UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2015

VOXX INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Delaware (State or other jurisdiction of incorporation or organization) | 0-28839 (Commission File Number) |

13-1964841 (IRS Employer Identification No.) |

180 Marcus Blvd., Hauppauge, New York (Address of principal executive offices) | 11788 (Zip Code) |

Registrant's telephone number, including area code (631) 231-7750

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of file following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(e))

Item 2.02 Results of Operations and Financial Condition.

On May 13, 2015, Voxx International Corporation (the “Company”) issued a press release announcing its earnings for the quarter and year ended February 28, 2015. A copy of the release is furnished herewith as Exhibit 99.1.

Item 8.01 Other Events.

On May 14, 2015, the Company held a conference call to discuss its financial results for the quarter and year ended February 28, 2015. The Company has prepared a transcript of that conference call, a copy of which is annexed hereto as Exhibit 99.2.

The information furnished under Items 2.02 and 8.01, including Exhibits 99.1 and 99.2, shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

99.1 | Press Release, dated May 13, 2015, relating to VOXX International Corporation's earnings release for the quarter and year ended February 28, 2015 (filed herewith). |

| |

99.2 | Transcript of conference call held on May 14, 2015 at 10:00 am (filed herewith). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

VOXX International Corporation (Registrant)

Date: May 15, 2015

BY: /s/ Charles M. Stoehr

Charles M. Stoehr

Senior Vice President and

Chief Financial Officer

May 13, 2015

VOXX International Corporation Reports Fiscal 2015 Financial Results

HAUPPAUGE, N.Y., May 13, 2015 /PRNewswire/ -- VOXX International Corporation (NASDAQ: VOXX), today announced financial results for its Fiscal 2015 fourth quarter and year-ended February 28, 2015.

Fourth Quarter Results (three months ended February 28, 2015 and February 28, 2014)

Net sales for the Fiscal 2015 fourth quarter were $169.9 million compared to $187.1 million reported in the comparable year-ago period, a decline of$17.2 million or 9.2%. Net sales were primarily impacted by four major factors: the Euro conversion, the West Coast port closure, the change in the Company's Mexico distribution model, and domestic sales that were negatively impacted by poor weather. Taking into account the impact of the Euro conversion alone (weighted average of 1.176 vs. 1.366) net sales were down $8.2 million or 4.6%. Additionally, the port closure negatively impacted fiscal 2015 fourth quarter sales by approximately $4 million. On a segment basis:

|

| | | | | |

| Q4 2015 | Q4 2014 | Q4 2015 vs. Q4 2014 (Euro impact) | Q4 2014 USD (Revised Consolidated) | Q4 2015 vs. Q4 2014 (w/ Euro conversion) |

Total Net Sales | $169.9 | $187.1 | ($9.1) | $178.1 | ($8.2) |

Automotive | $90.9 | $93.9 | ($6.1) | $87.8 | $3.1 |

Premium Audio | $37.3 | $42.7 | ($1.7) | $41.0 | ($3.7) |

Consumer Accessories | $41.5 | $50.2 | ($1.3) | $48.9 | ($7.4) |

Corporate | $0.2 | $0.4 | $— | $0.4 | ($0.2) |

The gross margin for the Fiscal 2015 fourth quarter was 29.1%, an increase of 80 basis points as compared to 28.3% for the same period last year. All three business segments posted increases in gross margin due to product mix shifts and better margins associated with new product launches and programs (Automotive - 28.2% vs. 27.8%; Premium Audio - 33.6% vs. 32.8%; Consumer Accessories - 26.5% vs. 24.5%).

Operating expenses for the Fiscal 2015 fourth quarter were $50.2 million as compared to operating expenses of $112.4 million in the comparable year-ago period. The 2014 fiscal fourth quarter included non-cash impairment charges of $57.6 million and excluding this impact, operating expenses were down approximately $4.7 million or 8.6%. This year-over-year improvement was primarily driven by a $2.1 million decrease in selling expenses, a $2.9 million decline in general and administrative costs, excluding the impairment charge, and a $0.9 million decline in engineering expenses, offset by $1.3 million of restructuring charges.

The Company reported an operating loss of $0.7 million as compared to an operating loss of $59.6 million in the fiscal 2014 fourth quarter. Excluding the impairment charges, operating loss for the Fiscal 2014 fourth quarter was $2.0 million, a year-over-year improvement of approximately $1.3 million. Net loss for the Fiscal 2015 fourth quarter was $14.4 million or a net loss per diluted share of $0.60 as compared to a net loss of $49.0 million or a net loss per diluted share of $2.01 for the comparable year-ago period.

Earnings before interest, taxes, depreciation and amortization ("EBITDA") for the Fiscal 2015 fourth quarter was ($6.2) million as compared to EBITDA of($53.4) million reported in the Fiscal 2014 fourth quarter. Adjusted EBITDA was $5.2 million as compared to $3.8 million for the comparable Fiscal 2015 and 2014 fourth quarter periods.

Commenting on the Company's fourth quarter performance, Pat Lavelle, President and Chief Executive Officer stated, "Our results this quarter were disappointing as there were a number of factors which hampered our top-line, the biggest of which were the Euro conversion and West Coast port closure. On the positive side, our gross margins continued to increase and the steps we took to curtail our expenses in light of lower sales volumes helped drive our operating performance. Additionally, we won a number of new programs in our Automotive segment, expanded our Premium Audio distribution driven by new product launches, and made inroads in reaching the enterprise segment for our myris biometrics product offering. All of these developments should help drive results over the next several years."

