UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 2, 2015

GLOBALSTAR, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-33117 (Commission File Number) | 41-2116508 (IRS Employer Identification No.) |

|

| |

300 Holiday Square Blvd. Covington, LA | 70433 |

(Address of Principal Executive Offices) | (Zip Code) |

| |

Registrant’s telephone number, including area code: (985) 335-1500

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 2.02 Results of Operations and Financial Condition.

On March 2, 2015, Globalstar, Inc. issued a press release to report 2014 year end financial results. The text of the press release is furnished as Exhibit 99.1 to this Form 8-K.

Item 7.01 Regulation FD Disclosure.

During Globalstar’s previously announced conference call at 5 p.m. Eastern Time on March 2, 2015, written presentation materials will be used and will be available on the company’s website. The text of the presentation materials is furnished as Exhibit 99.2 to this Form 8-K.

The information in this Current Report on Form 8-K and the Exhibits attached hereto is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

| 99.1 | Press release dated March 2, 2015 |

| 99.2 | Presentation materials dated March 2, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| GLOBALSTAR, INC. | |

| | |

| | |

| /s/ James Monroe III | |

| James Monroe III | |

| Chairman and | |

| Chief Executive Officer | |

Date: March 2, 2015

GLOBALSTAR ANNOUNCES 2014 FOURTH QUARTER AND ANNUAL RESULTS

Covington, LA - (March 2, 2015) - Globalstar, Inc. (NYSE MKT: GSAT) today announced its financial and operating results for the fourth quarter and year ended December 31, 2014.

Jay Monroe, Chairman and CEO of Globalstar, commented, “2014 represents an important year for Globalstar as it was the first full year of service restoration after the launch of our second-generation constellation. We have been able to not only gain market share in our core markets, but also invest and expand in additional territories including South and Central America and now Africa. Revenue for the year grew 9% while Adjusted EBITDA increased 47%. Our core business is on the right growth path as we expand our international footprint, introduce new consumer and enterprise-focused products and materially upgrade our service offerings with the near-term completion of our next generation ground infrastructure. We also are focused on concluding the Federal Communications Commission's approval process for our spectrum in the 2.4 GHz band. We look forward to the successful completion of the proceeding, which will provide the nation with an additional 22 MHz of terrestrial spectrum for mobile broadband.”

FOURTH QUARTER FINANCIAL REVIEW

Revenue

Revenue for the fourth quarter of 2014 was $22.1 million compared to $21.0 million for the fourth quarter of 2013, an increase of 5%, which was driven by increases in both service revenue and subscriber equipment revenue.

Service revenue was $17.2 million for the fourth quarter of 2014 compared to $16.8 million for the fourth quarter of 2013. The primary driver of this increase was growth in SPOT service revenue, which increased 7%. The growth in SPOT service revenue was due to an 8% increase in subscribers from December 31, 2013 to December 31, 2014. The increase in the SPOT subscriber base was driven predominantly by the market introduction of the SPOT Trace product in late 2013. Net quarterly subscriber additions increased 40% from approximately 13,600 to approximately 19,000. Fourth quarter 2014 service revenue growth also reflected both Duplex and Simplex revenue growth, which increased 2% and 14%, respectively, due primarily to increases in subscribers. The increases in Duplex, SPOT and Simplex service revenue were offset partially by a decrease in other service revenue. Driving the majority of the decrease in other service revenue for the fourth quarter of 2014 as compared to 2013 was a decrease in third-party revenue of $0.2 million, as well as a non-cash, out of period adjustment to revenue related to an international subsidiary of $0.4 million.

Subscriber equipment sales revenue was $4.9 million in the fourth quarter of 2014, an increase of 17% from the fourth quarter of 2013. Simplex equipment sales revenue, which was the largest contributor of the total increase, grew 48% due to higher priced units being sold in the fourth quarter of 2014 as compared to the same period in 2013. Also contributing to the total increase in equipment sales revenue was a 9% increase in SPOT equipment sales revenue.

Net Income (Loss)

Net income was $92.0 million for the fourth quarter of 2014 as compared to a net loss of $234.8 million for the fourth quarter of 2013. This fluctuation results primarily from the impact of non-cash gains in the fourth quarter of 2014 due to a decrease in the value of the Company's derivative liabilities. This decrease in value was driven primarily by the decrease in the Company’s stock price during the fourth quarter of 2014. Conversely, the impact of non-cash losses during the fourth quarter of 2013 was due to an increase in the value of the Company’s net derivative liabilities during the fourth quarter of 2013, which was driven primarily by the increase in the Company’s stock price during the fourth quarter of 2013. The fourth quarter of 2014 was also favorably impacted by lower interest expense of $9.4 million as compared to $28.0 million in the 2013 quarter driven primarily by conversions of our 5% Notes during 2013 that did not recur in 2014. Depreciation expense declined 19% to $19.8 million in the fourth quarter of 2014 as compared to

$24.5 million in the 2013 quarter due to the depreciable lives of certain first-generation assets coming to an end in 2014.

Offsetting these reductions in expenses was an $8.6 million increase in the reduction of carrying value of inventory from $5.8 million recorded during the fourth quarter of 2013 to $14.4 million during the fourth quarter of 2014. The inventory impairment charge recorded during the fourth quarter of 2014 related primarily to a reduction in the carrying value of Duplex phones, antennas, ancillary parts and car kit bases.

