UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 16, 2014

AMN HEALTHCARE SERVICES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

| 001-16753 |

|

06-1500476 |

| (Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

12400 High Bluff Drive; Suite 100

San Diego, California 92130

(Address of principal executive offices)

Registrant’s telephone number, including area code: (866) 871-8519

NOT APPLICABLE

(Former

name or address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On December 16, 2014, AMN Healthcare,

Inc., a Nevada corporation (“AMN”), a wholly owned subsidiary of AMN Healthcare Services, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Onward

Healthcare, Inc., a Delaware corporation (“OH”), Terrell Acquisition Corp., a Delaware corporation and a wholly owned subsidiary of AMN (“Merger Sub”), and OGH, LLC, a Delaware limited liability company (“OGH”), in its

individual capacity for purposes of certain sections of the Merger Agreement and in its capacity as the representative of the OH equityholders.

At the closing of the transactions contemplated by the Merger Agreement (the “Closing”), Merger Sub will merge with and into OH,

with OH continuing as the surviving corporation and a wholly owned subsidiary of AMN (the “Merger”). Also as a result of the Merger, OH’s wholly owned subsidiaries, Locum Leaders, Inc. and Medefis, Inc., will become indirect wholly

owned subsidiaries of AMN. OH and its subsidiaries are primarily engaged in the business of providing nurse and allied healthcare staffing, locum tenens staffing and vendor management technology services.

Subject to the terms and conditions of the Merger Agreement, AMN will acquire OH for the base purchase price of $82.5 million in cash,

which is subject to certain adjustments and escrow arrangements. The Merger is subject to certain customary conditions that are to be met or waived at or prior to the Closing, including the expiration or termination of the applicable waiting period

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). The Merger Agreement may be terminated prior to the consummation of the Merger by either AMN or OH if (i) the Merger has not been completed by

January 31, 2015 (which date may be extended at the option of either OH or AMN to February 28, 2015 if all the conditions to the Merger (other than the receipt of regulatory approval under the HSR Act) have been satisfied),

(ii) subject to customary limitations and conditions, the other party is in breach of the Agreement and such breach would cause the failure of certain closing conditions in the Merger Agreement, or (iii) the Merger is prohibited by law or

by a final non-appealable governmental order.

The Merger Agreement contains customary representations, warranties, covenants and

obligations for transactions of this type. Pursuant to the Merger Agreement, OH and AMN have agreed to indemnify the other party for any breach of such party’s representations, warranties and covenants contained in the Merger Agreement, subject

to varying survival periods and applicable negotiated caps, baskets, claims procedures and other limitations.

The foregoing description

of the Merger Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by the full text of the Merger Agreement, which the Company intends to file with the Securities and Exchange

Commission at a later date in accordance with applicable rules and regulations.

On December 17, 2014, AMN issued a press release announcing that it

had entered into the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

99.1 |

Press Release, dated December 17, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMN HEALTHCARE SERVICES, INC. |

|

|

|

|

| Date: December 17, 2014 |

|

|

|

By: |

|

/s/ Susan Salka |

|

|

|

|

|

|

Susan Salka |

|

|

|

|

|

|

President and Chief Executive Officer |

EXHIBIT 99.1

AMN Healthcare to Acquire Onward Healthcare, Locum Leaders, Medefis;

Expands Leadership Position in Healthcare Workforce Solutions

AMN to Host Conference Call on Thursday, December 18 at 12:00 PM ET

SAN DIEGO – Dec. 17, 2014 – AMN Healthcare Services, Inc. (NYSE: AHS), the nation’s leading innovator in healthcare

workforce solutions and staffing services, today announced a definitive agreement to acquire Onward Healthcare, Locum Leaders and Medefis from OGH, LLC for a total purchase price of $82.5 million. The acquisition is expected to be accretive to

AMN’s earnings in 2015, and will be funded out of cash on hand and borrowings under the Company’s existing revolving credit facility.

OGH, LLC

is a healthcare and technology workforce solutions holding company, and includes Onward Healthcare, a premier national nurse and allied healthcare staffing firm; Locum Leaders, a well-respected national locum tenens provider; and Medefis, a leading

provider of a SaaS-based vendor management system for healthcare facilities. The 2014 projected consolidated revenue for the three companies is $112 million, with anticipated EBITDA of approximately $10 million.

“This acquisition will enable us to increase the fill rates of our clients’ critical staffing needs,” said Susan Salka, President and Chief

Executive Officer of AMN Healthcare. “As a combined company, we are immediately growing our talent pool of quality clinicians and physicians and adding experienced sales and service team members.”

“At the same time, we are further enhancing our workforce solutions offering with the addition of Medefis, a differentiated and highly regarded VMS

technology that provides healthcare facilities with another vendor-neutral option to streamline the management of their contingent labor,” she noted.

Kevin Clark, CEO and Founder of OGH, LLC, added, “We are pleased that AMN will carry on the legacy of Onward Healthcare, Locum Leaders and

Medefis. Under AMN’s leadership, we are confident these brands will continue their success in the market, which was built around best-in-class customer service and support.”

