | $ | 79,643 |

| | $ | 177,295 |

| | $ | 160,183 |

|

Oxford | 60,882 |

| | 57,228 |

| | 56,232 |

| | 117,114 |

| | 109,877 |

|

| $ | 158,534 |

| | $ | 141,905 |

| | $ | 135,875 |

| | $ | 294,409 |

| | $ | 270,060 |

|

|

______

| |

(1) | The segments reported above reflect our new segment configuration. The Oxford segment now includes our former Life Sciences Europe segment. |

| |

(2) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. The results of these businesses are included in discontinued operations for all periods presented. Accordingly, the results shown above differ from the results in our previous filings with the SEC. |

SELECTED CASH FLOW INFORMATION (Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

June 30, | | March 31, | | June 30, |

| 2015 | | 2014 | | 2015 (1) | | 2015 (1) | | 2014 |

Cash provided by operations | $ | 32,477 |

| | $ | 29,330 |

| | $ | 19,943 |

| | $ | 52,420 |

| | $ | 25,009 |

|

Capital expenditures | $ | 5,331 |

| | $ | 5,618 |

| | $ | 8,000 |

| | $ | 13,331 |

| | $ | 9,638 |

|

SELECTED CONSOLIDATED BALANCE SHEET DATA (Unaudited)

(In thousands)

|

| | | | | | | |

| June 30, | | March 31, |

| 2015 | | 2015 |

Cash and cash equivalents | $ | 41,863 |

| | $ | 76,363 |

|

Accounts receivable, net | 330,958 |

| | 287,759 |

|

Goodwill and intangible assets, net | 1,319,747 |

| | 755,574 |

|

Total assets | 1,797,134 |

| | 1,214,229 |

|

Current portion of long-term debt (2) | — |

| | 17,353 |

|

Total current liabilities | 171,147 |

| | 153,794 |

|

Working capital | 246,551 |

| | 255,080 |

|

Long-term debt (2) | 830,085 |

| | 313,801 |

|

Other long-term liabilities | 70,806 |

| | 71,806 |

|

Stockholders’ equity | 725,096 |

| | 674,828 |

|

____

| |

(1) | Amounts include cash flows from our Physician Segment. This segment generated a negative $1.8 million of cash flows from operations and its capital expenditures were negligible during the three months ended March 31, 2015. There were no cash flows from the Physician Segment in the three months ended June 30, 2015. |

| |

(2) | March 31, 2015 balances have been adjusted to reflect unamortized deferred loan costs attributable to term loans as a reduction of the related debt balances. This change in presentation was the result of early adopting Accounting Standard Update 2015-03 Imputation of Interest (Subtopic 835-30) Simplifying the Presentation of Debt Issuance Cost. The March 31, 2015 balances are net of $0.9 million unamortized deferred loan costs for the current portion of debt, and $2.5 million unamortized deferred loan costs for the long term portion. The June 30, 2015 balance is net of $19.9 million unamortized deferred loan costs. |

RECONCILIATION OF GAAP INCOME FROM CONTINUING OPERATIONS AND EARNINGS PER DILUTED SHARE TO NON-GAAP ADJUSTED EBITDA AND ADJUSTED EBITDA

PER DILUTED SHARE (Unaudited)