Adjusted EBITDA

Adjusted EBITDA for the three-month periods ended December 31, 2014 and 2013 was $3.8 million and $3.9 million, respectively. This decrease in Adjusted EBITDA was due to a $1.5 million increase in revenue offset by a $1.6 million increase in expenses (both excluding EBITDA adjustments). The increase in expenses in the fourth quarter of 2014 was driven primarily by the higher cost of subscriber equipment sales, which grew in line with equipment revenue. Additionally, a rebate program introduced during 2014 impacted revenue generated from Duplex equipment sales and increased subscriber acquisition costs.

OPERATIONAL AND REGULATORY UPDATE

Regulatory Reform for Terrestrial Spectrum Authority

In February 2014, the Federal Communications Commission (FCC) published in the Federal Register proposed rules which, if adopted, would enable us to offer low power terrestrial broadband services in the 2.4 GHz band. This proceeding relates to Terrestrial Low Power Service (TLPS) and includes terrestrial authority over 22 MHz of spectrum. The Company will provide a demonstration of its service at the FCC this week, which we anticipate will enable the Commission to move forward with its final rules in the near future. We look forward to expanding this authority into other countries after the completion of the FCC proceeding.

Expansion Initiatives in Eastern Europe

On December 31, 2014, we entered into an agreement for the sale of a Globalstar gateway for installation in Eastern Europe, along with related construction and engineering services. Under the contract, we will provide all oversight personnel, engineering and other services and gateway equipment necessary to construct the gateway. The purchaser will become a provider of our mobile satellite services exclusively over the Globalstar System. Both parties anticipate having the gateway in commercial operation by early 2016. If the purchaser is not able to secure third party contracts and obtain permits, licenses, and other authorizations required to operate the gateway, the agreement terminates. When the gateway is operational, the purchaser will pay Globalstar a fixed, recurring annual payment in addition to the payments for the purchase of the gateway assets and engineering services.

ANNUAL FINANCIAL REVIEW

Revenue

Total revenue increased $7.4 million, or 9%, to $90.1 million during 2014 from $82.7 million in 2013. This increase was due to a $5.2 million increase in service revenue driven primarily by growth in our total subscriber base, coupled with a $2.2 million increase in revenue from subscriber equipment sales resulting primarily from SPOT product launches in the second half of 2013. In total, the Company's subscriber base increased 56,000 to approximately 639,000 at December 31, 2014 from approximately 583,000 at December 31, 2013. This increase of 56,000 or 165% is up from a net increase of approximately 21,000 in 2013.

Net Loss

Net loss decreased to $462.9 million for 2014 as compared to $591.1 million for 2013 due primarily to non-cash items impacting other income/expense. The decrease in other income/expense was primarily due to a lower loss on extinguishment of debt, loss on equity issuance, interest expense, derivative loss and other expenses recorded in 2014 as compared to 2013. Also contributing to the decrease in net loss was the $7.4 million, or 9%, increase in total revenue discussed above, offset by an increase in total operating expenses. This increase in operating expenses was due primarily to a $15.9 million increase in the non-cash reduction in value of inventory following cancellation of our contract with Qualcomm related to finished goods and raw materials as well as a reduction in the carrying value of Duplex phones and accessories in 2014. Marketing, general and administrative expenses increased $3.6 million, or 12%, due in part to an increase in the fair value of stock compensation. Depreciation, amortization, and accretion expense decreased $4.4 million, or 5%, due to the first-generation satellites launched during 2007 reaching the end of their estimated depreciable lives during 2014.

Adjusted EBITDA

Adjusted EBITDA for the years ending December 31, 2014 and 2013 was $17.4 million and $11.8 million, respectively, reflecting an increase of 47% year over year. The growth in Adjusted EBITDA is attributable to a $7.8 million increase in revenue offset partially by a $2.2 million increase in operating expenses (both excluding EBITDA adjustments).

Mr. Monroe concluded, “As we look forward to the full year 2015, we are at an important stage for the Company’s satellite business and spectrum opportunities. We have expanded our footprint to cover almost every person on earth and we look forward to continuing to allocate our focus on an ever expanding set of sectors and market areas. Our new ground stations, which we expect will be ready this time next year, will further differentiate Globalstar’s product offerings and we look forward to bringing to market products with speeds of up to 25x the current legacy system capabilities. Our attention is also focused on advancing and completing the FCC process. We have an important week ahead in the demonstrations at the FCC and we look forward to completing the process and making the spectrum available for consumer use.”

CONFERENCE CALL

The Company will conduct an investor conference call on March 2, 2015, at 5:00 p.m. ET to discuss the 2014 fourth quarter and annual financial results.

|

| |

Details are as follows: |

Conference Call: | 5:00 p.m. ET Investors and the media are encouraged to listen to the call through the Investor Relations section of the Company's website at www.globalstar.com/investors. If you would like to participate in the live question and answer session following the Company's conference call, please dial 1 (800) 446-1671 (US and Canada), 1 (847) 413-3362 (International) and use the participant pass code 3903 1122. |

Audio Replay: | A replay of the earnings call will be available for a limited time and can be heard after 7:30 p.m. ET on March 2, 2015. Dial: 1 (888) 843-7419 (US and Canada), 1 (630) 652-3042 (International) and pass code 3903 1122#. |

About Globalstar, Inc.