The acquisition, subject to regulatory approvals and customary closing conditions, is expected to close by mid-January 2015. OGH, LLC is majority owned by

Welsh, Carson, Anderson & Stowe, a private equity firm Robert W. Baird served as the exclusive financial advisor to OGH, LLC on this transaction.

Conference Call on December 18, 2014

AMN Healthcare

will host a live conference call and webcast on Thursday, December 18, 2014 at 12:00 p.m. Eastern Time to discuss the acquisition. A live webcast of the call can be accessed through AMN Healthcare’s website

at http://amnhealthcare.investorroom.com/presentations. Please log in at least 10 minutes prior to

the conference call in order to download the applicable audio software. Interested parties may participate live via telephone by dialing (800) 398-9379 in the U.S. or (612) 288-0337

internationally. Following the conclusion of the call, a replay of the webcast will be available at the Company’s website. Alternatively, a telephonic replay of the call will be available at 2:00 p.m. Eastern Time on December 18, 2014, and

can be accessed until 11:59 p.m. Eastern Time on January 1, 2015 by calling (800) 475-6701 in the U.S. or (320) 365-3844 internationally, with access code 348884.

About AMN Healthcare

AMN Healthcare is the innovator in

healthcare workforce solutions and staffing services to healthcare facilities across the nation. AMN Healthcare’s workforce solutions — including managed services programs, vendor management systems and recruitment process outsourcing

— enable providers to successfully reduce complexity, increase efficiency and improve patient outcomes within the rapidly evolving healthcare environment. The Company provides unparalleled access to the most comprehensive network of quality

healthcare professionals through its innovative recruitment strategies and breadth of career opportunities. Clients include acute-care hospitals, community health centers and clinics, physician practice groups, retail and urgent care centers, home

health facilities, pharmacies and many other healthcare settings. AMN Healthcare disseminates news and information about the Company through its website, which can be found at www.amnhealthcare.com.

About Onward Healthcare

Onward Healthcare is a leading

national provider of temporary healthcare staffing to hospitals, outpatient clinics, magnet facilities, long-term care facilities and schools. Onward Healthcare provides travel and local staffing assignments to registered nurses and allied health

professionals. More information can be found at www.onwardhealthcare.com.

About Locum Leaders

Locum Leaders is one of the fastest growing locum tenens recruitment firms and specializes in placing physicians in temporary assignments across the nation.

The company has been named as one of the Best Places to Work in Atlanta by the Atlanta Business Chronicle and Modern Healthcare. More information can be found at www.locumleaders.com.

About Medefis

Medefis is a leading provider of vendor

management services (VMS) technology for hospitals and healthcare organizations across the country. Medefis provides centralized, end-to-end management of a healthcare organization’s entire supplemental staffing process and is powered by a

proprietary bidding and talent ranking engine that ensures medical facilities receive the best-qualified clinical professionals at a true market rate. Medefis has streamlined the process of supplemental staffing for healthcare providers nationwide

by offering a convenient, centralized web-based VMS technology and service. More information can be found at www.medefis.com.

About Welsh,

Carson, Anderson & Stowe

Welsh, Carson, Anderson & Stowe focuses its investment activity in two target industries, information/business

services and healthcare. Since its founding in 1979, the Firm has organized 15 limited partnerships with total capital of $20 billion. The Firm is currently investing an equity fund, Welsh, Carson, Anderson & Stowe XI, L.P., and has a current

portfolio of approximately 25 companies. WCAS’s strategy is to partner with outstanding management teams and build value for the Firm’s investors through a combination of operational improvements, internal growth initiatives and

strategic acquisitions. See www.welshcarson.com to learn more.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include expectations regarding the acquired companies’ 2014 revenue and EBITDA, and accretion to the Company’s earnings in 2015. The Company based these

forward-looking statements on its current expectations, estimates and projections about future events and the industry in which it operates using information currently available to it. Actual results could differ materially from those discussed in,

or implied by, these forward-looking statements. Forward-looking statements are identified by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “may,”

“estimates,” variations of such words and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Factors

that could cause actual results to differ from those implied by the forward-looking statements contained in this press release are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and its other

periodic reports as well as the Company’s current and other reports filed from time to time with the Securities and Exchange Commission. Be advised that developments subsequent to this press release are likely to cause these statements to

become outdated with the passage of time.

Contact:

Amy Chang

Vice President, Investor Relations

866.861.3229

ir@amnhealthcare.com

Jim Gogek

Corporate Communications

858.350.3209

jim.gogek@amnhealthcare.com

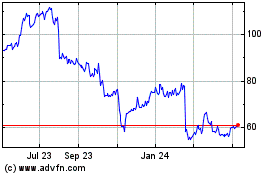

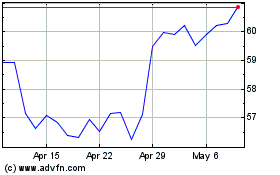

AMN Healthcare Services (NYSE:AMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMN Healthcare Services (NYSE:AMN)

Historical Stock Chart

From Apr 2023 to Apr 2024