(In thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | |

June 30, | | | |

| 2015 | | 2014 (1) | | March 31, 2015 | |

Net income | $ | 14,252 |

| | $ | 0.27 |

| | $ | 20,789 |

| | $ | 0.38 |

| | $ | 39,135 |

| | $ | 0.75 |

| |

Income (loss) from discontinued operations, net of tax | (83 | ) | | — |

| | 1,148 |

| | 0.02 |

| | 26,112 |

| | 0.50 |

| |

Income from continuing operations | 14,335 |

| | 0.27 |

| | 19,641 |

|

| 0.36 |

| | 13,023 |

| | 0.25 |

| |

Interest expense, net | 4,736 |

| | 0.09 |

| | 3,103 |

| | 0.05 |

| | 3,067 |

| | 0.06 |

| |

Write-off of loan costs | 3,751 |

| | 0.07 |

| | — |

| | — |

| | — |

| | — |

| |

Provision for income taxes | 9,888 |

| | 0.19 |

| | 14,025 |

| | 0.25 |

| | 8,981 |

| | 0.17 |

| |

Depreciation | 4,191 |

| | 0.08 |

| | 3,048 |

| | 0.06 |

| | 3,532 |

| | 0.07 |

| |

Amortization of intangible assets | 6,957 |

| | 0.13 |

| | 5,522 |

| | 0.10 |

| | 4,869 |

| | 0.09 |

| |

EBITDA | 43,858 |

| | 0.83 |

| | 45,339 |

| | 0.82 |

| | 33,472 |

| | 0.64 |

| |

Equity-based compensation | 5,236 |

| | 0.10 |

| | 3,926 |

| | 0.07 |

| | 3,954 |

| | 0.08 |

| |

Acquisition, integration and strategic planning expenses | 6,932 |

| | 0.13 |

| | 1,974 |

| | 0.04 |

| | 1,278 |

| | 0.02 |

| |

Adjusted EBITDA | $ | 56,026 |

| | $ | 1.06 |

| | $ | 51,239 |

| | $ | 0.93 |

| | $ | 38,704 |

| | $ | 0.74 |

| |

| | | | | | | | | | | | |

Weighted average common and common equivalent shares outstanding (diluted) | 52,633 |

| | | | 55,173 |

| | | | 52,209 |

| | | |

|

| | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, | |

| | 2015 | | 2014 (1) | |

Net income | | $ | 53,387 |

| | $ | 1.02 |

| | $ | 34,706 |

| | $ | 0.63 |

| |

Income from discontinued operations, net of tax | | 26,029 |

| | 0.50 |

| | 1,460 |

| | 0.03 |

| |

Income from continuing operations | | 27,358 |

| | 0.52 |

| | 33,246 |

| | 0.60 |

| |

Interest expense, net | | 7,803 |

| | 0.14 |

| | 6,431 |

| | 0.12 |

| |

Write-off of loan costs | | 3,751 |

| | 0.07 |

| | — |

| | — |

| |

Provision for income taxes | | 18,869 |

| | 0.36 |

| | 23,600 |

| | 0.43 |

| |

Depreciation | | 7,723 |

| | 0.15 |

| | 5,570 |

| | 0.10 |

| |

Amortization of intangible assets | | 11,826 |

| | 0.23 |

| | 11,060 |

| | 0.20 |

| |

EBITDA | | 77,330 |

| | 1.47 |

| | 79,907 |

| | 1.45 |

| |

Equity-based compensation | | 9,190 |

| | 0.18 |

| | 7,008 |

| | 0.12 |

| |

Acquisition, integration and strategic planning expenses | | 8,210 |

| | 0.16 |

| | 2,562 |

| | 0.05 |

| |

Adjusted EBITDA | | $ | 94,730 |

| | $ | 1.81 |

| | $ | 89,477 |

| | $ | 1.62 |

| |

| | | | | | | | | |

Weighted average common and common equivalent shares outstanding (diluted) | | 52,435 |

| | | | 55,098 |

| | | |

______

| |

(1) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. The results of these businesses are included in discontinued operations for all periods presented. Accordingly, the results shown above differ from the results in our previous filings with the SEC. |

RECONCILIATION OF GAAP INCOME AND DILUTED EPS TO NON-GAAP INCOME AND DILUTED EPS (Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

June 30, | | March 31, |

| 2015 | | 2014 (1) | | 2015 |

Net income | $ | 14,252 |

| | $ | 0.27 |

| | $ | 20,789 |

| | $ | 0.38 |

| | $ | 39,135 |

| | $ | 0.75 |

|

Income (loss) from discontinued operations, net of tax | (83 | ) | | — |

| | 1,148 |

| | 0.02 |

| | 26,112 |

| | 0.50 |

|

Income from continuing operations | 14,335 |

| | 0.27 |

| | 19,641 |

| | 0.36 |

| | 13,023 |

| | 0.25 |

|

Write-off of loan costs, net of tax | 2,288 |

| | 0.04 |

| | — |

| | — |

| | — |

| | — |

|

Acquisition, integration and strategic planning expenses, net of tax | 4,578 |

| | 0.09 |

| | 1,204 |

| | 0.02 |

| | 780 |

| | 0.01 |

|

Non-GAAP income from continuing operations | $ | 21,201 |

| | $ | 0.40 |

| | $ | 20,845 |

| | $ | 0.38 |

| | $ | 13,803 |

| | $ | 0.26 |

|

| | | | | | | | | | | |

Weighted average common and common equivalent shares outstanding (diluted) | 52,633 |