Globalstar provides mobile satellite voice and data services. Globalstar offers these services to commercial customers and recreational consumers in more than 120 countries around the world. The Company's products include mobile and fixed satellite telephones, simplex and duplex satellite data modems, flexible airtime service packages and the SPOT family of mobile satellite consumer products including the SPOT Satellite GPS Messenger. Many land based and maritime industries benefit from Globalstar with increased productivity from remote areas beyond cellular and landline service. Global customer segments include: oil and gas, government, mining, forestry, commercial fishing, utilities, military, transportation, heavy construction, emergency preparedness, and business continuity as well as individual recreational users. Globalstar data solutions are ideal for various asset and personal tracking, data monitoring and SCADA applications. Note that all SPOT products described in this press release are the products of Spot LLC, which is not affiliated in any manner with Spot Image of Toulouse, France or Spot Image Corporation of Chantilly, Virginia.

For more information regarding Globalstar, please visit Globalstar's web site at www.globalstar.com

Investor contact information:

Email

investorrelations@globalstar.com

Phone

(985) 335-1538

Safe Harbor Language for Globalstar Releases

This press release contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Forward-looking statements, such as the statements regarding our expectations with respect to actions by the FCC, future increases in our revenue and profitability and other statements contained in this release regarding matters that are not historical facts, involve predictions. Any forward-looking statements made in this press release are accurate as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update any such statements. Additional information on factors that could influence our financial results is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

GLOBALSTAR, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

(unaudited) |

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | Year Ended |

| | | | December 31, | | December 31, |

| | | | 2014 | | 2013 | | 2014 | | 2013 |

Revenue: | | | | | | | | |

| Service revenues | | $ | 17,176 |

| | 16,789 |

| | $ | 69,823 |

| | $ | 64,644 |

|

| Subscriber equipment sales | | 4,917 |

| | 4,205 |

| | 20,241 |

| | 18,067 |

|

| | Total revenue | | 22,093 |

| | 20,994 |

| | 90,064 |

| | 82,711 |

|

Operating expenses: | | | | | | | | |

| Cost of services (exclusive of depreciation, amortization, and accretion shown separately below) | | 7,742 |

| | 7,297 |

| | 29,668 |

| | 30,210 |

|

| Cost of subscriber equipment sales | | 3,617 |

| | 2,948 |

| | 14,857 |

| | 13,623 |

|

| Cost of subscriber equipment sales - reduction in the value of inventory | | 14,367 |

| | 5,794 |

| | 21,684 |

| | 5,794 |

|

| Marketing, general, and administrative | | 8,721 |

| | 7,308 |

| | 33,520 |

| | 29,888 |

|

| Reduction in the value of long-lived assets | | 84 |

| | — |

| | 84 |

| | — |

|

| Depreciation, amortization, and accretion | | 19,754 |

| | 24,478 |

| | 86,146 |

| | 90,592 |

|

| | Total operating expenses | | 54,285 |

| | 47,825 |

| | 185,959 |

| | 170,107 |

|

Loss from operations | | (32,192 | ) | | (26,831 | ) | | (95,895 | ) | | (87,396 | ) |

Other income (expense): | | | | | | | | |

| Gain (loss) on extinguishment of debt | | (231 | ) | | 1,717 |

| | (39,846 | ) | | (109,092 | ) |

| Loss on equity issuance | | — |

| | — |

| | — |

| | (16,701 | ) |

| Interest income and expense, net of amounts capitalized | | (9,381 | ) | | (27,959 | ) | | (43,233 | ) | | (67,828 | ) |

| Derivative gain (loss) | | 132,614 |

| | (179,087 | ) | | (286,049 | ) | | (305,999 | ) |

| Other | | 831 |

| | (1,839 | ) | | 3,038 |

| | (2,962 | ) |

| | Total other income (expense) | | 123,833 |

| | (207,168 | ) | | (366,090 | ) | | (502,582 | ) |

Income (loss) before income taxes | | 91,641 |

| | (233,999 | ) | | (461,985 | ) | | (589,978 | ) |

Income tax expense | | (374 | ) | | 798 |

| | 881 |

| | 1,138 |

|

Net income (loss) | | $ | 92,015 |

| | $ | (234,797 | ) | | $ | (462,866 | ) | | $ | (591,116 | ) |

| | | | | | | | | | |

Income (loss) per common share: | | | | | | | | |

| Basic | | $ | 0.09 |

| | $ | (0.36 | ) | | $ | (0.50 | ) | | $ | (0.96 | ) |

| Diluted | | $ | 0.08 |

| | $ | (0.36 | ) | | $ | (0.50 | ) | | $ | (0.96 | ) |

| | | | | | | | | | |

Weighted-average shares outstanding: | | | | | | | | |

| Basic | | 993,427 |

| | 779,483 |

| | 934,356 |

| | 614,959 |

|

| Diluted | | 1,192,263 |

| | 779,483 |

| | 934,356 |

| | 614,959 |

|

GLOBALSTAR, INC.

