Current Report Filing (8-k)

March 25 2015 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2015

Commission File Number: 000-50768

ACADIA

Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

061376651 |

| (State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

3611 Valley Centre Drive, Suite 300, San Diego, California 92130

(Address of principal executive offices)

858-558-2871

(Registrant’s Telephone number, including area code)

11085 Torreyana Road #100, San Diego, California 92121

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 4.01 |

Changes in Registrant’s Certifying Accountant. |

The Audit Committee (the “Committee”) of the Board of Directors of ACADIA Pharmaceuticals Inc. (the

“Company”) initiated a selection process in the first half of March to determine the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015, including the fiscal quarter ending

March 31, 2015.

On March 19, 2015, PricewaterhouseCoopers LLP orally notified the Company that it declined to stand for re-election as the

Company’s independent registered public accounting firm.

The reports of PricewaterhouseCoopers LLP on the Company’s consolidated financial

statements for the fiscal years ended December 31, 2014 and 2013 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended

December 31, 2014 and 2013, and in the subsequent interim period through March 19, 2015, there have been no disagreements with PricewaterhouseCoopers LLP on any matters of accounting principles or practices, financial statement disclosure

or auditing scope and procedure which, if not resolved to the satisfaction of PricewaterhouseCoopers LLP, would have caused PricewaterhouseCoopers LLP to make reference to the matter in its reports on the financial statements for such years. During

the two fiscal years ended December 31, 2014 and 2013 and the subsequent interim period through March 19, 2015, there were no reportable events (as that term is described in Item 304(a)(1)(v) of Regulation S-K).

The Company provided a copy of the foregoing disclosures to PricewaterhouseCoopers LLP and requested that PricewaterhouseCoopers LLP furnish it with a letter

addressed to the Securities and Exchange Commission stating whether PricewaterhouseCoopers LLP agrees with the above statements. A copy of PricewaterhouseCoopers LLP’s letter, dated March 25, 2015 is filed as Exhibit 16.1 to this Form 8-K.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On March 20, 2015, our board of directors approved a retention bonus agreement with Stephen R. Davis,

our interim Chief Executive Officer, providing for the payment of cash compensation to Mr. Davis in the amount of $100,000, payable upon the earlier of (i) September 21, 2015 or (ii) our termination of Mr. Davis’ employment

without cause. The cash payment will not be payable in the event Mr. Davis’ resigns or is terminated for cause prior to September 21, 2015.

The foregoing description of the retention agreement does not purport to be complete and is qualified in its entirety by reference to the agreement, a copy of

which will be filed as an exhibit to our Quarterly Report on Form 10-Q for the quarter ending March 31, 2015.

Also on March 20, 2015, our board

of directors approved a cash bonus for Uli Hacksell, Ph.D., our former President and Chief Executive Officer and current consultant, in the amount of $348,000, based upon an assessment of performance goals achieved during 2014 and

Dr. Hacksell’s previously established target bonus.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 16.1 |

|

Letter from PricewaterhouseCoopers LLP, dated March 25, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: March 25, 2015 |

|

|

|

ACADIA Pharmaceuticals Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Glenn F. Baity |

|

|

Name: |

|

Glenn F. Baity |

|

|

Title: |

|

EVP, General Counsel & Secretary |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 16.1 |

|

Letter from PricewaterhouseCoopers LLP, dated March 25, 2015 |

Exhibit 16.1

[PricewaterhouseCoopers LLP Letterhead]

March 25, 2015

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-7561

Commissioners:

We have read the statements made by ACADIA

Pharmaceuticals Inc. (copy attached), which we understand will be filed with the Securities and Exchange Commission, pursuant to Item 4.01 of Form 8-K, as part of the Form 8-K of ACADIA Pharmaceuticals Inc. dated March 19, 2015. We agree

with the statements concerning our Firm in such Form 8-K.

Very truly yours,

|

| /s/ PricewaterhouseCoopers LLP |

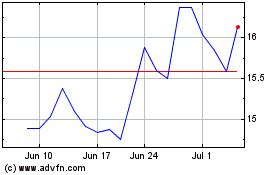

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

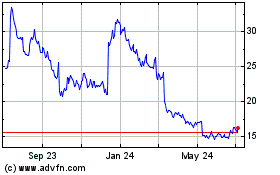

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Apr 2023 to Apr 2024