| |

|

| | 55,173 |

| | | | 52,209 |

| |

|

|

|

|

| | | | | | | | | | | | | | | |

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 (1) |

Net income | $ | 53,387 |

| | $ | 1.02 |

| | $ | 34,706 |

| | $ | 0.63 |

|

Income from discontinued operations, net of tax | 26,029 |

| | 0.50 |

| | 1,460 |

| | 0.03 |

|

Income from continuing operations | 27,358 |

| | 0.52 |

| | 33,246 |

| | 0.60 |

|

Write-off of loan costs, net of tax | 2,288 |

| | 0.05 |

| | 0 |

| | — |

|

Acquisition, integration and strategic planning expenses, net of tax | 5,358 |

| | 0.10 |

| | 1,563 |

| | 0.03 |

|

Non-GAAP income from continuing operations | $ | 35,004 |

| | $ | 0.67 |

| | $ | 34,809 |

| | $ | 0.63 |

|

| | | | | | | |

Weighted average common and common equivalent shares outstanding (diluted) | 52,435 |

| |

|

| | 55,098 |

| | |

| | | | | | | |

_____

| |

(1) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. The results of these businesses are included in discontinued operations for all periods presented. Accordingly, the results shown above differ from the results in our previous filings with the SEC. |

CALCULATION OF ADJUSTED EARNINGS PER DILUTED SHARE (Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, |

| 2015 | | 2014 (5) | | 2015 | | 2014 (5) |

Non-GAAP income from continuing operations (1) | $ | 21,201 |

| | $ | 20,845 |

| | $ | 35,004 |

| | $ | 34,809 |

|

Adjustments: | | | | | | | |

Amortization of intangible assets (2) | 6,957 |

| | 5,522 |

| | 11,826 |

| | 11,060 |

|

Cash tax savings on indefinite-lived intangible assets (3) | 4,791 |

| | 3,807 |

| | 8,673 |

| | 7,614 |

|

Income taxes on amortization for financial reporting purposes not deductible for income tax purposes (4) | (607 | ) | | (531 | ) | | (1,112 | ) | | (1,062 | ) |

Adjusted income from continuing operations | $ | 32,342 |

| | $ | 29,643 |

| | $ | 54,391 |

| | $ | 52,421 |

|

| | | | | | | |

Adjusted income from continuing operations per diluted share

| $ | 0.61 |

| | $ | 0.54 |

| | $ | 1.04 |

| | $ | 0.95 |

|

| | | | | | | |

Weighted average common and common equivalent shares outstanding (diluted) | 52,633 |

| | 55,173 |

| | 52,435 |

| | 55,098 |

|

| | | | | | | |

______

| |

(1) | Non-GAAP income from continuing operations as calculated on preceding page. Non-GAAP income from continuing operations excludes the write-off of loan costs, and acquisition, integration and strategic planning expenses. |

| |

(2) | Amortization of intangible assets of acquired businesses. |

| |

(3) | Income tax benefit (using 39 percent marginal tax rate) from amortization for income tax purposes of certain indefinite-lived intangible assets (goodwill and trademarks), on acquisitions in which the Company received a step-up tax basis. For income tax purposes, these assets are amortized on a straight-line basis over 15 years. For financial reporting purposes, these assets are not amortized and a deferred tax provision is recorded that fully offsets the cash tax benefit in the determination of net income. |

| |

(4) | Income taxes (assuming a 39 percent marginal rate) on the portion of amortization of intangible assets, which is not deductible for income tax purposes (mainly amortization associated with the acquisition of CyberCoders, Inc. that the Company was not able to step-up the tax basis in those acquired assets for tax purposes). |

| |

(5) | Amounts have been restated to exclude results of the Physician Segment from continuing operations. The Physician Segment was sold on February 1, 2015 and its results are now included in discontinued operations. |

SUPPLEMENTAL FINANCIAL AND OPERATING DATA (1)(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, |

| | 2015 | | 2014 (2) |

| | | | | | | | | | | | |

Revenues (in thousands): | | | | | | | | | | | | |

Apex | | $ | 338,704 |

| | $ | 294,293 |

| | $ | 307,724 |

| | $ | 306,027 |

| | $ | 297,893 |

| | $ | 278,408 |

|

Oxford | | 146,619 |

| | 135,752 |

| | 133,299 |

| | 136,416 |

| | 136,531 |

| | 128,443 |

|

Consolidated | | $ | 485,323 |

| | $ | 430,045 |

| | $ | 441,023 |

| | $ | 442,443 |

| | $ | 434,424 |

| | $ | 406,851 |

|

| | | | | | | | | | | | |

Direct hire and conversion revenues (in thousands): | | | | | | | | | | | | |

Apex | | $ | 6,285 |

| | $ | 4,079 |

| | $ | 4,146 |

| | $ | 3,930 |

| | $ | 3,988 |

| | $ | 3,682 |

|

Oxford | | 22,446 |

| | 19,825 |

| | 15,970 |

| | 18,523 |

| | 17,483 |

| | 15,312 |

|

Consolidated | | $ | 28,731 |

| | $ | 23,904 |

| | $ | 20,116 |

| | $ | 22,453 |

| | $ | 21,471 |

| | $ | 18,994 |

|

| | | | | | | | | | | | |

Gross margins: | | | | | | | | | | | | |

Apex | | 28.8 | % | | 27.1 | % | | 28.5 | % | | 28.5 | % | | 28.4 | % | | 27.1 | % |