RECONCILIATION OF GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA

(Dollars in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, | | December 31, |

| | | 2014 | | 2013 | | 2014 | | 2013 |

Net income (loss) | | $ | 92,015 |

| | $ | (234,797 | ) | | $ | (462,866 | ) | | $ | (591,116 | ) |

| | | | | | | | | |

| Interest income and expense, net | | 9,381 |

| | 27,959 |

| | 43,233 |

| | 67,828 |

|

| Derivative (gain) loss | | (132,614 | ) | | 179,087 |

| | 286,049 |

| | 305,999 |

|

| Income tax expense | | (374 | ) | | 798 |

| | 881 |

| | 1,138 |

|

| Depreciation, amortization, and accretion | | 19,754 |

| | 24,478 |

| | 86,146 |

| | 90,592 |

|

EBITDA | | (11,838 | ) | | (2,475 | ) | | (46,557 | ) | | (125,559 | ) |

| | | | | | | | | |

| Reduction in the value of inventory | | 14,367 |

| | 5,794 |

| | 21,684 |

| | 5,794 |

|

| Reduction in the value of long lived assets | | 84 |

| | — |

| | 84 |

| | — |

|

| Non-cash compensation | | 1,217 |

| | 403 |

| | 3,910 |

| | 2,282 |

|

| Research and development | | 175 |

| | 98 |

| | 478 |

| | 572 |

|

| Foreign exchange and other | | (831 | ) | | 1,839 |

| | (3,038 | ) | | 2,967 |

|

| (Gain)/Loss on extinguishment of debt | | 230 |

| | (1,717 | ) | | 39,846 |

| | 109,092 |

|

| Loss on equity issuance | | — |

| | — |

| | — |

| | 16,701 |

|

| Non-cash adjustment related to Int'l operations | | 404 |

| | — |

| | 404 |

| | — |

|

| Write off of deferred financing costs | | — |

| | — |

| | 194 |

| | — |

|

| Brazil litigation expense accrual | | — |

| | — |

| | 400 |

| | — |

|

Adjusted EBITDA (1) | | $ | 3,808 |

| | $ | 3,942 |

| | $ | 17,405 |

| | $ | 11,849 |

|

|

| | |

| (1) | EBITDA represents earnings before interest, income taxes, depreciation, amortization, accretion and derivative (gains)/losses. Adjusted EBITDA excludes non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new products, and certain other significant charges. Management uses Adjusted EBITDA in order to manage the Company's business and to compare its results more closely to the results of its peers. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to GAAP measurements, such as net income/(loss). These terms, as defined by us, may not be comparable to a similarly titled measures used by other companies. |

|

| | |

| | The Company uses Adjusted EBITDA as a supplemental measurement of its operating performance. The Company believes it best reflects changes across time in the Company's performance, including the effects of pricing, cost control and other operational decisions. The Company's management uses Adjusted EBITDA for planning purposes, including the preparation of its annual operating budget. The Company believes that Adjusted EBITDA also is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. As indicated, Adjusted EBITDA does not include interest expense on borrowed money or depreciation expense on our capital assets or the payment of income taxes, which are necessary elements of the Company's operations. Because Adjusted EBITDA does not account for these expenses, its utility as a measure of the Company's operating performance has material limitations. Because of these limitations, the Company's management does not view Adjusted EBITDA in isolation and also uses other measurements, such as revenues and operating profit, to measure operating performance. |

GLOBALSTAR, INC.

SCHEDULE OF SELECTED OPERATING METRICS

(Dollars in thousands, except subscriber and ARPU data)

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, | | December 31, |

| | | 2014 | | 2013 | | 2014 | | 2013 |

| | | Service | Equipment | | Service | Equipment | | Service | Equipment | | Service | Equipment |

Revenue | | | | | | | | | | | | |

| Duplex | | $6,486 | $1,343 | | $6,345 | $1,409 | | $26,990 | $6,199 | | $22,788 | $6,565 |

