UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 26, 2015

NEOGEN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| MICHIGAN |

|

0-17988 |

|

38-2367843 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

| 620 Lesher Place Lansing, Michigan |

|

48912 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code 517-372-9200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On March 26, 2015, Neogen Corporation issued a press release announcing results of operations for the fiscal quarter and year to date

periods ended February 28, 2015. A copy of the press release is attached as Exhibit 99.1 to this report. This Form 8-K and the attached exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, and are not incorporated by reference into any filing of the Registrant, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits

| |

99.1 |

Press Release dated March 26, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NEOGEN CORPORATION

(Registrant) |

|

|

|

|

| Date: March 27, 2015 |

|

|

|

|

|

/s/ Steven J. Quinlan |

|

|

|

|

|

|

Steven J. Quinlan |

|

|

|

|

|

|

Vice President & CFO |

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

|

|

| CONTACT: |

|

Steven J. Quinlan, Vice President and CFO |

|

|

517/372-9200 |

Neogen reports 13% increase in net income

LANSING, Mich., March 26, 2015 — Neogen Corporation (NASDAQ: NEOG) announced today that its net income for the third quarter of fiscal 2015, which

ended Feb. 28, increased 13% to $7,454,000, when compared to the prior year’s $6,575,000. Earnings per share in the current quarter were $0.20, compared to $0.18 a year ago. Current year-to-date net income increased 17% over prior year to

$24,142,000, or $0.65 per share, compared to $20,621,000, or $0.56 per share, for the same period a year ago.

Revenues for the third quarter of fiscal

2015 increased 10% to $68,409,000, from the previous year’s third quarter revenues of $61,996,000. This increase was aided by recent acquisitions completed by the company, and was achieved despite top line currency adjustments of approximately

$1.5 million resulting from currency weakness in our international markets. Overall organic growth for the company was 7% for the quarter. The quarterly revenue and net income results represent third quarter records for the 32-year-old company. Year

to date, fiscal 2015 revenues increased 14% to $204,463,000 from fiscal 2014’s $180,143,000.

“We are pleased to report strong third quarter

results despite the negative currency headwinds we were up against. We seized existing opportunities by responding to expanding market testing needs for spice blends and toxin in wheat, and made advancements in a number of key market segments,”

said James Herbert, Neogen’s chief executive officer and chairman. “We continue to believe that a large part of our growth potential is outside of the United States. We will continue to expand Neogen’s footprint into areas where

significant growth potential exists, and refine our currency strategies in an attempt to mitigate adverse effects.”

The third quarter was the 92nd

of the past 97 quarters that Neogen reported revenue increases as compared with the previous year — including all consecutive quarters in the last nine years.

Neogen’s gross margin was 49.3% in the third quarter, essentially flat compared to 49.5% for fiscal 2014’s third quarter. Operating income increased

18% in the quarter compared to the prior year, primarily driven by the increased revenues. Operating income as a percentage of sales was 17.8% in the current quarter, as compared to 16.6% in the third quarter of the company’s 2014 fiscal year.

“The adverse effects of the currency fluctuations we faced in the current quarter were evident in the sales of our Scotland-based Neogen Europe

operations, which recorded a solid 12% increase in revenue in local currency. However, after converting the revenues from pound sterling to dollars, that increase was reduced to 4%,” said Steve Quinlan, Neogen’s chief financial officer.

“That impact was felt not only on the top line for the quarter, but down to our bottom line. Despite these challenges, Neogen experienced another strong quarter of cash generation, and our increase in operating income exceeded our rate of

growth in revenues — which provides evidence of general operational strength throughout Neogen.”

Revenues for the company’s Food Safety

segment increased 14% during the third quarter, compared to the prior year, aided by the Oct. 1, 2014 BioLumix acquisition. Sales of Neogen’s rapid tests for food allergens continued their strong performance, improving approximately 15% in the

current quarter compared to the prior year’s third quarter. The growth was aided by Neogen’s effective response to the discovery of large-scale contamination of cumin and other spices with peanut and other known food allergens.