Year-end Results (periods ended February 28, 2015 and February 28, 2014)

Net sales in Fiscal 2015 were $757.5 million compared to $809.7 million reported in the comparable year-ago period, a decline of 6.5%. Taking into account the impact of the Euro conversion (weighted average of 1.29 vs. 1.33) net sales were down $40.2 million or 5.0%.

|

| | | | | |

| F' 2015 | F' 2014 | F' 2015 vs. F' 2014 (Euro impact) | F' 2014 USD (Revised Consolidated) | F' 2015 vs. F' 2014 (w/ Euro conversion) |

Total Net Sales | $757.5 | $809.7 | ($12.0) | $797.7 | ($40.2) |

Automotive | $396.4 | $412.5 | ($8.0) | $404.5 | ($8.1) |

Premium Audio | $165.8 | $189.2 | ($2.4) | $186.8 | ($21.0) |

Consumer Accessories | $194.1 | $206.3 | ($1.6) | $204.7 | ($10.6) |

Corporate | $1.2 | $1.7 | $— | $1.7 | ($0.5) |

| |

• | In addition to the Euro conversion impact, the Automotive segment experienced decreases in sales from its OEM manufacturing lines as a result of the temporary suspension of programs from one OEM customer, which subsequently resumed in the Fiscal 2015 third quarter and due to higher load-in sales from an OEM program in the prior fiscal year. Additionally, lower satellite radio and portable DVD sales, as well as suspended sales in Venezuela contributed to the year-over-year decline. Offsetting these declines were higher sales of remote start products and higher sales of devices for the Company's new Car Connection product lines. |

| |

• | Premium Audio sales declined primarily due to the Euro conversion, and lower sales for some of the Company's audio product lines, offset by increases in the Company's Commercial and Custom Installation business. |

| |

• | Consumer Accessories sales declined primarily due to lower sales of digital voice recorders, clock radios and lower comparable sales inMexico, offset by higher sales of wireless and Bluetooth speakers, improved sales in Europe and the launch of the Company's new Singtrix product, which was introduced in the Fiscal 2015 fourth quarter. |

The gross margin for the year ended February 28, 2015 was 29.6%, an increase of 120 basis points as compared to 28.4% for the prior Fiscal year. This increase was driven by improved margins in the Automotive and Consumer Accessories segment, up 200 basis points and 90 basis points, respectively, offset by a 30 basis point decline in the Premium Audio segment.

Operating expenses for the year ended February 28, 2015 were $207.3 million as compared to operating expenses of $267.6 million reported in the comparable year-ago period, a decline of $60.3 million. In Fiscal 2014, the Company recorded non-cash impairment charges of $57.6 million and excluding this impact, operating expenses were down $2.7 million, or 1.3%. Driving the improvement in operating expenses were lower selling, general and administrative expenses due to lower sales commissions and other profit based compensation, advertising expense, and due to in-sourcing of IT functions, offset by higher engineering expenses as a result of higher salary and benefit expenses at VOXXHirschmann to support various customer and prospective programs.

The Company reported operating income of $16.6 million for the year ended February 28, 2015 as compared to an operating loss of $37.4 millionreported in Fiscal 2014. Lower sales volumes were partially offset by higher gross margins and lower overhead, thus contributing to the year-over-year improvement.

The Company reported total other expenses for the year ended February 28, 2015 of $15.9 million as compared to total other income of $10.7 million in the comparable period last year. In Fiscal 2015, the Company recorded $7.4 million in charges representing the devaluation loss related to its Venezuelan bonds, resulting in a net Venezuela currency devaluation and translation loss for the year ended February 28, 2015 of $7.1 million as well as a $9.3 million charge related to the impairment of investment properties located in Venezuela. Additionally, Other, net, decreased primarily as a result of Fiscal 2014 events that were not repeated in Fiscal 2015, such as $5.6 million received in a class action settlement and $0.9 million related toKlipsch recoveries. Additionally, interest and bank charges were $6.9 million and $7.4 million for the year ended February 28, 2015 and February 28, 2014, respectively.

The Company reported a net loss of $0.9 million or a net loss per diluted share of $0.04 as compared to a net loss of $26.6 million or a net loss per diluted share of $1.10 for the year ended February 28, 2015 and February 28, 2014, respectively.

EBITDA in Fiscal 2015 was $23.1 million as compared to an EBITDA loss of $3.1 million reported in Fiscal 2014. Adjusted EBITDA for Fiscal 2015 was$41.5 million as compared to Adjusted EBITDA of $46.5 million for the comparable year-ago period.

Mr. Lavelle continued, "Despite the impact the Euro conversion is expected to have on our results, we anticipate our first quarter revenues will grow in US and Euro denominated business. We're executing our strategy and have taken more costs out of our operations to help drive bottom-line performance. Our balance sheet continues to improve and we remain active in the M&A markets. Our management team and Board remain committed to enhancing shareholder value and we believe the steps we've taken this past year will position us well for the future."

Non-GAAP Measures

Adjusted EBITDA and diluted adjusted earnings per common share are not financial measures recognized by GAAP. Adjusted EBITDA represents net income (loss), computed in accordance with GAAP, before interest expense and bank charges, taxes, depreciation and amortization, stock-based compensation expense, certain foreign currency remeasurements, relocation and restructuring charges, impairment charges, certain recoveries, settlements and costs and foreign exchange gains or losses relating to our acquisitions. Depreciation, amortization, stock-based compensation, and impairment expenses are non-cash items. Diluted adjusted earnings per common share represent the Company's diluted earnings per common share based on adjusted EBITDA.

We present adjusted EBITDA and diluted adjusted earnings per common share in this Form 10-K because we consider them to be useful and appropriate supplemental measures of our performance. Adjusted EBITDA and diluted adjusted earnings per common share help us to evaluate our performance without the effects of certain GAAP calculations that may not have a direct cash impact on our current operating performance. In addition, the exclusion of costs relating to the Company's acquisitions, restructuring, relocations, remeasurements, impairments, stock-based compensation, settlements and recoveries allows for a more meaningful comparison of our results from period-to-period. These non-GAAP measures, as we define them, are not necessarily comparable to similarly entitled measures of other companies and may not be an appropriate measure for performance relative to other companies. Adjusted EBITDA should not be assessed in isolation from or construed as a substitute for EBITDA prepared in accordance with GAAP. Adjusted EBITDA and diluted adjusted earnings per common share are not intended to represent, and should not be considered to be more meaningful measures than, or alternatives to, measures of operating performance as determined in accordance with GAAP.

Form 10-K Filing and Conference Call Information

The Company intends to file its Form 10-K for the period ended February 28, 2015 with the Securities and Exchange Commission by close of business tomorrow, May 14, 2015, within the SEC deadline.