| SPOT | | 7,506 |

| 1,595 |

| | 6,994 |

| 1,465 |

| | 29,072 |

| 6,280 |

| | 27,902 |

| 4,546 |

|

| Simplex | | 2,305 |

| 1,744 |

| | 2,023 |

| 1,176 |

| | 8,383 |

| 6,582 |

| | 7,619 |

| 5,927 |

|

| IGO | | 224 |

| 339 |

| | 290 |

| 176 |

| | 1,013 |

| 1,078 |

| | 1,029 |

| 841 |

|

| Other | | 655 |

| (104 | ) | | 1,137 |

| (22 | ) | | 4,365 |

| 102 |

| | 5,306 |

| 188 |

|

| | | $ | 17,176 |

| $ | 4,917 |

| | $ | 16,789 |

| $ | 4,204 |

| | $ | 69,823 |

| $ | 20,241 |

| | $ | 64,644 |

| $ | 18,067 |

|

| | | | | | | | | | | | | |

| | | Reported | | Reported |

Average Subscribers | | | | | | | | | | | | |

| Duplex | | 66,504 |

| | | 84,691 |

| | | 75,763 |

| | | 84,247 |

| |

| SPOT | | 238,027 |

| | | 221,129 |

| | | 231,106 |

| | | 231,488 |

| |

| Simplex | | 280,616 |

| | | 224,504 |

| | | 259,260 |

| | | 209,756 |

| |

| IGO | | 38,649 |

| | | 39,456 |

| | | 39,005 |

| | | 40,249 |

| |

| | | | | | | | | | | | | |

ARPU (1) | | | | | | | | | | | | |

| Duplex | | $ | 32.51 |

| | | $ | 24.97 |

| | | $ | 29.69 |

| | | $ | 22.54 |

| |

| SPOT | | 10.51 |

| | | 10.54 |

| | | 10.48 |

| | | 10.04 |

| |

| Simplex | | 2.74 |

| | | 3.00 |

| | | 2.69 |

| | | 3.03 |

| |

| IGO | | 1.93 |

| | | 2.45 |

| | | 2.16 |

| | | 2.13 |

| |

| | | | | | | | | | | | | |

| | | Adjusted (2) | | Adjusted (2) |

Average Subscribers | | | | | | | |

| Duplex | | 66,504 |

| | | 58,031 |

| | | 62,433 |

| | | 57,587 |

| |

| SPOT | | 238,027 |

| | | 221,129 |

| | | 231,106 |

| | | 213,438 |

| |

| Simplex | | 280,616 |

| | | 224,504 |

| | | 259,260 |

| | | 209,756 |

| |

| IGO | | 38,649 |

| | | 39,456 |

| | | 39,005 |

| | | 40,249 |

| |

| | | | | | | | | | | | | |

ARPU (1) | | | | | | | | | | | | |

| Duplex | | $ | 32.51 |

| | | $ | 36.45 |

| | | $ | 36.03 |

| | | $ | 32.98 |

| |

| SPOT | | 10.51 |

| | | 10.54 |

| | | 10.48 |

| | | 10.89 |

| |

| Simplex | | 2.74 |

| | | 3.00 |

| | | 2.69 |

| | | 3.03 |

| |

| IGO | | 1.93 |

| | | 2.45 |

| | | 2.16 |

| | | 2.13 |

| |

|

| | |

| (1) | Average monthly revenue per user (ARPU) measures service revenues per month divided by the average number of subscribers during that month. Average monthly revenue per user as so defined may not be similar to average monthly revenue per unit as defined by other companies in the Company's industry, is not a measurement under GAAP and should be considered in addition to, but not as a substitute for, the information contained in the Company's statement of income. The Company believes that average monthly revenue per user provides useful information concerning the appeal of its rate plans and service offerings and its performance in attracting and retaining high value customers. |

| (2) | During the first quarter of 2014, the Company deactivated approximately 26,000 suspended or non-paying Duplex subscribers. Adjusted average subscribers in the table above exclude these 26,000 subscribers from the prior periods for comparability.

During the first quarter of 2013, the Company deactivated approximately 36,000 suspended or non-paying SPOT subscribers. Adjusted average subscribers in the table above exclude these 36,000 subscribers from the prior periods for comparability. |

Earnings Call Presentation Q4 2014 March 2, 2015

Safe Harbor Language This press release contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward- looking statements. Forward-looking statements, such as the statements regarding our expectations with respect to actions by the FCC, future increases in our revenue and profitability and other statements contained in this release regarding matters that are not historical facts, involve predictions. Any forward-looking statements made in this press release are accurate as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update any such statements. Additional information on factors that could influence our financial results is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 1