Oxford | | 41.5 | % | | 41.4 | % | | 41.1 | % | | 42.2 | % | | 41.9 | % | | 41.0 | % |

Consolidated | | 32.7 | % | | 31.6 | % | | 32.3 | % | | 32.7 | % | | 32.7 | % | | 31.5 | % |

| | | | | | | | | | | | |

Average number of staffing consultants: | | | | | | | | | | | | |

Apex | | 1,067 |

| | 965 |

| | 942 |

| | 875 |

| | 835 |

| | 818 |

|

Oxford | | 983 |

| | 922 |

| | 870 |

| | 845 |

| | 835 |

| | 828 |

|

Consolidated | | 2,050 |

| | 1,887 |

| | 1,812 |

| | 1,720 |

| | 1,670 |

| | 1,646 |

|

| | | | | | | | | | | | |

Average number of customers: | | | | | | | | | | | | |

Apex | | 1,766 |

| | 1,293 |

| | 1,276 |

| | 1,475 |

| | 1,431 |

| | 1,375 |

|

Oxford | | 1,092 |

| | 1,027 |

| | 1,050 |

| | 1,013 |

| | 1,005 |

| | 985 |

|

Consolidated | | 2,858 |

| | 2,320 |

| | 2,326 |

| | 2,488 |

| | 2,436 |

| | 2,360 |

|

| | | | | | | | | | | | |

Top 10 customers as a percentage of revenue: | | | | | | | | | | | | |

Apex | | 25.2 | % | | 27.0 | % | | 29.0 | % | | 29.8 | % | | 29.7 | % | | 30.6 | % |

Oxford | | 11.2 | % | | 11.5 | % | | 12.6 | % | | 13.3 | % | | 13.0 | % | | 13.7 | % |

Consolidated | | 17.6 | % | | 18.5 | % | | 20.3 | % | | 20.6 | % | | 20.4 | % | | 20.9 | % |

| | | | | | | | | | | | |

Average bill rate: | | | | | | | | | | | | |

Apex | | $ | 54.99 |

| | $ | 54.02 |

| | $ | 54.59 |

| | $ | 54.65 |

| | $ | 54.16 |

| | $ | 53.89 |

|

Oxford | | $ | 101.01 |

| | $ | 103.17 |

| | $ | 103.92 |

| | $ | 102.33 |

| | $ | 102.95 |

| | $ | 100.64 |

|

Consolidated | | $ | 62.54 |

| | $ | 62.06 |

| | $ | 65.01 |

| | $ | 62.56 |

| | $ | 62.51 |

| | $ | 61.93 |

|

| | | | | | | | | | | | |

Gross profit per staffing consultant: | | | | | | | | | | | | |

Apex | | $ | 92,000 |

| | $ | 83,000 |

| | $ | 93,000 |

| | $ | 100,000 |

| | $ | 101,000 |

| | $ | 92,000 |

|

Oxford | | $ | 62,000 |

| | $ | 61,000 |

| | $ | 63,000 |

| | $ | 68,000 |

| | $ | 69,000 |

| | $ | 64,000 |

|

Consolidated | | $ | 77,000 |

| | $ | 72,000 |

| | $ | 79,000 |

| | $ | 84,000 |

| | $ | 85,000 |

| | $ | 78,000 |

|

______

| |

(1) | The segments reported above reflect our new segment configuration. The Oxford segment now includes our former Life Sciences Europe segment. |