Additionally, the Company will be hosting its conference call on Thursday, May 14, 2015 at 10:00 a.m. ET. Interested parties can participate by visitingwww.voxxintl.com, and clicking on the webcast in the Investor Relations section or via teleconference (toll-free number: 877-303-9079; international: 970-315-0461 / conference ID: 36388186). For those unable to join, a replay will be available approximately four hours after the call has been completed and will last for one week (replay number: 855-859-2056; international replay: 404-537-3406; conference ID: 36388186).

About VOXX International Corporation

VOXX International Corporation (NASDAQ:VOXX) has grown into a worldwide leader in many automotive and consumer electronics and accessories categories, as well as premium high-end audio. Today, VOXX International Corporation has an extensive distribution network that includes power retailers, mass merchandisers, 12-volt specialists and most of the world's leading automotive manufacturers. The Company has an international footprint in Europe, Asia, Mexico and South America, and a growing portfolio, which now comprises over 30 trusted brands. Among the key domestic brands are Klipsch®, RCA®, Invision®, Jensen®, Audiovox®, Terk®, Acoustic Research®, Advent®, Code Alarm®, CarLink®, 808®, AR for Her®, and Prestige®. International brands include Hirschmann Car Communication®, Klipsch®, Jamo®, Energy®, Mirage®, Mac Audio®, Magnat®, Heco®, Schwaiger®, Oehlbach® and Incaar™. For additional information, please visit our Web site at www.voxxintl.com.

Safe Harbor Statement

Except for historical information contained herein, statements made in this release that would constitute forward-looking statements may involve certain risks and uncertainties. All forward-looking statements made in this release are based on currently available information and the Company assumes no responsibility to update any such forward-looking statements. The following factors, among others, may cause actual results to differ materially from the results suggested in the forward-looking statements. The factors include, but are not limited to risks that may result from changes in the Company's business operations; our ability to keep pace with technological advances; significant competition in the automotive, premium audio and consumer accessories businesses; our relationships with key suppliers and customers; quality and consumer acceptance of

newly introduced products; market volatility; non-availability of product; excess inventory; price and product competition; new product introductions; foreign currency fluctuations and concerns regarding the European debt crisis; restrictive debt covenants; the possibility that the review of our prior filings by the SEC may result in changes to our financial statements; and the possibility that stockholders or regulatory authorities may initiate proceedings against VOXX International Corporation and/or our officers and directors as a result of any restatements. Risk factors associated with our business, including some of the facts set forth herein, are detailed in the Company's Form 10-K for the fiscal year ended February 28, 2015.

Company Contact:

Glenn Wiener, President

GW Communications

Tel: 212-786-6011

Email: gwiener@GWCco.com

VOXX International Corporation and Subsidiaries

Consolidated Balance Sheets

February 28, 2015 and February 28, 2014

(In thousands, except share data)

|

| | | | | | | |

| February 28,

2015 | | February 28,

2014 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 8,448 |

| | $ | 10,603 |

|

Accounts receivable, net | 102,766 |

| | 147,054 |

|

Inventory | 156,649 |

| | 144,339 |

|

Receivables from vendors | 3,622 |

| | 2,443 |

|

Investment securities, current | 275 |

| | — |

|

Prepaid expenses and other current assets | 26,370 |

| | 15,897 |

|

Income tax receivable | 1,862 |

| | 2,463 |

|

Deferred income taxes | 1,723 |

| | 3,058 |

|

Total current assets | 301,715 |

| | 325,857 |

|

Investment securities | 12,413 |

| | 14,102 |

|

Equity investments | 21,648 |

| | 20,628 |

|

Property, plant and equipment, net | 69,783 |

| | 83,222 |

|

Goodwill | 105,874 |

| | 117,938 |

|

Intangible assets, net | 158,455 |

| | 174,312 |

|

Deferred income taxes | 717 |

| | 760 |

|

Other assets | 6,908 |

| | 10,331 |

|

Total assets | $ | 677,513 |

| | $ | 747,150 |

|

Liabilities and Stockholders' Equity | |

| | |

|

Current liabilities: | |

| | |

|

Accounts payable | $ | 71,403 |

| | $ | 55,373 |

|

Accrued expenses and other current liabilities | 51,744 |

| | 64,403 |

|

Income taxes payable | 3,067 |

| | 3,634 |

|

Accrued sales incentives | 14,097 |

| | 17,401 |

|

Deferred income taxes | 1,060 |

| | 9 |

|

Current portion of long-term debt | 6,032 |

| | 5,960 |

|

Total current liabilities | 147,403 |

| | 146,780 |

|

Long-term debt | 79,455 |

| | 103,222 |

|

Capital lease obligation | 733 |

| | 6,114 |

|

Deferred compensation | 4,650 |

| | 5,807 |

|

Other tax liabilities | 5,157 |

| | 11,060 |

|

Deferred tax liabilities | 34,327 |

| | 34,963 |

|

Other long-term liabilities | 9,648 |

| | 9,620 |

|

Total liabilities | 281,373 |

| | 317,566 |

|

Commitments and contingencies |

|

| |

|

|

Stockholders' equity: | |

| | |

|

Preferred stock: | | | |

No shares issued or outstanding (see Note 9) | — |

| | — |

|

Common stock: | | | |

Class A, $.01 par value; 60,000,000 shares authorized, 24,003,240 and 23,988,240 shares issued, 21,873,790 and 22,172,968 shares outstanding at February 28, 2015 and February 28, 2014, respectively | 255 |

| | 255 |

|

Class B Convertible, $.01 par value, 10,000,000 authorized, 2,260,954 shares issued and outstanding | 22 |

| | 22 |

|

Paid-in capital | 292,427 |

| | 290,960 |

|

Retained earnings | 157,629 |

| | 158,571 |

|

Accumulated other comprehensive loss | (33,235 | ) | | (1,873 | ) |

Treasury stock, at cost, 2,129,450 and 1,815,272 shares of Class A Common Stock at February 28, 2015 and February 28, 2014, respectively | (20,958 | ) | | (18,351 | ) |

Total stockholders' equity | 396,140 |

| | 429,584 |

|

Total liabilities and stockholders' equity | $ | 677,513 |

| | $ | 747,150 |

|

VOXX International Corporation and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income (Loss)