Third quarter revenue also included a 6% increase in sales of natural toxin test kits. This included a 27%

increase in sales of tests to detect the mold toxin deoxynivalenol (DON), as Neogen responded to an outbreak of the toxin in the North American and European wheat crops, and its products continue to increase their market penetration. The increase in

DON kit sales more than offset a slight decrease in sales of kits to detect aflatoxin in the quarter, as last year’s clean corn crop resulted in less downstream testing for the toxin in the current quarter compared to the prior year quarter.

Sales of Neogen’s general microbiology products increased 47% in fiscal 2015’s third quarter compared to the prior year, in part due to the

BioLumix acquisition. The company believes there is a strong synergistic relationship between the similar BioLumix and Soleris test systems. Sales of Soleris disposable vials increased 11% in the current quarter, and sales of BioLumix products have

exceeded budget expectations in Neogen’s first year of ownership.

Current year third quarter revenue increases of 7% for the company’s Animal

Safety segment were aided by last year’s acquisition of Chem-Tech (agricultural insecticides). Sales of the Chem-Tech product line continue to exceed expectations, as the products have benefitted from Neogen’s sales and marketing

organization. Sales of the company’s rodenticides increased nearly 40% in the current quarter compared to prior year, as Neogen responded to a rodent outbreak in orchard crops, and its products have gained increased acceptance in the important

agricultural rodenticide market.

Revenues from GeneSeek, the company’s Nebraska-based genomics service laboratory, increased approximately 29% in

the current quarter compared to fiscal 2014’s third quarter. This increase resulted from growing acceptance of its proprietary genomic products, and by the increased operational capacity gained from the move into larger and upgraded facilities

in May 2014. Neogen recently introduced new cattle genomic tests that screen DNA for about 150,000 gene-marker variations linked to important traits in breeding stock.

Neogen Corporation develops and markets products dedicated to food and animal safety. The company’s Food Safety Division markets dehydrated culture media

and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases and sanitation concerns. Neogen’s Animal Safety Division is a leader in the development of animal genomics along with the

manufacturing and distribution of a variety of animal healthcare products, including diagnostics, pharmaceuticals, veterinary instruments, wound care and disinfectants.

Certain portions of this news release that do not relate to historical financial information constitute forward-looking statements. These forward-looking

statements are subject to certain risks and uncertainties. Actual future results and trends may differ materially from historical results or those expected depending on a variety of factors listed in Management’s Discussion and Analysis of

Financial Condition and Results of Operations in the Company’s most recently filed Form 10-K.

NEOGEN CORPORATION UNAUDITED SUMMARIZED CONSOLIDATED OPERATING DATA

(In thousands, except for per share and percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended Feb. 28 |

|

|

Nine months ended Feb. 28 |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Food Safety |

