UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 23, 2015

KAR Auction Services, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation) | 001-34568 (Commission File Number)

| 20-8744739 (I.R.S. Employer Identification No.) |

| 13085 Hamilton Crossing Boulevard Carmel, Indiana 46032 (Address of principal executive offices) (Zip Code) |

|

| (800) 923-3725 (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 7 — Regulation FD

Item 7.01 Regulation FD Disclosure.

On February 23, 2015, ADESA, Inc. ("ADESA"), a wholly owned subsidiary of KAR Auction Services, Inc., issued a press release announcing that ADESA has decided to not participate in a proposed multi-platform system (MPS) initiative.

The press release issued on February 23, 2015 announcing the foregoing events is furnished with this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

Section 9 — Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

| | |

Exhibit Number | | Exhibit Description |

99.1 | | ADESA Announces Decision to Not Participate in Proposed Multi-Platform System (MPS) Initiative, dated February 23, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| KAR AUCTION SERVICES, INC. |

| | |

| | |

Dated: February 23, 2015 | By: | /s/ | Rebecca C. Polak |

| Name: | Rebecca C. Polak |

| Title: | Executive Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Exhibit Description |

99.1 | | ADESA Announces Decision to Not Participate in Proposed Multi-Platform System (MPS) Initiative, dated February 23, 2015 |

EXHIBIT 99.1

February 23, 2015

For Immediate Release

Darci Valentine

darci.valentine@adesa.com

(317) 249-4414

ADESA Announces Decision to Not Participate in Proposed Multi-Platform System (MPS) Initiative

Proposed MPS would increase costs and reduce competition

Carmel, IN, February 23, 2015 — ADESA, a business unit of KAR Auction Services (NYSE: KAR), announced today that it will not proceed with a currently proposed MPS for the auto remarketing industry. The company has worked for nearly two years with major industry partners and invested several million dollars in attempting to evaluate and develop an MPS that would benefit both sellers and buyers. Unfortunately, in light of the current competitive landscape, technology challenges and expected antitrust issues, ADESA has concluded it would not be prudent to further pursue this initiative.

“After lengthy and protracted efforts to create an MPS, our industry partners have been unable to agree on the best way to execute this solution,” said Peter Kelly, president of the company’s Digital Services Group. “While we remain very committed to supporting industry-wide associations and initiatives that provide tangible value for our customers, such as NAAA, IARA, AutoIMS, AuctionNet, AuctionAccess and AutoGrade, MPS, in its current form, creates complex issues and significant antitrust risks."

As currently structured, the proposed MPS would subject market participants to heightened technology requirements and expenditures. ADESA also believes the proposed MPS structure and its associated economic and governance model poses antitrust risks by raising new barriers to entry for smaller industry players, reducing competition among the auctions and increasing costs for sellers, buyers and ultimately retail consumers.

“After much deliberation, we have concluded that the potential benefits to customers of the currently proposed MPS are not commensurate with all of the costs and risks,” said Kelly.

“We are committed to investing our resources to the benefit of our customers,” said Stéphane St-Hilaire, chief executive officer and president. “As we have publicly stated, we are focused on enhancing technologies for our customers, expanding our geographic footprint and increasing our online buyer network, which supports both physical and online sales.”

About ADESA

ADESA offers a full range of auction, reconditioning, logistical, and other vehicle-related services to meet the remarketing needs of both its institutional and dealer customers. The company handles virtually every stage of the used-vehicle lifecycle through its related subsidiaries of PAR North America, RDN, AutoVIN and CarsArrive. Remarketing services include a variety of activities designed to transfer used vehicles between professional sellers and buyers.

ADESA hosts weekly sales at its 65 auction locations across the United States, Canada and Mexico. The company also builds and manages online sale platforms for many major vehicle manufacturers. The company’s online auction venues include ADESA LiveBlock, which simulcasts vehicles worldwide; and ADESA DealerBlock, which offers two ways to buy: bid-now sales events or buy-now pricing 24/7. ADESA is part of the KAR Auction Services family of companies. Visit ADESA.com for details.

# # #

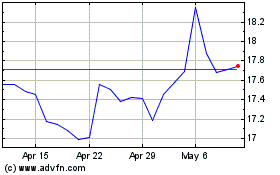

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

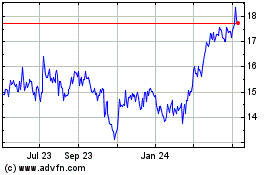

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Apr 2023 to Apr 2024