Years Ended February 28, 2015, February 28, 2014 and February 28, 2013

(In thousands, except share and per share data)

|

| | | | | | | | | | | |

| Year Ended | | Year Ended | | Year Ended |

| February 28,

2015 | | February 28,

2014 | | February 28,

2013 |

Net sales | $ | 757,498 |

| | $ | 809,709 |

| | $ | 835,577 |

|

Cost of sales | 533,628 |

| | 579,461 |

| | 598,755 |

|

Gross profit | 223,870 |

| | 230,248 |

| | 236,822 |

|

| | | | | |

Operating expenses: | |

| | |

| | |

|

Selling | 54,136 |

| | 55,725 |

| | 51,976 |

|

General and administrative | 114,849 |

| | 118,852 |

| | 114,653 |

|

Engineering and technical support | 37,157 |

| | 34,161 |

| | 26,971 |

|

Goodwill impairment charge | — |

| | 32,163 |

| | — |

|

Intangible and long-lived asset impairment charges | — |

| | 25,398 |

| | — |

|

Restructuring expense | 1,134 |

| | 1,324 |

| | — |

|

Acquisition related costs | — |

| | — |

| | 1,526 |

|

Total operating expenses | 207,276 |

| | 267,623 |

| | 195,126 |

|

| | | | | |

Operating income (loss) | 16,594 |

| | (37,375 | ) | | 41,696 |

|

| | | | | |

Other (expense) income: | |

| | |

| | |

|

Interest and bank charges | (6,851 | ) | | (7,394 | ) | | (8,288 | ) |

Equity in income of equity investee | 5,866 |

| | 6,070 |

| | 4,880 |

|

Venezuela currency devaluation, net | (7,104 | ) | | 177 |

| | (477 | ) |

Impairment of Venezuela investment properties (see Note 1(p)) | (9,304 | ) | | — |

| | — |

|

Other, net | 1,495 |

| | 11,867 |

| | (2,156 | ) |

Total other (expenses) income, net | (15,898 | ) | | 10,720 |

| | (6,041 | ) |

| | | | | |

Income (loss) from operations before income taxes | 696 |

| | (26,655 | ) | | 35,655 |

|

Income tax expense (benefit) | 1,638 |

| | (58 | ) | | 13,163 |

|

Net (loss) income | (942 | ) | | (26,597 | ) | | 22,492 |

|

| | | | | |

Other comprehensive (loss) income: | | | | | |

Foreign currency translation adjustments | (33,170 | ) | | 5,575 |

| | (1,281 | ) |

Derivatives designated for hedging, net of tax | 3,258 |

| | (648 | ) | | (174 | ) |

Pension plan adjustments, net of tax | (1,423 | ) | | (288 | ) | | (1,031 | ) |

Unrealized holding loss on available-for-sale investment securities arising during the period, net of tax | (27 | ) | | (15 | ) | | (38 | ) |

Other comprehensive (loss) income, net of tax | (31,362 | ) | | 4,624 |

| | (2,524 | ) |

Comprehensive (loss) income | $ | (32,304 | ) | | $ | (21,973 | ) | | $ | 19,968 |

|

| | | | | |

Net (loss) income per common share (basic) | $ | (0.04 | ) | | $ | (1.10 | ) | | $ | 0.96 |

|

| | | | | |

Net (loss) income per common share (diluted) | $ | (0.04 | ) | | $ | (1.10 | ) | | $ | 0.95 |

|

| | | | | |

Weighted-average common shares outstanding (basic) | 24,330,361 |

| | 24,109,270 |

| | 23,415,570 |

|

Weighted-average common shares outstanding (diluted) | 24,330,361 |

| | 24,109,270 |

| | 23,617,101 |

|

VOXX International Corporation and Subsidiaries

Reconciliation of GAAP Net (Loss) Income to Adjusted EBITDA

(In thousands, except share and per share data)

|

| | | | | | | | | | | | |

| | Fiscal | | Fiscal | | Fiscal |

| | 2015 | | 2014 | | 2013 |

Net (loss) income | | $ | (942 | ) | | $ | (26,597 | ) | | $ | 22,492 |

|

Adjustments: | | | | | | |

Interest expense and bank charges | | 6,851 |

| | 7,394 |

| | 8,288 |

|

Depreciation and amortization | | 15,565 |

| | 16,183 |

| | 16,446 |

|

Income tax expense (benefit) | | 1,638 |

| | (58 | ) | | 13,163 |

|

EBITDA | | 23,112 |

| | (3,078 | ) | | 60,389 |

|

Stock-based compensation | | 521 |

| | 641 |

| | 435 |

|

Venezuela bond remeasurement | | 7,396 |

| | — |

| | — |

|

Impairment of investment properties in Venezuela | | 9,304 |

| | — |

| | — |

|

Circuit City recovery | | — |

| | (940 | ) | | — |

|

Net legal settlements | | — |

| | (4,443 | ) | | 1,661 |

|

Unanticipated customer settlement payment | | — |

| | (4,370 | ) | | — |

|

Asia warehouse relocation | | — |

| | (208 | ) | | 789 |

|

Restructuring charges | | 1,134 |

| | 1,324 |

| | — |

|

Goodwill impairment charges | | — |

| | 32,163 |

| | — |

|

Intangible and long-lived asset impairment charges | | — |

| | 25,398 |

| | — |

|

Acquisition related costs | | — |

| | — |

| | 1,526 |

|

Loss/(gain) on foreign exchange as a result of Hirschmann acquisition | | — |

| | — |

| | 2,670 |

|

Adjusted EBITDA | | $ | 41,467 |

| | $ | 46,487 |

| | $ | 67,470 |

|

Diluted (loss) earnings per common share | | $ | (0.04 | ) | | $ | (1.10 | ) | | $ | 0.95 |

|

Diluted adjusted EBITDA per common share | | $ | 1.70 |

| | $ | 1.93 |

| | $ | 2.86 |

|

|

|

MAY 14, 2015 / 02:00PM GMT, VOXX - Q4 2015 VOXX International Corp Earnings Call |

|

|

|

THOMSON REUTERS STREETEVENTS |

EDITED TRANSCRIPT |

VOXX - Q4 2015 VOXX International Corp Earnings Call |

|

EVENT DATE/TIME: MAY 14, 2015 / 02:00PM GMT |

|

|

CORPORATE PARTICIPANTS

Glenn Wiener VOXX International Corp - GW Communications - IR

Pat Lavelle VOXX International Corp - President & CEO

Michael Stoehr VOXX International Corp - SVP and CFO

CONFERENCE CALL PARTICIPANTS

Sean McGowan Needham & Company - Analyst

Steve Dyer Craig-Hallum Capital Group - Analyst

Rob Stone Cowen and Company - Analyst

PRESENTATION

Operator

Good day, ladies and gentlemen, and welcome to the VOXX FY15 year end results conference call. At this time, all participants are in a listen-only mode. (Operator Instructions)