Financial Results Summary (1) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new products and certain other one-time charges. See reconciliation to GAAP Net Income (loss) on Annex A. (2) Duplex ARPU for prior period adjusted for deactivation of approximately 26,000 suspended or non-paying subscribers in Q1 2014. 2 Revenue, Net income / (loss) and Adjusted EBITDA of $22.1 million, $92.0 million and $3.8 million, respectively vs. $21.0 million, ($234.8) million and $3.9 million, respectively in prior year period Duplex, SPOT and Simplex service revenue improved 2%, 7% and 14% respectively, over Q4 2013 SPOT and Simplex equipment revenue increased 9% and 48%, respectively, over Q4 2013 Revenue, Net loss and Adjusted EBITDA of $90.1 million, ($462.9) million and $17.4 million, respectively vs. $82.7 million, ($591.1) million and $11.8 million, respectively in prior year period Duplex, SPOT and Simplex service revenue improved 18%, 4% and 10% respectively, over 2013 SPOT and Simplex equipment revenue increased 38% and 11%, respectively, over 2013 Fourth Quarter Comparison Full Year Comparison ($ in millions except ARPU data) INCOME STATEMENT SUMMARY Q1 2013 Q2 2013 Q3 2013 Q4 2013 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014 Revenue: Service revenue Duplex $4.8 $5.4 $6.2 $6.3 $22.8 $5.9 $6.9 $7.7 $6.5 $27.0 SPOT 7.1 6.9 7.0 7.0 27.9 7.0 7.0 7.5 7.5 29.1 Simplex 1.8 1.6 2.1 2.0 7.6 1.9 2.2 2.0 2.3 8.4 IGO & Other 1.6 1.6 1.7 1.4 6.3 1.5 1.7 1.3 0.9 5.4 Total Service Revenue $15.4 $15.4 $17.1 $16.8 $64.6 $16.2 $17.9 $18.5 $17.2 $69.8 Equipment sales revenue $3.9 $4.4 $5.5 $4.2 $18.1 $4.3 $6.1 $4.9 $4.9 $20.2 Total revenue $19.3 $19.8 $22.5 $21.0 $82.7 $20.5 $24.0 $23.4 $22.1 $90.1 Cost of services $7.5 $7.2 $8.2 $7.3 $30.2 $6.9 $7.1 $7.9 $7.7 $29.7 Cost of subscriber equipment sales 2.9 3.6 4.1 2.9 13.6 3.1 4.3 3.8 3.6 14.9 Marketing, general, and administrative 6.9 6.6 9.1 7.3 29.9 7.8 8.2 8.8 8.7 33.5 Depreciation, amortization, and accretion 20.3 22.1 23.7 24.5 90.6 23.3 22.0 21.0 19.8 86.1 Reduction in the value of inventory / long-lived assets 0.0 0.0 0.0 5.8 5.8 0.0 7.3 0.0 14.5 21.8 Total operating expenses $37.7 $39.4 $45.1 $47.8 $170.1 $41.1 $49.0 $41.5 $54.3 $186.0 Loss from operations ($18.4) ($19.6) ($22.6) ($26.8) ($87.4) ($20.6) ($25.0) ($18.1) ($32.2) ($95.9) Gain (Loss) on extinguishment of debt 0.0 (47.2) (63.6) 1.7 (109.1) (10.2) (16.5) (12.9) (0.2) (39.8) Other income (expense) (6.6) (59.3) (118.7) (208.9) (393.5) (219.6) (391.2) 160.5 124.1 (326.2) Income tax expense (0.1) (0.1) (0.1) (0.8) (1.1) (0.2) (1.0) (0.1) 0.4 (0.9) Net Income (loss) ($25.1) ($126.3) ($205.0) ($234.8) ($591.1) ($250.5) ($433.7) $129.4 $92.0 ($462.9) Adjusted EBITDA (1) $2.5 $2.9 $2.5 $3.9 $11.8 $3.8 $5.0 $4.8 $3.8 $17.4 ARPU Duplex $19.24 $21.29 $24.50 $24.97 $22.54 $27.43 $38.41 $40.18 $32.51 $29.69 Duplex Adjusted ARPU (2) 28.20 31.18 35.73 36.45 32.98 33.73 38.41 40.18 32.51 36.03 SPOT 10.45 10.69 10.64 10.54 10.04 10.52 10.34 10.73 10.51 10.48 Simplex 3.20 2.70 3.32 3.00 3.03 2.58 2.88 2.46 2.74 2.69 IGO / Wholesale 1.89 2.11 2.10 2.45 2.13 2.32 2.56 1.83 1.93 2.16

$19.8 $18.4 $22.8 $27.0 $15.0 $30.0 2011 2012 2013 2014 $24.49 $24.97 $32.98 $36.03 $20.00 $30.00 $40.00 2011 2012 2013 2014 65,387 57,670 57,503 67,362 45,000 60,000 75,000 2011 2012 2013 2014 6,419 6,751 15,252 18,773 - 10,000 20,000 2011 2012 2013 2014 2014 Financial Performance 23% Growth Duplex Performance Duplex Gross Adds Adjusted EBITDA(2) Adjusted Ending Subscribers(1) 17% Growth Duplex Service Revenue 18% Growth Duplex Adjusted ARPU(1) 9% Growth ($ in millions) 3 (2) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new products and certain other one-time charges. See reconciliation to GAAP Net Income (loss) on Annex B. (1) Adjusted for deactivation of approximately 26,000 suspended or non-paying subscribers in Q1 2014. $3.6 $27.3 $33.8 $21.8 ($14.2) ($12.6) ($8.5) ($6.4) $9.8 $11.8 $17.4 ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 $40.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Liquidity Review and Balance Sheet Highlights $38.9 $40.9 $45.5 $47.5 $48.2 $51.7 $42.5 $47.4 $53.5 $60.4 $68.2 $71.8 $71.8 $71.8 $47.0 $22.8 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2010 2011 2012 2013 2014 2011 5% Notes 2009 8% Notes Subordinated Loan 2013 8% Notes Subordinated Debt Principal Balances Liquidity and Capital Sources Review as of December 31, 2014 (1) $159.8 $205.7 $214.5 $159.0 Cash & Cash Eq. Terrapin Equity Line Debt Service Reserve Account Total Liquidity Unrestricted Liquidity $7.1 $24.0 $37.9 $69.0 $31.1 ($ in millions) (1) For the purposes of this schedule, excludes cash flow from operations. 4 $91.0

2014 Highlights Completed gateway repair procedures and built-out sales and marketing infrastructure in Brazil Executed agreement with partner TE.SA.M. Peru providing Company with long- term operational oversight and ability to sell directly in the region Completed gateway construction in Botswana – expands Company’s Simplex and SPOT presence in Africa Continued growth in Adjusted EBITDA – 47% increase year-over-year Globalstar’s shares listed on NYSE MKT on April 21, 2014 – improves visibility and trading liquidity Reduced pricing on hardware and expanded sales force to drive subscriber growth Launched STX3, Sat-Fi and the 9600 in 2014 – broadens addressable market Satellite augmented, scalable, reliable and secure air traffic management solution Second-generation upgrades to be complete by 2016 – provides enhanced services, 25x increase in speeds and significant reduction in product bill of materials On November 1, 2013, the Federal Communications Commission voted to release Globalstar’s requested NPRM over 22 MHz of spectrum including licensed (2483.5- 2495 MHz) and adjacent ISM spectrum (2473-2483.5 MHz) Comment cycle concluded June 4, 2014 Next step: FCC demonstration – March 2015 Operational & Liquidity Geographical Expansion New Products and Future Opportunities Spectrum Proceeding 5