|

$ |

31,965 |

|

|

$ |

28,020 |

|

|

$ |

95,883 |

|

|

$ |

86,417 |

|

| Animal Safety |

|

|

36,444 |

|

|

|

33,976 |

|

|

|

108,580 |

|

|

|

93,726 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

68,409 |

|

|

|

61,996 |

|

|

|

204,463 |

|

|

|

180,143 |

|

| Cost of sales |

|

|

34,706 |

|

|

|

31,291 |

|

|

|

102,476 |

|

|

|

89,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

33,703 |

|

|

|

30,705 |

|

|

|

101,987 |

|

|

|

90,560 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales & marketing |

|

|

12,655 |

|

|

|

11,986 |

|

|

|

37,617 |

|

|

|

33,529 |

|

| Administrative |

|

|

6,522 |

|

|

|

6,320 |

|

|

|

18,629 |

|

|

|

18,135 |

|

| Research & development |

|

|

2,366 |

|

|

|

2,106 |

|

|

|

7,245 |

|

|

|

6,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

21,543 |

|

|

|

20,412 |

|

|

|

63,491 |

|

|

|

58,160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

12,160 |

|

|

|

10,293 |

|

|

|

38,496 |

|

|

|

32,400 |

|

| Other income (expense) |

|

|

(526 |

) |

|

|

(40 |

) |

|

|

(728 |

) |

|

|

(522 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before tax |

|

|

11,634 |

|

|

|

10,253 |

|

|

|

37,768 |

|

|

|

31,878 |

|

| Income tax |

|

|

4,225 |

|

|

|

3,700 |

|

|

|

13,625 |

|

|

|

11,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

7,409 |

|

|

$ |

6,553 |

|

|

$ |

24,143 |

|

|

$ |

20,478 |

|

| Net loss (income) attributable to non-controlling interest |

|

$ |

45 |

|

|

$ |

22 |

|

|

$ |

(1 |

) |

|

$ |

143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Neogen Corp |

|

$ |

7,454 |

|

|

$ |

6,575 |

|

|

$ |

24,142 |

|

|

$ |

20,621 |

|

| Net income attributable to Neogen Corp per diluted share |

|

$ |

0.20 |

|

|

$ |

0.18 |

|

|

$ |

0.65 |

|

|

$ |

0.56 |

|

| Other information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares to calculate per share |

|

|

37,536 |

|

|

|

37,233 |

|

|

|

37,399 |

|

|

|

37,149 |

|

| Depreciation & amortization |

|

$ |

2,681 |

|

|

$ |

2,427 |

|

|

$ |

7,852 |

|

|

$ |

6,641 |

|

| Interest income |

|

|

66 |

|

|

|

28 |

|

|

|

158 |

|

|

|

88 |

|

| Gross margin (% of sales) |

|

|

49.3 |

% |

|

|

49.5 |

% |

|

|

49.9 |

% |

|

|

50.3 |

% |

| Operating income (% of sales) |

|

|

17.8 |

% |

|

|

16.6 |

% |

|

|

18.8 |

% |

|

|

18.0 |

% |

| Revenue increase vs. FY 2014 |

|

|

10.3 |

% |

|

|

|

|

|

|

13.5 |

% |

|

|

|

|

| Net income vs. FY 2014 |

|

|

13.4 |

% |

|

|

|

|

|

|

17.1 |

% |

|

|

|

|

NEOGEN CORPORATION SUMMARIZED CONSOLIDATED

BALANCE SHEET DATA

(In

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Feb. 28

2015 |

|

|

May 31

2014 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash & investments |

|

$ |

102,148 |

|

|

$ |

76,496 |

|

| Accounts receivable |

|

|

52,887 |

|

|

|

51,901 |

|

| Inventory |

|

|

55,096 |

|

|

|

51,178 |

|

| Other current assets |

|

|

7,215 |

|

|

|

9,171 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

217,346 |

|

|

|

188,746 |

|

| Property & equipment, net |

|

|

43,543 |

|

|

|

41,949 |

|

| Goodwill & other assets |

|

|

117,546 |

|

|

|

114,606 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

378,435 |

|

|

$ |

345,301 |

|

|

|

|

| Liabilities & Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

26,551 |

|

|

$ |

24,967 |

|

| Long-term debt |

|

|

0 |

|

|

|

0 |

|

| Other long-term liabilities |

|

|

15,171 |

|

|

|

14,034 |

|

| Equity: Shares outstanding

37,042 in Feb. & 36,732 in May |

|

|

336,713 |

|

|

|

306,300 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities & equity |

|

$ |

378,435 |

|

|

$ |

345,301 |

|

###

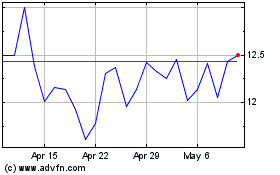

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Apr 2023 to Apr 2024