Please note, today's conference is being recorded. I would now like to hand the meeting over to today's host, Glenn Wiener. Please go ahead, sir.

Glenn Wiener - VOXX International Corp - GW Communications - IR

Thank you, Karen, and good morning, everyone. Welcome to VOXX International's FY15 results conference call. Today's call is being webcast from our website, www.voxxintl.com. It can be accessed in the Investors Relations section of the site. We also have a replay available for those who are unable to join this morning.

We issued our press release yesterday after market close and a copy can be found on our website in the IR section. Additionally, the Company intends to file its Form 10-K with the SEC for the period ended February 28, 2015 by close of business today within the SEC reporting guidelines, and once filed that can be found on our website in the IR section under SEC filings. Pat Lavelle, President and CEO; and Michael Stoehr, Senior Vice President and Chief Financial Officer, will be making remarks today and will be available for any questions, along with our Chairman, John Shalam.

Before I turn the call over to Pat, I would like to remind everyone that except for historical information contained herein, statements made on today's call and webcast that would constitute forward-looking statements are based on currently available information. The Company assumes no responsibility to update any such forward-looking statements.

Risk factors associated with our business are detailed in our Form 10-K for the fiscal year ended February 28, 2014, and updated risk factors will be in our Form 10-K for the FY15 period once filed. At this time, I would like to turn the call over to Pat.

Pat Lavelle - VOXX International Corp - President & CEO

Thank you, Glenn, and good morning, everyone. Yesterday, we reported our FY15 fourth quarter and year end results, and needless to say, the quarter was disappointing. Though, as we look at other companies' reports on the quarter, we are clearly not alone with the government reporting a weak, 0.2% GDP.

Our fourth quarter results were affected by three major factors, the port closure, a drastic drop in the value of the euro, which has affected our top line revenue, and domestic sales that were negatively impacted by poor weather. I will try to give you a little more clarity around the true performance of our operations taking out some of the extraneous events. I'll also cover our operations and what we see in FY16's first quarter, and then Mike will provide more of the financial details and discuss the balance sheet.

Fourth quarter sales were down $17 million, but taking into account the euro impact, they were down $8 million. Of the $8 million, we lost $4 million in sales due to the port closure, and we're still suffering delays which we estimate will finally be cleared up this month. The other $4 million is due to the change of our business model in Mexico, and finally, overall weakness at retail domestically.

On a positive side, our gross margins in 4Q were 29%, up 80 basis points over last year's fourth quarter, and our overhead was more than $2 million lower when we take out the non-cash impairment charges, the euro impact, and some severance charges. During the quarter, we took a non-cash impairment charge of $9.3 million to mark down to fair market our real estate holdings in Venezuela due to the continuing currency devaluation.

And finally, we also took aggressive measures to lower our fixed overhead in FY16 and beyond. On a segment basis, Automotive sales were down $3 million. But when factoring in the euro conversion, both domestic and European businesses were up quarter-over-quarter, but the increase was offset by a 12% euro devaluation.

Gross margins in the Automotive group improved by 40 basis points, and our overhead was down $1.2 million after we removed the impact of last year's non-cash charge and the euro. Within Premium Audio, sales were down $5.4 million for the quarter, or $3.7 million adjusted for the euro. The lower sales were driven by domestic retail weakness during the quarter, some of which can be attributed to weather.

Despite lower sales, gross margins were up 80 basis points, and overhead for this segment is basically flat net of adjustments. In our Consumer Accessory business, sales were down $8.6 million, and adjusted for the euro were down $7.4 million. Our Accessory business was impacted the most by the port shut down where we lost approximately $4 million in sales for the quarter. However, a majority of those sales have shifted into our first quarter. Gross margins were up 190 basis points and our overhead was flat, net of impairments, severance charges and foreign currency adjustments.

As we look to FY16, we are changing our strategy on guidance and we will only give full year guidance on margins and overhead. We will, however, project revenue for the following quarter on each call to keep you updated on our progress and near-term outlook. We are taking this step because in recent years forecasting revenues for the entire year has been extremely difficult to do with accuracy.

For instance, discussions with our key retail partners for holiday promotions do not even start until the June timeframe. We simply cannot predict the potential impact of bad weather in our fourth quarter. It is difficult to know consumer sentiment far in advance given the fluctuation in the government's GDP estimates. And finally, we see no signs of the euro stabilizing. In FY15, the weighted average of the euro is $1.29.

In our business plan for the year, we have conservatively estimated the euro at one to one, and at this rate, it would have been impacted our FY15 sales by more than $60 million, or 20% of our euro business. In the first quarter of this fiscal year, the euro hit a low of $1.05. Although it is now around $1.14, there are still too many factors that could drag the euro below parity.

That said, we expect sales in FY16 to increase in US and euro-denominated currencies, since we have a number of new products, programs and opportunities that should materialize. For the year, we project our gross margins in the 29% range, and we have taken additional steps to lower our overhead, which we expect will be in the $185 million to $190 million range.

For the first quarter outlook, we are projecting sales of $168 million versus $187 million in last year's first quarter. However, taking into account the euro, it is essentially flat with last year. Gross margins for the quarter should come in around 28%, building up throughout the year, consistent with prior years. And our operating expenses are expected to be around $48 million.