| |

(2) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. |

SUPPLEMENTAL FINANCIAL AND OPERATING DATA (1) (2) (Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, |

| | 2013 |

| | | | | | | | |

Revenues (in thousands): | | | | | | | | |

Apex | | $ | 281,032 |

| | $ | 276,849 |

| | $ | 262,347 |

| | $ | 239,765 |

|

Oxford | | 115,038 |

| | 117,551 |

| | 118,431 |

| | 112,087 |

|

Consolidated | | $ | 396,070 |

| | $ | 394,400 |

| | $ | 380,778 |

| | $ | 351,852 |

|

| | | | | | | | |

Direct hire and conversion revenues (in thousands): | | | | | | | | |

Apex | | $ | 3,221 |

| | $ | 3,414 |

| | $ | 2,968 |

| | $ | 3,229 |

|

Oxford | | 4,085 |

| | 1,915 |

| | 2,038 |

| | 2,073 |

|

Consolidated | | $ | 7,306 |

| | $ | 5,329 |

| | $ | 5,006 |

| | $ | 5,302 |

|

| | | | | | | | |

Gross margins: | | | | | | | | |

Apex | | 28.1 | % | | 28.5 | % | | 27.8 | % | | 26.7 | % |

Oxford | | 36.6 | % | | 34.2 | % | | 33.9 | % | | 33.7 | % |

Consolidated | | 30.5 | % | | 30.2 | % | | 29.7 | % | | 28.9 | % |

| | | | | | | | |

Average number of staffing consultants: | | | | | | | | |

Apex | | 805 |

| | 796 |

| | 777 |

| | 772 |

|

Oxford | | 695 |

| | 616 |

| | 612 |

| | 599 |

|

Consolidated | | 1,500 |

| | 1,412 |

| | 1,389 |

| | 1,371 |

|

| | | | | | | | |

Average number of customers: | | | | | | | | |

Apex | | 1,381 |

| | 1,345 |

| | 1,331 |

| | 1,312 |

|

Oxford | | 1,048 |

| | 905 |

| | 917 |

| | 891 |

|

Consolidated | | 2,429 |

| | 2,250 |

| | 2,248 |

| | 2,203 |

|

| | | | | | | | |

Top 10 customers as a percentage of revenue: | | | | | | | | |

Apex | | 31.1 | % | | 31.3 | % | | 30.3 | % | | 29.7 | % |

Oxford | | 14.4 | % | | 16.8 | % | | 18.3 | % | | 15.4 | % |

Consolidated | | 22.1 | % | | 21.9 | % | | 21.2 | % | | 20.6 | % |

| | | | | | | | |

Average bill rate: | | | | | | | | |

Apex | | $ | 53.41 |

| | $ | 54.10 |

| | $ | 54.26 |

| | $ | 53.59 |

|

Oxford | | $ | 102.24 |

| | $ | 105.27 |

| | $ | 107.94 |

| | $ | 107.07 |

|

Consolidated | | $ | 61.55 |

| | $ | 62.76 |

| | $ | 63.84 |

| | $ | 63.09 |

|

| | | | | | | | |

Gross profit per staffing consultant: | | | | | | | | |

Apex | | $ | 98,000 |

| | $ | 99,000 |

| | $ | 94,000 |

| | $ | 83,000 |

|

Oxford | | $ | 61,000 |

| | $ | 65,000 |

| | $ | 66,000 |

| | $ | 63,000 |

|

Consolidated | | $ | 81,000 |

| | $ | 84,000 |

| | $ | 81,000 |

| | $ | 74,000 |

|

______

| |

(1) | The segments reported above reflect our new segment configuration. The Oxford segment now includes our former Life Sciences Europe segment. |

| |

(2) | Amounts have been restated to give retroactive effect to the sale of our Physician Segment on February 1, 2015, and the closure of our European retained search unit in the fourth quarter of 2014. |

SUPPLEMENTAL FINANCIAL INFORMATION – KEY METRICS (Unaudited)

|

| | | |

| Three Months Ended |

June 30, 2015 | | March 31, 2015 |

Percentage of revenues: | | | |

Top ten clients | 17.6% | | 18.5% |

Direct hire/conversion | 5.9% | | 5.6% |

| | | |

Bill rate: | | | |

% Sequential change | 0.8% | | (4.5%) |

% Year-over-year change | —% | | 0.2% |

| | | |

Bill/Pay spread: | | | |

% Sequential change | 1.2% | | (5.2%) |

% Year-over-year change | (3.8%) | | (2.2%) |

| | | |

Average headcount: | | | |

Contract professionals (CP) | 15,506 | | 12,318 |

Staffing consultants (SC) | 2,050 | | 1,887 |

| | | |

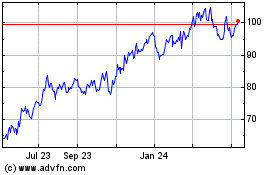

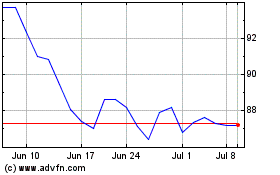

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024