MSS Growth Initiatives Introduced aggressive rebate programs for two-way Duplex – material success in 2014. Reduced pricing initiatives to continue in 2015 – fuels subscriber growth in core territories, generating high-margin recurring revenue stream for Globalstar. Re-engaging dealer network & expanded into additional channels to augment distribution Established complementary reseller model offering – access to additional points of presence to fuel subscriber growth and market share improvement Rolled out pre-paid offering, expanded rental options and introduced no-cost roaming through Large Home Zone initiative – currently leveraging improved service offerings to expand distribution network Expanding Market Share in Existing Footprint 6 Expanding Footprint to Cover Additional Territories New Product Rollouts Broadening MSS Relevance Globalstar’s focus on expanding MSS business comprises three key initiatives – 1) market share improvement in traditional core markets, 2) penetrating new markets through effective capital deployment, and 3) the continued release of affordable and feature-rich MSS devices Fully restored gateway operations in Brazil; invested in sales and marketing infrastructure and experienced significant growth since upgrading operations Executed agreement with TE.SA.M Peru, Globalstar’s IGO partner – agreement provides Globalstar the ability to sell directly in the region Completed construction of new gateway in Botswana – expands Globalstar’s Simplex and SPOT presence in Africa Entered into a contract for the sale of a Globalstar gateway for installation in Eastern Europe. Subject to securing third party contracts, licenses and permits, purchaser to become a provider of mobile satellite services exclusively over the Globalstar System. Company anticipates operations to commence in 2016. Completed 3 new product launches in 2014 including STX3, Sat-Fi & the 9600 The 9600 allows existing satellite phone subscribers to pair Wi-Fi enabled devices to access Globalstar’s network for data services Sat-Fi represents a ground breaking technology that converts any Wi-Fi enabled device into a satellite phone – low price mass market version to be released in 2016 STX3 – world’s lowest power- consuming satellite network chipset. Low cost and easy to integrate STX3 chipsets allow VARs and OEMs to develop smaller, more efficient M2M solutions. Current R&D efforts focused on decreased bill of materials and reduction of form factor – integration of Hughes chips allows for the development and rollout of affordable devices

SPOT Product Rescues: 3,500 Since 2007, Globalstar’s SPOT customers have initiated over 3,500 rescues globally, averaging 2 people per rescue On average, Globalstar’s SPOT customers are initiating 1 rescue everyday somewhere around the world No other communications product has achieved the life saving record of SPOT SPOT Rescue Map: 3,500 Rescues and Counting 7

Globalstar’s Upgraded Ground Network 8 Globalstar’s upgraded ground network will allow for improved voice and data transfer speeds as well as the development of new products. Key Vendors Scope of Work Benefit to Globalstar Ground Network ● Design, supply and implement the Radio Access Network (“RAN”) ground network ● Design second-generation interface chips for new handsets ● New chipsets will significantly lower the cost of Globalstar handsets and other devices ‒ Enables Globalstar to release affordable products with a small form factor ● Upgrades air interface to modern standards Core Network ● Develop, implement and maintain a ground interface, or core network, system ● Modern and standard telco core network for maximum flexibility ● Enables voice and data transfer rates of up to 256 kbps for uplink and downlink ● Allows additional product functionality and applications Second-Generation Ground Rollout Schedule Initial Deliveries North American Installations Rest of the World Installations Complete 2015 2016

ALAS – Space-Based Air Traffic Management System Recent 7,000 Mile Flight Demonstrating Our Dual-Link Space-Based ADS-B System ● Full Duplex capability for sending flight information to and from aircraft in real-time ● Supports ADS-B in (FIS-B and TIS-B) applications, as well as ADS-B out ● Fully compatible with both 1090 MHz extended squitter (for commercial aviation) and 978 MHz UAT (Universal Access Transceiver) for aircraft operating below 18,000 feet ● Substantial and scalable capacity ensures ability to track all aircraft globally ● Highly reliable system with minimal points of failure ADS-B Ground station ADS-B Ground station 9

FCC’s NPRM Regulatory Update Globalstar’s NPRM Process Overview November 13, 2012 Globalstar Files Petition for Rulemaking January 20, 2013 Initial & Reply Comments Filed September 5, 2013 FCC Circulates NPRM Internally November 1, 2013 FCC Unanimously Votes For and Releases NPRM February 19, 2014 NPRM Publication in Federal Register May 5, 2014 Comment Due Date June 4, 2014 Reply Comment Due Date Expected Shortly Process Completion Com p le te d 10

