Current Report Filing (8-k)

March 16 2015 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT: March 16, 2015

DATE OF EARLIEST EVENT REPORTED: March 10, 2015

001-35922

(Commission file number)

PEDEVCO CORP.

(Exact name of registrant as specified in its charter)

|

Texas

|

22-3755993

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification

No.)

|

4125 Blackhawk Plaza Circle, Suite 201

Danville, California 94506

(Address of principal executive offices)

(855) 733 2685

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 8.01 OTHER EVENTS.

On March 16, 2015, PEDEVCO Corp. (the “Company”) issued a press release announcing that on March 10, 2015, the NYSE MKT (the “Exchange”) notified the Company that it had accepted the Company’s plan of compliance (the “Plan”) which the Company previously presented to the Exchange on February 6, 2015. The Company has been provided until July 8, 2016 to regain compliance with Section 1003(a)(iii) of the NYSE MKT Company Guide, which requires the Company’s stockholders’ equity to be at least $6 million. If the Company does not make progress consistent with the Plan during the Plan period or regain compliance with the applicable continued listing standards of the Exchange by July 8, 2016, the Exchange will initiate delisting proceedings as appropriate. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein under Item 8.01 and set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

Description

|

| |

|

|

|

Press Release dated March 16, 2015

|

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

| |

PEDEVCO CORP.

|

| |

|

|

| |

By:

|

/s/ Michael L. Peterson

|

| |

|

Michael L. Peterson

|

| |

|

President and

Chief Financial Officer

|

| |

|

|

| |

|

|

| |

|

|

Date: March 16, 2015

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

| |

|

|

|

Press Release dated March 16, 2015

|

*Furnished herewith.

EXHIBIT 99.1

Pacific Energy Development Announces Acceptance of

Listing Compliance Plan by NYSE MKT

March 16, 2015 – PEDEVCO Corp. d/b/a Pacific Energy Development (NYSE MKT: PED) (the “Company”), today announced that the NYSE MKT (the “Exchange”) notified the Company that it has accepted the Company’s plan of compliance (the “Plan”) which the Company previously presented to the Exchange on February 6, 2015 to increase its stockholders’ equity to at least $6 million prior to the targeted completion date of July 8, 2016, during which period the Company’s listing is being continued pursuant to an extension. The Company’s Plan as accepted by the Exchange contemplated the acquisition of additional oil and gas assets in exchange for equity. As subsequently announced by the Company on February 24, 2015, we believe the Company’s recent consummation of the asset acquisition from Golden Globe Energy (US), LLC achieves the Plan’s objectives as it substantially increases the Company’s stockholders’ equity to well above the Exchange’s minimum continued listing standards. In addition, the recently announced planned combination with Dome Energy, Inc. will also add substantially to stockholder’s equity if and when closed.

Mr. Frank Ingriselli, Chairman and Chief Executive Officer of the Company, commented, “As previously disclosed, we believe that our acquisition this month of approximately 13,000 net D-J Basin acres and interests in 53 gross wells, which nearly doubled our current production and cash flow, has remedied our stockholders’ equity shortfall and will return our Company to full compliance with the NYSE MKT’s continued listing standards. In addition, our planned combination with Dome Energy should further increase our stockholders’ equity and place the Company on an even stronger footing as we continue to execute our business plan and strive to build shareholder value.”

About Pacific Energy Development (PEDEVCO Corp.)

PEDEVCO Corp, d/b/a Pacific Energy Development (NYSE MKT: PED), is a publicly-traded energy company engaged in the acquisition and development of strategic, high growth energy projects, including shale oil and gas assets, in the United States. The Company’s principal asset is its D-J Basin Asset located in the DJ Basin in Colorado. Pacific Energy Development is headquartered in Danville, California, with an operations office in Houston, Texas.

Forward-Looking Statements

All statements in this press release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. While management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of the Company’s control, that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth under Item 1A “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and its subsequent Quarterly Reports on Form 10-Q. The Company operates in a highly competitive and rapidly changing environment, thus new or unforeseen risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. The Company disclaims any intention to, and undertakes no obligation to, update or revise any forward-looking statements. Readers are also urged to carefully review and consider the other various disclosures in the Company’s public filings with the SEC.

Contacts

Pacific Energy Development

Bonnie Tang

1-855-733-3826 ext 21 (Media)

PR@pacificenergydevelopment.com

Investor Relations:

Stonegate, Inc.

Casey Stegman

1-214-987-4121

casey@stonegateinc.com

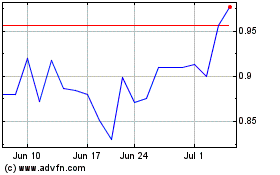

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024