UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 13, 2015

NN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-23486 |

|

62-1096725 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 207 Mockingbird Lane |

|

37604 |

| (Address of principal executive offices) |

|

(Zip Code) |

(423) 743-9151

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 5.07. |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

The 2015 Annual Meeting of the

Stockholders of NN, Inc. (the “Company”) was held on May 14, 2015. At the Annual Meeting, the following proposals were considered:

| |

(1) |

The election of three Class II directors to serve for a term of three years; |

| |

(2) |

An advisory resolution to approve the compensation of the Company’s named executive officers; and |

| |

(3) |

The ratification of the selection of PricewaterhouseCoopers LLP as the Company’s registered independent public accounting firm for the fiscal year ending December 31, 2015. |

For beneficial owners holding the Company’s common stock at a bank or brokerage institution, a “broker non-vote” occurred if

the owner failed to give voting instructions, and the bank or broker was otherwise restricted from voting on the owner’s behalf.

Proposal 1

Three Class II directors were elected, and the aggregate votes cast for or withheld, and the broker non-votes were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Withheld |

|

|

Broker Non-Votes |

|

| Robert E. Brunner |

|

|

14,369,851 |

|

|

|

874,757 |

|

|

|

1,542,317 |

|

| Richard D. Holder |

|

|

14,851,974 |

|

|

|

392,634 |

|

|

|

1,542,317 |

|

| David L. Pugh |

|

|

14,807,660 |

|

|

|

436,948 |

|

|

|

1,542,317 |

|

Proposal 2

The advisory resolution to approve the compensation of the Company’s named executive officers was approved, and the aggregate votes cast

for or against, as well as the abstentions and broker non-votes, were as follows:

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstentions |

|

Broker Non-Votes |

| 13,827,250 |

|

1,137,153 |

|

280,205 |

|

1,542,317 |

Proposal 3

The Audit Committee’s selection of PricewaterhouseCoopers LLP as the Company’s registered independent public accounting firm for the

fiscal year ending December 31, 2015 was ratified, and the aggregate votes cast for or against and the abstentions, were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstentions |

| 15,593,015 |

|

1,188,960 |

|

4,950 |

On May 13, 2015, the Company issued a press release announcing the

declaration of a quarterly cash dividend of $0.07 per common share payable on June 19, 2015, to stockholders of record as of the close of business on June 5, 2015. The full text of the press release is attached as Exhibit 99.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release of NN, Inc. dated May 13, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: May 14, 2015

|

|

|

| NN, INC. |

|

|

| By: |

|

/s/ William C. Kelly, Jr. |

|

|

Name: William C. Kelly, Jr. |

|

|

Title: Vice President and Chief Administrative Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release of NN, Inc. dated May 13, 2015. |

Exhibit 99.1

|

|

|

|

|

RE: NN, Inc. |

|

|

207 Mockingbird Lane |

|

|

3rd Floor |

|

|

Johnson City, TN 37604 |

FOR FURTHER INFORMATION:

|

|

|

| AT THE COMPANY |

|

AT FINANCIAL RELATIONS BOARD |

| Robbie Atkinson |

|

Marilynn Meek |

| Corporate Treasurer & Investor Relations |

|

(General info) |

| (423) 434-8398 |

|

212-827-3773 |

FOR IMMEDIATE RELEASE

May 13, 2015

NN, INC. ANNOUNCES

QUARTERLY DIVIDEND

Johnson City, Tenn, May 13, 2015 –NN, Inc., (NASDAQ: NNBR) a diversified industrial company, announced today its

Board of Directors declared a quarterly cash dividend of $0.07 per common share. The dividend will be paid on June 19, 2015, to shareholders of record as of the close of business on June 5, 2015.

NN, Inc., a diversified industrial company manufactures and supplies high precision metal bearing components, industrial plastic and rubber products and

precision metal components to a variety of markets on a global basis. Headquartered in Johnson City, Tennessee, NN has 25 manufacturing plants in the United States, Western Europe, Eastern Europe, South America and China.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or

expenditures, statements of plans and objectives or future operations or statements of future economic performance. These, and similar statements, are forward-looking statements concerning matters that involve risks, uncertainties and other factors

which may cause the actual performance of NN, Inc. and its subsidiaries to differ materially from those expressed or implied by this discussion. All forward-looking information is provided by the Company pursuant to the safe harbor established under

the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of these factors. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “assumptions”,

“target”, “guidance”, “outlook”, “plans”, “projection”, “may”, “will”, “would”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “potential” or “continue” (or the negative or other derivatives of each of these terms) or similar terminology. Factors which could materially affect actual results include, but are not limited to: general

economic conditions and economic conditions in the industrial sector, inventory levels, regulatory compliance costs and the Company’s ability to manage these costs, start-up costs for new operations, debt reduction, competitive influences,

risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability and price of raw materials, currency and other risks associated with international trade, the Company’s

dependence on certain major customers, and the successful implementation of the global growth plan including development of new products. Similarly, statements made herein and elsewhere regarding pending or completed acquisitions are also

forward-looking statements, including statements relating to the anticipated closing date of an acquisition, the Company’s ability to obtain required regulatory approvals or satisfy closing conditions, the costs of an acquisition and the

Company’s source(s) of financing, the future performance and prospects of an acquired business, the expected benefits of an acquisition on the Company’s future business and operations and the ability of the Company to successfully

integrate recently acquired businesses.

For additional information concerning such risk factors and cautionary statements, please see the section

titled “Risk Factors” in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Except as required by law, we undertake no obligation to update or revise any forward-looking statements we make in our press releases, whether as a result of new information, future events or otherwise.

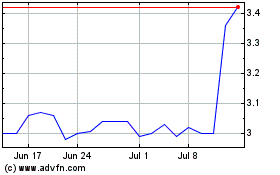

NN (NASDAQ:NNBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

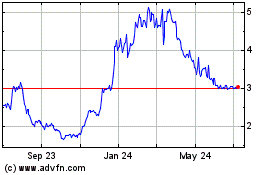

NN (NASDAQ:NNBR)

Historical Stock Chart

From Sep 2023 to Sep 2024