Key Value Drivers Fully restored satellite network for core MSS operations with a new $1 billion constellation Diverse business lines across consumer, commercial and government markets Historically, focus has been on North America – beginning in 2014, operational focus has materially expanded to include new territories such as Central and South America, Southern Africa and Eastern Europe 1.6 GHz and 2.4 GHz U.S. license Expecting 2.4 GHz Terrestrial Low Power Service (“TLPS”) authority shortly − Managed, carrier grade service − Increased data speeds and range − Leverages existing Wi-Fi infrastructure ITU authority for 25.225 MHz – opportunity to free up terrestrial authority worldwide Unique globally harmonized position Opportunity to deploy terrestrial services including TLPS after U.S. approval – leverages worldwide Wi-Fi standards and devices Core MSS Operations U.S. Spectrum Value Global Spectrum Value 11

Annex A – Reconciliation of Quarterly Adjusted EBITDA 12 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Net Income (loss) ($25.1) ($126.3) ($205.0) ($234.8) ($250.5) ($433.7) $129.4 $92.0 Interest income and expense, net 7.8 15.2 16.9 28.0 10.9 13.9 9.1 9.4 Derivative (gain) loss (0.5) 29.9 97.5 179.1 209.4 376.3 (167.0) (132.6) Income tax expense (benefit) 0.1 0.1 0.1 0.8 0.2 1.0 0.1 (0.4) Depreciation, amortization, and accretion 20.3 22.1 23.7 24.5 23.3 22.0 21.0 19.8 EBITDA $2.6 ($59.0) ($66.7) ($2.5) ($6.7) ($20.6) ($7.4) ($11.8) Reduction in the value of long-lived assets & inventory $0.0 $0.0 $0.0 $5.8 $0.0 $7.3 $0.0 $14.5 Non-cash compensation 0.4 0.3 1.2 0.4 0.8 0.6 1.3 1.2 Research and development 0.2 0.1 0.2 0.1 0.1 0.1 0.1 0.2 Severance 0.0 - - - - - - - Foreign exchange and other (income) loss (0.6) 0.2 1.5 1.8 (0.7) 1.1 (2.6) (0.8) (Gain) Loss on extinguishment of debt - 47.2 63.6 (1.7) 10.2 16.5 12.9 0.2 Non-cash adjustment related to international operations - - - - - - - 0.4 Loss on future equity issuance - 14.0 2.7 - - - - - Write off of deferred financing costs - - - - 0.2 - - - Brazil litigation expense accrual - - - - - - 0.4 - Adjusted EBITDA $2.5 $2.9 $2.5 $3.9 $3.8 $5.0 $4.8 $3.8

Annex B – Reconciliation of Annual Adjusted EBITDA 13 ($ in millions) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Net Income (loss) $0.4 $18.7 $23.6 ($27.9) ($22.8) ($74.9) ($97.5) ($54.9) ($112.2) ($591.1) ($462.9) Interest income and expense, net 1.3 (0.0) 2.1 5.9 1.0 5.9 4.6 4.8 21.5 67.8 43.2 Derivative (gain) loss - - - 3.2 3.3 16.0 30.0 (23.8) (7.0) 306.0 286.1 Income tax expense (benefit) (4.3) 2.5 (14.1) 2.9 (2.3) (0.0) 0.4 (0.1) 0.4 1.1 0.9 Depreciation, amortization, and accretion 2.0 3.0 6.7 13.1 27.0 21.9 27.4 50.0 69.8 90.6 86.1 Other income (expense) - 2.3 7.9 - - - - - - - - EBITDA ($0.7) $26.5 $26.3 ($2.8) $6.2 ($31.3) ($35.1) ($24.0) ($27.5) ($125.6) ($46.6) Reduction in the value of long-lived assets & inventory $0.1 $0.1 $1.9 $19.1 $0.4 $0.9 $16.0 $12.4 $8.6 $5.8 $21.8 Non-cash compensation - - 1.2 9.6 12.9 10.6 1.0 2.2 1.3 2.3 3.9 Research and development - - - - 2.7 4.3 3.7 1.8 0.3 0.6 0.5 Severance - - - - - 1.6 2.1 1.3 0.1 0.0 - Foreign exchange and other (income) loss - - 4.0 (8.7) 4.5 (0.7) 0.8 0.9 2.3 3.0 (3.0) (Gain) Loss on extinguishment of debt - - - - (41.4) - - - - 109.1 39.8 Non-cash adjustment related to international operations - - - - - - - - - - 0.4 Revenue recognized from Open Range lease term. - - - - - - - (2.0) - - - Thales arbitration expenses - - - - - - - 1.0 1.8 - - Contract termination charge - - - - - - - - 22.0 - - Loss on future equity issuance - - - - - - - - - 16.7 - Write off of deferred financing costs - - - - - - - - 0.8 - 0.2 Brazil litigation expense accrual - - - - - - - - - - 0.4 Other one time non-recurring charges 4.1 0.6 0.4 4.7 0.6 1.9 2.9 - - - - Adjusted EBITDA $3.6 $27.3 $33.8 $21.8 ($14.2) ($12.6) ($8.5) ($6.4) $9.8 $11.8 $17.4

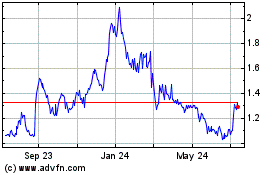

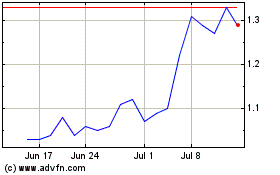

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Apr 2023 to Apr 2024