This should give us an operating loss of approximately $700,000 to $800,000 for the quarter, but that is within our plan. We expect our operations to be profitable in each subsequent quarter this year.

Within the Automotive group, where we have the largest concentration of European business, sales will be most affected by the euro, and we're expecting sales to be down a bit with the conversion, but we have a lot of exciting programs and products under development, and I believe our long-term positioning has never been better.

Our previously announced five-year $160 million award for multi-digital tuner modules with Daimler-Benz is expected to begin in December, and should add approximately $30 million in annualized revenues each year. We announced this similar contract with Jaguar Land Rover, which will ship in July, and over the life of the three-year contract should generate $58 million. Our contract with Audi for 4G antennae has begun and we expect it to also expand to other VW models within the VW/Audi Group.

We also won two new programs for rear seat entertainment with our new EVO bay system. Mazda begins shipping in late fall, and the second contract with another OEM has the potential to represent more than $25 million to $30 million of annualized sales over the lifetime of the contract, which begins with the 2018 models.

GM's all new Cadillac Escalade Platinum, which launched late in 2014, is Cadillac's flagship in SUV luxury. We are including the Klipsch premier Image ONE earphone, with the dual headrest, rear seat entertainment system for this vehicle. This is the first time we are using a Klipsch product and brand in the OEM space, and needless to say, we are very pleased to be associated with the premier Cadillac brand.

In the after market, we continue to gain momentum with Car Connection and now have 27 insurance companies on board, and our partner, AT&T, just launched Car Connection 2.0, which offers consumer sought after functions and features, such as roadside assistance, automatic crash SOS, and stolen vehicle recovery alerts. All these added to the already robust suite of features of Car Connection, plus the increased number of insurance carriers now on board, should allow this category to continue to grow.

In our Premium Audio segment, we are getting good placement at retail for our new Reference series speakers. We have also launched our WiSA enabled Reference wireless home theater system that won the Digital Trends Top Tech of CES awards, a testament to the quality and the potential of the system. Our Klipsch headphones remain one of the best premium brands in the market, and we introduced our first on-ear headphone under the Reference brand in January, and those products are now available at several retail outlets and online.

Our gaming headsets are selling at Gamestop and other national and regional retailers, and our in-ears have garnered best-in-class reviews from Time magazine, Digital Trends, Men's Journal, and a lot more. In March, Klipsch announced a three-year partnership with the Rock 'n' Roll Hall of Fame where Klipsch was the first ever presenting sponsor at their 30th Anniversary induction ceremony. The media attention was tremendous. USA Today, Rolling Stone, Billboard magazine and others resulted in several hundred million impressions for the Klipsch brand.

It's important to note that in the NPD year end report, Klipsch ranked number one in the home speaker category, both in units and dollar sales. For the entire 12-month period from January 14 through January 15, Klipsch had number one market share at 17%. And over the last three-month period of that report, our market share grew to 22%. As we've discussed in prior quarters, the introduction of our Reference series should result in improved margins and profitability for the year.

Within Consumer Accessories, we're anticipating growth this year, mostly due to the success of our 808 line, contributions from Myris, Singtrix, and the launch of 360fly. Our 808 products are doing great and resonating well with the youth audience.

We have increased distribution significantly with products now selling at Target, Walmart, Sam's Club and other major US retailers. We'll be introducing our 808 HEX and NRG GLO bluetooth speakers this year, and we expect to see continued growth in 808. Our Acoustic Research outdoor speakers are also selling well with increased distribution, now featured at Best Buy, Costco, Home Depot, Bed, Bath and Beyond, and other retail and furniture chains.

Our RCA AIR Ultra-Thin Antenna will be arriving at retailers later this year and should help us continue our dominance in the antenna category where we believe we have an estimated 65% market share. Singtrix, introduced last year, virtually sold out within days after an airing of Shark Tank, is gaining traction at retail and online with Amazon, Crutchfield and Sears. We have recently added Target and Toys R Us, and we expect Singtrix to help drive sales in the Consumer Accessory category this year.

And our two new offerings, 360fly and Myris, 360 will ship in July with retail availability in August, a little off our last projected launch date, but retailers remain anxious to add 360 to their action camera offerings. Myris, our iris authentication product introduced last fall, continues to gain popularity, especially in the enterprise segment. While we are placed well at retail, our real opportunity for growth remains in the enterprise market.

We are constantly reading reports about security breaches and identity theft, and costing enterprises millions of dollars to address. This is potentially a huge market opportunity, but like fingerprint biometrics it will take time for enterprises to adapt to this new technology. We are currently in talks with several enterprise customers, and we are anticipating one large financial institution coming on board later this summer and have several others across a number of market segments under development.

I'm very excited about the reception of Myris and EyeLock, that they have received, and I see this as one of the great long-term drivers for our Company today. I can certainly go on and on and add more and more about our products, but I'll hold additional comments until Q&A. I'm going to turn the call over to Mike now, and then we'll open it up for questions. Michael?

Michael Stoehr - VOXX International Corp - SVP and CFO

Thanks, Pat. Good morning, everyone. As Pat already covered sales margins and some of our operating expenses for the fourth quarter, I'll start off with the rest of the income statement before moving to the balance sheet. We're going to keep our remarks to the quarter, but we can certainly address any fiscal year questions when we open up the call.

For the fourth quarter, operating expenses for the quarter were $50.2 million, down $4.7 million, or 8.6% from last year's fourth quarter when you exclude the non-cash impairment charges. We had a $2.1 million decline in selling expenses principally due to lower advertising in [teenee] offset by higher benefit costs. G&A expenses were down $2.9 million without the impairments, mostly as a result of cost control measures we have been instituting throughout the year.

And our engineering tech support expenses were down $900,000, as we had higher customer reimbursements offset by increases in support of newer product lines, such as our EVO rear seat entertainment and security and higher benefits cost. We also had $1.1 million in restructuring expenses, as we took further steps in fourth quarter to reduce overhead and lower future fixed expenses, the effect of which will be realized throughout FY16.

This resulted in an operating loss of $700,000 versus an operating loss excluding the impairments of $2 million last year -- excluding the impairments of $2 million last year, an improvement of $1.3 million. For the three months comparison, there were virtually no changes in our interest and bank charges, approximately $1.8 million for both periods, and equity income derived from our ASA joint venture was approximately $1.2 million in FY15 fourth quarter versus $1.3 million in prior year's quarter.

Other net was approximately [$179,000] versus approximately $600,000, or $574,000. There was a non-cash charge for our Venezuela property amounting to $9.3 million. This is a result of when we valued the property for February 28, 2014, the conversion rate was 11.7.

When we valued the property at February 28, 2015, the rate was 177. We still own the buildings, we're collecting rent and covering local expenses with local currency. The remaining building balance of $3.8 million may be written off at some point based upon the continued volatility of the currency.

For the quarter, we had a tax expense of $3 million, principally in Europe, versus a benefit last year's fourth quarter of $10.3 million. We did not receive any tax benefits for the Venezuelan impairments. We reported a net loss of $14.4 million for the quarter, or a loss of $0.60 per diluted share, versus a net loss of $49 million or $2.01 per share in last year's fourth quarter.

On a pre-tax basis, excluding impairment changes in FY14 fourth quarter and all Venezuela impairments for bonds and buildings in FY15 fourth quarter, the Company would have reported a pre-tax loss of $1.4 million versus a pre-tax loss of $1.7 million in the fourth quarter last year. We had an EBITDA loss of $6.2 million compared to a loss of $53.4 million. On an adjusted basis, EBITDA was $5.2 million versus $3.8 million and the adjustments are as follows.

In FY15 fourth quarter, we had $9.3 million Venezuela impairment charges, $1.1 million in restructuring charges, $694,000 related to the Venezuelan bond remeasurements, and $230,000 of stock-based compensation. This compares to FY14 fourth quarter where we had $57.6 million of impairment charges, $475,000 in net legal settlements, and a customer settlement payments combined, and $89,000 in stock-based compensation.

Now for our balance sheet. Our cash position as of February 28, 2015, was $8.4 million versus $10.6 million as of February 28, 2014. Accounts receivable declined by $44.3 million and our inventory position increased by $12.3 million. The inventory increase was primarily related to products stuck on the water due to the West Coast port issues and increased inventory in Hirschmann for plant production.

Our total debt as of February 28, 2015, which is inclusive of all mortgages and capital leases, stood at $86.3 million compared to $115.3 million as of February 28, 2014, an improvement of $29 million. This also takes into account $6 million in new investments in EyeLock and IC-360 during FY15, as well as $2.6 million in stock repurchases, and $2.9 million spent in fourth quarter for the purchase of land in Florida for our new facility. Additionally, our domestic bank obligations were $67.7 million as of February 28, 2015 versus $88 million at the same time last year, a $20.3 million improvement. Our total leverage was 2.18.

CapEx, which we initially guided to $12 million or $13 million, with the addition of the planned investments in our [lando] OEM facility came in at $17.1 million for the year, all within the ranges provided in our last quarterly conference. As a result, we generated free cash flow of $15 million for this year. Our balance sheet continues to improve, and we tend to use free cash from operations to pay down debt and potentially for any M&A activity that may arise in the future.

We have taken a lot of costs out of the business and while we expect to realize some savings in FY16, we're also reinvesting in the business and in structural areas in support of projected growth, such as our OEM manufacturing facility in Florida, our sole initiatives in Hauppauge, the consolidation of operations in [India] and in Germany and things of this nature. Operator, this concludes my remarks, and we'll open up the floor now for questions.

QUESTION AND ANSWER

Operator

Thank you.

(Operator Instructions)

Our first comes from the line of Sean McGowan from Needham & Company.

Sean McGowan - Needham & Company - Analyst

Good morning, guys, thanks for taking the questions.

Mike, I have a couple of questions, probably grouped under the currency heading, and let's start with what impact currency may have had on the gross profit margin in the fourth quarter of last year?

Michael Stoehr - VOXX International Corp - SVP and CFO

Could you ask that question again, please.

Sean McGowan - Needham & Company - Analyst

What impact did currency have on the gross margin in the fourth quarter?

Michael Stoehr - VOXX International Corp - SVP and CFO

None.

Sean McGowan - Needham & Company - Analyst

Okay. And how about on operating costs? I would imagine that you have some operating costs denominated in euros --

Michael Stoehr - VOXX International Corp - SVP and CFO

Well, the operating costs would be reduced as you convert euros at a lower rate.

Sean McGowan - Needham & Company - Analyst

Any way to quantify what that impact may have been?

Michael Stoehr - VOXX International Corp - SVP and CFO

For the quarter or for the year? Right up through the third quarter it was pretty constant. For the fourth quarter it would be several million dollars.

Sean McGowan - Needham & Company - Analyst

Okay. And, Pat, on your guidance commentary for the year, saying you expect growth in dollars and in local currency, did you mean your sales in US would be up and your sales in local currencies outside the US would be up, but perhaps on a full-year basis they would not be up? I'm trying to interpret that.

Pat Lavelle - VOXX International Corp - President & CEO

Yes, our euro-denominated business should be up next year, and so should our US-denominated businesses. So we're projecting increases in each of the group. Whatever the conversion is will affect that.

Sean McGowan - Needham & Company - Analyst

Okay. And then, finally, could you just give us some detail on why the 360Fly was delayed?

Pat Lavelle - VOXX International Corp - President & CEO

Just getting the software tuned in, so that it's working perfectly. Obviously, we're going to get one chance to launch this product and we want to make sure that everything is working properly. We are comfortable with the final changes that have been instituted, and we feel confident that we'll be able to produce in July and deliver to retail in August.

Sean McGowan - Needham & Company - Analyst

Would you say your confidence is higher in that than it would be out in May?

Pat Lavelle - VOXX International Corp - President & CEO

Yes. I know that the issues that were giving them some pause have been corrected. So, yes, I'm much more confident.

Sean McGowan - Needham & Company - Analyst

Okay. All right. Thank you.

Operator

Thank you. And our next question comes from the line of Steve Dyer from Craig-Hallum.

Steve Dyer - Craig-Hallum Capital Group - Analyst

Thank you, good morning.

A follow-on to the 360Fly -- I think it was sort of a one-of-a-kind product when it was first discussed a while back. It's my understanding there's some competitive 360 panoramic-type products, particularly from GoPro come into the market. Do you still feel like there's a kind of unique competitive aspect to yours? Or has that changed at all?

Pat Lavelle - VOXX International Corp - President & CEO

Basically, everything that we have seen on the market that is 360, we think that our product is far superior to that product in its operation, in its intended use. Some of the 360 products that are on the market are really not designed for heavy action. So we're comfortable with the technology that has been developed, with the IP that surrounds that technology; and I think, obviously, when we get to retail, the consumer's going to make the decision, but we're confident that our product is superior to what's coming.

Steve Dyer - Craig-Hallum Capital Group - Analyst

Okay. And then just some clarification on some of the guidance metrics you gave. Gross margin for the year -- is that a blended rate of 29% you anticipate?

Michael Stoehr - VOXX International Corp - SVP and CFO

Yes.

Steve Dyer - Craig-Hallum Capital Group - Analyst

And then, operating expenses, I think I heard $185 million to $190 million. First, is that correct? Secondly, do you expect any additional restructuring charges that will run through the P&L as a result of taking that kind of cost out?

Pat Lavelle - VOXX International Corp - President & CEO

Well, a big portion of that cost reduction, obviously, is also the currency. So $185 million to $190 million is where we project that we are going to be. I don't see any major restructuring. There will be things that we always do to fine tune the Company, but I don't see anything at this point that I would consider to be major.

Steve Dyer - Craig-Hallum Capital Group - Analyst

Okay. Thank you.

Pat Lavelle - VOXX International Corp - President & CEO

You're welcome.

Operator

Thank you. And our next question comes from the line of Rob Stone from Cowen and Company.

Rob Stone - Cowen and Company - Analyst

Hello, guys.

Pat Lavelle - VOXX International Corp - President & CEO

Hello, Rob.

Rob Stone - Cowen and Company - Analyst

Just to follow up on that last one. So you may still be taking some minor restructuring actions during the year?

Pat Lavelle - VOXX International Corp - President & CEO

Well, we still have a Venezuelan operation. We still have a Mexican operation that we have been changing the business model in. So there might be some expenses that come through for restructuring those. But the basic ones, and the core ones, are pretty intact going into the year. So we did a lot of restructuring and right-sizing towards the end of last year, so I don't see anything major at this point.

Rob Stone - Cowen and Company - Analyst

Okay. And I hate to keep beating the dead horse here, but coming back to your comments about growth in all three, in the businesses -- I guess if Q1 is going to be down after accounting for FX, are you expecting a big chunk of year-over-year growth in the second half? Or should we start to see an upturn in the second quarter? I know you're not giving guidance for full year revenue or those future quarters, but any directional commentary would be helpful.

Pat Lavelle - VOXX International Corp - President & CEO

The thing we are looking at is, we have some new, we have our WiSA-based system coming out; we have 360 coming out, we have the enterprise unit coming out, we have Singtrix that we will have. So we're looking at the second half -- as we get into the second half -- where we're going to get contributions from all these new products. In the late part of the year, we have the contribution from the Daimler-Benz program. So that's where we're seeing the growth. Again, offsetting some declines in the core business to average selling price declines, and some products that have reached the end of their life cycle.

Rob Stone - Cowen and Company - Analyst

Okay. A couple of housekeeping questions for Mike, if I may.

Mike, what was the weighted average shares you used in computing EPS for Q4?

Michael Stoehr - VOXX International Corp - SVP and CFO

That would be 23 million -- I'll get you the exact count. Hang on a second. I want to make sure -- because you haven't got the K, I want to give it right off the statement. 24,330,000.

Rob Stone - Cowen and Company - Analyst

Okay. And you have this kind of unusual situation where you were paying taxes though you reported a loss. I know the moving parts by jurisdiction may be a little tough, but what kind of normalized tax rate should we be thinking about for this year?

Michael Stoehr - VOXX International Corp - SVP and CFO

I think for your purposes -- and I tell this to the analysts -- use the -- we book the GAAP tax rate. The Company does have a lot of [1048.] We do take an aggressive tax position on a tax return on deferred taxes. So for your projections, use the normal 37%.

Rob Stone - Cowen and Company - Analyst

Okay. And then finally -- CapEx, you bumped up a little bit this past year versus your original thought. Do you have a CapEx figure in mind that you can disclose for FY16?

Michael Stoehr - VOXX International Corp - SVP and CFO

Yes, it's between $14 million and $15 million.

Rob Stone - Cowen and Company - Analyst

Okay. And any sense of how that plays out through the year? Is it more towards the front as you're working on this new facility? Or spread over the year?

Michael Stoehr - VOXX International Corp - SVP and CFO

First, look at it, first six months you'll see more than, about half -- about more than half will go.

Rob Stone - Cowen and Company - Analyst

Okay.

Michael Stoehr - VOXX International Corp - SVP and CFO

It will tail off in the last six months.

Rob Stone - Cowen and Company - Analyst

All right. Thank you.

Operator

Thank you. And that concludes our question-and-answer session for today. I would like to turn the conference back over to Management for closing comments.

Pat Lavelle - VOXX International Corp - President & CEO

Okay. If there are no more questions, I want to thank you all for your interest. I do feel that we are embarking with some of the new products, and some of the new categories that we're getting in, that we will see some new areas of growth as we try to continue to evolve the Company, innovate, so that we are relevant in the markets in the years ahead.

So I appreciate your interest, and I wish you all a good day. Thank you.

Operator

Thank you. Ladies and gentlemen, thank you for your participation in today's conference. This does conclude the program, and you may now disconnect. Everyone, have a good day.

|

|

DISCLAIMER Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2015 Thomson Reuters. All Rights Reserved. |

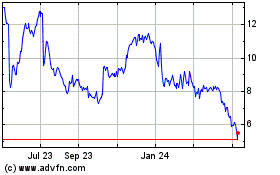

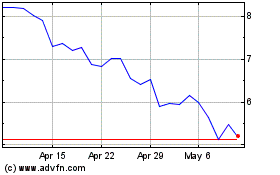

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Apr 2023 to Apr 2024